Classic Vehicle Insurance Quote

Are you a proud owner of a classic car, a vintage motorcycle, or any other vintage vehicle that holds a special place in your heart and collection? Insuring these cherished historic vehicles is not just a matter of legal compliance but also a crucial step to protect your investment and ensure peace of mind. With a unique set of risks and considerations, classic vehicle insurance requires a tailored approach. In this comprehensive guide, we'll delve into the world of classic vehicle insurance, offering you an expert's perspective on obtaining the best quote and coverage for your prized possession.

Understanding Classic Vehicle Insurance

Classic vehicle insurance is a specialized form of coverage designed for vehicles that are typically older than 20 to 25 years and possess a significant historical or collectible value. These policies cater to the unique needs of classic car owners, providing comprehensive protection against a range of risks, including damage, theft, and liability.

Unlike standard auto insurance, classic vehicle insurance often takes into account the specialized maintenance and storage requirements of these vehicles. It also recognizes that the value of a classic car may increase over time due to its historical significance and collectability.

The Benefits of Classic Vehicle Insurance

Opting for classic vehicle insurance offers several key advantages. Firstly, it provides comprehensive coverage tailored to the specific needs of your classic vehicle. This can include protection against physical damage, theft, and liability, ensuring that your vehicle is adequately insured for its unique value.

Secondly, classic vehicle insurance often allows for agreed value coverage, where the policyholder and insurer agree on the value of the vehicle beforehand. This ensures that, in the event of a total loss, you receive the agreed-upon value, which can be significantly higher than the market value of a standard vehicle.

Lastly, classic vehicle insurance policies often offer flexible usage options, recognizing that classic vehicles may not be driven daily. You can choose from a range of coverage options, including pleasure use, exhibition, and even limited daily driving.

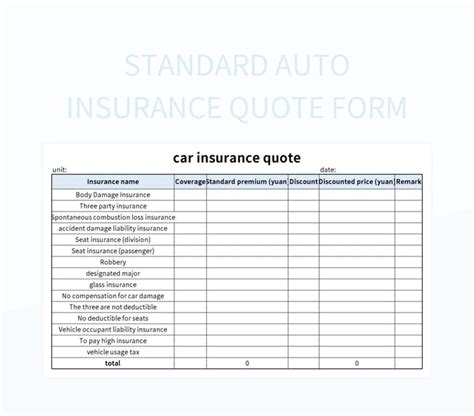

| Coverage Type | Description |

|---|---|

| Agreed Value | A predetermined value agreed upon by the insurer and policyholder, ensuring fair compensation in case of a total loss. |

| Comprehensive Coverage | Protection against various risks, including damage, theft, and liability. |

| Flexible Usage Options | Coverage tailored to how you use your classic vehicle, whether for pleasure, exhibition, or occasional daily driving. |

Factors Influencing Your Classic Vehicle Insurance Quote

Several key factors come into play when determining your classic vehicle insurance quote. Understanding these factors can help you navigate the process more effectively and potentially secure a better rate.

Vehicle Type and Age

The type and age of your classic vehicle are fundamental considerations. Older vehicles, especially those with historical significance or limited production runs, may attract higher insurance premiums due to their rarity and increased value.

Certain vehicle types, such as classic sports cars or vintage motorcycles, may also be considered higher risk due to their performance capabilities and potential for more frequent usage. On the other hand, classic trucks or sedans might be seen as lower risk and therefore command more competitive rates.

Vehicle Condition and Modifications

The condition of your classic vehicle plays a significant role in determining your insurance quote. Well-maintained vehicles with all original parts are generally viewed more favorably by insurers, as they present a lower risk of mechanical failure or breakdown.

If your classic vehicle has been modified, either for performance or aesthetic reasons, this can impact your insurance quote. Performance modifications, in particular, may increase your premium as they are often associated with higher risk driving behaviors.

Driver Profile and Usage

Your own profile as a driver and the intended usage of your classic vehicle are crucial considerations. Younger drivers or those with a history of accidents or traffic violations may face higher premiums, as they are statistically more likely to be involved in an accident.

The intended usage of your classic vehicle also matters. If you plan to use it for daily driving, your premium will likely be higher than if you only intend to use it for occasional pleasure drives or exhibitions. Classic vehicles that are kept in storage for most of the year and only driven on special occasions can often qualify for lower rates.

Storage and Security

The way you store and secure your classic vehicle can impact your insurance quote. Secure storage, such as in a locked garage or a specialized storage facility, can reduce your risk profile and lead to lower premiums. On the other hand, storing your vehicle outdoors or in an unsecured location may increase your insurance costs.

Additionally, installing security devices such as alarms, immobilizers, or tracking systems can also work in your favor, as they reduce the risk of theft or unauthorized use.

