Cheap Auto Insurance Rate

Finding affordable car insurance is a top priority for many drivers, and with the right strategies and knowledge, it's possible to secure a great deal on your auto insurance coverage. The market for car insurance is highly competitive, and by understanding the factors that influence rates and the available options, you can make informed decisions to get the best value for your money. In this comprehensive guide, we'll explore the key aspects of cheap auto insurance rates, providing you with expert insights and practical tips to navigate the insurance landscape successfully.

Understanding the Basics of Auto Insurance Rates

Auto insurance rates are determined by a combination of factors, and insurance companies use these factors to assess the level of risk associated with insuring a particular driver. Understanding these fundamental aspects is crucial for finding the best deals on car insurance.

Risk Assessment Factors

Insurance companies consider various elements when calculating your premium. These factors can include your age, gender, driving history, the type of vehicle you drive, and even your location. Additionally, they may examine your credit score, as it is often seen as an indicator of financial responsibility.

For instance, younger drivers are generally considered higher-risk due to their lack of driving experience, which can result in higher insurance premiums. Similarly, drivers with a history of accidents or traffic violations may face increased rates as they are deemed more likely to file claims.

Policy Coverage Options

When shopping for auto insurance, it’s essential to understand the different types of coverage available. The most common types include liability coverage, which protects you if you cause an accident, and comprehensive and collision coverage, which cover damages to your own vehicle. Additionally, you may opt for personal injury protection (PIP) or medical payments coverage to cover medical expenses in the event of an accident.

Each coverage type has its own cost, and the level of coverage you choose will impact your overall premium. It’s crucial to find a balance between adequate coverage and affordable rates.

Strategies for Lowering Your Auto Insurance Rates

Now that we have a solid understanding of the basics, let’s delve into some practical strategies to reduce your auto insurance rates and make the most of your coverage.

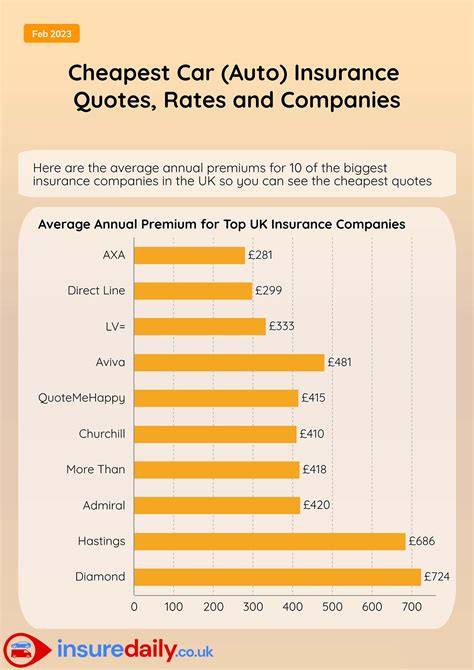

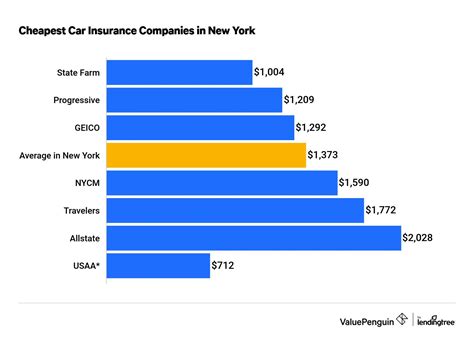

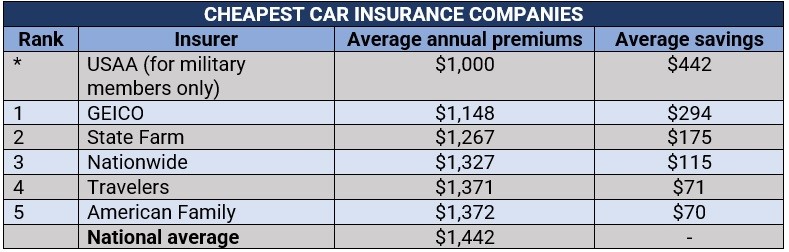

Shop Around and Compare Quotes

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple insurance providers. Each company has its own rating system and pricing structure, so getting quotes from at least three insurers is a good starting point. Online quote comparison tools can make this process quicker and more convenient.

When comparing quotes, pay attention to the coverage levels and any additional perks or discounts offered. Some companies may provide discounts for bundling policies (e.g., auto and home insurance), while others may offer loyalty discounts for long-term customers.

Take Advantage of Discounts

Insurance companies often offer a range of discounts to attract and retain customers. These discounts can significantly reduce your premium, so it’s worth exploring your options.

Common discounts include:

- Safe Driver Discounts: These rewards are given to drivers with clean records, often for a certain period without accidents or violations.

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as home or renters insurance, can result in substantial savings.

- Loyalty Discounts: Many insurers offer discounts to customers who have been with them for a specific period.

- Pay-in-Full Discounts: Some companies provide a discount if you pay your premium upfront rather than in installments.

- Occupational Discounts: Certain occupations, such as teachers or military personnel, may be eligible for special discounts.

Don’t hesitate to ask your insurance provider about the discounts they offer and how you can qualify for them.

Consider Higher Deductibles

Increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower premiums. This strategy works best for drivers who are confident they won’t need to make frequent claims and have the financial means to cover a higher deductible in the event of an accident.

