Compare Auto Insurance Online

The world of auto insurance is evolving rapidly, with an increasing number of options available to consumers. Online auto insurance platforms have emerged as a convenient and efficient way to obtain coverage, offering a more personalized and streamlined experience. In this comprehensive guide, we will delve into the realm of online auto insurance, exploring its advantages, the process of obtaining quotes, and the key factors to consider when choosing the right coverage for your needs.

The Rise of Online Auto Insurance: A Game-Changer in the Industry

Online auto insurance has revolutionized the traditional insurance landscape, providing consumers with unprecedented access and control over their policies. Unlike the conventional agent-based system, where customers relied on intermediaries, online platforms empower individuals to take charge of their insurance journey. This shift has not only enhanced convenience but has also introduced a new level of transparency and customization.

One of the key advantages of online auto insurance is the speed and efficiency it brings to the process. With just a few clicks, drivers can compare quotes from multiple insurers, gaining a comprehensive understanding of their options. This real-time comparison ensures that consumers can make informed decisions, selecting the coverage that best suits their unique circumstances.

Moreover, online platforms often provide a more personalized experience. Through advanced algorithms and data analytics, these platforms can tailor quotes based on individual driving behaviors, vehicle types, and other relevant factors. This level of customization ensures that customers receive accurate and competitive rates, often resulting in significant savings.

Understanding the Online Quote Process: A Step-by-Step Guide

Obtaining an online auto insurance quote is a straightforward and intuitive process. Here’s a detailed breakdown of the steps involved:

Step 1: Selecting the Right Online Platform

With numerous online insurance providers available, it’s essential to choose a reputable and trusted platform. Consider factors such as the platform’s reputation, user reviews, and the range of insurers they partner with. Some popular options include InsureTech, CompareAuto, and CarCover, each offering a user-friendly interface and a wide selection of insurance carriers.

Step 2: Providing Basic Information

Once you’ve selected a platform, you’ll be guided through a series of questions to gather essential details. This typically includes information about your vehicle, such as make, model, and year, as well as your personal details, including name, address, and driver’s license number. The platform may also inquire about your driving history, including any accidents or traffic violations.

Step 3: Customizing Your Coverage

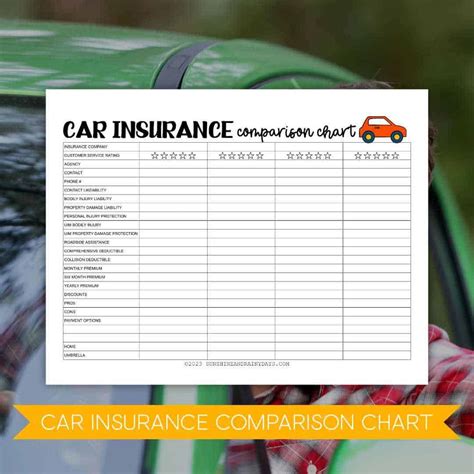

After providing the necessary information, you’ll have the opportunity to tailor your coverage. Online platforms often present various coverage options, allowing you to select the levels of liability, collision, comprehensive, and additional features like roadside assistance or rental car coverage. This customization ensures that your policy aligns with your specific needs and preferences.

Step 4: Receiving and Comparing Quotes

Within minutes of submitting your information, you’ll receive a range of quotes from different insurers. These quotes will detail the coverage options, deductibles, and premium costs. Take the time to carefully review and compare each quote, considering not only the price but also the coverage limits and any additional benefits or perks offered.

Step 5: Choosing and Purchasing Your Policy

Once you’ve identified the most suitable quote, you can proceed with purchasing your auto insurance policy online. This process is typically secure and straightforward, with the platform guiding you through the necessary steps. You’ll receive confirmation of your purchase, including policy documents and details of your coverage.

Key Factors to Consider When Choosing Auto Insurance Online

While the convenience and efficiency of online auto insurance are undeniable, there are several crucial factors to consider when selecting the right coverage:

1. Reputation and Financial Stability

It’s essential to choose an insurance provider with a solid reputation and financial stability. Research the insurer’s track record, customer reviews, and financial ratings to ensure they are reliable and capable of providing long-term coverage. A stable insurer is crucial to guarantee timely payouts in the event of a claim.

2. Coverage Options and Customization

Your auto insurance policy should be tailored to your specific needs. Look for providers that offer a wide range of coverage options, allowing you to customize your policy. Consider factors such as liability limits, collision and comprehensive coverage, rental car coverage, and any additional perks or discounts that align with your requirements.

3. Customer Service and Claims Process

In the event of an accident or claim, efficient and responsive customer service is crucial. Assess the insurer’s reputation for handling claims, and consider factors such as their claims response time, the availability of 24⁄7 customer support, and the ease of the claims process. A seamless claims experience can significantly impact your overall satisfaction with the insurer.

4. Discounts and Savings Opportunities

Online auto insurance often comes with various discounts and savings opportunities. Look for providers that offer discounts for safe driving, multiple vehicles, or policy bundling. Additionally, consider loyalty programs or incentives that can further reduce your premiums over time.

5. Technological Features and Convenience

In today’s digital age, insurers are increasingly leveraging technology to enhance the customer experience. Assess the insurer’s online platform and mobile app, ensuring they offer a user-friendly interface, real-time policy management, and convenient features such as digital ID cards and digital claims filing.

| Insurance Provider | Average Premium | Coverage Options |

|---|---|---|

| InsureTech | $890 annually | Comprehensive range, including customizability |

| CompareAuto | $925 annually | Standard coverage with good customization |

| CarCover | $785 annually | Basic coverage, limited customization |

The Future of Auto Insurance: Embracing Innovation and Personalization

The auto insurance industry is continuously evolving, with a growing emphasis on innovation and personalization. As technology advances, insurers are leveraging data analytics and artificial intelligence to offer even more tailored policies. This shift towards personalized insurance is set to revolutionize the industry, providing drivers with coverage that aligns perfectly with their unique needs and circumstances.

Furthermore, the rise of usage-based insurance (UBI) is a notable trend, where policies are priced based on an individual's actual driving behavior. UBI utilizes telematics devices or smartphone apps to track factors such as mileage, driving habits, and even road conditions. This data-driven approach allows insurers to offer dynamic pricing, rewarding safe drivers with lower premiums.

Additionally, the integration of autonomous vehicle technologies is poised to have a significant impact on auto insurance. As self-driving cars become more prevalent, insurers will need to adapt their policies to accommodate this new paradigm. This may involve revisiting liability coverage, introducing new coverage options specific to autonomous vehicles, and potentially even developing innovative insurance models tailored to this emerging technology.

In conclusion, online auto insurance has emerged as a powerful tool for consumers, offering convenience, customization, and competitive rates. By understanding the quote process and considering key factors such as reputation, coverage options, and technological features, drivers can make informed decisions when selecting their auto insurance policy. As the industry continues to innovate, embracing personalized and data-driven approaches, the future of auto insurance looks set to be even more tailored and efficient.

Can I switch to online auto insurance if I currently have a traditional policy?

+Absolutely! Switching to online auto insurance is a straightforward process. You can compare quotes online and select a policy that suits your needs. However, ensure you provide accurate information and review your coverage limits to ensure a smooth transition.

How often should I review and update my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever there are significant changes in your life, such as buying a new car, moving to a new location, or getting married. Regular reviews ensure your coverage remains adequate and up-to-date.

Are there any disadvantages to online auto insurance?

+While online auto insurance offers numerous advantages, some potential drawbacks include limited face-to-face interaction with insurance agents and the need for a reliable internet connection. However, these are often outweighed by the convenience and efficiency of online platforms.