Cheapest Insurance California

When it comes to finding the cheapest insurance in California, it's important to understand that the cost of insurance can vary significantly based on several factors, including the type of insurance, your specific needs, and your personal circumstances. However, with a bit of research and knowledge, you can navigate the insurance market and secure affordable coverage. This comprehensive guide will delve into the various aspects of insurance in California, offering insights and tips to help you find the most cost-effective options tailored to your requirements.

Understanding Insurance Costs in California

California, known for its diverse landscapes and vibrant culture, also boasts a robust insurance market. The Golden State’s insurance landscape is influenced by various factors, including state regulations, market competition, and the unique needs of its residents. Understanding these factors is crucial for anyone seeking affordable insurance coverage.

Regulatory Environment

California’s insurance industry is tightly regulated by the California Department of Insurance (CDI). The CDI ensures that insurance providers adhere to strict standards, protecting consumers from unfair practices. This regulatory oversight can impact insurance costs, as providers must comply with state-mandated coverage requirements and pricing guidelines.

One notable regulation in California is the Fair Access to Insurance Requirements (FAIR) plan, which ensures that homeowners in high-risk areas, such as those prone to wildfires or earthquakes, can obtain property insurance. While this plan provides essential coverage, it can come at a higher cost due to the increased risk factors.

| Insurance Type | Average Annual Cost in California |

|---|---|

| Auto Insurance | $1,660 |

| Homeowners Insurance | $1,095 |

| Health Insurance (Individual Plan) | $5,100 |

| Life Insurance (Term) | $250 - $350 per year for a 30-year-old |

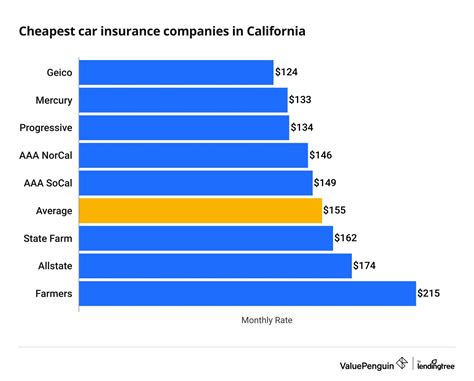

Market Competition

California’s insurance market is highly competitive, with a diverse range of providers offering various coverage options. This competition can drive down prices, as insurers strive to attract customers with competitive rates and tailored policies. Online comparison platforms and insurance brokers play a crucial role in this market, providing consumers with easy access to multiple quotes and allowing for quick comparisons.

Tips for Finding the Cheapest Insurance in California

Securing the cheapest insurance in California requires a strategic approach. Here are some expert tips to help you navigate the process and find the most affordable coverage that meets your needs:

Shop Around and Compare Quotes

The insurance market in California is vast, with numerous providers offering a wide range of policies. To find the best deal, it’s essential to shop around and compare quotes from multiple insurers. Online comparison tools and insurance brokers can be invaluable resources for this task.

When comparing quotes, pay attention to the following factors:

- Coverage Limits: Ensure that the policies provide adequate coverage for your needs. For auto insurance, consider the state's minimum liability limits, which are $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage.

- Deductibles: Higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expense if a claim occurs.

- Discounts: Many insurers offer discounts for various reasons, such as good driving records, safety features in your vehicle, or multiple policies with the same provider. Take advantage of these discounts to reduce your overall costs.

Understand Your Coverage Needs

Before you start shopping for insurance, take the time to understand your specific coverage needs. Different types of insurance, such as auto, home, health, and life insurance, serve distinct purposes and have unique considerations.

- Auto Insurance: In California, it's mandatory to have liability insurance to drive legally. However, you may also want to consider additional coverage, such as collision and comprehensive insurance, to protect your vehicle from damage or theft.

- Homeowners Insurance: If you own a home, you'll need homeowners insurance to protect your property and belongings. California's unique risks, such as earthquakes and wildfires, should be taken into account when choosing your policy.

- Health Insurance: With the implementation of the Affordable Care Act (ACA), health insurance is more accessible and affordable in California. You can shop for health insurance plans through the state's insurance marketplace, Covered California, during open enrollment periods or if you qualify for a special enrollment period.

- Life Insurance: Life insurance provides financial protection for your loved ones in the event of your death. Term life insurance is often the most affordable option, offering coverage for a specified period, typically 10, 20, or 30 years.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when you purchase multiple policies from them. For example, you can often save money by bundling your auto and home insurance policies with the same insurer. This not only simplifies your insurance management but also reduces your overall costs.

