Cheap Car Insurance Full Coverage

In the world of personal finance and automotive ownership, one of the most significant expenses to manage is car insurance. With rising costs and varying coverage options, finding affordable full coverage car insurance has become a priority for many vehicle owners. This comprehensive guide will delve into the intricacies of securing cheap full coverage car insurance, offering insights and strategies to help you make informed decisions and potentially save on your insurance premiums.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive policy that provides protection for your vehicle and covers a wide range of potential incidents. It typically includes two main components: collision coverage and comprehensive coverage, along with other essential aspects of car insurance.

Collision Coverage

Collision coverage is a vital part of full coverage car insurance. It protects your vehicle in the event of an accident, regardless of fault. This means that if you collide with another vehicle or object, your insurance policy will cover the costs of repairing or replacing your car, up to the policy limits.

Collision coverage is especially important for newer or more valuable vehicles, as it can help mitigate the financial impact of accidents. The cost of this coverage varies based on factors such as the make and model of your car, your driving history, and the insurance provider.

Some insurance companies offer additional benefits with collision coverage, such as rental car reimbursement or diminished value protection. These add-ons can provide further financial security in the event of an accident.

Comprehensive Coverage

Comprehensive coverage is the other key component of full coverage car insurance. It protects your vehicle from damages caused by events other than collisions, such as:

- Theft: If your car is stolen, comprehensive coverage will reimburse you for the value of the vehicle, minus your deductible.

- Vandalism: If your car is vandalized, comprehensive coverage can help cover the costs of repairs.

- Natural Disasters: Events like hailstorms, hurricanes, and floods are covered under comprehensive insurance, helping to protect your vehicle from weather-related damages.

- Animal Collisions: Hitting an animal on the road is often covered by comprehensive insurance, ensuring your vehicle is repaired or replaced if necessary.

- Falling Objects: Comprehensive coverage can also protect your vehicle if it’s damaged by a falling tree branch, debris from a construction site, or other objects.

Other Important Aspects of Full Coverage

In addition to collision and comprehensive coverage, full coverage car insurance typically includes the following essential components:

- Liability Coverage: This protects you if you’re found at fault in an accident, covering the costs of damages or injuries sustained by others.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Roadside Assistance: Many full coverage policies include roadside assistance, offering services like towing, flat tire changes, and battery jumps.

Tips for Finding Cheap Full Coverage Car Insurance

Securing cheap full coverage car insurance requires a combination of research, understanding your options, and making informed choices. Here are some strategies to help you find the best deal:

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Use online tools and insurance comparison websites to get estimates from multiple insurers. This will give you a clear idea of the range of prices and coverage options available.

When comparing quotes, pay attention to the specific coverages included and any additional benefits or discounts offered. Some insurers may provide better rates for certain types of vehicles or drivers, so tailor your search to your specific needs.

Understand Your Coverage Needs

Not every driver needs the same level of coverage. Evaluate your specific needs and circumstances to determine the appropriate level of coverage. For example, if you have an older vehicle with a lower market value, you may not need as extensive a policy as someone with a new, expensive car.

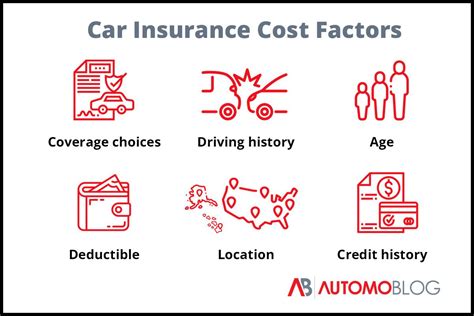

Consider your driving habits, the area you live in, and any personal factors that could impact your insurance rates. This will help you strike the right balance between coverage and cost.

Explore Discounts and Savings

Insurance companies offer a variety of discounts that can significantly reduce your premiums. Common discounts include:

- Safe Driver Discounts: If you have a clean driving record with no accidents or violations, you may be eligible for a safe driver discount.

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as home or renters insurance, can often lead to substantial savings.

- Loyalty Discounts: Staying with the same insurer for an extended period may result in loyalty discounts.

- Educational and Occupational Discounts: Some insurers offer discounts for certain professions or educational achievements.

- Safe Vehicle Discounts: Vehicles equipped with advanced safety features or anti-theft devices may qualify for discounts.

Be sure to ask your insurance provider about any potential discounts you may qualify for.

Consider Higher Deductibles

Increasing your deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your insurance premiums. However, this strategy requires careful consideration, as it means you’ll have to pay more upfront in the event of a claim. Make sure you choose a deductible amount that you can comfortably afford.

