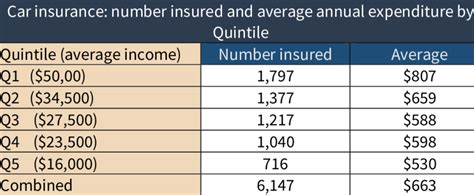

Car Insurance Under 100

The cost of car insurance can vary greatly depending on numerous factors, and finding affordable coverage, especially under $100 per month, can be a challenging task. However, with the right knowledge and strategies, it is possible to secure comprehensive car insurance policies at competitive rates. This comprehensive guide aims to provide an in-depth analysis of the factors influencing car insurance costs and offer practical tips to help you find the best deals, ensuring your vehicle is adequately protected without breaking the bank.

Understanding the Factors Influencing Car Insurance Costs

Car insurance rates are influenced by a multitude of factors, including your personal circumstances, the vehicle you drive, and the specific coverage options you choose. By understanding these factors, you can make informed decisions to reduce your insurance costs while ensuring adequate protection.

Personal Factors

Your age, gender, and driving history play a significant role in determining your insurance premiums. Generally, younger drivers, especially those under 25, are considered higher risk and may face higher premiums. Gender can also be a factor, with some insurers charging different rates for male and female drivers based on historical data. However, this practice is becoming less common due to legal restrictions in some regions.

Your driving record is another crucial factor. A clean driving history with no accidents or traffic violations can lead to lower premiums. On the other hand, a history of accidents, especially those where you were at fault, can significantly increase your insurance costs. Additionally, certain personal details, such as your credit score and marital status, can impact your insurance rates, as insurers often consider these factors when assessing risk.

Vehicle Factors

The type of vehicle you drive can also influence your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher risk of theft, damage, and expensive repairs. Similarly, luxury vehicles and certain makes and models known for their safety features may attract lower premiums. The age and condition of your vehicle also play a role, with newer vehicles typically requiring more comprehensive coverage.

The location where your vehicle is primarily garaged can impact your insurance rates. Areas with higher crime rates or a history of frequent accidents and claims may result in higher premiums. Additionally, the usage of your vehicle, such as whether it's primarily for commuting or pleasure, can affect your insurance costs.

Coverage Options

The coverage options you choose significantly impact your insurance premiums. Comprehensive and collision coverage, which protect against damage to your vehicle, can be costly, especially for newer or more expensive vehicles. Liability coverage, which is mandatory in most states, protects you financially if you’re at fault in an accident, and the level of liability coverage you choose can affect your premium.

Other optional coverages, such as rental car reimbursement, emergency road service, and gap insurance, can also increase your premium. While these additional coverages provide valuable protection, it's essential to carefully consider your needs and budget to ensure you're not paying for coverage you don't require.

Strategies to Find Affordable Car Insurance

While the factors mentioned above influence your insurance costs, there are several strategies you can employ to find affordable car insurance coverage under $100 per month.

Shop Around and Compare Quotes

One of the most effective ways to find affordable car insurance is to shop around and compare quotes from multiple insurers. Insurance rates can vary significantly between providers, so obtaining quotes from at least three to five different companies can help you identify the best deals. Online quote comparison tools can be particularly useful for this purpose, as they allow you to quickly and easily compare rates from various insurers.

Understand Your Coverage Needs

Before purchasing car insurance, it’s essential to understand your coverage needs. Assess your personal situation and the risks you face as a driver. Consider factors such as the value of your vehicle, your driving record, and your financial ability to pay for repairs or replacements out of pocket. By understanding your needs, you can tailor your coverage to strike a balance between adequate protection and affordability.

Consider Higher Deductibles

Opting for a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible in the event of a claim, you can lower your monthly premiums. However, it’s essential to choose a deductible amount that you can afford to pay if the need arises.

Explore Discounts and Savings

Insurers often offer various discounts and savings opportunities to attract and retain customers. Some common discounts include safe driver discounts for maintaining a clean driving record, multi-policy discounts for bundling your car insurance with other policies like home or renters insurance, and loyalty discounts for staying with the same insurer for an extended period. Additionally, some insurers offer discounts for specific occupations, affiliations, or even for taking a defensive driving course.

