California Dept Of Insurance

California Department of Insurance: Protecting Consumers and Regulating the Insurance Industry

The California Department of Insurance (CDI) is a pivotal state government agency tasked with safeguarding the interests of California's residents and businesses in their interactions with the insurance industry. With a mandate to ensure fair practices, consumer protection, and the financial stability of insurance providers, CDI plays a critical role in shaping the insurance landscape of the Golden State.

This comprehensive guide delves into the multifaceted responsibilities and impact of the California Department of Insurance, offering an in-depth analysis of its functions, achievements, and the ways it influences the lives of Californians. From consumer education and fraud prevention to industry oversight and disaster recovery support, CDI's reach extends across a broad spectrum of insurance-related activities.

The Mandate and Mission of the California Department of Insurance

Established under the Insurance Code of California, the Department of Insurance operates under the leadership of the Insurance Commissioner, an elected official who serves a four-year term. The current Insurance Commissioner, Ricardo Lara, has been at the helm since 2019, bringing a wealth of experience and a commitment to protecting consumers and promoting equitable insurance practices.

The department's primary mission is to ensure that insurance companies operating within California adhere to state laws and regulations, thereby protecting consumers from unfair or deceptive practices. This involves a wide range of activities, including licensing and regulating insurance companies, investigating complaints, enforcing insurance laws, and providing educational resources to empower consumers to make informed insurance decisions.

Additionally, CDI plays a crucial role in responding to natural disasters and other catastrophic events. In the aftermath of such incidents, the department steps in to assist policyholders in navigating the claims process and advocating for fair and prompt settlements. This disaster recovery support is a critical aspect of CDI's consumer protection mandate.

Key Responsibilities and Functions of CDI

Consumer Protection

At the core of CDI's mission is consumer protection. The department is tasked with ensuring that insurance consumers in California are treated fairly and that their rights are respected. This involves a range of activities, including:

- Educating consumers about their rights and responsibilities when purchasing insurance policies.

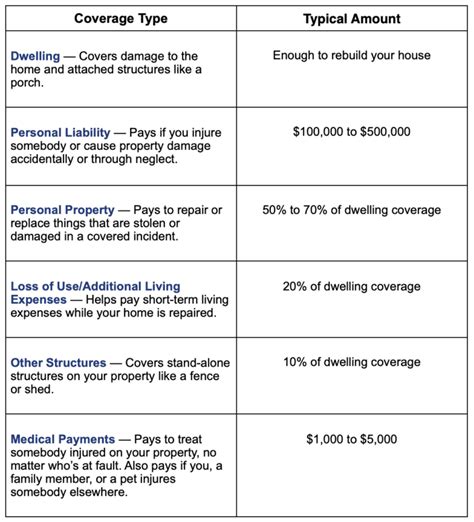

- Providing resources to help consumers understand complex insurance concepts and navigate the claims process.

- Investigating and resolving consumer complaints against insurance companies.

- Enforcing state laws and regulations to prevent unfair or deceptive insurance practices.

- Advocating for consumer interests in legislative and regulatory proceedings.

CDI's consumer protection efforts are crucial in ensuring that Californians receive the coverage and benefits they are entitled to, especially in times of need. The department's resources and guidance empower consumers to make informed choices and take action when their rights are violated.

Industry Oversight and Regulation

CDI is responsible for overseeing and regulating the insurance industry in California, which involves a complex array of tasks. The department licenses and monitors insurance companies, agents, and brokers to ensure they meet state standards and operate ethically.

Key aspects of CDI's industry oversight include:

- Reviewing and approving insurance rates to ensure they are fair and not excessive.

- Monitoring the financial stability of insurance companies to protect policyholders' investments.

- Enforcing compliance with insurance laws and regulations, including those related to market conduct and consumer protection.

- Investigating and prosecuting insurance fraud, a critical function that helps maintain the integrity of the insurance market.

- Collaborating with other state and federal agencies to address systemic issues and ensure consistent regulatory standards.

By maintaining a robust regulatory framework, CDI helps ensure that the insurance industry in California operates with integrity, financial stability, and consumer-focused practices.

Disaster Recovery and Claims Support

California, known for its diverse landscape and dynamic weather patterns, is susceptible to various natural disasters, from wildfires and earthquakes to floods and severe storms. In the aftermath of such events, the California Department of Insurance steps in to provide crucial support to policyholders.

