Cheap Insurance Health Insurance

In today's world, health insurance is an essential financial safeguard for individuals and families. However, the rising costs of healthcare and insurance premiums have made it increasingly challenging for many to secure adequate coverage. This article explores the concept of cheap insurance in the context of health coverage, delving into the strategies, trade-offs, and considerations involved in finding affordable options without compromising on essential benefits.

Understanding Cheap Health Insurance

Cheap health insurance refers to policies that offer coverage at a relatively low cost compared to standard plans. These plans are designed to cater to individuals and families with limited financial resources or those who prefer a more budget-conscious approach to healthcare. While the term “cheap” may suggest a lack of quality, it’s important to note that affordable health insurance can still provide valuable protection and access to essential medical services.

Strategies for Affordable Health Insurance

Securing cheap health insurance often involves a careful balance between cost and coverage. Here are some strategies and considerations to help individuals find the best affordable options:

Assess Your Healthcare Needs

Before diving into insurance options, it’s crucial to understand your specific healthcare needs. Consider factors such as your age, existing medical conditions, prescription medication requirements, and the frequency of doctor visits. By evaluating your needs, you can tailor your insurance search to find plans that offer the right coverage for your situation.

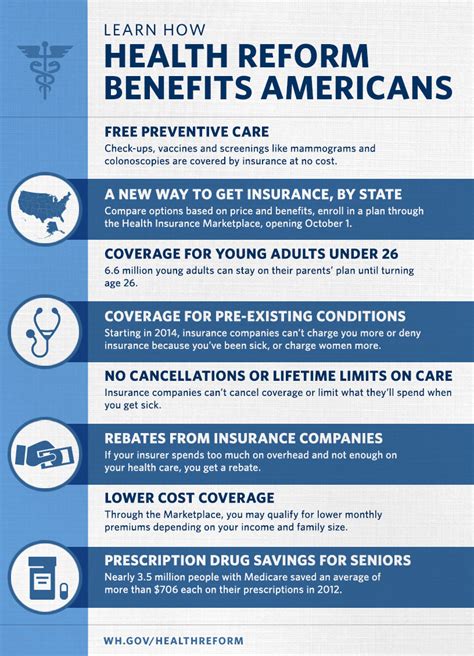

Explore Government-Sponsored Programs

Many governments offer subsidized health insurance programs for low-income individuals and families. These programs, such as Medicaid in the United States or similar initiatives in other countries, provide comprehensive coverage at little to no cost. Eligibility criteria vary, but these programs can be a lifeline for those facing financial hardships.

Compare Private Insurance Plans

Private health insurance providers offer a range of plans with varying levels of coverage and costs. Compare multiple plans from different insurers to find the best balance between affordability and benefits. Look for plans with reasonable deductibles, copays, and out-of-pocket maximums that align with your financial capabilities.

Consider High-Deductible Health Plans (HDHPs)

HDHPs are insurance plans with higher deductibles, which means you’ll pay more out of pocket before the insurance coverage kicks in. These plans are often paired with Health Savings Accounts (HSAs), allowing you to save pre-tax dollars for healthcare expenses. While HDHPs may have lower premiums, they require careful financial planning to manage the higher deductibles.

Evaluate Network Restrictions

Cheap insurance plans may have narrower networks of healthcare providers, which means you may have fewer options for choosing doctors and hospitals. Evaluate the network restrictions carefully, ensuring that your preferred healthcare providers are included. If not, consider the trade-off between cost and convenience.

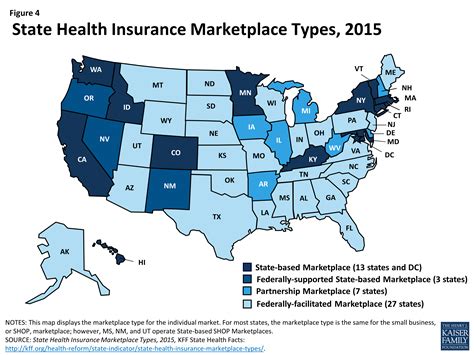

Utilize Online Insurance Marketplaces

Online insurance marketplaces, like government-run exchanges or private platforms, provide a convenient way to compare and purchase health insurance plans. These marketplaces often offer a wide range of options, making it easier to find affordable plans that suit your needs. Additionally, they may provide subsidies or tax credits to lower the cost of coverage.

