Aig Term Insurance

In the realm of financial planning, life insurance is an essential component that provides a safety net for individuals and their loved ones. One popular type of life insurance is Term Insurance, and among the many providers, AIG Term Insurance stands out as a reliable choice. This comprehensive guide will delve into the features, benefits, and unique aspects of AIG's Term Insurance plans, offering an in-depth analysis to help you make informed decisions about your financial future.

Understanding AIG Term Insurance

American International Group, commonly known as AIG, is a global insurance provider with a rich history spanning over a century. AIG’s Term Insurance plans are designed to offer protection for a specified period, typically ranging from 10 to 30 years. During this term, policyholders enjoy peace of mind, knowing their loved ones will receive a financial payout in the event of their untimely demise.

Key Features of AIG Term Insurance

- Flexible Terms: AIG Term Insurance allows you to choose the duration of your policy, ensuring it aligns with your life stage and financial goals. Whether you’re planning for a short-term goal or securing your family’s future over the long haul, AIG has options.

- Affordable Premiums: One of the standout features of AIG Term Insurance is its competitive pricing. With AIG, you can secure substantial coverage amounts at surprisingly affordable rates, making it an attractive option for budget-conscious individuals.

- Conversion Options: As your life circumstances change, so might your insurance needs. AIG understands this and offers conversion privileges, allowing you to transition from a term policy to a permanent one without a medical exam. This flexibility ensures your coverage evolves with your life.

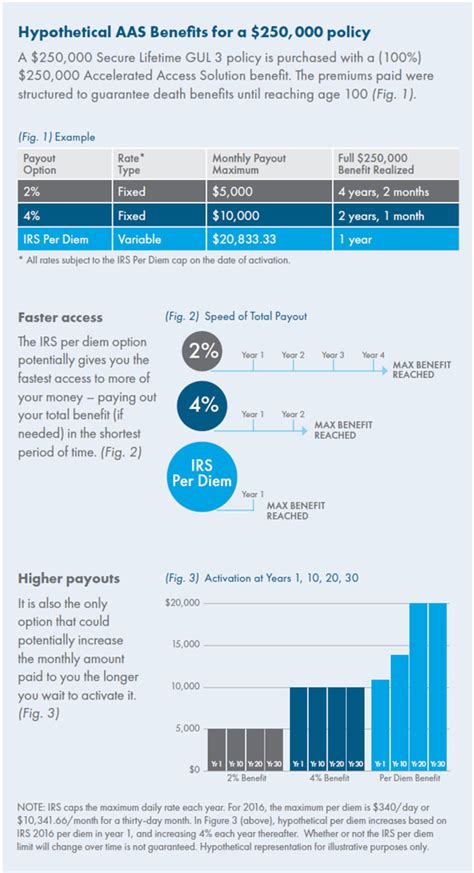

- Accelerated Benefit Riders: AIG’s Term Insurance plans come with the option to add riders, enhancing your coverage. The Accelerated Benefit Rider is particularly noteworthy, as it provides access to a portion of your death benefit if you’re diagnosed with a critical illness or terminal condition. This rider can offer crucial financial support during challenging times.

| Term Length | Coverage Amount | Premium Example |

|---|---|---|

| 10 Years | $500,000 | $25/month |

| 20 Years | $1,000,000 | $45/month |

| 30 Years | $2,000,000 | $75/month |

Benefits of Choosing AIG Term Insurance

Selecting AIG Term Insurance brings a host of advantages, making it a preferred choice for many individuals and families.

Financial Security and Peace of Mind

AIG Term Insurance ensures your loved ones receive a substantial financial payout in the event of your passing. This benefit provides a safety net, helping to cover essential expenses such as funeral costs, outstanding debts, and daily living expenses. With AIG, you can rest assured that your family’s financial future is secure.

Customizable Coverage

AIG understands that every individual’s financial situation is unique. Their Term Insurance plans offer customizable coverage, allowing you to tailor your policy to your specific needs. Whether you require a larger sum assured or additional riders, AIG provides the flexibility to create a policy that aligns perfectly with your life.

