Cash Value Life Insurance

Cash value life insurance, a versatile financial tool, has gained significant popularity among individuals and families seeking comprehensive protection and long-term savings benefits. This type of insurance offers a unique blend of coverage and investment opportunities, making it an attractive option for those with specific financial goals and a desire to build wealth over time. As we delve into the intricacies of cash value life insurance, we'll explore its various facets, including its underlying mechanisms, potential advantages, and the factors to consider when making an informed decision.

Understanding Cash Value Life Insurance

Cash value life insurance, often referred to as permanent life insurance, is a policy that provides coverage for the entirety of the insured individual’s life, provided the premiums are paid. The key distinguishing feature of this insurance is the accumulation of cash value within the policy itself. This cash value component serves as a savings element, allowing policyholders to build a financial asset over time. Unlike term life insurance, which provides coverage for a specified period, cash value life insurance offers a combination of protection and the potential for long-term financial growth.

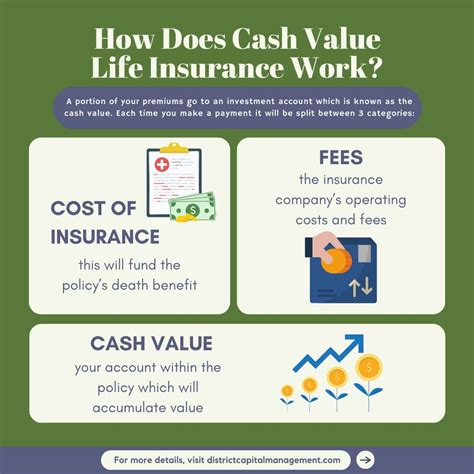

The cash value within the policy grows through a combination of factors. A portion of the premium payments is allocated to the insurance coverage, ensuring the policy remains active. The remaining amount is directed towards the cash value component, which accumulates interest and may benefit from the policy's investment performance. Over time, this cash value can grow, providing policyholders with a valuable financial resource.

Key Components of Cash Value Life Insurance

Death Benefit

The primary purpose of life insurance, including cash value policies, is to provide financial protection to the insured’s beneficiaries in the event of their death. The death benefit, often referred to as the face value, is the amount of money that the beneficiaries will receive upon the insured’s passing. This benefit is a crucial aspect of life insurance, offering peace of mind and financial security to loved ones.

In the case of cash value life insurance, the death benefit remains consistent throughout the policy's duration, unlike term life insurance where the benefit may decrease over time. This feature ensures that the beneficiaries receive a guaranteed sum, regardless of when the insured passes away.

Cash Value Accumulation

One of the most appealing aspects of cash value life insurance is the ability to build cash value over time. This value, also known as the policy’s cash surrender value, represents the savings component within the policy. It grows through a combination of factors, including premium payments, interest accumulation, and potential investment returns.

The cash value can be used for various purposes. Policyholders may borrow against it, use it to pay premiums, or even withdraw a portion without affecting the policy's coverage. This flexibility makes cash value life insurance an attractive option for those seeking both protection and the ability to access their savings.

Investment Options

Many cash value life insurance policies offer a range of investment options, allowing policyholders to customize their policies to align with their financial goals and risk tolerance. These options typically include fixed-rate accounts, where the cash value accumulates at a guaranteed interest rate, and variable accounts, which offer the potential for higher returns but also carry more risk.

Policyholders can choose to allocate their cash value across these investment options, providing an opportunity to balance the desire for growth with the need for stability. The investment performance of the policy can significantly impact the overall growth of the cash value, making it an important consideration when selecting a cash value life insurance policy.

Advantages of Cash Value Life Insurance

Lifetime Coverage

One of the most significant advantages of cash value life insurance is its lifelong coverage. Unlike term life insurance, which provides coverage for a specified period, cash value policies offer protection for the insured’s entire life. This feature ensures that the policyholder’s loved ones are financially secured, regardless of when the insured passes away.

Savings and Investment Opportunities

The cash value component of the policy provides an opportunity for policyholders to build savings and potentially grow their wealth. Over time, the accumulated cash value can serve as a financial resource, offering flexibility and the potential for significant returns. This aspect makes cash value life insurance an attractive option for those seeking both protection and the ability to invest for the future.

Tax Advantages

Cash value life insurance policies often offer tax advantages, providing an additional incentive for policyholders. The growth of the cash value within the policy is typically tax-deferred, meaning it accumulates without being subject to annual taxation. Additionally, withdrawals or loans against the cash value may be tax-free, depending on the policy and applicable laws.

