Business Insurance Commercial

Business insurance is an essential aspect of running a successful and resilient commercial enterprise. It serves as a protective shield, safeguarding businesses against various risks and potential losses. From small startups to established corporations, commercial insurance plays a pivotal role in ensuring the financial stability and longevity of organizations across diverse industries. In this comprehensive article, we delve into the world of business insurance, exploring its significance, key coverage types, the process of obtaining policies, and the impact it has on the commercial landscape.

The Significance of Business Insurance

In the dynamic and often unpredictable business environment, unforeseen events can arise, posing significant threats to the financial health and operational continuity of enterprises. Business insurance acts as a vital risk management tool, offering a safety net that mitigates the financial consequences of these unexpected occurrences. By providing coverage for a wide range of perils, from property damage and liability claims to business interruption and cyber threats, insurance policies empower businesses to navigate challenges with confidence and resilience.

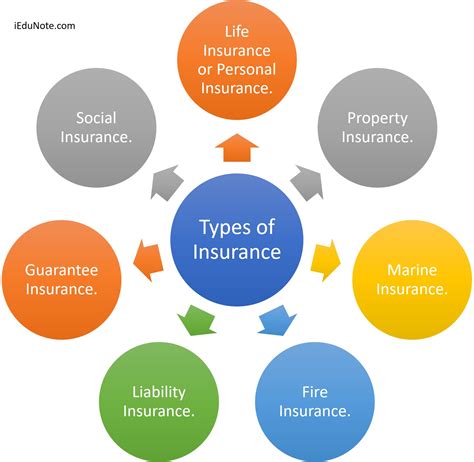

Key Coverage Types in Commercial Insurance

The realm of business insurance is multifaceted, encompassing a multitude of coverage types tailored to address the diverse needs of different industries and business operations. Here, we shed light on some of the most prevalent and critical coverage options:

Property Insurance

Property insurance stands as a cornerstone of commercial protection, safeguarding businesses against losses arising from damage to or loss of physical assets. This comprehensive coverage extends to a wide array of perils, including fire, theft, natural disasters, and vandalism. By providing financial reimbursement for repairs or replacements, property insurance ensures that businesses can swiftly recover and resume operations following unforeseen incidents.

Within the realm of property insurance, there exists a spectrum of specialized coverages catering to the unique needs of specific industries. For instance, businesses engaged in manufacturing or warehousing may opt for business owners' policies (BOPs), which bundle property and liability coverage into a single, cost-effective package. Alternatively, businesses operating in high-risk environments, such as those in the construction industry, may require builders' risk insurance to protect against losses during construction projects.

Liability Insurance

Liability insurance serves as a critical safeguard for businesses, shielding them from financial repercussions arising from legal claims and lawsuits. This coverage is particularly crucial in today’s litigious society, where even unfounded accusations can result in substantial financial burdens. By providing protection against a multitude of liability risks, including product defects, slip-and-fall accidents, and professional negligence, liability insurance offers businesses peace of mind and the ability to focus on their core operations.

The landscape of liability insurance is diverse, with various coverage types tailored to address the unique risks faced by different industries. For instance, businesses involved in the healthcare sector may opt for medical malpractice insurance, while those in the professional services realm may require errors and omissions (E&O) insurance to protect against claims arising from professional errors or omissions.

Business Interruption Insurance

Business interruption insurance is a vital component of a comprehensive commercial insurance portfolio, offering protection against the financial losses incurred when a business is forced to suspend or curtail its operations due to unforeseen events. These events can range from natural disasters, such as hurricanes or wildfires, to man-made disruptions, including civil unrest or cyber attacks. By providing financial support during these challenging times, business interruption insurance ensures that businesses can maintain their financial stability and weather the storm until normal operations can be resumed.

The coverage provided by business interruption insurance is often tailored to the specific needs and risks faced by individual businesses. For instance, a manufacturing facility located in a hurricane-prone region may require a policy that provides coverage for extended periods of business interruption, taking into account the time needed to rebuild or repair physical assets. Conversely, a technology startup may prioritize coverage for losses arising from cyber attacks, given the increasing prevalence of such incidents in today's digital landscape.

