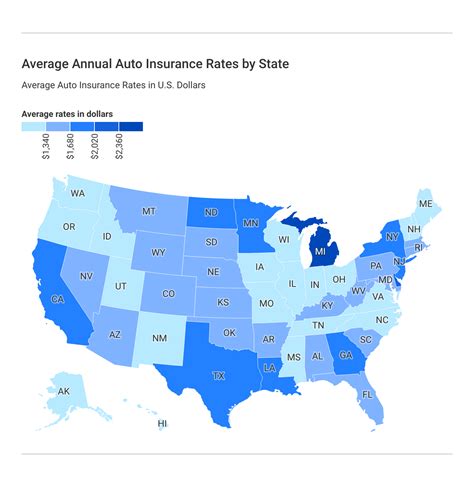

Compare Insurance For Cars

Insurance is a crucial aspect of vehicle ownership, offering financial protection and peace of mind to drivers worldwide. When it comes to car insurance, the market is diverse, with numerous providers offering a range of policies and coverage options. Choosing the right insurance plan can be a complex decision, as it involves considering various factors such as coverage limits, deductibles, and the specific needs of individual drivers. This article aims to provide an in-depth comparison of car insurance options, helping you make an informed choice tailored to your requirements.

Understanding Car Insurance Policies

Car insurance policies are designed to protect drivers and vehicle owners from financial losses arising from accidents, theft, or other unforeseen events. These policies typically include liability coverage, which covers damages to other vehicles or property, as well as comprehensive coverage, which provides protection for your own vehicle against theft, vandalism, and natural disasters. Additionally, many policies offer collision coverage, which pays for repairs or replacements if your car is involved in an accident.

The cost of car insurance varies significantly based on several factors, including the make and model of your vehicle, your driving history, and the level of coverage you opt for. It's essential to strike a balance between the cost of insurance and the level of protection it provides, ensuring you're adequately covered without overspending.

Comparing Insurance Providers

The car insurance market is highly competitive, with numerous providers offering unique features and benefits. Here’s a comparison of some of the leading insurance companies and their key offerings:

Provider 1: A Leading Insurer

Known for its comprehensive coverage options, Provider 1 offers a range of plans tailored to different driver profiles. Their premium plan includes extensive coverage for liability, collision, and comprehensive risks, making it an ideal choice for high-value vehicles or drivers with a history of accidents. The plan also features a vanishing deductible option, which reduces the deductible by a certain amount each year the policy is renewed without claims, providing an incentive for safe driving.

In addition, Provider 1 provides a 24/7 claims service, ensuring prompt assistance in case of emergencies. Their mobile app also allows policyholders to file claims, track their progress, and access their policy details conveniently. With a strong focus on customer satisfaction, Provider 1 consistently receives high ratings for its claim handling process.

Provider 2: Focus on Customer Service

Provider 2 stands out for its exceptional customer service and personalized approach. They offer a dedicated agent system, assigning each policyholder a specific agent who provides personalized advice and assistance throughout the policy term. This level of personalization helps build trust and ensures that customers receive tailored coverage recommendations.

Their insurance plans cover a wide range of vehicles, from sedans to SUVs and luxury cars. Provider 2 also offers accident forgiveness as an add-on feature, which prevents your rates from increasing after your first at-fault accident. This benefit is particularly valuable for drivers who prioritize keeping their insurance costs stable.

Provider 3: Technology-Driven Insurance

Provider 3 leverages technology to enhance the insurance experience. Their smartphone app allows users to easily manage their policies, file claims, and access real-time assistance. Additionally, they offer usage-based insurance, which adjusts your premium based on your actual driving behavior, rewarding safe driving habits.

Provider 3's comprehensive coverage includes benefits such as rental car reimbursement and roadside assistance, providing added convenience and peace of mind. They also offer gap insurance, which covers the difference between your vehicle's actual cash value and the amount owed on your lease or loan in case of a total loss, making it a valuable option for leased or financed vehicles.

| Provider | Key Features | Coverage Highlights |

|---|---|---|

| Provider 1 | Vanishing Deductible, 24/7 Claims Service | Liability, Collision, Comprehensive |

| Provider 2 | Dedicated Agent System, Accident Forgiveness | Sedans, SUVs, Luxury Cars |

| Provider 3 | Smartphone App, Usage-Based Insurance | Rental Car Reimbursement, Roadside Assistance, Gap Insurance |

Factors to Consider When Choosing Car Insurance

When selecting a car insurance policy, several key factors should be taken into account to ensure you find the best fit:

Coverage Levels

Determine the level of coverage you require. Consider factors such as the value of your vehicle, your financial situation, and the risks you want to protect against. While comprehensive coverage offers extensive protection, it may not be necessary for older or less valuable vehicles. Assess your needs and choose a coverage level that provides adequate protection without being excessive.