Another way to save on car insurance is by taking advantage of usage-based insurance programs. These programs use telematics devices or smartphone apps to monitor your driving behavior, such as speed, braking, and mileage. Safe driving habits can lead to significant discounts on your insurance premiums.

Maintain a Good Driving Record

A clean driving record is crucial for keeping your insurance costs low. Avoid traffic violations and accidents as much as possible. If you do get into an accident, ensure you handle the situation properly, including reporting the incident to your insurer promptly and providing accurate information. Maintaining a good driving record demonstrates to insurers that you’re a responsible driver, which can lead to lower premiums.

Choose Your Vehicle Wisely

The type of vehicle you drive can significantly impact your insurance costs. When choosing a vehicle, consider factors such as safety ratings, theft rates, and repair costs. Vehicles with higher safety ratings and lower theft rates are generally more affordable to insure. Additionally, opting for a less expensive vehicle can also lead to lower insurance premiums, as the cost to repair or replace the vehicle is typically lower.

Understanding Car Insurance Coverage

Car insurance is a complex product with various coverage options and add-ons. Understanding the different types of coverage and how they work is essential to ensuring you have the right protection for your needs. Here’s a breakdown of the most common car insurance coverages:

Liability Coverage

Liability coverage is the most basic and essential type of car insurance. It provides protection if you’re found at fault in an accident, covering the costs of bodily injury and property damage you cause to others. This coverage is mandatory in most states and is typically divided into bodily injury liability and property damage liability.

Bodily injury liability covers the medical expenses and lost wages of individuals injured in an accident for which you're responsible. Property damage liability covers the cost of repairing or replacing the other party's vehicle or other property damaged in the accident.

Collision Coverage

Collision coverage is an optional coverage that protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs to your vehicle or its replacement if it’s deemed a total loss. Collision coverage is particularly valuable for newer or more expensive vehicles, as it can help cover the cost of repairs or replacements that may be beyond your means.

Comprehensive Coverage

Comprehensive coverage, another optional coverage, provides protection for your vehicle against damages caused by events other than collisions. This includes damage from natural disasters, such as hail or floods, theft, vandalism, or damage caused by animals. Comprehensive coverage is crucial for ensuring your vehicle is protected against a wide range of potential risks.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you financially if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage can pay for your medical expenses, lost wages, and other related costs if the at-fault driver is uninsured or underinsured.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, covers the medical expenses of you and your passengers if you’re involved in an accident, regardless of who is at fault. This coverage can be particularly valuable, as it provides quick access to funds to cover immediate medical needs following an accident.

Personal Injury Protection (PIP)

Personal injury protection, or PIP, is a type of coverage that provides broader medical coverage than MedPay. PIP covers not only medical expenses but also lost wages, funeral expenses, and other related costs. It’s a no-fault coverage, meaning it pays out regardless of who is at fault in the accident.

Rental Car Reimbursement

Rental car reimbursement coverage provides financial assistance if you need to rent a vehicle while your insured car is being repaired or replaced following an accident. This coverage can be particularly useful if you rely heavily on your vehicle for daily transportation.

Emergency Roadside Assistance

Emergency roadside assistance coverage provides assistance in various situations, such as flat tires, dead batteries, lockouts, or running out of gas. This coverage can be a valuable addition to your insurance policy, especially if you frequently travel long distances or to remote areas.

Tips for Effective Claims Handling

In the unfortunate event of an accident or vehicle damage, knowing how to effectively handle an insurance claim can help ensure a smoother process and potentially save you money. Here are some tips to guide you through the claims process:

Document the Scene

If you’re involved in an accident, take photos of the scene, including any damage to your vehicle and the other party’s vehicle. Document the location, date, and time of the incident. If there were any witnesses, obtain their contact information, as their statements can be valuable in supporting your claim.

Report the Claim Promptly

Contact your insurance company as soon as possible after the accident to report the claim. Providing accurate and detailed information about the incident can help expedite the claims process. Be prepared to answer questions about the accident and provide any relevant documentation, such as police reports or medical records.

