Cheap Auto Insurance Prices

Finding affordable auto insurance is a top priority for many drivers, and with the right knowledge and strategies, it is possible to secure low rates without compromising on coverage. This comprehensive guide will delve into the factors that influence auto insurance prices, provide tips on how to get the best deals, and offer insights into the cheapest options available in the market. By understanding the key considerations and taking proactive steps, you can ensure you're getting the most value for your money while staying protected on the road.

Understanding the Factors That Affect Auto Insurance Prices

The cost of auto insurance is influenced by a multitude of factors, and being aware of these elements can help drivers make informed decisions when shopping for coverage. From personal details to vehicle specifications and driving history, each aspect plays a crucial role in determining insurance premiums.

Personal Factors

Insurance companies assess various personal characteristics when calculating premiums. Age, gender, and marital status are common considerations, with younger drivers often facing higher rates due to their perceived higher risk. Additionally, credit history can impact insurance costs, as a good credit score may lead to lower premiums. Understanding how these personal factors influence rates is essential for drivers seeking the best deals.

| Personal Factor | Impact on Insurance |

|---|---|

| Age | Younger drivers typically pay more. |

| Gender | Gender may influence rates, with some companies offering discounts for specific genders. |

| Marital Status | Being married can result in lower premiums. |

| Credit History | A good credit score can lead to significant savings on insurance costs. |

Vehicle-Related Factors

The type of vehicle you drive and its specifications are crucial in determining insurance costs. Newer, high-performance cars often come with higher premiums due to their expensive repair costs and increased risk of theft. Conversely, older, safer models with good safety ratings can result in lower insurance rates. Understanding how your vehicle’s characteristics impact insurance costs is key to making cost-effective choices.

| Vehicle Factor | Impact on Insurance |

|---|---|

| Age of Vehicle | Older vehicles generally have lower insurance costs. |

| Vehicle Make and Model | Some makes and models are more expensive to insure due to repair costs and theft risks. |

| Safety Features | Vehicles with advanced safety features may qualify for insurance discounts. |

Driving History and Record

Your driving history is a significant factor in insurance pricing. A clean driving record with no accidents or traffic violations can lead to lower premiums, as it indicates a lower risk profile. On the other hand, a history of accidents, claims, or traffic violations can result in higher insurance costs. Maintaining a safe driving record is essential for accessing the best insurance rates.

Strategies to Find the Cheapest Auto Insurance Prices

With a solid understanding of the factors that influence auto insurance prices, drivers can employ various strategies to secure the most affordable coverage. From shopping around and comparing quotes to leveraging discounts and bundle deals, there are numerous ways to reduce insurance costs without compromising on quality.

Comparing Quotes from Multiple Insurers

One of the most effective ways to find cheap auto insurance is by obtaining quotes from multiple insurers. Each company uses its own formula to calculate premiums, so shopping around can reveal significant differences in rates. Online comparison tools and insurance brokerages can streamline this process, making it easier to identify the best deals.

Understanding Discounts and Bundle Deals

Insurance companies offer a range of discounts and bundle deals to attract customers and encourage loyalty. From multi-policy discounts (bundling auto insurance with home or renters insurance) to safe driver discounts and loyalty rewards, these incentives can significantly reduce insurance costs. Understanding the available discounts and qualifying criteria is key to maximizing savings.

| Discount Type | Description |

|---|---|

| Multi-Policy Discount | Save by bundling multiple insurance policies, such as auto and home insurance, with the same provider. |

| Safe Driver Discount | Maintain a clean driving record to qualify for reduced rates. |

| Loyalty Discount | Stay with the same insurer for an extended period to receive loyalty rewards. |

Enhancing Your Profile for Lower Rates

Drivers can take proactive steps to improve their insurance profiles and qualify for lower rates. This includes maintaining a safe driving record, improving credit scores, and exploring options to reduce the risk associated with their vehicles. By implementing these strategies, drivers can position themselves as low-risk customers and access more affordable insurance options.

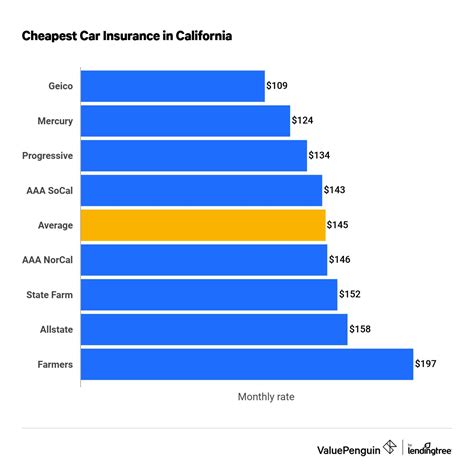

Cheapest Auto Insurance Options: A Comprehensive Analysis

Now that we’ve explored the factors influencing auto insurance prices and strategies to secure the best deals, let’s delve into a detailed analysis of the cheapest auto insurance options available in the market. From budget-friendly providers to cost-saving tips, this section will provide valuable insights to help drivers make informed choices.

