Car Insurance Employment

Welcome to an in-depth exploration of the critical relationship between car insurance and employment, two aspects of modern life that are intricately linked. This article aims to shed light on the various ways these two elements intertwine, the implications they have on individuals and businesses, and the future prospects they hold.

The world of car insurance is a complex one, with numerous factors influencing policy costs and availability. Employment status is one such factor, and it plays a significant role in determining insurance rates and coverage options. In this comprehensive guide, we'll delve into the specifics of how employment affects car insurance, the challenges it presents, and the potential solutions that can benefit both employees and insurance providers.

The Role of Employment in Car Insurance

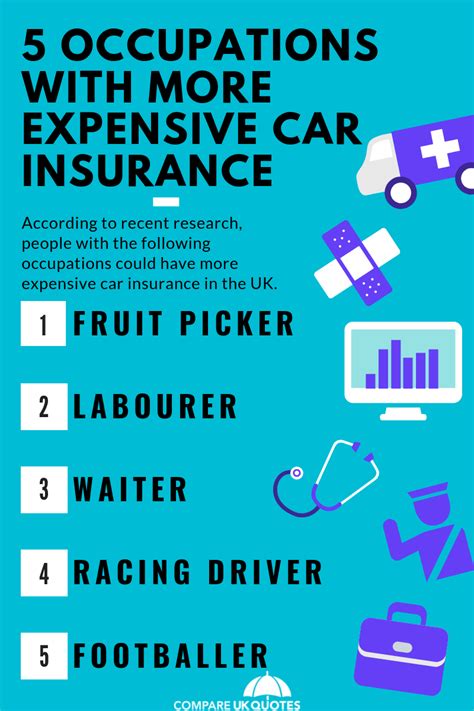

Employment status is a key determinant in car insurance rates and coverage. It serves as a proxy for various risk factors that insurance companies consider when assessing a driver’s profile. These risk factors can include driving frequency, exposure to traffic, and the potential for accidents or claims.

From a statistical perspective, certain employment types are associated with higher or lower risk profiles. For instance, individuals with stable, full-time jobs often have more predictable driving patterns and lower accident rates, making them a preferred demographic for insurance providers. On the other hand, those with fluctuating employment or gig-based work may face higher insurance costs due to the perceived unpredictability of their driving habits.

Moreover, the nature of one's employment can also impact insurance rates. Jobs that involve extensive driving, such as delivery services or sales roles, may be considered higher risk, leading to increased premiums. Conversely, occupations that require minimal driving, like office-based jobs, can result in more affordable insurance options.

Case Study: Impact of Employment on Insurance Rates

Consider the example of two individuals, both aged 30 with clean driving records. One works as a full-time office administrator, driving primarily for personal reasons, while the other is a freelance delivery driver, spending a significant portion of their day on the road.

| Employment Type | Insurance Premium |

|---|---|

| Office Administrator | $1200 annually |

| Freelance Delivery Driver | $1800 annually |

As illustrated above, the freelance delivery driver, despite having the same driving record as the office administrator, pays significantly higher insurance premiums. This discrepancy is due to the higher risk associated with their employment, which involves frequent and often unpredictable driving.

Challenges and Solutions for Employees

For individuals, especially those with fluctuating or gig-based employment, the impact of their work on car insurance can be a significant concern. High insurance costs can deter people from seeking certain job opportunities or force them to choose less expensive coverage, which may not adequately protect them in the event of an accident.

To address these challenges, here are some strategies individuals can consider:

- Shop Around: Compare quotes from different insurance providers. Rates can vary significantly, so it's worth exploring multiple options to find the best fit.

- Consider Bundling: If you have multiple insurance needs, such as home and auto, bundling your policies can often lead to discounts.

- Evaluate Coverage: Review your coverage annually to ensure it aligns with your current needs and budget. You may be able to reduce costs by adjusting certain aspects of your policy.

- Maintain a Clean Record: A good driving record is essential for keeping insurance costs down. Avoid accidents and moving violations to maintain a positive profile.

Government Initiatives and Support

In some regions, governments have recognized the challenges faced by individuals with non-traditional employment and have taken steps to address them. For instance, certain jurisdictions offer subsidies or programs to help offset the higher insurance costs associated with certain jobs.

