Can I Cancel My Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. However, there may be instances where you find yourself considering canceling your car insurance policy. This article aims to guide you through the process, exploring the reasons, requirements, and potential implications of canceling your car insurance.

Understanding the Reasons for Cancellation

Before diving into the cancellation process, it’s crucial to identify the reasons why individuals might choose to cancel their car insurance. While circumstances vary, some common motivations include:

- Change in Circumstances: Life events such as selling a vehicle, moving to a new location, or acquiring a new car can prompt the need to adjust insurance coverage.

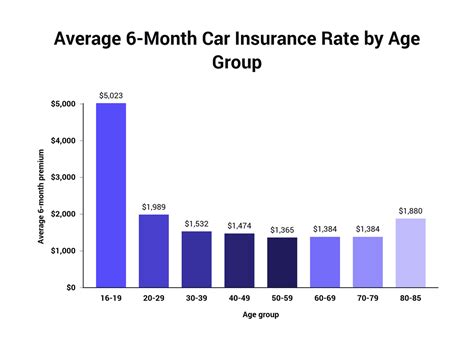

- Cost Considerations: In certain situations, the cost of insurance may become a burden, leading policyholders to seek more affordable options or explore alternatives.

- Switching Insurers: Some drivers may opt to cancel their existing policy to take advantage of better rates or more comprehensive coverage offered by another insurance provider.

- Temporary Coverage Needs: If you anticipate a period of time when you won’t be driving, you might consider canceling your insurance to save on costs during that period.

- Policy Dissatisfaction: Dissatisfaction with the insurance company’s service, claim handling, or policy terms could lead to a desire to cancel and find a more suitable insurer.

The Cancellation Process: A Step-by-Step Guide

Canceling your car insurance policy requires a thoughtful and systematic approach. Here’s a comprehensive guide to ensure a smooth cancellation process:

- Review Your Policy: Begin by carefully reviewing your insurance policy documents. Understand the terms and conditions, including any cancellation fees or penalties that may apply.

- Contact Your Insurer: Reach out to your insurance provider to discuss your intention to cancel. They can guide you through the specific procedures and provide information about any outstanding payments or refunds.

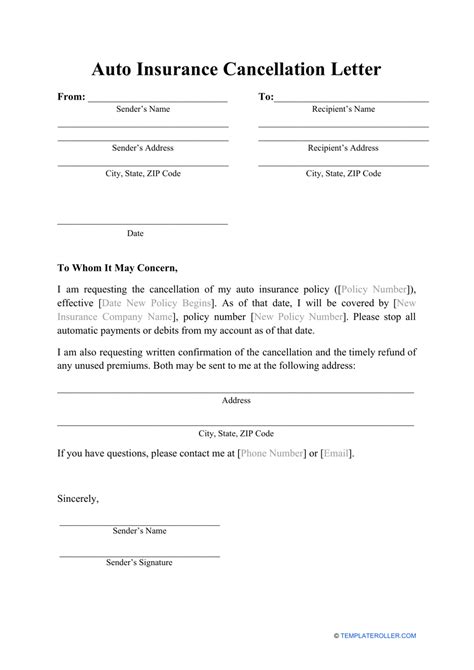

- Provide a Cancellation Notice: Most insurance companies require a written notice of cancellation. This notice should include your policy number, effective cancellation date, and a clear statement of your intent to cancel.

- Check for Cancellation Fees: Be aware of any cancellation fees or penalties that may be incurred. These fees are typically outlined in your policy documents and can vary depending on the insurer and the timing of your cancellation.

- Secure a Refund: If you’ve prepaid your insurance premiums, you may be eligible for a refund. Calculate the amount you’re entitled to and request a refund from your insurer. The refund process and timeline can vary, so ensure you understand the details.

- Switch to a New Provider (Optional): If you’re canceling your policy to switch to a new insurer, ensure you have the new policy in place before canceling the old one. This prevents a gap in coverage and ensures continuous protection.

- Update Your Records: Once the cancellation is complete, update your records and documentation. This includes removing the insurance company’s information from your vehicle registration and any other relevant documents.

- Consider Short-Term Insurance: If you anticipate a temporary period without a vehicle, you might opt for short-term insurance to bridge the gap. This ensures you maintain coverage during this period.

Potential Implications and Considerations

Canceling your car insurance policy comes with certain implications and considerations that you should be aware of:

- Legal Requirements: Depending on your location and local laws, it may be mandatory to maintain a certain level of car insurance coverage. Canceling your policy could lead to legal consequences or penalties if you’re caught driving without the required insurance.

- Gap in Coverage: Canceling your policy can leave you without insurance coverage, exposing you to financial risks in the event of an accident or other unforeseen circumstances. Ensure you have an alternative arrangement in place before canceling.

- Future Insurance Costs: Canceling your policy may impact your future insurance costs. Insurers may view a canceled policy as a sign of increased risk, potentially leading to higher premiums when you apply for a new policy.

- Claim History: If you’ve made claims during your policy period, canceling may impact your future insurance options. Some insurers may be reluctant to offer coverage to drivers with a history of claims.

- Financial Planning: Car insurance is a significant financial commitment, and canceling it can free up funds. However, it’s important to consider the potential costs of an accident or other unforeseen events that could arise without insurance coverage.

Alternatives to Cancellation

Before canceling your car insurance policy, it’s worth exploring alternative options that may better suit your needs:

- Adjust Your Coverage: Instead of canceling your policy, consider adjusting your coverage to better align with your current circumstances. This could involve reducing your coverage limits or opting for a more basic policy to save on costs.

- Shop Around for Better Rates: If cost is a primary concern, take the time to compare insurance rates from different providers. You might find a more affordable policy that still meets your coverage needs.

- Explore Usage-Based Insurance: Usage-based insurance programs offer personalized rates based on your driving behavior. These programs can be a cost-effective option for safe and cautious drivers.

- Consider Group or Multi-Policy Discounts: If you have multiple vehicles or policies with the same insurer, you may be eligible for group or multi-policy discounts. This can help reduce your overall insurance costs.

- Bundle Your Insurance: Bundling your car insurance with other policies, such as home or life insurance, can often result in significant savings.

Conclusion: Making an Informed Decision

Canceling your car insurance policy is a significant decision that requires careful consideration. By understanding the reasons, following a systematic cancellation process, and being aware of the potential implications, you can make an informed choice that aligns with your needs and circumstances. Remember, while canceling your policy may provide short-term savings, it’s crucial to ensure you have adequate coverage to protect yourself and others on the road.

Frequently Asked Questions

Can I cancel my car insurance at any time?

+While you have the right to cancel your insurance policy, there may be certain conditions or penalties associated with cancellation. It’s best to review your policy documents or consult with your insurer to understand the specific terms and conditions.

Will canceling my insurance affect my future premiums?

+Yes, canceling your insurance policy may impact your future premiums. Insurers may view a canceled policy as a potential risk, which could lead to higher rates when you apply for a new policy.

What happens if I cancel my insurance and get into an accident?

+If you cancel your insurance and subsequently get into an accident, you may be held financially responsible for any damages or injuries caused. It’s crucial to have alternative coverage or funds to cover such expenses.

Can I get a refund if I cancel my insurance early?

+In most cases, you can receive a refund for any prepaid premiums if you cancel your insurance policy. However, the refund amount and process may vary depending on your insurer and the timing of your cancellation.

Are there any penalties for canceling my insurance policy?

+Some insurance policies may include cancellation fees or penalties. It’s essential to review your policy documents or consult with your insurer to understand any potential fees or penalties associated with cancellation.