Explore Government-Sponsored Programs

California offers several government-sponsored insurance programs designed to make coverage more accessible and affordable for specific populations. These programs can provide valuable assistance, especially for those with low incomes or unique circumstances.

- Medi-Cal: California's Medicaid program, Medi-Cal, provides health coverage for low-income individuals and families. Eligibility is based on income and other factors, and enrollment is ongoing throughout the year.

- CalFresh: Formerly known as food stamps, CalFresh provides nutrition benefits to supplement the food budget of eligible, low-income individuals and families. This program can help reduce your overall costs by ensuring you have access to nutritious food.

- California Earthquake Authority (CEA): The CEA is a publicly managed, not-for-profit organization that provides residential earthquake insurance in California. This program can offer affordable coverage for those living in earthquake-prone areas.

Maintain a Good Credit Score

In California, insurance providers are allowed to use your credit-based insurance score when determining your premium. A higher credit score can lead to lower insurance rates, as it indicates a lower risk profile. Therefore, maintaining a good credit score is crucial for securing the cheapest insurance rates.

Stay Informed About Discounts and Special Offers

Insurance providers often offer discounts and special promotions to attract new customers or reward loyal policyholders. Stay informed about these offers by regularly checking insurance company websites or subscribing to their newsletters. You can also inquire with your insurance agent or broker about any available discounts that may apply to your policy.

Review and Adjust Your Coverage Regularly

Your insurance needs may change over time, so it’s essential to review your policies regularly. Life events such as marriage, the birth of a child, purchasing a new home, or changing jobs can impact your insurance requirements. Regularly reviewing your coverage ensures that you have the right amount of insurance at the most affordable rates.

The Role of Insurance Brokers in California

Insurance brokers play a crucial role in helping Californians find the cheapest insurance options that meet their unique needs. These professionals are licensed and knowledgeable about the insurance market, regulations, and coverage options. Here’s how an insurance broker can assist you:

- Expertise: Insurance brokers have extensive knowledge of the insurance industry and can provide valuable insights into the best coverage options for your specific circumstances.

- Multiple Options: Brokers work with a wide range of insurance providers, giving them access to various policies and quotes. They can compare these options to find the most affordable coverage that suits your needs.

- Personalized Service: Brokers offer a personalized approach, taking the time to understand your unique situation and requirements. This tailored service ensures you receive the right coverage at the best price.

- Negotiation: Brokers can negotiate with insurance providers on your behalf, often securing better rates or additional coverage benefits.

- Claim Support: In the event of a claim, an insurance broker can provide valuable assistance, guiding you through the process and ensuring a smooth and efficient resolution.

Conclusion: Your Journey to Affordable Insurance

Finding the cheapest insurance in California is a journey that requires research, understanding, and a strategic approach. By following the expert tips outlined in this guide, you can navigate the insurance market with confidence and secure affordable coverage that meets your unique needs. Remember, the key is to shop around, compare quotes, and tailor your coverage to your specific circumstances.

Whether you're seeking auto, home, health, or life insurance, the Golden State offers a diverse range of options. By staying informed, leveraging the expertise of insurance brokers, and taking advantage of government-sponsored programs, you can make informed decisions and secure the most cost-effective insurance policies. Your journey to affordable insurance starts here, and with the right knowledge and tools, you can achieve your goal of finding the cheapest insurance in California.

How do I choose the right insurance coverage for my needs in California?

+Choosing the right insurance coverage involves assessing your specific needs. Consider factors like your assets, liabilities, health status, and lifestyle. For example, if you own a home, you’ll need homeowners insurance. If you have a family, life insurance may be a priority. Evaluate your risks and choose coverage that provides adequate protection without unnecessary expenses.

What are some common discounts available for insurance in California?

+Common discounts for insurance in California include multi-policy discounts (bundling multiple policies with one insurer), good student discounts for young drivers with good grades, safe driver discounts for those with clean driving records, and loyalty discounts for long-term customers. Additionally, some insurers offer discounts for specific safety features in vehicles or homes.

How can I save money on auto insurance in California?

+To save money on auto insurance, consider raising your deductibles (but ensure you can afford them), maintain a clean driving record (as insurers reward safe drivers with lower rates), and shop around for quotes from multiple insurers. Additionally, explore discounts such as good student discounts or safe driver discounts, and consider bundling your auto insurance with other policies like homeowners insurance.