Cash Value Insurance

Cash value insurance, a type of permanent life insurance, has gained significant attention in the financial industry for its unique benefits and features. Unlike traditional term life insurance policies, cash value insurance offers policyholders the potential for both life coverage and a cash savings component. This article delves into the intricacies of cash value insurance, exploring its definitions, mechanics, advantages, and considerations to provide a comprehensive understanding of this financial tool.

Understanding Cash Value Insurance

Cash value insurance, often referred to as permanent life insurance or whole life insurance, is a financial product that combines life insurance coverage with a savings or investment element. It is designed to provide long-term financial protection, ensuring that beneficiaries receive a death benefit while also offering policyholders the opportunity to build cash value over time.

The key distinction between cash value insurance and term life insurance lies in the latter's focus on pure protection without an associated savings component. Term life insurance policies offer coverage for a specified period, typically 10 to 30 years, and are more affordable in the short term. In contrast, cash value insurance provides coverage for the policyholder's entire life, with the added benefit of cash value accumulation.

How Cash Value Insurance Works

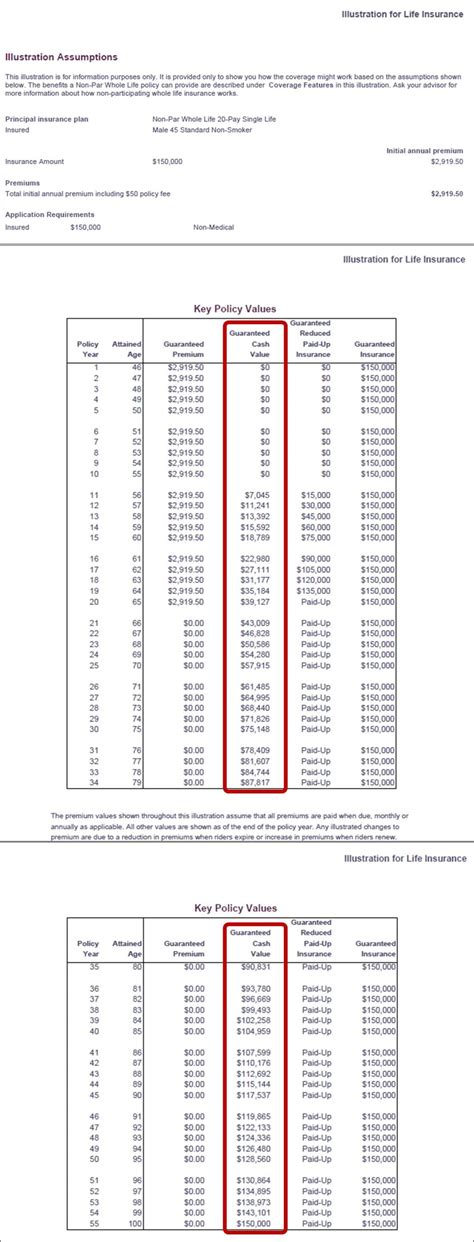

When an individual purchases a cash value insurance policy, they make regular premium payments to the insurance company. A portion of these premiums is allocated to provide the life insurance coverage, ensuring that beneficiaries receive a specified amount upon the policyholder’s death. The remaining portion of the premiums is directed towards building the policy’s cash value.

The cash value component of the policy acts as a savings or investment account. Over time, this cash value grows, typically earning interest or investment returns. The specific growth rate and investment options can vary depending on the type of cash value insurance policy and the insurance company's investment strategies.

Policyholders can access the cash value through various means. They may choose to withdraw a portion of the cash value as a lump sum, use it to pay future premiums, or borrow against it through policy loans. These loans are typically interest-bearing and must be repaid, with interest, to maintain the policy's benefits.

| Cash Value Insurance Metrics | Explanation |

|---|---|

| Death Benefit | The amount paid to beneficiaries upon the policyholder's death. |

| Premium Payments | Regular contributions made by the policyholder to maintain the policy. |

| Cash Value Accumulation | The savings or investment component that grows over time. |

| Policy Loans | Borrowing against the policy's cash value, with interest. |

| Investment Options | Various investment strategies offered by the insurance company for cash value growth. |

Advantages of Cash Value Insurance

Long-Term Financial Protection

One of the primary advantages of cash value insurance is its ability to provide lifelong financial protection. Unlike term life insurance, which expires after a set period, cash value insurance ensures that beneficiaries receive a death benefit regardless of the policyholder’s age or health at the time of death. This makes it an attractive option for those seeking long-term peace of mind.

Cash Value Accumulation

The savings or investment component of cash value insurance offers policyholders the opportunity to build wealth over time. The cash value can be used for various financial goals, such as funding retirement, covering unexpected expenses, or supplementing income during retirement. It provides a flexible source of funds that can be accessed as needed.