Tips for Obtaining the Best Classic Vehicle Insurance Quote

Now that we’ve explored the key factors influencing your classic vehicle insurance quote, here are some expert tips to help you secure the best coverage at the most competitive rate.

Shop Around and Compare Quotes

Classic vehicle insurance is a specialized market, and different insurers may offer significantly different quotes for the same vehicle and driver profile. It’s therefore crucial to shop around and compare quotes from multiple providers to ensure you’re getting the best deal.

Consider using an insurance broker who specializes in classic vehicle insurance. They can often access a wider range of insurers and policies, and their expertise can be invaluable in navigating the complexities of this market.

Negotiate and Understand the Fine Print

Don’t be afraid to negotiate your insurance quote. Many insurers are willing to discuss your coverage needs and may offer discounts or tailored solutions to meet your specific requirements. Remember, classic vehicle insurance is often highly customizable, so understanding your options and negotiating can lead to significant savings.

Always read the fine print of your insurance policy. Classic vehicle insurance policies can be complex, and it's important to understand exactly what you're covered for and what exclusions or limitations apply. This will ensure you're not caught off guard in the event of a claim.

Consider Bundle Deals and Loyalty Discounts

If you have multiple vehicles, consider a bundle deal where you insure all your vehicles, including your classic, with the same insurer. This can often lead to significant savings, as insurers may offer discounts for multiple policies.

Additionally, many insurers offer loyalty discounts for long-term customers. If you've been with the same insurer for a while, don't hesitate to ask about potential discounts or special offers for your classic vehicle insurance.

Maintain a Clean Driving Record

A clean driving record is a significant factor in determining your insurance premium. If you have a history of accidents or traffic violations, it’s worth taking steps to improve your driving habits and reduce your risk profile. This can lead to lower insurance premiums over time.

Consider taking a defensive driving course or, if you're a young driver, enrolling in a recognized driver training program. These steps not only improve your driving skills but can also lead to insurance discounts and a lower risk profile.

Take Advantage of Classic Car Club Memberships

Many classic car clubs offer insurance discounts to their members. If you’re a member of a classic car club, be sure to inquire about potential insurance benefits. These discounts can often lead to significant savings on your classic vehicle insurance.

Additionally, classic car clubs often provide access to a network of specialized mechanics and restorers, which can be invaluable in maintaining your vehicle and keeping it in top condition.

Consider Agreed Value Coverage

As mentioned earlier, agreed value coverage is a key feature of classic vehicle insurance. By agreeing on the value of your vehicle with your insurer beforehand, you can ensure fair compensation in the event of a total loss. This can provide significant peace of mind and protect your investment.

When determining the agreed value, be sure to consider not just the market value of your vehicle but also its historical significance and collectability. This can often lead to a higher valuation and better protection for your classic.

Implement Security Measures

Installing security devices such as alarms, immobilizers, or tracking systems can significantly reduce your risk of theft or unauthorized use. This, in turn, can lead to lower insurance premiums, as insurers view these measures as a reduction in risk.

Additionally, consider investing in a secure storage solution for your classic vehicle. A locked garage or a specialized storage facility can provide an added layer of security and potentially lead to insurance discounts.

Understand Your Coverage Needs

Classic vehicle insurance is highly customizable, and it’s important to understand your specific coverage needs. Consider factors such as the intended usage of your vehicle, the level of protection you require, and any unique risks associated with your vehicle or driving habits.

By understanding your coverage needs, you can tailor your policy to provide the right level of protection at the best possible price. This may involve choosing a higher deductible to reduce your premium, or opting for additional coverage options such as roadside assistance or rental car reimbursement.

Conclusion

Obtaining the best classic vehicle insurance quote requires a combination of knowledge, expertise, and a tailored approach. By understanding the key factors that influence your insurance quote and implementing the expert tips outlined above, you can secure the coverage your classic vehicle deserves at a competitive rate.

Remember, classic vehicle insurance is not just about protecting your vehicle but also about preserving your passion and investment. With the right coverage and a thorough understanding of the market, you can drive with confidence, knowing your classic is protected.

What is considered a classic vehicle for insurance purposes?

+

Generally, a classic vehicle is one that is at least 20 to 25 years old and has historical or collectible value. However, the exact definition can vary between insurers and regions.

Can I get classic vehicle insurance if I’m a young driver?

+

Yes, but young drivers may face higher premiums due to their statistical risk profile. Taking steps to improve your driving record and understanding the options available can help mitigate these costs.

How can I reduce my classic vehicle insurance premium?

+

There are several strategies, including shopping around for quotes, negotiating with insurers, maintaining a clean driving record, taking advantage of discounts, and implementing security measures for your vehicle.