Call Progressive Insurance Company

In today's fast-paced world, having reliable insurance coverage is essential to protect ourselves and our assets. Among the numerous insurance providers in the market, Progressive Insurance Company stands out as a trusted and innovative leader. With a rich history and a commitment to customer satisfaction, Progressive has become a go-to choice for millions of individuals and businesses. In this comprehensive guide, we will delve into the world of Progressive Insurance, exploring its services, benefits, and why it is a top choice for many.

A History of Progressive Innovation

Progressive Insurance Company, headquartered in Mayfield Village, Ohio, has a rich legacy that dates back to 1937. Founded by Joseph Lewis and Jack Green, the company’s mission was clear from the start: to provide affordable, high-quality insurance options to the masses. Their innovative approach and focus on customer needs have propelled Progressive to become one of the largest insurance providers in the United States.

Over the years, Progressive has revolutionized the insurance industry with its forward-thinking strategies. They were among the first to embrace technology, introducing online quoting and policy management systems that streamlined the insurance experience for customers. This commitment to innovation has allowed Progressive to stay ahead of the curve and adapt to the ever-changing needs of its clients.

Comprehensive Insurance Services

Progressive Insurance offers a wide range of insurance products to cater to various needs. Their core services include:

Auto Insurance

Progressive’s auto insurance policies are tailored to provide comprehensive coverage for vehicles of all types. Whether you own a car, truck, SUV, or even a classic car, Progressive offers customizable policies to fit your needs. Their policies cover liability, collision, comprehensive, and additional features like rental car reimbursement and roadside assistance.

| Policy Type | Coverage |

|---|---|

| Liability | Covers bodily injury and property damage claims made against you. |

| Collision | Protects your vehicle in the event of a collision, regardless of fault. |

| Comprehensive | Covers damage to your vehicle caused by non-collision events like theft, vandalism, or natural disasters. |

Progressive's auto insurance policies also offer optional add-ons such as gap coverage, which covers the difference between your vehicle's actual cash value and the remaining loan balance in case of a total loss.

Home Insurance

Progressive understands that your home is one of your most valuable assets. Their home insurance policies provide protection against a wide range of risks, including fire, theft, vandalism, and natural disasters. With customizable coverage limits and deductibles, Progressive allows you to tailor your policy to fit your specific needs.

Additionally, Progressive offers unique features like the Home Quote Explorer tool, which provides an estimate of your home's replacement cost based on various factors such as location, construction type, and square footage. This ensures that you have adequate coverage without overpaying.

Business Insurance

Progressive recognizes the importance of protecting businesses of all sizes. Their business insurance policies offer comprehensive coverage for various industries, including retail, manufacturing, and professional services. Whether you’re a small startup or a large corporation, Progressive can provide tailored solutions to protect your business assets and operations.

Business insurance policies from Progressive typically include coverage for property damage, liability claims, business interruption, and employee-related risks. They also offer specialized coverage for unique business needs, such as cyber liability insurance to protect against data breaches and identity theft.

Life Insurance

Progressive understands that life insurance is an essential component of financial planning. Their life insurance policies provide peace of mind to individuals and their families, ensuring financial security in the event of an untimely death. Progressive offers term life and whole life insurance policies with flexible coverage amounts and term lengths to suit different needs and budgets.

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is an affordable option for individuals who require coverage for a specific period, such as during their working years when their income is essential to support their families.

Whole life insurance, on the other hand, provides permanent coverage and builds cash value over time. It is a more comprehensive option that offers both protection and a potential savings component.

Progressive’s Unique Benefits

Progressive Insurance Company stands out not only for its comprehensive insurance offerings but also for the unique benefits and features it provides to its customers.

Snapshot Program

Progressive’s Snapshot program is a groundbreaking initiative that rewards safe driving. With Snapshot, customers can voluntarily plug a small device into their vehicle’s diagnostic port, which tracks their driving habits. Based on these habits, Progressive offers personalized discounts on auto insurance premiums. The safer you drive, the more you save!

The Snapshot program has been a game-changer for many drivers, as it incentivizes safe driving practices and can lead to significant savings on insurance costs. Progressive's commitment to promoting safe driving behaviors through technology sets them apart from traditional insurance providers.

Name Your Price Tool

Progressive’s Name Your Price tool is a powerful feature that empowers customers to take control of their insurance costs. With this tool, customers can enter their desired monthly premium amount, and Progressive will work to find a policy that fits within their budget. This innovative approach ensures that customers get the coverage they need without breaking the bank.

The Name Your Price tool is particularly beneficial for individuals on a tight budget or those who prioritize affordability in their insurance choices. Progressive's willingness to accommodate different financial situations makes them a top choice for cost-conscious consumers.

24⁄7 Customer Support

Progressive understands the importance of being there for its customers when they need it the most. Their dedicated customer support team is available 24 hours a day, 7 days a week, to assist with any insurance-related queries or emergencies. Whether it’s a simple policy question or a claim filing, Progressive’s team is ready to provide prompt and reliable assistance.

The 24/7 customer support is a testament to Progressive's commitment to putting its customers first. This level of accessibility and responsiveness is highly valued by policyholders, as it provides peace of mind knowing that help is always just a phone call or click away.