Tax Advantages

Cash value insurance policies often come with tax benefits. The growth of the cash value is typically tax-deferred, meaning that any gains or interest earned are not subject to taxation until the policyholder withdraws or borrows against the cash value. This can lead to significant tax savings over the long term.

Policy Flexibility

Cash value insurance policies offer a high degree of flexibility. Policyholders can choose to adjust their premium payments or even skip payments in certain circumstances. They can also access the cash value through loans or withdrawals, providing a source of emergency funds or additional income. This flexibility allows individuals to tailor their policies to their changing financial needs.

Considerations and Limitations

Cost and Premiums

One of the primary considerations with cash value insurance is the cost. Premiums for cash value insurance policies are typically higher than those for term life insurance, as they include both the cost of life insurance coverage and the savings component. The long-term commitment required for cash value insurance may not be feasible for everyone, especially those on a tight budget.

Investment Risks

The investment component of cash value insurance comes with inherent risks. While some policies offer guaranteed interest rates, others are tied to the performance of the insurance company’s investment portfolio. In the case of poor investment performance, the growth of the cash value may be impacted, potentially reducing the policy’s overall value.

Withdrawal and Loan Considerations

Withdrawing or borrowing against the cash value of a policy can have implications. Withdrawals reduce the policy’s overall value and may incur surrender charges or tax penalties if the policy has not been held for a certain period. Policy loans, while interest-bearing, must be repaid to maintain the policy’s benefits. Failing to repay a policy loan could result in a lapse of coverage.

Real-World Examples

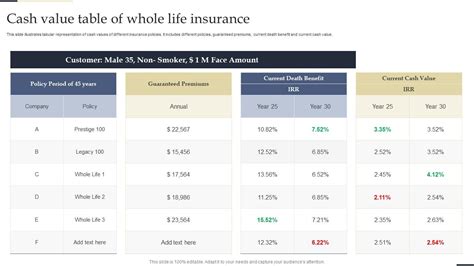

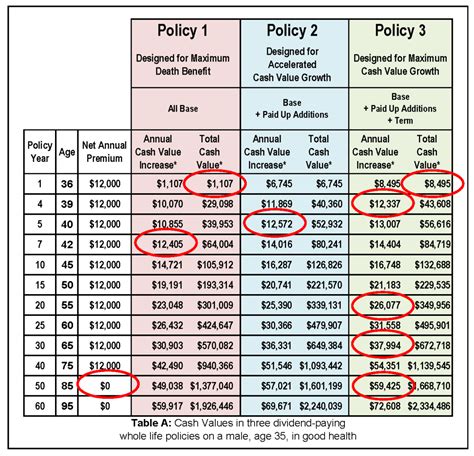

Case Study: John’s Financial Planning

John, a 35-year-old professional, is considering his financial options. He wants to provide for his family’s future and ensure their financial security. After consulting with a financial advisor, he decides to opt for a cash value insurance policy. With a 500,000 death benefit and a premium of 1,200 per year, John’s policy allows him to build cash value over time.

Over the next 30 years, John's cash value grows to $150,000. This provides him with a substantial savings cushion, which he can use to fund his retirement or leave as an inheritance for his children. The tax-deferred growth of the cash value further enhances the policy's benefits, making it a valuable component of John's overall financial plan.

Industry Insights

Cash value insurance has seen a resurgence in popularity in recent years, particularly among those seeking long-term financial security and wealth accumulation. Insurance companies have responded by offering a range of cash value insurance products, from traditional whole life policies to more flexible universal life policies. The latter allows for greater customization and flexibility in premium payments and cash value growth.

Conclusion

Cash value insurance offers a unique blend of financial protection and savings potential. It provides policyholders with the peace of mind that comes with lifelong coverage while also offering the opportunity to build wealth through cash value accumulation. However, it is essential to carefully evaluate the costs, risks, and considerations associated with cash value insurance before making a decision. For those seeking a long-term financial solution, cash value insurance can be a valuable tool in achieving their goals.

What is the difference between cash value insurance and term life insurance?

+

Cash value insurance, also known as permanent life insurance, provides lifelong coverage and includes a savings or investment component. Term life insurance, on the other hand, offers coverage for a specific period, typically 10 to 30 years, and does not include a savings element. Cash value insurance is more expensive but provides long-term financial protection and wealth accumulation opportunities.

How does the cash value of a policy grow over time?

+

The cash value of a policy grows through interest or investment returns. The specific growth rate and investment options depend on the type of policy and the insurance company’s strategies. Some policies offer guaranteed interest rates, while others are tied to the performance of the insurance company’s portfolio.

Can I access the cash value of my policy during my lifetime?

+

Yes, policyholders can access the cash value of their policy through various means. They can withdraw a portion of the cash value as a lump sum, use it to pay future premiums, or borrow against it through policy loans. These loans are typically interest-bearing and must be repaid with interest to maintain the policy’s benefits.