CDI's disaster recovery efforts include:

- Educating consumers about their rights and the claims process following a disaster.

- Providing resources and guidance to help policyholders understand their insurance coverage and navigate the often-complex claims process.

- Investigating and addressing insurance-related issues that arise post-disaster, such as delayed or denied claims.

- Advocating for policyholders to ensure they receive fair and prompt settlements for their losses.

- Collaborating with insurance companies and other state agencies to streamline the disaster recovery process and minimize the impact on affected communities.

CDI's work in disaster recovery is vital in helping Californians rebuild their lives and businesses after catastrophic events. The department's expertise and resources provide a critical safety net during times of crisis.

The Impact of CDI's Work: Real-World Examples

The California Department of Insurance's efforts have had a tangible impact on the lives of Californians and the state's insurance landscape. Here are a few real-world examples of CDI's work in action:

Protecting Consumers from Fraud

CDI's Fraud Division plays a critical role in combating insurance fraud, which not only protects honest policyholders but also helps keep insurance rates down for everyone. In a recent case, the department uncovered a complex scheme involving staged car accidents and fraudulent claims. Through a collaborative effort with law enforcement, CDI helped bring the perpetrators to justice and recovered millions of dollars in fraudulent payouts.

Ensuring Fair and Affordable Insurance

CDI is vigilant in monitoring insurance rates to ensure they are fair and reasonable. In one instance, the department investigated a proposed rate hike by a major insurance carrier, finding that the increase was excessive and not justified by the carrier's financial position. As a result, CDI denied the rate increase, saving policyholders millions of dollars collectively.

Advocating for Consumer Interests

CDI actively participates in legislative and regulatory proceedings to advocate for consumer-friendly insurance practices. For example, the department played a pivotal role in the enactment of the California Consumer Privacy Act (CCPA), ensuring that insurance companies' handling of consumer data is transparent and secure. This advocacy extends to various other policy areas, always with the aim of protecting consumers' rights and interests.

Assisting Policyholders After Disasters

In the aftermath of the devastating Camp Fire in 2018, CDI's Disaster Response Team was on the ground to assist policyholders in the affected areas. The team provided resources and guidance to help residents understand their insurance coverage and navigate the claims process. CDI's intervention led to faster and more comprehensive settlements for many policyholders, facilitating their recovery and rebuilding efforts.

The Future of Insurance Regulation in California

As the insurance landscape continues to evolve, driven by technological advancements, changing consumer expectations, and emerging risks, the California Department of Insurance remains committed to adapting its regulatory framework to meet these new challenges. Key areas of focus for the future include:

- Enhancing consumer education and outreach, particularly in the digital realm, to ensure that Californians are equipped to navigate the evolving insurance marketplace.

- Strengthening oversight of emerging insurance products and services, such as parametric insurance and digital insurance platforms, to ensure they are consumer-friendly and financially sound.

- Advancing data analytics and technology to enhance the efficiency and effectiveness of regulatory processes, including fraud detection and consumer complaint resolution.

- Engaging with stakeholders, including industry experts, consumer advocates, and academic researchers, to stay abreast of emerging trends and best practices in insurance regulation.

- Continuing to advocate for policy changes that promote consumer protection, financial stability, and market integrity in the insurance sector.

By embracing these initiatives, CDI is poised to ensure that California's insurance market remains robust, innovative, and, most importantly, focused on the needs and interests of the state's residents and businesses.

What is the role of the California Department of Insurance (CDI) in consumer protection?

+

CDI plays a critical role in consumer protection by educating consumers about their rights and responsibilities, providing resources to navigate the insurance landscape, investigating and resolving consumer complaints, enforcing state laws and regulations, and advocating for consumer interests in legislative and regulatory proceedings.

How does CDI regulate the insurance industry in California?

+

CDI regulates the insurance industry by licensing and monitoring insurance companies, agents, and brokers; reviewing and approving insurance rates; monitoring the financial stability of insurance companies; enforcing compliance with insurance laws and regulations; and investigating and prosecuting insurance fraud.

What support does CDI provide in the aftermath of natural disasters?

+

CDI provides critical support to policyholders after natural disasters by educating consumers about their rights and the claims process, offering resources and guidance to navigate insurance coverage and the claims process, investigating and addressing insurance-related issues post-disaster, and advocating for fair and prompt settlements for policyholders’ losses.