California Of Insurance

Unveiling the Role of the California Department of Insurance: A Comprehensive Guide

In the vast landscape of the insurance industry, regulatory bodies play a pivotal role in safeguarding consumers and ensuring the integrity of the market. Among these, the California Department of Insurance (CDI) stands out as a powerhouse, wielding significant influence over the insurance sector within the Golden State. This comprehensive guide aims to delve into the functions, impact, and significance of the CDI, shedding light on its critical role in shaping the insurance landscape of California.

The Mandate and Mission of the California Department of Insurance

Established with a clear mandate, the California Department of Insurance serves as the regulatory authority for the insurance industry in the state. Its primary mission is twofold: to protect consumers by ensuring insurance companies act fairly and honestly, and to maintain a stable and competitive market environment for insurance providers.

At the core of the CDI's mandate lies a commitment to consumer protection. This involves ensuring that insurance companies offer policies that are transparent, understandable, and provide the coverage they advertise. The department vigilantly monitors insurance practices, intervenes when necessary to rectify unfair or deceptive conduct, and provides consumers with the resources and support they need to navigate the complex world of insurance.

Furthermore, the CDI plays a crucial role in maintaining a stable insurance market. By regulating insurance rates and practices, the department prevents predatory pricing and ensures that insurance providers operate in a competitive yet sustainable manner. This balance is essential for fostering a healthy insurance ecosystem, where providers can thrive while also delivering fair and affordable coverage to consumers.

Key Functions and Responsibilities of the CDI

The California Department of Insurance wields a broad range of powers and responsibilities to fulfill its mission. Here's an in-depth look at some of its critical functions:

License and Regulate Insurance Providers

The CDI is the gatekeeper for insurance companies seeking to do business in California. It grants licenses to insurance providers, ensuring they meet the state's stringent criteria for financial stability, ethical conduct, and consumer protection. This licensing process is a critical line of defense, ensuring that only reputable and financially sound companies enter the California market.

Once licensed, the CDI continues to oversee these providers, conducting regular audits and examinations to ensure compliance with state regulations. This ongoing oversight helps to identify and rectify any issues that may arise, from unfair claim practices to financial instability.

Enforce Consumer Protection Laws

Consumer protection is at the heart of the CDI's mission. The department enforces a range of laws and regulations designed to safeguard consumers, including the Unfair Insurance Practices Act and the Unfair Claims Settlement Practices Regulations. These laws ensure that insurance companies treat consumers fairly, promptly investigate and pay valid claims, and provide accurate and transparent information.

The CDI also fields complaints from consumers and investigates potential violations of these laws. If an insurance company is found to be in breach of these regulations, the department can take a range of enforcement actions, from issuing fines and cease-and-desist orders to revoking the company's license to operate in California.

Monitor and Regulate Insurance Rates

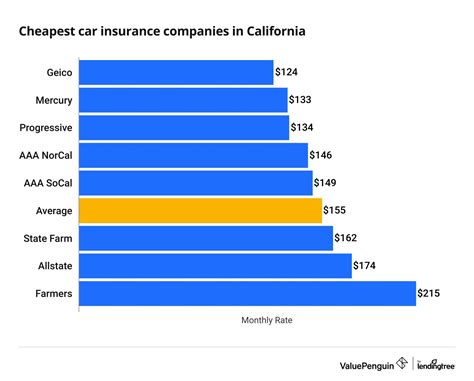

One of the most critical roles of the CDI is the regulation of insurance rates. The department reviews and approves rate changes proposed by insurance companies, ensuring they are not excessive, inadequate, or unfairly discriminatory. This process helps to prevent insurance companies from charging consumers exorbitant premiums or offering inadequate coverage.

The CDI also conducts market conduct examinations, analyzing the overall performance and behavior of insurance companies in the California market. These examinations help the department identify systemic issues, such as widespread unfair practices or market distortions, and take corrective action to protect consumers and maintain a competitive market.

Educate Consumers and Provide Resources

Beyond its regulatory functions, the CDI plays a vital role in educating consumers and providing them with the tools they need to navigate the insurance market. The department maintains a comprehensive website with resources on a range of insurance topics, from understanding different types of policies to knowing your rights as a consumer.