Additionally, some governments are working with insurance providers to develop more flexible and affordable insurance options for gig workers and others with non-traditional employment. These initiatives aim to ensure that individuals can access adequate insurance coverage without facing financial strain.

Implications for Businesses

The impact of employment on car insurance extends beyond individuals; it also has significant implications for businesses, particularly those that rely on a fleet of vehicles or employ drivers.

Fleet Management and Insurance

Businesses that maintain a fleet of vehicles face unique challenges when it comes to insurance. The cost of insuring a fleet can be substantial, and the risk profile of the fleet can be influenced by various factors, including the driving habits of employees and the types of vehicles in the fleet.

To manage these challenges, fleet managers can implement strategies such as:

- Driver Training: Providing comprehensive driver training can reduce accident rates and, consequently, insurance costs.

- Vehicle Maintenance: Regularly maintaining vehicles can prevent unexpected breakdowns and reduce the risk of accidents.

- Telematics: Utilizing telematics technology can provide real-time data on driving behavior, allowing for more accurate risk assessment and potentially lower insurance premiums.

Employment and Driver Risk Assessment

When hiring drivers, businesses must consider the impact of their employees’ employment status on insurance. This includes assessing the potential risk associated with an individual’s driving habits and history.

Here are some steps businesses can take to manage this aspect:

- Background Checks: Conducting thorough background checks on potential drivers can reveal past driving records and help identify high-risk individuals.

- Incentivizing Safe Driving: Implementing programs that reward safe driving practices can encourage employees to maintain positive driving habits.

- Regular Reviews: Periodically reviewing the driving records of employees can help identify any changes in risk profile and adjust insurance coverage accordingly.

The Future of Car Insurance and Employment

As the world of work continues to evolve, with gig-based and remote employment on the rise, the relationship between car insurance and employment is likely to undergo significant changes. Insurance providers will need to adapt their models to accommodate these new employment dynamics.

One potential solution is the development of usage-based insurance (UBI) models. These models utilize telematics data to assess driving behavior in real-time, allowing for more accurate and flexible insurance pricing. UBI can benefit individuals with non-traditional employment by providing insurance rates that better reflect their actual driving habits.

Additionally, the integration of advanced technologies, such as autonomous vehicles, is expected to have a profound impact on car insurance. While these technologies may reduce overall accident rates, they could also lead to new types of risks and liabilities that insurance providers will need to address.

The Role of Data and Technology

The increasing availability of data and advanced analytics tools presents an opportunity for both insurance providers and businesses to better understand and manage risk. By leveraging data-driven insights, insurance companies can develop more accurate risk assessment models, while businesses can optimize their fleet management strategies and employee driving behaviors.

Conclusion: Navigating the Complex World of Car Insurance and Employment

The relationship between car insurance and employment is a multifaceted one, with implications for individuals, businesses, and the insurance industry as a whole. While employment status can present challenges in terms of insurance costs and coverage, there are strategies and solutions available to mitigate these issues.

As we move forward, the key to navigating this complex landscape lies in adaptability. Both individuals and businesses must be prepared to adjust their approaches to insurance in response to changing employment dynamics and advancements in technology. By staying informed and proactive, it is possible to ensure that car insurance remains a manageable aspect of modern life, regardless of one's employment status.

How does employment type affect car insurance rates?

+

Employment type can significantly impact car insurance rates. Jobs that involve extensive driving, such as delivery services or sales roles, may be considered higher risk, leading to increased premiums. Conversely, occupations with minimal driving requirements, like office-based jobs, can result in more affordable insurance options.

What can individuals do to manage high insurance costs associated with their employment?

+

Individuals can take several steps to manage high insurance costs, including shopping around for quotes from different providers, considering bundling policies, evaluating coverage annually, and maintaining a clean driving record. Additionally, some regions offer government subsidies or programs to help offset higher insurance costs for certain jobs.

How can businesses manage insurance costs for their fleet of vehicles?

+

Businesses can implement strategies such as providing comprehensive driver training, maintaining regular vehicle upkeep, and utilizing telematics technology to assess driving behavior in real-time. These measures can help reduce accident rates, optimize insurance costs, and ensure the safety of employees.