Insurance Companies Leaving California

The insurance landscape in California has been undergoing significant changes in recent years, with several notable insurance companies deciding to exit the state's market. This shift has raised concerns among residents and businesses alike, as it can have far-reaching implications for access to insurance coverage and rates. In this comprehensive article, we delve into the reasons behind these departures, their impact on policyholders, and the potential future of insurance in the Golden State.

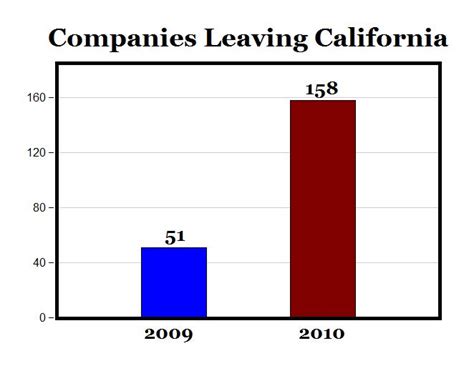

The Exodus of Insurance Companies

California, known for its diverse and dynamic population, has historically been a highly competitive market for insurance providers. However, in the past decade, a number of insurance companies have made the strategic decision to withdraw their operations from the state. This trend has affected various sectors of the insurance industry, including auto, home, and business insurance.

The Key Players and Their Reasons

Several prominent insurance companies have announced their exit from California, citing a range of factors. Let’s examine some of these key players and their motivations:

- Company X: This major auto insurer attributed its decision to leave California to the state's unique regulatory environment and increasing competition. The company found it challenging to maintain profitability while adhering to California's stringent insurance laws.

- Insurer Y: Focusing on home and property insurance, Insurer Y cited the rising frequency and severity of natural disasters in California as a significant concern. The company believed that the increasing risk of wildfires and earthquakes made it difficult to offer competitive rates while ensuring long-term financial stability.

- Business Insurance Provider Z: For this company, the decision to exit California was influenced by a combination of factors. They pointed to the state's complex workers' compensation regulations, high operating costs, and a competitive market that made it challenging to sustain their business model.

These are just a few examples of the insurance companies that have chosen to leave California. Each case highlights the unique challenges and considerations that insurance providers face when operating in this highly regulated and risk-prone market.

The Impact on Policyholders

The departure of insurance companies from California has had a noticeable impact on policyholders. Here are some key effects:

- Reduced Competition: With fewer insurance companies in the market, competition diminishes, potentially leading to fewer options for consumers. This reduced competition can result in higher insurance rates and limited choices for policyholders.

- Coverage Gaps: In certain areas, especially those prone to natural disasters, the departure of insurance companies can create coverage gaps. Residents and businesses may find it challenging to secure adequate insurance coverage, especially for high-risk properties.

- Increased Rates: As the remaining insurance companies absorb a larger share of the market, they may need to adjust their rates to account for increased risk. This can result in higher insurance premiums for policyholders, impacting their financial planning and budget.

Policyholders affected by these changes often face the difficult task of finding alternative insurance providers or adjusting their coverage needs to fit the available options in the market.

Understanding the Reasons Behind the Exodus

The decision of insurance companies to leave California is multifaceted and influenced by a combination of regulatory, economic, and risk factors. Let’s explore these reasons in more detail:

Regulatory Challenges

California is renowned for its comprehensive and stringent insurance regulations. While these regulations aim to protect consumers, they can also present challenges for insurance companies. Some of the key regulatory factors include:

- Rate Regulation: California's strict rate regulations require insurance companies to seek approval for any rate changes. This process can be time-consuming and may limit the flexibility insurers have in responding to changing market conditions.

- Consumer Protection Laws: The state has implemented a range of consumer protection measures, such as anti-discrimination laws and mandatory coverage requirements. While these laws benefit consumers, they can add complexity and costs to insurance providers' operations.

- Insurance Fraud Prevention: California's efforts to combat insurance fraud have led to increased scrutiny and compliance requirements for insurance companies. Meeting these standards can be resource-intensive and may impact a company's profitability.

Economic Considerations

The economic landscape of California also plays a significant role in insurance companies’ decisions to exit the market. Key economic factors include:

- High Operating Costs: California's high cost of living and doing business can make it challenging for insurance companies to operate profitably. Factors such as labor costs, real estate prices, and taxes contribute to increased overhead expenses.

