Cheap Cheap Car Insurance

Finding affordable car insurance is a top priority for many drivers, and it's a crucial aspect of financial planning. In this comprehensive guide, we will delve into the world of cheap car insurance, exploring the factors that influence rates, offering tips to reduce costs, and providing insights to help you make informed decisions. With the right strategies, you can secure reliable coverage without breaking the bank.

Understanding the Factors That Impact Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a significant role in determining your premium. By understanding these factors, you can make more strategic choices to lower your insurance expenses.

Vehicle Make and Model

The type of car you drive is a primary consideration for insurance providers. Different vehicles have varying safety features, repair costs, and theft rates, all of which impact the overall risk assessment. For instance, a high-performance sports car may attract a higher premium due to its expensive parts and potential for speed-related accidents.

| Vehicle Type | Average Annual Premium |

|---|---|

| Economy Sedan | $1,200 |

| SUV (Standard) | $1,350 |

| Luxury Coupe | $1,800 |

When choosing a car, consider the insurance implications. Opting for a vehicle with advanced safety features and a lower theft rate can lead to significant savings on your insurance.

Driver’s Profile and History

Your driving record and personal details are crucial in insurance assessments. Younger drivers, especially males under 25, often face higher premiums due to their statistical risk profile. Conversely, mature drivers with a clean record and extensive driving experience may enjoy more affordable rates.

Here's a breakdown of how driver demographics can influence premiums:

| Driver Profile | Average Premium Impact |

|---|---|

| Male, Age 22 | +20% |

| Female, Age 35 | -15% |

| Senior Citizen, Age 65 | -5% |

Coverage and Deductibles

The level of coverage you choose directly affects your premium. Comprehensive coverage, which includes collision, liability, and uninsured motorist protection, will cost more than a basic liability-only policy. However, higher deductibles can reduce your premium, as you’re agreeing to pay more out-of-pocket in the event of a claim.

Location and Usage

Your geographical location and the purpose of your vehicle’s usage are additional factors. Urban areas often have higher insurance rates due to increased traffic and accident risks. Similarly, if you use your vehicle for business purposes, your insurance may be more expensive.

Strategies to Secure Cheap Car Insurance

Now that we’ve examined the key factors, let’s explore practical strategies to reduce your car insurance costs.

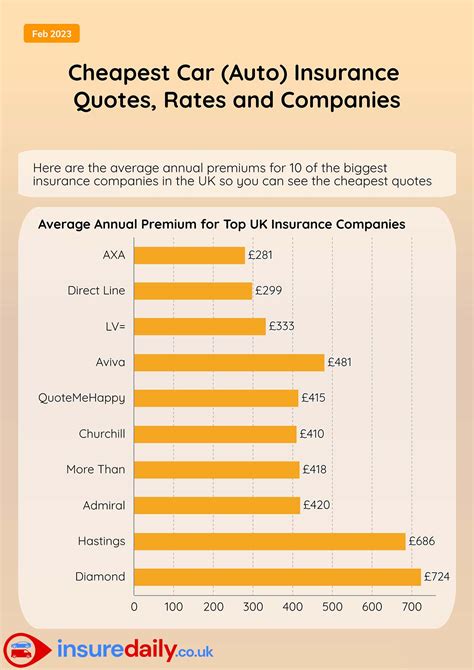

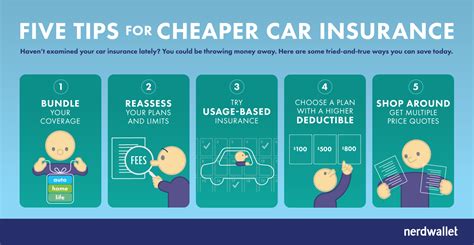

Shop Around and Compare

Insurance providers offer a wide range of rates, so it’s essential to compare quotes. Use online comparison tools and request quotes from at least three providers to ensure you’re getting the best deal. Don’t settle for the first quote you receive; competition drives prices down, so leverage this to your advantage.

Bundling Policies

If you have multiple insurance needs, such as home and auto, consider bundling your policies with the same provider. Many insurers offer discounts for multiple policies, resulting in significant savings. Additionally, review your coverage annually to ensure you’re not overpaying for unnecessary add-ons.

Increase Your Deductible

While it may not be an attractive option, increasing your deductible can lead to lower premiums. By agreeing to pay a higher out-of-pocket amount in the event of a claim, you reduce the insurer’s risk, which translates to lower rates for you.

Maintain a Clean Driving Record

Your driving history is a significant factor in insurance assessments. A clean record demonstrates responsible driving behavior and can lead to substantial discounts. Avoid traffic violations and accidents to keep your record spotless and your insurance rates low.

Explore Discounts

Insurance providers offer various discounts to attract customers. These may include safe driver discounts, good student discounts, loyalty discounts, and more. Always inquire about available discounts and ensure you’re eligible for as many as possible.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive, is an innovative approach that tailors your premium to your actual driving behavior. With this model, insurers track your driving habits and offer discounts for safe driving practices. It’s an excellent option for low-mileage drivers or those with a history of safe driving.

Review Your Coverage Regularly

Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current requirements. If you’ve recently purchased a new car or moved to a different area, your insurance needs may have shifted. Adjusting your coverage can lead to cost savings without compromising protection.

The Future of Affordable Car Insurance

The insurance industry is continually evolving, and new technologies are shaping the future of affordable coverage. Telematics, for instance, is a system that collects and analyzes data from your vehicle to assess your driving behavior. This data can be used to offer more accurate and personalized insurance rates, potentially leading to significant savings for safe drivers.

Additionally, the rise of electric and autonomous vehicles may further impact insurance costs. Electric vehicles often have lower maintenance and repair costs, which can translate to cheaper insurance rates. Autonomous vehicles, while still in their infancy, have the potential to drastically reduce accidents, leading to a paradigm shift in insurance pricing.

As the insurance landscape evolves, staying informed and proactive is key to securing the best deals. Regularly educate yourself on industry trends and new offerings to ensure you're always getting the most value for your insurance dollar.

Conclusion

Securing cheap car insurance is a combination of understanding the factors that influence rates and implementing strategic cost-saving measures. By staying informed, comparing quotes, and optimizing your coverage, you can enjoy reliable protection without straining your finances. Remember, the key to affordable insurance is a combination of responsible driving, smart shopping, and regular policy review.

How often should I review my car insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying for unnecessary features.

Can I get cheap insurance with a new driver on my policy?

+Adding a new driver, especially a young one, can increase your premium. However, shopping around and exploring multi-policy discounts can help mitigate these costs. Additionally, encouraging safe driving habits can lead to future discounts.

What are some common discounts I should look for?

+Common discounts include safe driver, good student, loyalty, and multi-policy discounts. Some insurers also offer discounts for anti-theft devices, defensive driving courses, and even certain professions or memberships.