Flexibility and Access to Funds

Cash value life insurance policies offer a high degree of flexibility. Policyholders can borrow against the cash value, use it to pay premiums, or even withdraw a portion without impacting the policy’s coverage. This flexibility allows individuals to access their savings when needed, providing a financial safety net in times of emergency or for major life events.

Factors to Consider

Cost

Cash value life insurance policies tend to be more expensive than term life insurance due to the added savings and investment components. Policyholders should carefully consider their financial situation and goals to determine if the added cost is justified by the potential benefits.

Investment Risk

The investment options within cash value life insurance policies carry varying levels of risk. While fixed-rate accounts offer guaranteed returns, variable accounts may provide higher potential returns but also expose policyholders to market risks. It’s crucial to assess one’s risk tolerance and financial goals when selecting investment options within the policy.

Policy Duration

Cash value life insurance policies are designed for long-term commitments. Policyholders should consider their life expectancy and financial goals to ensure that the policy’s duration aligns with their needs. Premature surrender of the policy may result in penalties and the loss of accumulated cash value.

Surrender Penalties

Cash value life insurance policies may carry surrender penalties if the policy is canceled within a certain period. These penalties can significantly impact the policyholder’s savings, so it’s essential to understand the terms and conditions of the policy before making any decisions.

Performance Analysis

The performance of cash value life insurance policies can vary significantly based on the investment options chosen and the policy’s overall structure. Fixed-rate accounts offer a guaranteed interest rate, providing a stable and predictable growth rate for the cash value. On the other hand, variable accounts may experience fluctuations in value based on market performance, offering the potential for higher returns but also carrying more risk.

Policyholders should carefully monitor the performance of their cash value life insurance policies, especially if they have chosen variable investment options. Regular reviews can help ensure that the policy is aligned with their financial goals and risk tolerance. In some cases, policyholders may have the option to reallocate their cash value between different investment options to optimize returns.

| Investment Type | Potential Returns | Risk Level |

|---|---|---|

| Fixed-Rate Accounts | Stable, Guaranteed Returns | Low Risk |

| Variable Accounts | Higher Potential Returns | High Risk |

Evidence-Based Future Implications

The future of cash value life insurance is closely tied to the broader trends in the insurance and financial sectors. As individuals seek more flexibility and control over their financial resources, cash value life insurance is likely to remain a popular option. The ability to build savings and access funds while maintaining lifelong coverage makes it an attractive choice for those with long-term financial planning goals.

However, the evolving regulatory landscape and changing market conditions may impact the structure and availability of cash value life insurance policies. Policyholders should stay informed about any changes in the industry and consult with financial advisors to ensure their policies remain aligned with their needs and goals.

Additionally, the increasing focus on digital technologies and online platforms in the insurance sector may lead to more efficient and accessible cash value life insurance options. This could make it easier for individuals to compare policies, understand their benefits, and make informed decisions.

Conclusion

Cash value life insurance is a valuable financial tool that offers a unique combination of protection and savings opportunities. Its ability to provide lifelong coverage, build cash value, and offer investment options makes it an attractive option for those seeking comprehensive financial planning. However, policyholders must carefully consider the costs, risks, and long-term implications to ensure that cash value life insurance aligns with their specific financial goals and circumstances.

What is the difference between cash value life insurance and term life insurance?

+

Cash value life insurance, also known as permanent life insurance, provides coverage for the insured’s entire life and includes a savings component known as cash value. In contrast, term life insurance offers coverage for a specified period, typically 10-30 years, and does not accumulate cash value.

How does the cash value within a cash value life insurance policy grow?

+

The cash value within a cash value life insurance policy grows through a combination of factors. A portion of the premium payments is allocated to the insurance coverage, while the remaining amount is directed towards the cash value component. This cash value accumulates interest and may also benefit from the policy’s investment performance over time.

What are the tax advantages of cash value life insurance?

+

Cash value life insurance policies often offer tax advantages. The growth of the cash value within the policy is typically tax-deferred, meaning it accumulates without being subject to annual taxation. Additionally, withdrawals or loans against the cash value may be tax-free, depending on the policy and applicable laws.

Can I borrow against the cash value in my cash value life insurance policy?

+

Yes, policyholders can borrow against the cash value in their cash value life insurance policy. This provides a flexible way to access funds without affecting the policy’s coverage. However, it’s important to note that any outstanding loans against the cash value will reduce the policy’s death benefit and may impact the overall value of the policy.