Cooperate with Your Insurer

Cooperate fully with your insurance company during the claims process. Provide all necessary documentation and respond promptly to any requests for information. Your insurer will guide you through the process, and it’s essential to follow their instructions to ensure a smooth resolution.

Understand Your Coverage Limits

Before filing a claim, review your insurance policy to understand your coverage limits and deductibles. This knowledge can help you manage your expectations and ensure you’re not filing a claim for an amount that exceeds your coverage limits.

Consider Repair Options

If your vehicle requires repairs, consider your options carefully. You can choose to have your vehicle repaired at a repair shop of your choice or use a repair shop recommended by your insurer. Some insurers may offer preferred repair shops, which can sometimes lead to faster and more efficient repairs.

Monitor the Repair Process

Stay involved in the repair process by regularly checking in with the repair shop. Ensure that the repairs are being done to your satisfaction and that any necessary parts are being used. If there are any concerns or delays, contact your insurer and the repair shop to address the issues promptly.

Review Your Policy Periodically

Regularly review your insurance policy to ensure it still meets your needs and provides adequate coverage. As your circumstances change, such as getting married, having children, or purchasing a new vehicle, your insurance needs may also change. Periodically reviewing your policy can help you identify areas where you may be over- or underinsured and make necessary adjustments.

Conclusion

Finding affordable car insurance under $100 per month is possible with the right approach and strategies. By understanding the factors that influence insurance costs, shopping around for the best deals, and making informed decisions about your coverage, you can secure the protection you need without straining your budget. Additionally, by maintaining a good driving record, choosing your vehicle wisely, and exploring discounts and savings opportunities, you can further reduce your insurance premiums.

Remember, car insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents or other unforeseen circumstances. By staying informed and taking proactive steps to manage your insurance costs, you can ensure you're adequately protected while keeping your expenses in check.

How can I lower my car insurance premiums if I have a poor driving record?

+If you have a poor driving record, it can be challenging to lower your insurance premiums. However, there are a few strategies you can employ. First, consider shopping around for quotes from different insurers, as rates can vary significantly. Additionally, you can opt for a usage-based insurance program, which monitors your driving behavior and can lead to discounts for safe driving habits. Finally, maintain a clean driving record going forward, as insurers often reward drivers who improve their driving habits over time.

What factors determine if a vehicle is considered a “high-risk” vehicle for insurance purposes?

+A vehicle is considered “high-risk” for insurance purposes based on several factors. These include the make and model of the vehicle, with certain brands and models being more prone to theft or having higher repair costs. The age and condition of the vehicle can also influence risk, as older vehicles may have more wear and tear and be more susceptible to mechanical issues. Additionally, the vehicle’s safety features and crash ratings play a role, with vehicles with higher safety ratings often attracting lower insurance premiums.

How can I save on car insurance if I’m a young driver?

+As a young driver, finding affordable car insurance can be challenging due to the higher risk associated with younger drivers. However, there are ways to save. Consider enrolling in a defensive driving course, as some insurers offer discounts for completing such courses. Additionally, maintain a clean driving record, as insurers often reward young drivers who demonstrate safe driving habits. Finally, explore multi-policy discounts by bundling your car insurance with other policies, such as renters or homeowners insurance.

What is the difference between collision and comprehensive coverage?

+Collision coverage provides protection if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle. Comprehensive coverage, on the other hand, provides protection for your vehicle against damages caused by events other than collisions, such as natural disasters, theft, or vandalism. It’s important to note that both collision and comprehensive coverage are optional and may not be required by law, but they can provide valuable protection for your vehicle.

Are there any car insurance companies that specialize in providing coverage for high-risk drivers?

+Yes, there are insurance companies that specialize in providing coverage for high-risk drivers, often referred to as non-standard insurance providers. These companies cater to drivers with poor driving records, multiple accidents or violations, or those who have had their insurance canceled or non-renewed. While premiums may be higher due to the increased risk, these insurers can provide the coverage needed to get back on the road legally and safely.