Take Advantage of Employer-Sponsored Plans

If you’re employed, explore the health insurance options offered by your employer. Many employers provide group health insurance plans, which can offer significant cost savings due to the collective bargaining power. Even if your employer’s plan is not cheap, it may still be more affordable than individual plans.

Consider Short-Term Plans

Short-term health insurance plans are designed to provide temporary coverage for individuals between jobs or during gaps in coverage. These plans are often more affordable than standard plans but come with limitations, such as pre-existing condition exclusions and shorter coverage periods. They can be a good option for those seeking temporary coverage while they explore more comprehensive options.

Negotiate with Insurance Providers

Don’t be afraid to negotiate with insurance providers. Some insurers may offer discounts or special rates for specific groups, such as students, seniors, or members of certain organizations. Reach out to providers and inquire about any potential discounts or promotional offers that could reduce your insurance costs.

Trade-offs and Considerations

While cheap health insurance can provide financial relief, it’s important to be aware of the potential trade-offs and considerations:

- Limited Coverage: Cheap insurance plans may have narrower coverage, excluding certain services or treatments. Carefully review the plan's benefits and exclusions to ensure it aligns with your healthcare needs.

- High Out-of-Pocket Costs: Lower premiums often come with higher deductibles and copays. Consider your ability to afford these out-of-pocket expenses when choosing a plan.

- Network Restrictions: Narrower networks may limit your choice of healthcare providers. Ensure that your preferred doctors and specialists are included in the plan's network.

- Pre-Existing Condition Exclusions: Some cheap insurance plans may exclude coverage for pre-existing conditions. If you have a pre-existing condition, carefully review the plan's terms to understand any potential limitations.

- Lack of Preventive Care: Affordable plans may have limited or no coverage for preventive care services, such as annual check-ups or vaccinations. Consider the importance of preventive care in your healthcare plan.

Performance Analysis

The performance of cheap health insurance plans can vary greatly depending on individual needs and circumstances. While these plans may not offer the same level of comprehensive coverage as more expensive options, they can still provide valuable protection against unexpected medical expenses. The key is to carefully evaluate your healthcare needs and choose a plan that strikes the right balance between affordability and coverage.

| Plan Type | Average Premium | Coverage Level |

|---|---|---|

| Government-Sponsored | $0 - $100/month | Comprehensive |

| Private Insurance | $150 - $500/month | Varies |

| High-Deductible Plans | $100 - $300/month | Basic to Moderate |

| Short-Term Plans | $50 - $200/month | Limited |

Future Implications

The future of cheap health insurance is closely tied to healthcare reforms and economic trends. As governments and insurers work to make healthcare more accessible and affordable, we can expect to see continued innovation in the insurance market. This may include the expansion of government-sponsored programs, the development of more affordable private plans, and increased focus on preventive care to reduce long-term healthcare costs.

Additionally, technological advancements and digital health solutions are likely to play a significant role in shaping the future of affordable health insurance. Telemedicine and remote healthcare services can reduce the cost of medical consultations and treatments, making healthcare more accessible and cost-effective. Moreover, the integration of artificial intelligence and data analytics in healthcare could lead to more efficient and personalized insurance plans, further driving down costs.

However, it's important to remain vigilant about potential challenges and pitfalls. The rise of cheap insurance plans may lead to concerns about profit margins and the sustainability of insurance providers. This could potentially impact the quality of care and the availability of certain treatments. As such, it's crucial for individuals to stay informed about industry developments and advocate for policies that promote equitable and affordable healthcare for all.

How do I know if I’m eligible for government-sponsored health insurance programs?

+Eligibility criteria for government-sponsored programs vary by country and region. In the United States, for example, Medicaid eligibility is primarily based on income and family size. It’s important to research the specific criteria for your area and consult with local authorities or insurance brokers to determine your eligibility.

Can I switch to a cheaper health insurance plan mid-year if I find a better option?

+Switching health insurance plans mid-year is typically possible during specific enrollment periods or under certain qualifying life events. Check with your current insurer and the new plan’s provider to understand the rules and potential penalties for switching plans outside of the standard enrollment period.

What are the potential drawbacks of short-term health insurance plans?

+Short-term health insurance plans often have limitations and exclusions. They may not cover pre-existing conditions, may have shorter coverage periods, and may not provide comprehensive coverage for emergency or specialized medical treatments. It’s crucial to carefully review the plan’s terms and understand the potential drawbacks before enrolling.