Ease of Application and Management

Applying for AIG Term Insurance is a straightforward process. You can complete the application online or with the assistance of an agent, and AIG’s user-friendly platform makes managing your policy a breeze. From updating personal information to making premium payments, everything is accessible and convenient.

Excellent Customer Service

AIG prides itself on its exceptional customer service. Their team of knowledgeable and friendly representatives is always ready to assist with any queries or concerns you may have. Whether you need guidance during the application process or support in understanding your policy, AIG ensures a seamless and supportive experience.

Performance Analysis and Real-World Examples

AIG Term Insurance has consistently demonstrated its reliability and effectiveness in real-world scenarios. Here are a few examples of how AIG’s Term Insurance plans have made a difference in the lives of policyholders:

Case Study 1: Protecting a Growing Family

John and Emily, a young couple with two children, recognized the importance of financial security as their family grew. They opted for AIG’s 20-year Term Insurance plan, ensuring their children’s future was protected. Unfortunately, Emily passed away due to an unforeseen illness. AIG’s prompt payout provided the family with the financial support they needed during this difficult time, covering medical expenses and ensuring the children’s education was secure.

Case Study 2: Securing a Business Legacy

Sarah, a successful entrepreneur, understood the value of protecting her business legacy. She chose AIG’s 30-year Term Insurance plan to safeguard her company’s future. When Sarah unexpectedly passed away, AIG’s policy ensured her business could continue to thrive. The payout provided liquidity to cover business expenses and helped maintain the company’s operations, honoring Sarah’s vision.

Case Study 3: Peace of Mind for Retirement

Robert, nearing retirement, wanted to ensure his spouse had financial security during his golden years. He opted for AIG’s 10-year Term Insurance plan, providing peace of mind. AIG’s policy offered Robert the confidence to enjoy his retirement, knowing his spouse would be taken care of should anything happen to him. The plan’s affordability made it an ideal choice for Robert’s financial planning.

Future Implications and Industry Insights

AIG Term Insurance continues to evolve to meet the changing needs of its policyholders. With a focus on innovation and customer satisfaction, AIG is well-positioned to adapt to the dynamic insurance landscape. Here’s a glimpse into the future of AIG’s Term Insurance offerings:

Digital Transformation

AIG recognizes the importance of a seamless digital experience. They are investing in technology to enhance their online platforms, making it even easier for policyholders to manage their policies and access information. This digital transformation ensures AIG remains accessible and user-friendly in an increasingly digital world.

Enhanced Personalization

AIG understands that one-size-fits-all policies may not meet everyone’s needs. They are exploring ways to further personalize insurance plans, allowing policyholders to tailor coverage to their specific circumstances. This level of customization ensures AIG’s Term Insurance plans remain relevant and valuable to a diverse range of individuals.

Sustainable and Ethical Practices

AIG is committed to sustainability and ethical practices. They are actively working towards reducing their environmental impact and promoting social responsibility. By aligning with these values, AIG ensures its Term Insurance plans appeal to a broader audience, including those who prioritize sustainable and ethical financial choices.

Conclusion

AIG Term Insurance stands as a testament to the company’s commitment to providing reliable and affordable protection for individuals and families. With its flexible terms, customizable coverage, and exceptional customer service, AIG has solidified its position as a trusted provider in the insurance industry. As you navigate your financial journey, consider AIG Term Insurance as a crucial component of your overall financial plan.

Can I renew my AIG Term Insurance policy after it expires?

+Yes, AIG offers the option to renew your term policy at the end of its term. Renewal terms and conditions may vary, so it’s best to review your policy details or consult with an AIG representative for accurate information.

What happens if I miss a premium payment?

+Missing a premium payment can result in your policy lapsing. However, AIG provides a grace period to allow for late payments without penalty. It’s essential to stay up to date with your premiums to maintain continuous coverage.

Can I add additional riders to my AIG Term Insurance policy?

+Absolutely! AIG offers a range of riders that can be added to your term policy to enhance your coverage. These riders can provide benefits such as critical illness coverage, accidental death benefit, and more. Consult with an AIG representative to explore your options and choose the riders that best suit your needs.