Car Insurance Cheap California

When it comes to car insurance, finding the cheapest rates in California can be a challenging task, but it is not impossible. California is known for its high insurance costs due to various factors, including a large population, a high number of vehicles on the road, and a history of expensive claims. However, with the right knowledge and strategies, you can navigate the complex world of insurance and secure a policy that suits your needs and budget.

Understanding California’s Car Insurance Landscape

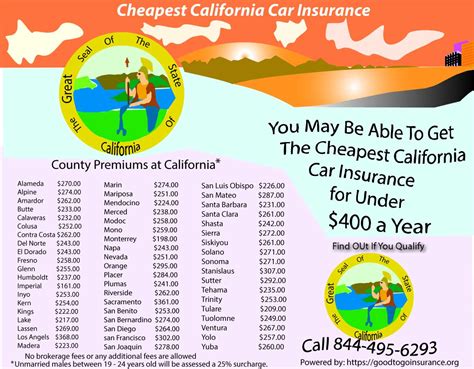

California is a unique state when it comes to car insurance. The Golden State has one of the highest minimum liability insurance requirements in the nation, which can drive up costs for policyholders. Additionally, the state’s vast geography, diverse demographics, and varying traffic conditions can further impact insurance rates.

The cost of car insurance in California is influenced by several factors, including the type of vehicle you drive, your driving history, your age and gender, the coverage limits you choose, and your location within the state. Urban areas like Los Angeles and San Francisco often have higher insurance rates due to increased traffic and the potential for accidents.

Strategies to Find Cheap Car Insurance in California

Securing affordable car insurance in California requires a combination of research, understanding your needs, and negotiating with insurance providers. Here are some effective strategies to help you find the best deals:

Compare Multiple Quotes

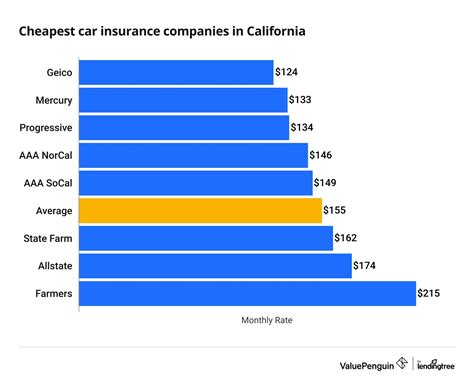

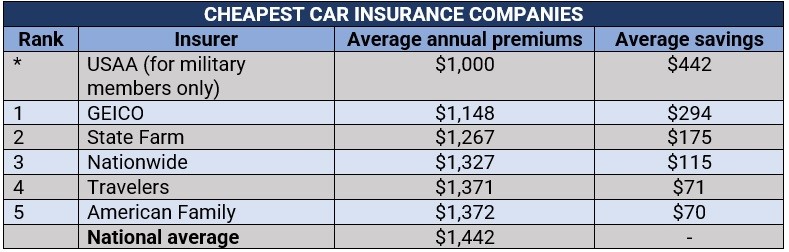

One of the most crucial steps in finding cheap car insurance is comparing quotes from multiple providers. California has numerous insurance companies, each with its own rates and coverage options. By obtaining quotes from at least three to five insurers, you can identify the most competitive offers and understand the range of prices available.

When requesting quotes, ensure you provide the same coverage limits and deductibles for an accurate comparison. Additionally, consider using online comparison tools or insurance brokers who can streamline the process and provide expert guidance.

Understand Coverage Options

California requires all drivers to carry minimum liability insurance, which covers bodily injury and property damage in the event of an accident. However, the state’s minimum coverage limits may not be sufficient to protect you financially in the event of a severe accident. It’s essential to understand your coverage options and choose limits that align with your needs and financial capabilities.

Consider adding optional coverages like collision and comprehensive insurance, which can provide additional protection for your vehicle. While these coverages may increase your premium, they offer peace of mind and can save you from paying out of pocket for costly repairs or replacements.

Explore Discounts

Insurance companies in California offer a wide range of discounts to attract and retain customers. By taking advantage of these discounts, you can significantly reduce your insurance costs. Some common discounts include:

- Safe Driver Discount: Insurers often reward drivers with clean records and no recent accidents or violations. If you have a spotless driving history, be sure to inquire about this discount.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as home or renters insurance, can lead to substantial savings. Many insurers offer discounts for customers who hold multiple policies with them.