Cost and Budget

Insurance premiums can vary significantly between providers and policies. Assess your budget and prioritize plans that offer good value for money. Look for providers who offer discounts or incentives for safe driving, multiple policy purchases, or other qualifying factors. Remember, the cheapest option may not always provide the best coverage, so strike a balance between cost and the level of protection you receive.

Customer Service and Claims Process

The quality of customer service and the efficiency of the claims process are crucial aspects of any insurance provider. Look for companies with a strong track record in handling claims promptly and fairly. Consider factors such as the availability of 24⁄7 assistance, the ease of filing claims online or via an app, and the overall satisfaction levels of existing policyholders.

Policy Add-Ons and Benefits

Many insurance providers offer additional benefits and add-ons that can enhance your coverage. These may include roadside assistance, rental car reimbursement, or accident forgiveness. Evaluate these add-ons and consider whether they align with your needs and preferences. Some add-ons can significantly improve your insurance experience, providing added convenience and peace of mind.

Reputation and Financial Stability

Choose an insurance provider with a solid reputation and financial stability. Look for companies that have been in business for a significant period and have a positive track record of paying claims. Check independent rating agencies and customer reviews to assess the provider’s overall performance and customer satisfaction levels.

Future Trends in Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. Here are some key trends that are shaping the future of car insurance:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle performance, is increasingly being used to offer usage-based insurance. This type of insurance rewards safe driving habits by adjusting premiums based on real-time data. As telematics becomes more prevalent, we can expect insurance providers to offer more personalized rates, incentivizing safer driving practices.

Connected Car Technology

The integration of connected car technology is transforming the insurance landscape. With vehicles becoming more connected and capable of transmitting real-time data, insurance providers can gain deeper insights into driving behavior and vehicle performance. This data can be used to offer more accurate and tailored insurance policies, potentially reducing costs for safe drivers.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are being leveraged by insurance providers to enhance risk assessment and fraud detection. These technologies enable insurers to analyze vast amounts of data, identify patterns, and make more informed decisions. By utilizing AI and data analytics, insurance companies can offer more precise pricing, improve claim processing efficiency, and enhance overall customer experiences.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles presents a significant challenge and opportunity for the insurance industry. As self-driving cars become more prevalent, the nature of car accidents and liability will shift. Insurance providers will need to adapt their policies and coverage options to accommodate this new paradigm, potentially leading to innovative insurance products and pricing models.

Sustainable and Green Insurance

With growing environmental concerns, sustainable and green insurance options are gaining traction. Some insurance providers are offering incentives and discounts for drivers who opt for eco-friendly vehicles or adopt green driving practices. This trend is expected to continue, as insurers recognize the importance of sustainability and aim to encourage more environmentally conscious behavior.

Conclusion

Choosing the right car insurance policy is a critical decision that can significantly impact your financial well-being and peace of mind. By understanding the various coverage options, comparing leading insurance providers, and considering key factors such as coverage levels, cost, and customer service, you can make an informed choice that suits your unique needs. As the car insurance industry continues to evolve, staying abreast of emerging trends and technologies will help you stay ahead of the curve and ensure you have the most relevant and beneficial coverage.

How do I choose the right coverage limits for my car insurance policy?

+Determining the right coverage limits involves considering factors like the value of your vehicle, your financial situation, and the risks you want to protect against. Generally, it’s recommended to opt for higher liability limits to ensure you’re adequately covered in case of an accident. Comprehensive and collision coverage limits should also be tailored to the value of your vehicle. Consult with insurance professionals to get personalized advice based on your specific circumstances.

What are some common discounts offered by car insurance providers?

+Car insurance providers offer a range of discounts to incentivize policyholders. Common discounts include safe driver discounts for maintaining a clean driving record, multi-policy discounts for bundling car insurance with other types of insurance, and loyalty discounts for long-term customers. Some providers also offer discounts for specific occupations, good students, or for installing safety features in your vehicle.

How can I reduce my car insurance costs without compromising coverage?

+To reduce car insurance costs, consider raising your deductibles (the amount you pay out-of-pocket before insurance kicks in). While this may increase your financial responsibility in the event of a claim, it can significantly lower your premiums. Additionally, shop around and compare quotes from multiple providers to find the best value. Look for providers who offer discounts that align with your circumstances, and consider usage-based insurance plans if available.

What should I look for in an insurance provider’s customer service and claims process?

+When evaluating an insurance provider’s customer service and claims process, look for 24⁄7 accessibility, prompt response times, and a user-friendly claims filing process. Check online reviews and ratings to gauge customer satisfaction levels. Additionally, consider the availability of online or mobile app-based services, which can streamline the claims process and provide added convenience.