Cheap Auto Insurance California

Welcome to our comprehensive guide on navigating the world of cheap auto insurance in California. With its vast network of highways and vibrant cities, having a reliable car insurance policy is essential for every driver in the Golden State. However, finding affordable coverage can sometimes feel like a challenging maze. But fear not! In this article, we will illuminate the path to discovering the best deals on auto insurance in California, ensuring you get the protection you need without breaking the bank.

Understanding California’s Auto Insurance Landscape

California, being one of the most populous states in the US, boasts a diverse insurance market. This diversity, while offering numerous options, can also make it challenging for drivers to identify the most cost-effective policies. The state’s insurance regulations, along with the unique driving conditions and risks, play a significant role in determining insurance premiums. By understanding these factors, drivers can make more informed choices and potentially save hundreds of dollars annually on their auto insurance.

California’s Minimum Requirements

Every vehicle registered in California must meet the state’s minimum insurance requirements. These include liability coverage for bodily injury and property damage. The specific limits are 15,000 for injury/death of one person, 30,000 for injury/death of two or more people, and $5,000 for property damage in a single accident. However, many experts recommend exceeding these minimums to ensure adequate protection.

| Minimum Insurance Requirements in California | Coverage Limits |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

Additionally, California is a fault state, meaning that in the event of an accident, the driver deemed at fault will be responsible for the other party's injuries and damages. This further highlights the importance of having comprehensive and collision coverage, which can protect you from substantial out-of-pocket expenses.

Factors Affecting Auto Insurance Premiums

Several key factors influence the cost of auto insurance in California, including:

- Driver’s Age and Gender: Younger drivers, especially males under 25, often face higher premiums due to their statistically higher accident rates. However, rates can decrease as drivers gain more experience and mature.

- Vehicle Type: The make, model, and year of your vehicle play a significant role. Sports cars and luxury vehicles, for instance, typically have higher premiums due to their expensive repair costs.

- Driving Record: A clean driving record can lead to substantial savings. Conversely, violations, accidents, and DUIs can significantly increase your insurance rates.

- Credit Score: In California, insurance companies are allowed to use credit-based insurance scores when determining premiums. A higher credit score can often lead to lower rates.

- Location: The area where you live and work can impact your rates. Urban areas with higher crime rates and more traffic often have higher insurance costs.

Strategies to Find Cheap Auto Insurance in California

Now that we’ve covered the fundamentals, let’s dive into some practical strategies to secure the most affordable auto insurance in California.

Compare Multiple Quotes

The insurance market in California is highly competitive, with numerous carriers offering unique policies. By comparing quotes from multiple providers, you can identify the best rates for your specific circumstances. Online comparison tools can be especially useful for quickly gathering a range of quotes.

Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By consolidating your insurance needs with one provider, you can often secure substantial savings.

Utilize Discounts

Insurance companies in California offer a variety of discounts, including:

- Safe Driver Discount: If you maintain a clean driving record, you may qualify for a safe driver discount.

- Multi-Policy Discount: Bundling your auto insurance with other policies, like homeowners or renters insurance, can lead to significant savings.

- Good Student Discount: If you or a family member is a full-time student with a good GPA, you may be eligible for this discount.

- Loyalty Discount: Some providers offer discounts for long-term customers.

- Low Mileage Discount: If you drive less than the average number of miles per year, you may qualify for this discount.

Choose the Right Coverage

While it’s tempting to opt for the lowest premium, it’s crucial to ensure you have adequate coverage. Review your policy regularly and adjust it as your circumstances change. For instance, if you’ve paid off your car, you may no longer need collision or comprehensive coverage, which can save you money.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses real-time data to determine your premium. This can be a great option for safe, low-mileage drivers. By installing a tracking device or using an app, the insurance company can monitor your driving habits and offer personalized rates.

Shop Around Regularly

Insurance rates can change frequently, and what was once an expensive policy might become a bargain the next year. It’s a good practice to review your insurance options annually or whenever your circumstances change significantly.

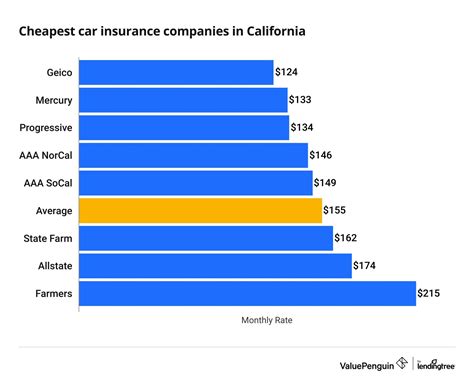

Top Insurance Companies for Cheap Rates in California

While the best insurance company for you will depend on your unique circumstances, here are some carriers known for offering competitive rates in California:

- GEICO: GEICO is renowned for its competitive rates and extensive discounts. They offer a wide range of coverage options and are known for their excellent customer service.

- Progressive: Progressive provides highly customizable policies and is often a top choice for drivers seeking affordable insurance.

- State Farm: With a strong focus on customer satisfaction, State Farm offers competitive rates and a variety of coverage options.

- Esurance: Esurance is a subsidiary of Allstate and specializes in providing insurance online. They offer flexible policies and competitive rates, particularly for tech-savvy drivers.

- Mercury Insurance: Mercury is a well-known California-based insurance company that offers comprehensive coverage at competitive prices.

Conclusion: Finding the Best Deal on Auto Insurance in California

Navigating the world of auto insurance in California can be complex, but by understanding the key factors and employing strategic approaches, you can secure the best deals on car insurance. Whether it’s comparing multiple quotes, utilizing discounts, or choosing the right coverage, there are numerous ways to save on your auto insurance premiums.

Remember, the most affordable policy isn't always the best fit. It's crucial to balance cost with adequate coverage to ensure you're protected in the event of an accident. By staying informed and regularly reviewing your insurance options, you can make the most of your hard-earned dollars while enjoying the freedom of the road in California.

How much is auto insurance in California on average?

+The average cost of auto insurance in California is approximately 1,650 per year. However, this figure can vary significantly based on individual factors such as driving record, age, gender, and location.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What are the penalties for driving without insurance in California?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Driving without insurance in California can result in a fine of up to 2,000, suspension of your driver’s license, and even vehicle impoundment. It’s crucial to maintain valid insurance coverage at all times.

Can I get auto insurance without a license in California?

+No, it is generally not possible to obtain auto insurance without a valid driver’s license in California. Insurance companies require proof of a valid license as part of the application process.