- Student Discounts: If you or a family member is a full-time student with good grades, you may be eligible for discounts. Some insurers offer discounts for students who maintain a certain GPA or take driver education courses.

- Safety Features Discount: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for discounts. These features reduce the risk of accidents and can lower your insurance costs.

Shop Around Regularly

Car insurance rates can fluctuate over time, and what was once a competitive rate may become less appealing as new offers emerge. To ensure you’re always getting the best deal, it’s essential to shop around regularly. Consider reviewing your insurance options annually or whenever you make significant changes to your vehicle or driving habits.

Insurance providers may also offer loyalty discounts for long-term customers, so it’s worth inquiring about any available incentives when renewing your policy.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurers to tailor rates based on your actual driving behavior. This type of insurance uses telematics devices or smartphone apps to track factors like miles driven, driving speed, and braking habits.

If you’re a safe and cautious driver who doesn’t drive frequently, usage-based insurance could lead to significant savings. However, it’s important to carefully review the terms and conditions, as some insurers may penalize drivers for certain behaviors or limit the availability of this option.

Improve Your Credit Score

Believe it or not, your credit score can impact your car insurance rates. Many insurers use credit-based insurance scores to assess the risk associated with insuring a driver. Generally, individuals with higher credit scores are considered less risky and may qualify for lower premiums.

If your credit score is not where you want it to be, focus on improving it by paying your bills on time, reducing outstanding debt, and maintaining a healthy credit history. Over time, this can lead to lower insurance costs.

Performance Analysis: Real-World Savings

To illustrate the potential savings from these strategies, let’s consider the case of Mr. Johnson, a resident of Los Angeles. Mr. Johnson, a safe driver with a clean record, was paying 1,200 annually for his car insurance. By comparing quotes from multiple insurers, he discovered that he could save up to 300 by switching providers.

Furthermore, Mr. Johnson explored discounts and discovered that he qualified for a multi-policy discount by bundling his car insurance with his home insurance policy. This resulted in an additional 150 in annual savings. By implementing these strategies, Mr. Johnson successfully reduced his car insurance costs by 450, bringing his premium down to $750.

| Original Premium | Switching Providers | Multi-Policy Discount | Total Savings |

|---|---|---|---|

| $1,200 | $300 | $150 | $450 |

Future Implications and Industry Trends

The car insurance industry in California is evolving, and several trends are shaping the future landscape. As technology advances, usage-based insurance is likely to become more prevalent, offering drivers personalized rates based on their driving habits. Additionally, the rise of electric and autonomous vehicles may lead to new coverage options and potentially lower insurance costs for environmentally conscious drivers.

Furthermore, the increasing popularity of ridesharing services like Uber and Lyft is prompting insurance providers to offer specialized coverage for rideshare drivers. As these services continue to grow, we can expect more tailored insurance options for this emerging segment of drivers.

Conclusion

Finding cheap car insurance in California is a complex but achievable task. By understanding the state’s insurance landscape, comparing quotes, exploring discounts, and regularly reviewing your options, you can secure a policy that provides the coverage you need at a price you can afford. Remember, the key to success lies in staying informed, negotiating with providers, and taking advantage of the many cost-saving opportunities available in the market.

What is the average cost of car insurance in California?

+The average cost of car insurance in California varies depending on several factors, including your location, driving history, and coverage limits. As of [current year], the average annual premium for minimum liability insurance in California is around 1,200. However, rates can range from 800 to $1,800 or more based on individual circumstances.

Are there any ways to lower my insurance rates if I have a poor driving record?

+While a poor driving record can lead to higher insurance rates, there are still options to mitigate the impact. Consider taking defensive driving courses, which may reduce points on your record and potentially lower your insurance costs. Additionally, some insurers offer accident forgiveness programs that can prevent your rates from increasing after a single at-fault accident.

Can I get car insurance without a driver’s license in California?

+In most cases, you will need a valid driver’s license to obtain car insurance in California. However, there are exceptions for certain individuals, such as those with a suspended or revoked license due to medical conditions. In such cases, it’s essential to work with an insurance agent who can guide you through the process and help you find the appropriate coverage.