Cheapest Car And Home Insurance

Finding the cheapest car and home insurance can be a daunting task, especially with the vast array of options available in the market. However, with the right knowledge and a strategic approach, you can secure affordable coverage for your vehicles and property. This comprehensive guide will delve into the world of insurance, providing you with expert insights and practical tips to help you identify the most cost-effective options.

Understanding the Factors that Influence Insurance Costs

Before we dive into the specific providers and policies, it’s crucial to grasp the underlying factors that determine insurance premiums. These factors can vary depending on the type of insurance, but some common considerations include:

- Location: Your geographical area plays a significant role in insurance rates. Regions with higher crime rates, severe weather conditions, or a higher density of accidents often command higher premiums.

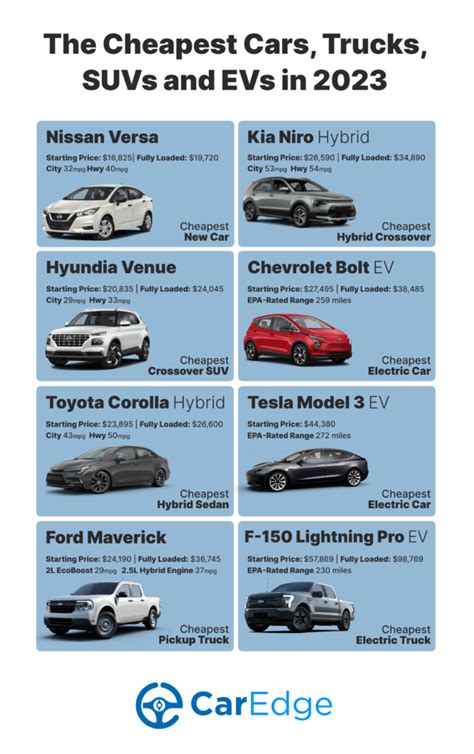

- Risk Factors: For car insurance, your driving record, the make and model of your vehicle, and your age and gender are all taken into account. Similarly, home insurance premiums are influenced by factors like the age of your home, its construction materials, and its vulnerability to natural disasters.

- Coverage Limits: The level of coverage you choose directly impacts your premiums. Higher coverage limits typically result in higher costs.

- Deductibles: Opting for a higher deductible can lower your insurance premiums. This is because you’ll be responsible for a larger portion of the costs in the event of a claim.

- Bundling Policies: Many insurance providers offer discounts when you bundle multiple policies, such as car and home insurance, with them.

Exploring the Cheapest Car Insurance Options

When it comes to car insurance, there’s no one-size-fits-all solution. The cheapest option for you will depend on a multitude of factors, including your personal circumstances and the specific coverage you require. However, there are a few insurance providers that consistently offer competitive rates and deserve a closer look.

State Farm

State Farm is a well-established insurance provider with a strong reputation for customer service. They offer a range of car insurance policies tailored to different needs and budgets. Here’s a glimpse at their offerings:

| Policy Type | Average Annual Premium |

|---|---|

| Minimum Liability | 500 - 700 |

| Standard Coverage | 1,000 - 1,500 |

| Comprehensive Coverage | 1,500 - 2,000 |

💡 State Farm often provides significant discounts for good drivers and those who bundle their car insurance with other policies, such as home or life insurance.

Geico

Geico is another major player in the insurance industry, known for its digital-first approach and competitive pricing. They offer a wide range of car insurance policies, including:

- Minimum Liability Coverage: Starting at 400 annually.</li> <li><strong>Standard Coverage:</strong> Around 800 - 1,200 per year.</li> <li><strong>Comprehensive Coverage:</strong> Premium ranges from 1,200 to $1,800 annually.

💡 Geico frequently runs promotional offers and provides discounts for military personnel, federal employees, and members of certain professional organizations.

Progressive

Progressive is a leading insurance provider that offers a range of innovative coverage options. Their car insurance policies are designed to cater to various needs and budgets:

- Basic Liability Coverage: Starts at approximately 500 per year.</li> <li><strong>Standard Coverage:</strong> Average premium is around 1,200 annually.

- Comprehensive Coverage: Premium ranges from 1,500 to 2,500 per year.

💡 Progressive is renowned for its Name Your Price tool, allowing you to set your desired premium and then suggesting coverage options to match.

Securing the Most Affordable Home Insurance

Home insurance is an essential aspect of protecting your property and possessions. Just like car insurance, the cheapest option for you will depend on a multitude of factors, including the value of your home, its location, and the level of coverage you require. Here are some providers to consider when seeking affordable home insurance.

Allstate

Allstate is a prominent insurance provider that offers a range of home insurance policies to suit different needs. Their coverage options include:

- Basic Homeowners Insurance: Starting at approximately 800 annually.</li> <li><strong>Standard Homeowners Insurance:</strong> Average premium is around 1,200 per year.

- Enhanced Homeowners Insurance: Premium ranges from 1,500 to 2,500 annually.

💡 Allstate provides various discounts, including those for new customers, safe homes, and bundled policies.

Farmers Insurance

Farmers Insurance is a well-known provider that offers a comprehensive range of insurance products, including home insurance. Their policies include:

- Basic Homeowners Policy: Starts at around 700 per year.</li> <li><strong>Standard Homeowners Policy:</strong> Average premium is approximately 1,100 annually.

- Deluxe Homeowners Policy: Premium ranges from 1,500 to 2,000 per year.

💡 Farmers Insurance provides discounts for loyal customers, safe homes, and those who bundle multiple policies.

Liberty Mutual

Liberty Mutual is a leading insurance provider known for its personalized approach to coverage. Their home insurance policies include:

- Standard Homeowners Insurance: Starting at around 900 per year.</li> <li><strong>Enhanced Homeowners Insurance:</strong> Premium ranges from 1,200 to $1,800 annually.

- Customized Homeowners Insurance: Premium varies based on your specific needs and coverage limits.

💡 Liberty Mutual offers a wide range of discounts, including those for new customers, safe homes, and those who bundle policies.

Tips for Further Reducing Your Insurance Costs

While the providers mentioned above offer competitive rates, there are additional strategies you can employ to further reduce your insurance costs:

- Shop Around: Obtain quotes from multiple providers to compare rates and find the best deal.

- Review Your Coverage Regularly: As your circumstances change, so might your insurance needs. Regularly review your policies to ensure you’re not overpaying for coverage you no longer require.

- Increase Your Deductibles: Opting for higher deductibles can significantly lower your premiums. Just ensure you can afford the deductible in the event of a claim.

- Bundle Policies: Bundling your car and home insurance, or other policies, with the same provider can result in substantial discounts.

- Utilize Discounts: Many insurance providers offer discounts for various reasons, such as safe driving records, loyalty, or certain professional affiliations. Be sure to inquire about all available discounts.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the US is around 1,674 per year. However, this can vary significantly based on factors like your location, driving record, and the make and model of your vehicle.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How much does home insurance typically cost annually?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The average annual cost of homeowners insurance in the US is approximately 1,312. Again, this can vary depending on factors like the value of your home, its location, and the level of coverage you require.

Are there any insurance providers that offer discounts for eco-friendly vehicles or homes?

+Yes, some insurance providers offer discounts for eco-friendly vehicles or homes. For instance, Geico provides a discount for hybrid and electric vehicles, while State Farm offers a discount for homes with solar panels. It’s always worth inquiring about such discounts when obtaining quotes.