Budget-Friendly Insurance Providers

Several insurance companies are known for offering affordable coverage without compromising on quality. These providers often cater to a specific niche, such as young drivers, seniors, or those with a less-than-perfect driving record. By understanding your unique needs and researching these specialized insurers, you can access competitive rates and comprehensive coverage.

| Insurance Provider | Target Market |

|---|---|

| State Farm | Family-oriented drivers seeking comprehensive coverage. |

| Geico | Young professionals and military members. |

| Progressive | Drivers with a range of profiles, offering discounts for safe driving and bundling. |

Cost-Saving Tips for Auto Insurance

In addition to choosing the right insurance provider, there are numerous cost-saving tips that drivers can employ to reduce their insurance premiums. From adjusting coverage limits and deductibles to exploring usage-based insurance programs, these strategies can result in significant savings without sacrificing protection.

- Adjust Coverage Limits and Deductibles: Review your coverage limits and consider increasing deductibles to lower premiums. However, ensure you can afford the higher deductible in the event of a claim.

- Usage-Based Insurance Programs: Some insurers offer pay-as-you-drive or mileage-based insurance programs. These programs use telematics devices to track driving behavior and reward safe driving with lower rates.

- Pay Annually or Semi-Annually: Paying your insurance premium upfront or in larger installments can often result in discounts compared to monthly payments.

Understanding Insurance Coverage and Its Impact on Costs

The type and extent of coverage you choose can significantly impact your insurance costs. While comprehensive coverage offers the most protection, it also comes with higher premiums. Understanding the different coverage options and their costs is essential for making informed decisions about your insurance policy.

| Coverage Type | Description | Cost |

|---|---|---|

| Liability Coverage | Covers damages to others in an accident you cause. | Lower cost, but provides limited protection. |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of fault. | Moderate cost, provides comprehensive protection for your vehicle. |

| Comprehensive Coverage | Covers damages from non-accident events, such as theft, fire, or natural disasters. | Highest cost, offers the most comprehensive protection. |

The Future of Affordable Auto Insurance

As the insurance industry continues to evolve, the landscape of affordable auto insurance is set to change. From advancements in technology to shifts in consumer behavior, several factors are influencing the future of insurance pricing and accessibility. Understanding these trends can help drivers stay ahead of the curve and make informed choices when it comes to their insurance coverage.

Technological Innovations in Insurance

The integration of technology in the insurance industry is revolutionizing the way insurance is priced and delivered. Telematics devices, artificial intelligence, and blockchain technology are just a few examples of innovations that are impacting the industry. These advancements are not only improving the customer experience but also enabling more accurate risk assessment and cost-effective insurance solutions.

Shifts in Consumer Behavior and Insurance Preferences

Changing consumer preferences and behaviors are also shaping the future of affordable auto insurance. With the rise of ride-sharing services and electric vehicles, traditional insurance models may need to adapt to accommodate these new trends. Additionally, the increasing demand for personalized and flexible insurance options is pushing insurers to offer more tailored coverage plans, potentially resulting in more affordable options for specific consumer segments.

Regulation and Industry Trends

Regulatory changes and industry trends play a significant role in determining the future of affordable auto insurance. As governments and industry bodies work to improve consumer protection and market competition, new regulations may influence insurance pricing and availability. Additionally, emerging trends such as usage-based insurance and pay-per-mile models are gaining traction, offering new opportunities for drivers to access more affordable coverage.

How often should I review my auto insurance policy and shop for new quotes?

+It’s recommended to review your auto insurance policy annually or whenever your personal circumstances change significantly. Shopping for new quotes regularly, especially when your policy is up for renewal, can help you identify cost-saving opportunities and ensure you’re getting the best value for your money.

What are some common misconceptions about auto insurance pricing?

+One common misconception is that all insurance companies offer similar rates. In reality, premiums can vary significantly between providers, even for the same coverage and profile. It’s essential to shop around and compare quotes to avoid paying more than necessary.

How can I improve my chances of getting lower auto insurance rates in the future?

+Maintaining a clean driving record, improving your credit score, and exploring options to reduce the risk associated with your vehicle are key strategies to improve your insurance profile over time. Additionally, staying informed about insurance trends and innovations can help you make proactive choices to access more affordable coverage.