Car Insurance Based On Mileage

In the world of automotive finance, a novel concept has emerged that challenges the traditional norms of car insurance. Enter pay-per-mile car insurance, a disruptive innovation that promises to revolutionize the way drivers are insured and how they perceive the cost of vehicle ownership. This unique approach to insurance coverage has gained traction, particularly among environmentally conscious drivers and those who prioritize flexibility and affordability. As we delve into the intricacies of this concept, we uncover a system that offers a personalized and cost-effective solution, tailor-made for the modern, eco-aware motorist.

Understanding Pay-Per-Mile Car Insurance

Pay-per-mile car insurance, as the name suggests, is an insurance policy that charges drivers based on the actual distance they travel. This innovative model deviates from the conventional practice of charging a flat premium, which can often be a financial burden for drivers who use their vehicles infrequently. By adopting a usage-based approach, pay-per-mile insurance aims to provide a fairer and more equitable system, ensuring that drivers only pay for the coverage they actually need.

This concept is particularly appealing to those who lead an urban lifestyle, rely on public transportation, or have vehicles that are primarily used for occasional long-distance trips. For such drivers, the traditional insurance model can be a financial burden, as they are essentially subsidizing the coverage for more frequent drivers. Pay-per-mile insurance, on the other hand, offers a more transparent and cost-effective solution, aligning the cost of insurance with the actual usage of the vehicle.

The Benefits of Mileage-Based Insurance

The advantages of pay-per-mile insurance are multifaceted. Firstly, it provides significant financial savings for low-mileage drivers. By only paying for the miles they drive, these drivers can reduce their insurance costs substantially. For example, a driver who commutes only a few miles a day can expect to pay significantly less than someone who drives the same vehicle long distances every day.

Secondly, this model encourages environmentally conscious driving habits. With insurance costs directly tied to mileage, drivers are incentivized to reduce their carbon footprint by opting for public transportation, carpooling, or simply driving less. This not only benefits the environment but also promotes a more sustainable and responsible approach to vehicle ownership.

Additionally, pay-per-mile insurance offers a level of flexibility that traditional policies often lack. With the ability to adjust coverage based on mileage, drivers can easily adapt their insurance plans to suit their changing needs. Whether it's a seasonal change in driving habits or a one-off long-distance trip, pay-per-mile insurance provides a tailored solution that ensures drivers are always covered, without overpaying.

How Pay-Per-Mile Insurance Works

The mechanics of pay-per-mile insurance are relatively straightforward. Insurance providers typically install a small device, often referred to as a telematics device, in the vehicle. This device tracks the vehicle’s mileage, recording the distance traveled and transmitting this data to the insurance company. This data is then used to calculate the premium, which is typically charged at the end of each month based on the total miles driven.

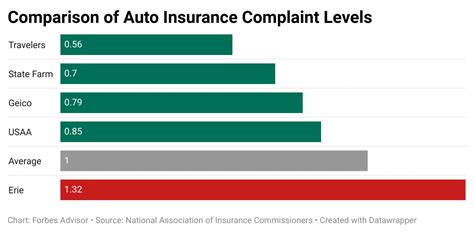

Some insurance providers offer a fixed daily rate, while others charge per mile. The specific rates and terms can vary widely between providers, so it's essential for drivers to shop around and compare different options to find the most suitable and cost-effective plan.

| Insurance Provider | Rate Type | Per Mile Rate | Daily Rate |

|---|---|---|---|

| Company A | Per Mile | $0.05/mile | N/A |

| Company B | Daily | N/A | $2/day |

| Company C | Hybrid | $0.07/mile (over 100 miles) | $1.50/day (up to 100 miles) |

Real-World Applications and Success Stories

The concept of pay-per-mile insurance has already gained traction in several regions, with positive outcomes for both drivers and the environment. For instance, in the United Kingdom, where pay-per-mile insurance has been offered for several years, it has proven to be a popular choice among younger drivers and those living in urban areas. These drivers, who often have limited budgets and rely on public transport, have found significant savings with this model, sometimes reducing their insurance costs by up to 50%.

In the United States, pay-per-mile insurance has also made strides, particularly in states with high insurance rates. Drivers in these areas have embraced the concept, leading to a noticeable shift in insurance preferences. One notable success story comes from a driver in California who, due to high traditional insurance rates, opted for a pay-per-mile plan. By driving fewer miles and taking advantage of public transportation, this driver was able to reduce their annual insurance costs from $1,200 to just $600.

Environmental Impact and Sustainable Future

The environmental benefits of pay-per-mile insurance are substantial. By incentivizing drivers to reduce their mileage, this model indirectly contributes to a decrease in carbon emissions. As more drivers opt for alternative transportation methods or simply drive less, the overall environmental impact of personal vehicle usage can be significantly reduced.

Looking ahead, the future of pay-per-mile insurance seems promising. With increasing concerns about climate change and a growing demand for sustainable practices, this model is well-positioned to play a pivotal role in the automotive industry. As more insurance providers adopt this approach and technological advancements improve the accuracy and convenience of mileage tracking, pay-per-mile insurance is likely to become an even more attractive and accessible option for drivers worldwide.

Conclusion: Embracing a Fairer, Greener Future

Pay-per-mile car insurance represents a significant shift in the automotive insurance landscape, offering a fairer, more flexible, and environmentally conscious approach to coverage. With its ability to cater to the unique needs of low-mileage drivers and its potential to reduce carbon emissions, this innovative model is poised to shape the future of vehicle ownership. As more drivers and insurance providers embrace this concept, we can expect to see a greener, more sustainable automotive industry, where insurance costs are truly aligned with usage and the environment benefits from reduced vehicle mileage.

How does pay-per-mile insurance compare to traditional policies in terms of cost?

+Pay-per-mile insurance can offer significant cost savings for low-mileage drivers. However, it’s important to note that the savings will vary based on individual driving habits and the specific rate structure of the insurance provider. In some cases, drivers who cover a lot of miles may find that traditional policies are more cost-effective.

Are there any disadvantages to pay-per-mile insurance?

+One potential drawback is the need for a tracking device, which some drivers may view as an invasion of privacy. Additionally, drivers who cover a lot of miles may find that the per-mile rate adds up quickly, making traditional insurance a more attractive option. It’s important to carefully consider individual driving habits and insurance needs before making a decision.

What kind of tracking devices are used for pay-per-mile insurance, and how accurate are they?

+Insurance providers typically use small, discreet devices that are installed in the vehicle. These devices use GPS technology to accurately track mileage. While some older devices may have had issues with accuracy, modern telematics devices are highly accurate and provide reliable data for insurance purposes.