Multiple Insurance Quotes

When it comes to insurance, having multiple quotes is often the key to making an informed decision. Whether you're looking for auto, home, health, or life insurance, getting multiple quotes can provide valuable insights and ensure you find the best coverage at the right price. In this comprehensive guide, we will delve into the world of multiple insurance quotes, exploring the benefits, the process, and how to make the most of your search. By the end, you'll have a clear understanding of why multiple quotes matter and how to navigate the insurance landscape with confidence.

Understanding the Benefits of Multiple Insurance Quotes

Obtaining multiple insurance quotes offers a wealth of advantages that can significantly impact your insurance journey. Here’s why it’s essential to explore various options:

Comparison and Cost Savings

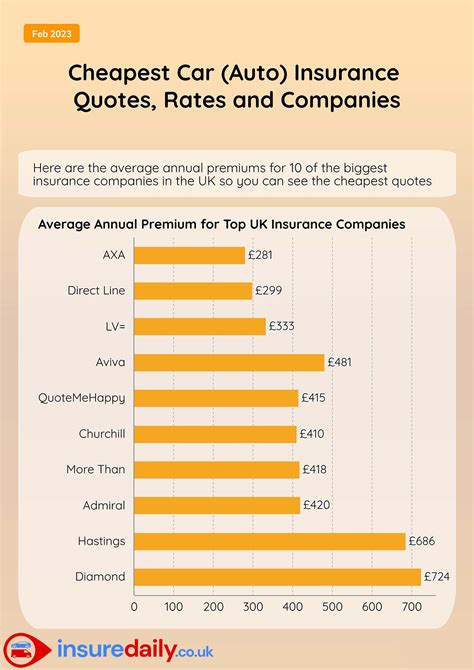

One of the primary benefits is the ability to compare different insurance policies side by side. By requesting quotes from multiple providers, you can easily identify the most cost-effective options that align with your coverage needs. This comparison process empowers you to make informed choices, ensuring you secure the best value for your insurance premium.

For instance, imagine you're in the market for auto insurance. By obtaining quotes from various insurers, you might discover that Company A offers a comprehensive policy with a lower premium than Company B, even though they provide similar coverage. This comparison allows you to save money without compromising on the quality of your coverage.

Customized Coverage

Insurance needs vary greatly from person to person. Multiple quotes enable you to tailor your coverage to your unique circumstances. Different insurers may offer specialized packages or unique policy features that better suit your requirements. By exploring these options, you can create a customized insurance plan that provides the right protection for your specific needs, whether it’s enhanced liability coverage, accident forgiveness, or discounts for safe driving.

| Insurer | Coverage Options |

|---|---|

| Insurer X | Pet Injury Coverage, Rental Car Reimbursement |

| Insurer Y | Roadside Assistance, Accident Forgiveness |

| Insurer Z | Discounts for Safe Driving, Multi-Policy Bundles |

Understanding Market Rates

Collecting multiple quotes provides a valuable opportunity to understand the current market rates for insurance. It allows you to gauge whether the premiums quoted are competitive and fair within the industry. By comparing quotes, you can identify potential red flags or overly inflated prices, ensuring you’re not overpaying for your insurance coverage.

The Process of Obtaining Multiple Insurance Quotes

Now that we’ve explored the benefits, let’s delve into the step-by-step process of acquiring multiple insurance quotes:

Identify Your Insurance Needs

Before requesting quotes, it’s crucial to have a clear understanding of your insurance requirements. Consider the following factors:

- Type of Insurance: Determine whether you need auto, home, health, life, or another type of insurance.

- Coverage Amounts: Decide on the level of coverage you desire. For example, you might need a higher liability limit for auto insurance or specific coverage for valuable possessions in your home.

- Deductibles: Evaluate your financial situation and decide on an appropriate deductible that balances cost and coverage.

- Additional Features: Think about any specific features or endorsements you require, such as rental car coverage or identity theft protection.

Research Insurers

Take the time to research and identify a list of reputable insurers in your area. Consider factors such as:

- Financial Stability: Opt for insurers with a strong financial rating to ensure they can provide reliable coverage and pay claims promptly.

- Customer Satisfaction: Check reviews and ratings to gauge customer experiences with the insurer.

- Policy Options: Look for insurers that offer a range of policy options and customization to meet your specific needs.

- Discounts and Promotions: Explore insurers that provide discounts for bundling policies or offer loyalty rewards.

Request Quotes

Contact the insurers on your list and request quotes. You can do this online, over the phone, or by visiting their offices. Provide accurate and detailed information about your insurance needs, ensuring consistency across all quotes for a fair comparison.

Analyze and Compare Quotes

Once you’ve received multiple quotes, it’s time to analyze and compare them. Here’s what to look for:

- Premium Costs: Compare the annual or monthly premiums to identify the most cost-effective options.

- Coverage Details: Carefully review the coverage limits, deductibles, and any exclusions to ensure they align with your needs.

- Additional Benefits: Evaluate any unique benefits or perks offered by different insurers, such as roadside assistance or travel insurance.

- Customer Service and Claims Process: Consider the insurer's reputation for customer service and claims handling. Check online reviews and ratings to assess their responsiveness and reliability.

Making an Informed Decision

With your quotes analyzed and compared, it’s time to make an informed decision. Here are some key considerations to help you choose the right insurance provider:

Consider Long-Term Value

While a low premium may be tempting, it’s essential to consider the long-term value of the insurance policy. Assess the stability and reliability of the insurer, as well as the potential for future rate increases. A slightly higher premium with a reputable insurer might provide better value in the long run.

Trust and Reputation

Choose an insurer with a solid reputation and a history of honoring claims promptly. Read reviews and seek recommendations from trusted sources to ensure you’re placing your trust in a reliable company.

Customized Coverage and Flexibility

Opt for an insurer that offers customizable coverage options and the flexibility to adjust your policy as your needs change. This ensures your insurance remains relevant and adequate as your life circumstances evolve.

Maximizing Your Insurance Experience

To get the most out of your insurance journey, consider the following tips:

Review Your Coverage Regularly

Insurance needs can change over time. Review your coverage annually or whenever significant life events occur, such as marriage, buying a new home, or starting a family. This ensures your insurance remains up-to-date and provides adequate protection.

Explore Discounts and Savings

Insurers often offer a variety of discounts, including bundling discounts for multiple policies, safe driver discounts, or loyalty rewards. Take advantage of these opportunities to further reduce your insurance costs.

Utilize Technology

Leverage online tools and comparison websites to quickly and easily obtain multiple quotes. These platforms can provide a convenient and efficient way to compare insurers and their offerings.

Frequently Asked Questions

How many quotes should I get before making a decision?

+

While there is no magic number, obtaining at least three to five quotes from reputable insurers is a good starting point. This allows for a diverse range of options and provides a more comprehensive comparison.

Can I negotiate insurance rates with insurers?

+

In some cases, insurers may be open to negotiation, especially if you have a strong insurance history or unique circumstances. It’s worth inquiring about potential discounts or rate adjustments, but be mindful that not all insurers are flexible in this regard.

What happens if I find a better quote after purchasing insurance?

+

If you discover a more favorable quote after purchasing insurance, you can consider switching providers. However, be aware of potential cancellation fees and ensure the new policy offers adequate coverage. It’s often best to thoroughly research and compare quotes before making a final decision.

By following this comprehensive guide, you’ll be well-equipped to navigate the world of multiple insurance quotes. Remember, taking the time to compare and analyze your options is a crucial step in securing the best insurance coverage for your needs. Happy quoting!