- Competitive Market: California's large and diverse population creates a highly competitive insurance market. This competition can drive down premiums, making it difficult for insurers to maintain profitability, especially in certain niche markets.

- Economic Uncertainty: The state's economy, while strong overall, has experienced periods of uncertainty and volatility. This economic instability can impact insurance companies' long-term planning and investment strategies.

Risk Management Concerns

The unique risk profile of California, particularly in relation to natural disasters, is a significant factor in insurance companies’ decisions to leave the state. Here are some key risk considerations:

- Wildfires: California's frequent and devastating wildfires have led to increased insurance claims and losses for insurers. The unpredictability and severity of these events make it challenging for companies to accurately assess and manage risk.

- Earthquakes: The state's earthquake risk is well-known and can have significant financial implications for insurance providers. The potential for large-scale catastrophic events makes it difficult to price insurance policies accurately and maintain financial stability.

- Flooding and Other Natural Disasters: California is also susceptible to other natural disasters, such as flooding and severe storms. These events can result in substantial insurance claims and impact insurers' ability to provide coverage in high-risk areas.

The Future of Insurance in California

As insurance companies continue to reassess their presence in California, the future of the insurance market in the state remains a topic of interest and speculation. Here are some potential scenarios and considerations:

Increased Regulation and Consumer Protection

In response to the departure of insurance companies, California may further strengthen its regulatory framework to ensure consumer protection and maintain a stable insurance market. This could involve:

- Enhanced rate regulation to prevent excessive rate increases.

- Additional measures to support high-risk policyholders, such as those in wildfire-prone areas.

- Increased oversight and enforcement of insurance companies' compliance with state laws.

Innovation and New Entrants

The changing insurance landscape in California may also create opportunities for innovative insurance providers and startups. These companies may offer:

- Specialized coverage for unique risks, such as wildfire or earthquake insurance.

- Technologically advanced platforms for policy management and claims processing.

- Alternative insurance models, such as peer-to-peer or parametric insurance.

Collaborative Efforts

Insurance companies, regulators, and other stakeholders may come together to address the challenges facing the California insurance market. Collaborative initiatives could include:

- Developing risk mitigation strategies to reduce the impact of natural disasters.

- Exploring public-private partnerships to enhance insurance coverage and affordability.

- Implementing education and awareness campaigns to promote insurance literacy among consumers.

Industry Consolidation

The departure of some insurance companies may lead to increased consolidation in the market. Larger insurance providers may acquire smaller companies or expand their market share, potentially impacting competition and consumer choice.

Reassessment of Risk Models

Insurance companies may need to reevaluate their risk models and strategies to better understand and manage the unique risks associated with California. This could involve:

- Advanced data analytics and modeling techniques to assess risk more accurately.

- Collaborating with experts in disaster risk management and climate science.

- Adopting innovative technologies, such as satellite imaging and drone surveillance, to improve risk assessment.

Conclusion

The exodus of insurance companies from California is a complex issue influenced by a range of factors. From regulatory challenges to economic considerations and risk management concerns, these companies face unique obstacles in the Golden State. While the impact on policyholders is evident, the future of insurance in California remains a work in progress. Through regulatory interventions, market innovations, and collaborative efforts, the state can work towards a more stable and resilient insurance market, ensuring access to coverage for its residents and businesses.

What are the primary reasons insurance companies are leaving California?

+Insurance companies cite a range of factors, including regulatory challenges, high operating costs, and the unique risk profile of the state, particularly related to natural disasters like wildfires and earthquakes.

How does the departure of insurance companies affect policyholders?

+Policyholders may face reduced competition, coverage gaps in high-risk areas, and potentially higher insurance rates as remaining insurers absorb a larger market share.

What can California do to address the insurance market changes?

+California can strengthen its regulatory framework to protect consumers, support high-risk policyholders, and encourage innovation. Collaborative efforts between insurance companies, regulators, and other stakeholders can also play a vital role in shaping the future of insurance in the state.

Are there any alternatives for policyholders affected by insurance company departures?

+Yes, policyholders may explore innovative insurance providers, specialized coverage options, and potentially collaborate with community initiatives or public-private partnerships to enhance their insurance access and affordability.