Business Workers Comp Insurance

Business workers' compensation insurance is a crucial aspect of safeguarding both employers and employees in the event of workplace accidents or injuries. It provides a vital safety net, ensuring that injured workers receive the necessary medical care and financial support while also protecting employers from potential liability claims. This insurance policy is a legal requirement in many jurisdictions and serves as a cornerstone of workplace safety and risk management.

Understanding the Importance of Workers’ Compensation Insurance

Workers’ compensation insurance, often referred to as workman’s comp or work comp, is a specialized form of insurance that is designed to provide coverage for employees who suffer work-related injuries or illnesses. It offers a comprehensive system that ensures prompt medical treatment, rehabilitation, and, if needed, compensation for lost wages. This insurance policy not only benefits the injured employee but also plays a significant role in maintaining a healthy and productive workforce for businesses.

For employers, workers' compensation insurance is a legal obligation that demonstrates their commitment to employee welfare and workplace safety. It helps to foster a positive work environment and can boost employee morale, knowing that their well-being is a top priority for the company. Moreover, this insurance coverage can significantly reduce the financial burden on employers in the event of a workplace accident, as it covers the costs associated with medical expenses, rehabilitation, and disability benefits.

Key Components of Workers’ Compensation Insurance

Workers’ compensation insurance typically includes several critical components, each designed to address a specific aspect of workplace injuries or illnesses.

- Medical Benefits: This component covers the cost of medical treatment for work-related injuries or illnesses. It includes doctor visits, hospital stays, surgical procedures, prescription medications, and other necessary medical services.

- Lost Wage Compensation: Workers' compensation provides benefits to replace a portion of an employee's wages if they are unable to work due to a work-related injury or illness. The specific amount and duration of these benefits vary depending on the jurisdiction and the severity of the injury.

- Rehabilitation and Retraining: In cases where an injury results in permanent disability, workers' compensation insurance can provide funds for rehabilitation services and vocational retraining to help the employee return to work in a different capacity.

- Death Benefits: If a workplace accident results in the death of an employee, workers' compensation insurance typically provides benefits to the employee's dependents or survivors, including funeral expenses and ongoing financial support.

Each of these components plays a vital role in ensuring that employees receive the necessary care and support following a workplace incident, while also providing employers with a structured framework to manage these situations effectively.

The Role of Business Workers’ Compensation Insurance

Business workers’ compensation insurance is specifically tailored to meet the unique needs of businesses and their employees. It provides comprehensive coverage for a wide range of workplace injuries and illnesses, offering protection to both the employer and the workforce.

Protecting Employers

For business owners, workers’ compensation insurance is an essential risk management tool. It shields employers from potential lawsuits and personal liability claims that could arise from workplace accidents or injuries. By having this insurance in place, employers can focus on running their businesses without the constant worry of financial ruin due to unforeseen workplace incidents.

Additionally, workers' compensation insurance can help businesses maintain their operations in the event of a workplace injury. It ensures that injured employees receive the necessary medical care and financial support, allowing them to recover and potentially return to work. This continuity of operations is vital for the long-term success and stability of any business.

Benefits for Employees

Workers’ compensation insurance provides employees with a sense of security and peace of mind, knowing that their well-being is a priority for their employer. In the unfortunate event of a workplace injury or illness, employees can access the medical treatment and financial support they need without worrying about the associated costs.

This insurance coverage also ensures that employees receive fair and standardized benefits, regardless of the nature of their employment or the size of their employer. It promotes equality in the workplace and ensures that all employees are treated equitably when it comes to their rights and entitlements following a work-related incident.

| Coverage Type | Description |

|---|---|

| Medical Treatment | Covers the cost of doctor visits, hospital stays, medications, and other medical services related to work injuries. |

| Lost Wage Compensation | Provides partial wage replacement for employees who cannot work due to a work-related injury or illness. |

| Rehabilitation and Retraining | Offers financial support for rehabilitation services and vocational training to help injured employees return to work. |

| Death Benefits | Provides financial support to the dependents or survivors of an employee who dies due to a work-related incident. |

The Process of Obtaining Workers’ Compensation Insurance

Obtaining workers’ compensation insurance is a straightforward process, but it requires careful consideration and compliance with legal requirements. Here’s a step-by-step guide to help businesses navigate the process.

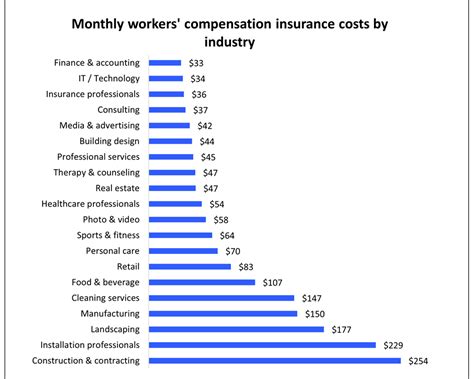

Assessing Business Needs

Before purchasing workers’ compensation insurance, it’s essential to assess the specific needs of your business. Consider factors such as the size of your workforce, the nature of your industry, and the potential risks associated with your business operations. This assessment will help you determine the level of coverage required and any additional endorsements or riders that may be necessary.

Researching Insurance Providers

Once you have a clear understanding of your business’s needs, it’s time to research insurance providers. Look for reputable companies that specialize in workers’ compensation insurance and have a strong track record of providing comprehensive coverage and excellent customer service. Compare quotes and policy terms to find the best fit for your business.

Applying for Coverage

To apply for workers’ compensation insurance, you’ll need to provide detailed information about your business, including the number of employees, the nature of your work, and any past claims or incidents. Be sure to provide accurate and complete information to ensure that your policy accurately reflects your business’s needs and potential risks.

Understanding Policy Terms

Before finalizing your workers’ compensation insurance policy, carefully review the terms and conditions. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your business’s needs and that you fully understand your rights and responsibilities as the policyholder.

Regular Policy Review and Updates

Workers’ compensation insurance policies should be reviewed periodically to ensure they remain adequate and up-to-date. As your business grows or changes, your insurance needs may evolve as well. Regular policy reviews can help you identify areas where additional coverage is required or where you may be able to make adjustments to better suit your business’s current circumstances.

Workers’ Compensation Insurance: Frequently Asked Questions

What happens if an employee sustains a workplace injury, and the business doesn’t have workers’ compensation insurance?

+In the absence of workers’ compensation insurance, injured employees may file a lawsuit against the employer to recover damages. This can lead to significant financial liabilities for the business and may result in legal penalties for non-compliance with insurance requirements.

Can employees choose to opt out of workers’ compensation insurance coverage?

+No, employees do not have the option to opt out of workers’ compensation insurance coverage. This insurance is designed to protect both the employer and the employee, and it is a legal requirement in most jurisdictions. Employees are entitled to the benefits provided by workers’ compensation insurance in the event of a work-related injury or illness.

How does workers’ compensation insurance affect an employer’s liability in the event of a workplace accident?

+Workers’ compensation insurance significantly reduces an employer’s liability in the event of a workplace accident. It provides a predetermined system of benefits for injured workers, eliminating the need for employees to file personal injury lawsuits against their employers. This insurance coverage protects employers from potential financial ruin and legal consequences that could arise from workplace incidents.