Cheapest Auto Insurance New York

When it comes to finding the cheapest auto insurance in New York, there are several factors to consider. The cost of car insurance can vary significantly depending on various criteria, including your driving history, the type of vehicle you own, and the coverage options you choose. This guide aims to provide an in-depth analysis of the factors influencing auto insurance rates in New York and offer strategies to help you secure the most affordable coverage for your needs.

Understanding Auto Insurance Costs in New York

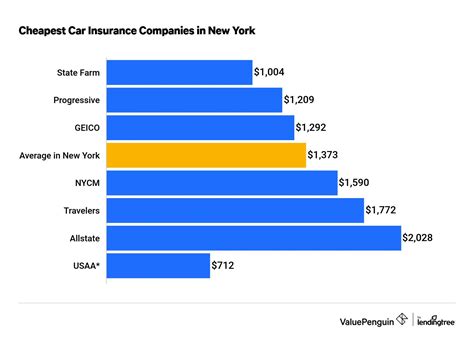

New York is known for having some of the highest car insurance rates in the United States. The average cost of full coverage auto insurance in the state is approximately $2,166 per year, according to a recent study by Insure.com. However, it’s essential to note that this average can vary greatly depending on your specific circumstances.

Several key factors contribute to the overall cost of auto insurance in New York. These include:

- Driving Record: A clean driving record with no accidents or violations can significantly lower your insurance rates. On the other hand, a history of traffic violations or at-fault accidents will increase your premiums.

- Vehicle Type: The make, model, and age of your vehicle play a role in determining your insurance costs. Generally, newer and more expensive vehicles tend to have higher insurance premiums.

- Coverage Options: The level of coverage you choose will impact your insurance costs. Full coverage insurance, which includes liability, collision, and comprehensive coverage, is typically more expensive than basic liability-only insurance.

- Location: Insurance rates can vary between different regions of New York. Urban areas like New York City often have higher insurance costs due to increased traffic congestion and the higher risk of accidents and theft.

- Insurance Company: Different insurance providers offer varying rates and discounts. It's essential to shop around and compare quotes from multiple companies to find the most affordable option.

Strategies to Find the Cheapest Auto Insurance in New York

If you’re looking to reduce your auto insurance costs in New York, here are some strategies to consider:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to request quotes from multiple insurance providers. This will give you a better idea of the range of prices available and help you identify the most competitive rates.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto insurance with homeowners or renters insurance. If you’re in the market for multiple types of insurance, inquire about potential bundle discounts.

Choose the Right Coverage

While it’s tempting to opt for the lowest-cost insurance option, it’s essential to ensure you have adequate coverage. Assess your needs and choose a policy that provides the necessary protection without unnecessary add-ons that can drive up your costs.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and prevent accidents to maintain a positive driving history.

Explore Discounts

Insurance companies offer various discounts, including safe driver discounts, good student discounts, and loyalty discounts. Inquire about the discounts available with each provider and ensure you meet the criteria to take advantage of them.

Consider Usage-Based Insurance

Some insurance companies offer usage-based insurance programs, also known as pay-as-you-drive insurance. These programs use telematics devices to monitor your driving habits and can result in lower premiums for safe drivers. However, it’s essential to carefully review the terms and conditions of these programs before enrolling.

Choose a Higher Deductible

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your monthly premiums. However, be aware that this means you’ll have to pay more if you need to make a claim.

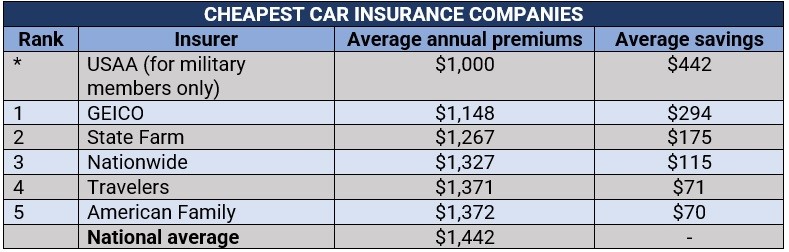

Comparing Auto Insurance Companies in New York

When comparing auto insurance providers in New York, it’s essential to consider not only the cost but also the quality of service and coverage options offered. Here’s a comparison of some of the top insurance companies in the state:

| Insurance Company | Average Annual Premium | Discounts Offered |

|---|---|---|

| State Farm | $1,747 | Good student, safe driver, loyalty, and multiple policy discounts |

| GEICO | $1,822 | Military, federal employee, good student, and safe driver discounts |

| Allstate | $2,062 | Safe driving, good student, and loyalty discounts |

| Progressive | $2,145 | Snapshot usage-based insurance, good student, and multiple policy discounts |

| Liberty Mutual | $2,264 | Safe driver, good student, and multiple policy discounts |

Please note that these are average annual premiums and may not reflect the exact rates you'll receive. It's always recommended to obtain personalized quotes based on your specific circumstances.

Tips for Maintaining Affordable Auto Insurance in New York

Once you’ve secured affordable auto insurance, it’s essential to maintain those low rates. Here are some tips to help you keep your insurance costs under control:

- Review Your Policy Regularly: Insurance rates can change over time, so it's a good idea to review your policy annually and shop around for better rates.

- Keep Your Driving Record Clean: As mentioned earlier, a clean driving record is crucial for maintaining affordable insurance. Avoid traffic violations and accidents to prevent increases in your premiums.

- Explore Telematics Devices: Usage-based insurance programs can offer significant discounts for safe drivers. If you're a cautious driver, consider enrolling in one of these programs to save money.

- Consider a Higher Deductible: Increasing your deductible can lower your monthly premiums, but be sure you're comfortable with the financial risk.

- Avoid Unnecessary Coverage: Review your policy regularly and ensure you're not paying for coverage you don't need. This can help keep your costs down.

Frequently Asked Questions

How much does car insurance cost in New York on average?

+The average cost of full coverage auto insurance in New York is approximately $2,166 per year. However, this average can vary significantly based on individual circumstances.

What factors impact auto insurance rates in New York?

+Several factors influence auto insurance rates in New York, including driving record, vehicle type, coverage options, location, and the insurance company.

How can I find the cheapest auto insurance in New York?

+To find the cheapest auto insurance, shop around and compare quotes from multiple providers. Consider bundling policies, choosing the right coverage, maintaining a clean driving record, exploring discounts, and opting for usage-based insurance if you’re a safe driver.

Are there any discounts available for auto insurance in New York?

+Yes, many insurance companies offer discounts such as safe driver discounts, good student discounts, loyalty discounts, and multiple policy discounts. It’s worth inquiring about these options when obtaining quotes.

What is usage-based insurance, and how can it help me save money?

+Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics devices to monitor your driving habits. Safe drivers can often save money with this type of insurance, as their cautious driving habits are rewarded with lower premiums.