However, it’s important to strike a balance. Choosing an excessively high deductible may make it difficult to afford repairs if you’re involved in an accident. Aim for a deductible that you can comfortably afford while still enjoying a lower premium.

Improve Your Driving Record

Your driving history is a significant factor in determining your insurance rates. Maintaining a clean record can help you secure lower premiums. If you have violations or accidents on your record, consider taking defensive driving courses or driver improvement programs. These can sometimes lead to reduced points on your license and potentially lower insurance rates.

Additionally, avoid unnecessary risks while driving, such as speeding or using your phone behind the wheel. These behaviors not only endanger your safety but can also result in violations that impact your insurance rates.

Explore Telematics Programs

Telematics, or usage-based insurance (UBI), is a relatively new concept in the insurance industry. With UBI, insurance companies monitor your driving behavior through a device installed in your vehicle or an app on your smartphone. They then use this data to adjust your premium based on your actual driving habits.

While UBI may not be suitable for everyone, it can be an excellent option for safe drivers who are confident in their abilities. By demonstrating responsible driving, you may qualify for lower rates through these programs.

Maintain a Good Credit Score

As mentioned earlier, your credit score can influence your insurance rates. Insurance companies often use credit-based insurance scores to assess the risk of insuring a driver. Improving your credit score can potentially lead to lower insurance premiums.

Focus on paying your bills on time, reducing credit card debt, and maintaining a healthy credit mix. These practices not only benefit your overall financial health but can also positively impact your insurance rates.

Choose the Right Vehicle

The type of vehicle you drive can have a significant impact on your insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance costs due to their higher repair costs and increased likelihood of theft.

When purchasing a new vehicle, consider its safety ratings and insurance costs. Opting for a vehicle with good safety features and a lower risk of theft can help you save on insurance premiums.

Analyzing Your Auto Insurance Policy

Understanding your auto insurance policy is crucial to ensuring you’re getting the best value for your money. Here’s a closer look at some key aspects of your policy.

Coverage Limits

Your policy’s coverage limits define the maximum amount your insurance company will pay out in the event of a claim. It’s essential to review these limits to ensure they align with your needs. If you have significant assets, consider increasing your liability limits to protect yourself in the event of a serious accident.

Similarly, if you own an older vehicle, you may want to reconsider comprehensive and collision coverage, as the cost of repairs may exceed the vehicle’s value.

Understanding Your Deductible

As mentioned earlier, your deductible is the amount you pay out of pocket before your insurance coverage takes effect. It’s crucial to understand how your deductible works and what it covers. Some policies may have separate deductibles for different types of coverage, so be sure to review these details.

Reviewing Your Policy’s Exclusions

Every insurance policy has exclusions, which are specific situations or events that are not covered by your policy. It’s essential to review these exclusions to avoid any surprises in the event of a claim. Common exclusions include damage caused by natural disasters, such as floods or earthquakes, or damage resulting from intentional acts.

Exploring Additional Coverage Options

Your base auto insurance policy may not cover all potential risks. Consider adding optional coverages to protect yourself further. For example, you may want to add rental car reimbursement coverage or roadside assistance coverage to your policy.

Additionally, if you frequently drive for work or use your vehicle for business purposes, you may need to add commercial auto insurance coverage to your policy.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is constantly evolving, and new technologies and trends are shaping the future of insurance. Here’s a glimpse into some of the upcoming changes and innovations.

The Rise of Telematics and UBI

Telematics and UBI are expected to become even more prevalent in the coming years. With the increasing adoption of connected car technologies, insurers will have access to more detailed driving data, allowing for more accurate risk assessment and potentially lower rates for safe drivers.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are being used to improve various aspects of the insurance industry, including fraud detection, claims processing, and risk assessment. These technologies can help insurers make more informed decisions and offer personalized insurance products.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize the insurance industry by enhancing security, transparency, and efficiency. Smart contracts, which are self-executing contracts with the terms directly written into code, can streamline the claims process and reduce the need for intermediaries.

Connected Car Technologies

Connected car technologies, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, are expected to play a significant role in the future of auto insurance. These technologies can provide real-time data on driving behavior and vehicle performance, enabling insurers to offer more tailored coverage options.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is also set to impact the auto insurance industry. Electric vehicles, with their lower maintenance costs and advanced safety features, may lead to reduced insurance premiums. Autonomous vehicles, while still in their early stages, have the potential to significantly reduce accidents and insurance claims.

Conclusion

Securing cheap auto insurance rates is a combination of understanding the factors that influence premiums, adopting strategic approaches, and staying informed about industry trends. By comparing quotes, taking advantage of discounts, and making smart choices about your vehicle and driving habits, you can find affordable coverage that meets your needs.

As the auto insurance landscape continues to evolve, staying up-to-date with emerging technologies and trends will be essential for navigating the market and securing the best deals. With the right knowledge and approach, you can confidently navigate the world of auto insurance and make informed decisions that benefit your wallet and your peace of mind.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually or whenever you experience significant life changes, such as getting married, buying a new car, or moving to a different location. These events can impact your insurance needs and rates, so staying updated is crucial.

Can I negotiate my auto insurance rates with my provider?

+While insurance rates are generally non-negotiable, you can discuss your options with your provider. They may be able to offer alternative coverage options or recommend discounts you may qualify for. It’s worth having an open conversation to explore your possibilities.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Contact the police to file a report and exchange information with the other driver(s). Afterward, notify your insurance company as soon as possible to initiate the claims process.