Cheapest Cheap Car Insurance

Finding the cheapest car insurance can be a daunting task, especially with the multitude of options available in the market. While it's tempting to opt for the lowest premium, it's crucial to ensure you're getting adequate coverage without compromising on essential benefits. This comprehensive guide aims to help you navigate the process, providing valuable insights and tips to secure the best deal for your insurance needs.

Understanding Car Insurance Coverage

Car insurance is an essential aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It's a legal requirement in most countries and can significantly impact your financial well-being in the event of an incident. Understanding the different types of coverage and their implications is key to making informed decisions.

Liability Coverage

Liability coverage is a fundamental component of car insurance. It covers the costs associated with injuries or property damage you cause to others in an accident. This coverage is mandatory in most states and is crucial for protecting your finances in the event of a lawsuit.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties in an accident. |

| Property Damage Liability | Pays for repairs or replacement of damaged property, such as other vehicles or structures. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage provide protection for your own vehicle. Collision coverage pays for repairs or replacement if your car is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-accident related damages, such as theft, vandalism, natural disasters, or collisions with animals.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. It's a vital component for ensuring comprehensive medical coverage.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have sufficient coverage to pay for the damages. It ensures you're not left financially burdened due to the actions of another driver.

Factors Affecting Car Insurance Rates

Car insurance rates can vary significantly based on a multitude of factors. Understanding these factors can help you make informed decisions and potentially lower your insurance premiums.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly impact your insurance rates. Sports cars, luxury vehicles, and SUVs often have higher premiums due to their higher repair costs and potential for accidents. Additionally, if you use your vehicle for business purposes or frequently commute long distances, your insurance rates may be higher.

Driver's Profile

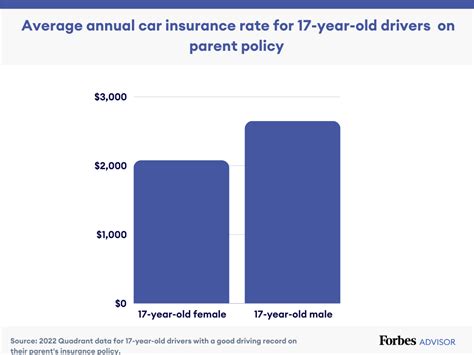

Your driving history and personal profile play a crucial role in determining insurance rates. Young drivers and those with a history of accidents or traffic violations often face higher premiums. Similarly, your credit score can also influence your insurance rates, with lower credit scores often resulting in higher premiums.

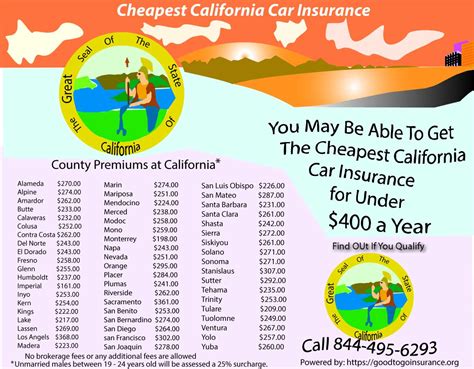

Location and Risk Factors

Your geographical location can significantly impact your insurance rates. Areas with high crime rates, frequent natural disasters, or dense traffic often have higher insurance premiums. Additionally, the number of claims made in your area can also affect your rates.

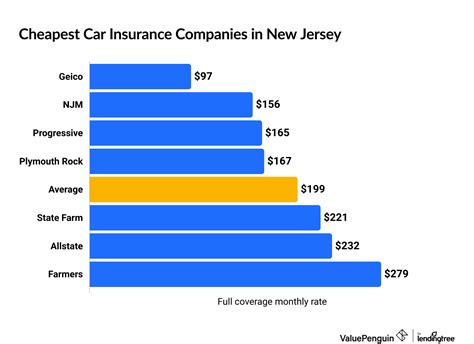

Insurance Company and Coverage Options

Different insurance companies offer varying coverage options and premiums. It's essential to compare quotes from multiple providers to find the best deal. Additionally, the coverage options you choose, such as deductibles and additional coverages, can impact your overall premium.

Tips for Getting the Cheapest Car Insurance

Securing the cheapest car insurance requires a combination of research, understanding, and negotiation. Here are some tips to help you find the best deal:

Shop Around

Don't settle for the first insurance quote you receive. Compare quotes from multiple providers to find the best rate. Online comparison tools can be a great starting point, but be sure to also reach out to local insurance agents for personalized quotes.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. This can significantly reduce your overall insurance costs.

Choose Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. However, ensure you choose a deductible amount that you're comfortable paying out of pocket in the event of a claim.

Maintain a Clean Driving Record

A clean driving record can significantly impact your insurance rates. Avoid accidents and traffic violations to keep your premiums low. Additionally, taking defensive driving courses can sometimes result in insurance discounts.

Explore Discounts

Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, loyalty discounts, and more. Ask your insurance provider about the discounts they offer and ensure you're taking advantage of all applicable discounts.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that calculates your insurance premium based on your actual driving habits. This can be a great option for low-mileage drivers or those with safe driving records.

Frequently Asked Questions

How can I lower my car insurance premiums if I have a poor driving record?

+If you have a poor driving record, your insurance premiums are likely to be higher. However, there are steps you can take to reduce your premiums. Firstly, maintain a clean driving record going forward by avoiding accidents and traffic violations. Secondly, consider enrolling in a defensive driving course, as some insurance companies offer discounts for completing these courses. Additionally, shopping around for insurance quotes can help you find a provider that offers more competitive rates for drivers with a less-than-perfect record.

What factors influence car insurance rates for young drivers?

+Car insurance rates for young drivers can be significantly higher due to their lack of driving experience and the higher risk they pose on the roads. Factors that influence insurance rates for young drivers include age (with rates generally decreasing as they get older), driving record, the type of vehicle they drive, and their location. Additionally, some insurance companies offer discounts for young drivers who maintain good grades in school or complete approved driver training programs.

Can I get car insurance without a driver's license?

+Obtaining car insurance without a valid driver's license can be challenging but not impossible. Some insurance providers may offer policies for vehicles that are not primarily driven, such as classic cars or collector's items. These policies often have restrictions and may not provide the same level of coverage as a standard auto insurance policy. It's crucial to check with insurance providers about their specific requirements and policies regarding insuring vehicles without a driver's license.

What should I do if I'm denied car insurance due to my credit score?

+If you're denied car insurance or offered higher premiums due to your credit score, there are a few steps you can take. Firstly, review your credit report to ensure there are no errors or discrepancies. If you find inaccuracies, dispute them with the credit bureau. Secondly, consider improving your credit score by paying off debts, reducing credit card balances, and making timely payments. Additionally, shop around for insurance providers who offer policies for individuals with lower credit scores or provide options to build credit through insurance payments.

How often should I review and update my car insurance policy?

+It's beneficial to review your car insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you're not overpaying for unnecessary coverage. Reviewing your policy annually allows you to compare rates and coverage options from different providers, take advantage of discounts you may qualify for, and adjust your coverage as needed. Additionally, updating your policy whenever your personal circumstances change, such as a move to a new location or a new vehicle purchase, ensures your insurance remains relevant and comprehensive.

Securing the cheapest car insurance requires a combination of knowledge, research, and negotiation. By understanding the different types of coverage, the factors that influence insurance rates, and the strategies to lower premiums, you can make informed decisions and find the best deal for your insurance needs. Remember, it’s crucial to strike a balance between cost and coverage to ensure you’re adequately protected on the roads.