The CDI also conducts outreach programs and workshops, particularly in underserved communities, to ensure all Californians have access to the information they need to make informed insurance decisions. By empowering consumers with knowledge, the department helps to level the playing field and ensure that everyone can access the protection they need.

Impact and Significance of the CDI's Work

The California Department of Insurance's work has a profound impact on the insurance landscape of the state. By enforcing consumer protection laws and regulating insurance practices, the CDI helps to ensure that Californians have access to fair, transparent, and affordable insurance coverage. This, in turn, fosters a sense of security and peace of mind, knowing that they are protected in times of need.

Moreover, the CDI's work contributes to the stability and competitiveness of the insurance market. By regulating insurance rates and practices, the department helps to prevent market distortions and ensures that insurance providers can thrive while also delivering value to consumers. This balance is essential for the long-term sustainability of the insurance industry and the protection of consumers.

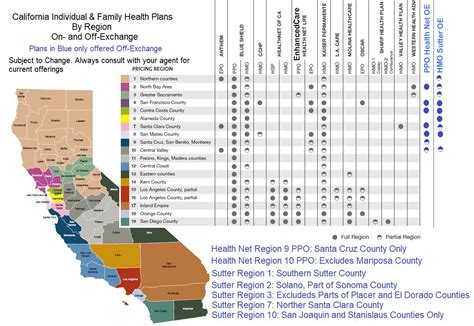

The CDI's role is particularly critical in a state as large and diverse as California. With a population of nearly 40 million and a wide range of insurance needs, the department's oversight and regulation help to ensure that the insurance market can meet the diverse demands of the state's residents. From auto and homeowners' insurance to health and life coverage, the CDI works to ensure that all Californians can access the protection they need.

The Future of Insurance Regulation in California

As the insurance industry continues to evolve, driven by technological advancements and changing consumer needs, the California Department of Insurance is poised to play an even more critical role. The department is committed to staying ahead of the curve, adapting its regulatory framework to address new challenges and opportunities.

One key area of focus for the CDI is the rise of digital insurance and the emergence of insurtech companies. The department is actively engaged in understanding and regulating these new players, ensuring that they operate in a manner that protects consumers and promotes a fair and competitive market. This includes addressing issues such as data privacy, algorithmic bias, and the unique challenges posed by digital distribution channels.

Additionally, the CDI is committed to promoting diversity and inclusion in the insurance industry. The department recognizes the importance of a diverse insurance workforce and consumer base, and is working to address historical inequalities and ensure that insurance is accessible and beneficial to all Californians, regardless of background or circumstance.

As the insurance landscape continues to evolve, the California Department of Insurance will remain a vital force, ensuring that the interests of consumers and the stability of the market are at the heart of the industry. Through its vigilant oversight, consumer protection efforts, and adaptive regulatory framework, the CDI is poised to continue shaping a fair, competitive, and sustainable insurance market in California.

How does the California Department of Insurance handle complaints from consumers?

+The CDI takes consumer complaints very seriously and has a dedicated team to handle them. Consumers can file complaints online or by phone, and the department will investigate the issue. If the complaint is found to be valid, the CDI may take action against the insurance company, which can range from fines to license revocation.

What happens if an insurance company is found to be in breach of consumer protection laws in California?

+If an insurance company is found to be in violation of consumer protection laws, the CDI can take a range of enforcement actions. This may include issuing a cease-and-desist order, imposing fines, or, in severe cases, revoking the company’s license to operate in California. The CDI’s goal is to ensure that insurance companies operate fairly and honestly, and to protect consumers from any harmful practices.

How does the CDI ensure insurance rates are fair and affordable for consumers?

+The CDI carefully reviews and approves rate changes proposed by insurance companies. They assess whether the rates are excessive, inadequate, or unfairly discriminatory. If the rates are found to be unreasonable, the CDI can reject the proposed changes and work with the company to develop a more suitable rate structure. This process helps to ensure that insurance rates are fair and affordable for California consumers.