Review Your Policy Regularly

Insurance rates and coverage needs can change over time. Regularly review your policy to ensure it still meets your requirements and that you’re not paying for coverages you no longer need. This is especially important if your vehicle’s value has significantly decreased or if your driving habits have changed.

Performance Analysis and Case Studies

To illustrate the impact of these strategies, let’s examine a few case studies of individuals who successfully reduced their full coverage car insurance premiums:

Case Study 1: John’s Experience

John, a 35-year-old with a clean driving record, recently purchased a new car. He wanted to find the most affordable full coverage insurance for his vehicle. By shopping around and comparing quotes from various insurers, John discovered that he could save over 20% on his premiums by choosing a policy with a slightly higher deductible and bundling his car insurance with his home insurance.

Case Study 2: Sarah’s Story

Sarah, a 28-year-old living in an urban area, had been paying high insurance premiums for her full coverage policy. After reviewing her coverage needs, she realized that she could reduce her premiums by lowering her collision and comprehensive coverage limits, as her car’s value had significantly decreased over the years. By making this adjustment and exploring discounts for safe driving and loyalty, Sarah was able to save nearly 30% on her annual premiums.

Case Study 3: David’s Strategy

David, a 45-year-old with a long-standing relationship with his insurance provider, decided to review his policy when he noticed his premiums had increased. After discussing his options with his insurer, he learned that he could qualify for additional discounts by enrolling in a usage-based insurance program. By installing a tracking device in his car and driving safely, David reduced his premiums by 15% over the course of a year.

| Case Study | Savings (%) | Strategies |

|---|---|---|

| John | 20% | Higher deductible, bundling policies |

| Sarah | 30% | Adjusted coverage limits, discounts |

| David | 15% | Usage-based insurance, safe driving |

Future Implications and Trends

The landscape of car insurance is constantly evolving, influenced by technological advancements and changing consumer needs. Here are some key trends and future implications to consider:

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is becoming increasingly popular. This type of insurance uses technology to track your driving habits, such as mileage, speed, and time of day driven. By offering real-time data on your driving behavior, insurers can more accurately assess your risk and provide personalized premiums.

Advancements in Vehicle Safety

As vehicle safety technology continues to advance, the risk of accidents and the severity of injuries are likely to decrease. This could lead to lower insurance premiums over time, as insurers may adjust their rates based on the reduced risk profile of modern vehicles.

Increased Focus on Data Analytics

Insurance companies are leveraging data analytics to improve risk assessment and pricing. By analyzing large sets of data, insurers can identify patterns and make more accurate predictions about driving behaviors and accident probabilities. This can lead to more tailored insurance products and potentially lower premiums for safer drivers.

Autonomous Vehicles and Car-Sharing Services

The rise of autonomous vehicles and car-sharing services could significantly impact the car insurance industry. As these technologies become more prevalent, insurers may need to adapt their policies and pricing structures to accommodate these new modes of transportation. This could potentially lead to innovative insurance products and new opportunities for cost savings.

Conclusion

Finding cheap full coverage car insurance is a journey that requires research, understanding, and a proactive approach. By shopping around, comparing quotes, and leveraging discounts, you can significantly reduce your insurance premiums. Regularly reviewing and adjusting your policy based on your needs and the evolving insurance landscape can further enhance your savings.

As the car insurance industry continues to evolve, staying informed about emerging trends and technologies will be crucial. With a strategic approach and a keen eye for opportunities, you can navigate the world of car insurance with confidence and ensure you’re getting the best value for your insurance dollar.

What is the average cost of full coverage car insurance in the United States?

+

The average cost of full coverage car insurance in the U.S. varies significantly based on factors such as location, driving history, and the make and model of the vehicle. According to recent data, the national average for full coverage insurance is approximately 1,674 per year. However, rates can range from as low as 1,000 to over $3,000 annually, depending on individual circumstances.

How can I lower my full coverage car insurance premiums if I have a less-than-perfect driving record?

+

If you have a less-than-perfect driving record, there are still strategies you can employ to lower your insurance premiums. First, consider increasing your deductible, as this can lead to significant savings. Additionally, explore options for taking defensive driving courses, which may qualify you for discounts. Finally, regularly review your coverage limits and consider lowering them if your vehicle’s value has decreased. Always discuss your options with your insurance provider to find the best solution.

Are there any alternatives to full coverage car insurance that can provide cost savings?

+

Yes, depending on your specific circumstances and the value of your vehicle, you may consider alternatives to full coverage car insurance. For older vehicles with lower market values, liability-only insurance or a basic state-required policy might be more cost-effective. However, it’s essential to carefully assess your needs and the potential risks before opting for less comprehensive coverage.