Why Choose Progressive Insurance Company

Progressive Insurance Company has established itself as a leading insurance provider for numerous reasons. Here are some key factors that make Progressive a top choice:

- Innovative Approach: Progressive's dedication to innovation has positioned them at the forefront of the insurance industry. Their use of technology, such as online quoting and the Snapshot program, has revolutionized the way insurance is purchased and managed.

- Comprehensive Coverage: With a wide range of insurance products, Progressive offers comprehensive protection for individuals and businesses. Whether it's auto, home, business, or life insurance, Progressive has a policy to suit every need.

- Customer-Centric Focus: Progressive places a strong emphasis on customer satisfaction. Their Name Your Price tool and 24/7 customer support demonstrate their commitment to tailoring insurance solutions to meet individual needs and providing exceptional service.

- Financial Strength: Progressive is a financially stable company, rated A+ by A.M. Best. This rating signifies their ability to meet their financial obligations and provides policyholders with peace of mind, knowing their insurance coverage is secure.

- Discounts and Rewards: Progressive offers a variety of discounts and rewards to its customers. From safe driving discounts to multi-policy discounts, Progressive rewards its loyal customers and encourages safe and responsible behaviors.

Choosing Progressive Insurance Company means gaining access to a comprehensive suite of insurance products, backed by a company that values innovation, customer satisfaction, and financial stability. With their innovative approaches and commitment to putting customers first, Progressive has earned its reputation as a trusted insurance provider.

Progressive’s Future Outlook

As the insurance industry continues to evolve, Progressive Insurance Company remains at the forefront, constantly adapting and innovating to meet the changing needs of its customers. With a focus on technology and customer experience, Progressive is well-positioned to continue its growth and success in the years to come.

Progressive's dedication to data-driven decision-making and its use of advanced analytics will further enhance its ability to provide personalized insurance solutions. By leveraging technology and customer insights, Progressive can offer even more tailored coverage options and improve overall customer satisfaction.

Furthermore, Progressive's commitment to sustainability and corporate social responsibility initiatives positions them as a forward-thinking company. Their focus on environmental stewardship and community involvement aligns with the values of an increasing number of consumers, further solidifying their reputation as a responsible and trusted insurer.

In conclusion, Progressive Insurance Company offers a comprehensive range of insurance services, backed by a rich history of innovation and a customer-centric approach. With their focus on technology, financial strength, and customer satisfaction, Progressive continues to be a top choice for individuals and businesses seeking reliable and affordable insurance coverage. As they continue to evolve and adapt, Progressive is well-equipped to meet the insurance needs of a diverse and ever-changing market.

How can I get a quote from Progressive Insurance Company?

+

You can easily obtain a quote from Progressive Insurance Company by visiting their official website or by calling their customer service hotline. The website provides an online quoting tool, allowing you to enter your details and receive a personalized quote in just a few minutes. Alternatively, you can speak directly with a Progressive representative over the phone, who can guide you through the quoting process and answer any questions you may have.

What types of discounts does Progressive Insurance offer?

+

Progressive Insurance offers a variety of discounts to its customers, including multi-policy discounts, good student discounts, safe driver discounts, and loyalty rewards. These discounts can help reduce your insurance premiums, making Progressive’s policies even more affordable. It’s worth checking with Progressive to see which discounts you may be eligible for based on your specific circumstances.

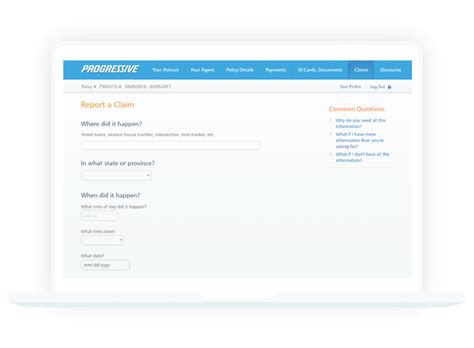

How do I file a claim with Progressive Insurance Company?

+

Filing a claim with Progressive Insurance Company is a straightforward process. You can start by logging into your online account or calling their 24⁄7 customer support hotline. Progressive’s dedicated claims team will guide you through the process, providing assistance and support every step of the way. They may ask for details about the incident, such as the date, time, and location, as well as any relevant documentation or photos.

Does Progressive Insurance offer pet insurance?

+

Yes, Progressive Insurance does offer pet insurance through their partnership with PetFirst Healthcare. Pet insurance provides coverage for unexpected veterinary expenses, such as illnesses, injuries, and surgeries. By partnering with PetFirst, Progressive ensures that pet owners can access comprehensive and affordable coverage for their furry family members.

What is the Progressive Insurance Company’s commitment to sustainability and corporate social responsibility?

+

Progressive Insurance Company is dedicated to sustainability and corporate social responsibility. They have implemented various initiatives to reduce their environmental impact, such as utilizing renewable energy sources and promoting paperless communication. Additionally, Progressive actively supports community programs and organizations, focusing on education, financial literacy, and disaster relief efforts. Their commitment to these causes demonstrates their dedication to being a responsible corporate citizen.