Cyber Insurance

In the digital age, where businesses rely heavily on technology and online systems, the risks of cyber attacks and data breaches have become increasingly prevalent. Cyber insurance has emerged as a critical coverage type, providing protection against the financial fallout of these modern-day threats. From data loss and system downtime to legal fees and regulatory fines, cyber insurance offers a comprehensive solution to mitigate the potential damage caused by cyber incidents.

As the cyber threat landscape evolves, so too does the range of cyber insurance coverage options. For instance, businesses may opt for cyber liability insurance, which provides protection against first-party losses, such as data breaches and system failures. Alternatively, cyber crime insurance may be more suited to businesses seeking coverage for third-party losses, including business interruption and legal defense costs arising from cyber attacks.

Workers’ Compensation Insurance

Workers’ compensation insurance is a statutory requirement in many jurisdictions, designed to provide financial support to employees who suffer work-related injuries or illnesses. This coverage ensures that injured workers receive medical treatment and compensation for lost wages, while also protecting businesses from potential lawsuits and liability claims. By fostering a safe and supportive work environment, workers’ compensation insurance contributes to a positive employee experience and enhances overall operational efficiency.

The specifics of workers' compensation insurance vary across jurisdictions, with different states and countries having their own unique regulations and coverage requirements. As such, businesses operating in multiple locations may need to tailor their workers' compensation insurance policies to comply with local laws and regulations. Additionally, certain high-risk industries, such as construction or manufacturing, may require additional coverage to address the heightened risks associated with their operations.

The Process of Obtaining Business Insurance

Securing the right business insurance coverage involves a comprehensive and strategic approach. Here, we outline the key steps involved in the process:

Assessing Risks and Needs

The first step in obtaining business insurance is conducting a thorough assessment of the unique risks and needs of the enterprise. This involves identifying potential hazards, evaluating the likelihood and severity of various incidents, and determining the financial impact that these events could have on the business. By gaining a clear understanding of the specific risks faced, businesses can tailor their insurance coverage to address these vulnerabilities effectively.

Researching Insurance Providers

Once the risks and needs have been identified, the next step is to research and evaluate potential insurance providers. This process involves scrutinizing the reputation, financial stability, and coverage offerings of various insurers to identify those that best align with the specific requirements of the business. By carefully evaluating multiple providers, businesses can ensure that they secure the most suitable and cost-effective coverage options available.

Obtaining Quotes and Proposals

After shortlisting potential insurance providers, the next step is to request quotes and proposals from these companies. This process typically involves providing detailed information about the business, including its operations, financial health, and risk management strategies. Based on this information, insurance providers will assess the risks and offer tailored coverage options, along with corresponding premium quotes.

It is crucial for businesses to carefully review and compare the quotes and proposals received from different providers. This involves scrutinizing the coverage limits, deductibles, exclusions, and other policy terms to ensure that the selected coverage adequately addresses the identified risks. By taking the time to thoroughly evaluate the options, businesses can make informed decisions and secure the most comprehensive and cost-effective insurance coverage available.

Negotiating and Finalizing the Policy

Once a suitable insurance provider and coverage option have been identified, the final step is to negotiate and finalize the policy terms. This process may involve discussing and clarifying any uncertainties or concerns regarding the policy, as well as negotiating more favorable terms or coverage limits where possible. By engaging in open and transparent communication with the insurer, businesses can ensure that the final policy meets their specific needs and expectations.

The Impact of Business Insurance on Commercial Enterprises

Business insurance has a profound impact on the commercial landscape, influencing the success and resilience of enterprises in numerous ways. Here, we explore some of the key benefits and outcomes associated with robust commercial insurance coverage:

Financial Protection and Stability

Perhaps the most significant impact of business insurance is its ability to provide financial protection and stability to commercial enterprises. By offering coverage for a wide range of risks, insurance policies shield businesses from potentially devastating financial losses. This financial security enables businesses to maintain their operations, honor financial commitments, and weather unforeseen challenges without compromising their long-term viability.

Risk Management and Mitigation

Business insurance plays a pivotal role in risk management and mitigation, empowering enterprises to proactively identify and address potential hazards. Through the implementation of risk management strategies and the utilization of insurance coverage, businesses can effectively minimize the likelihood and impact of adverse events. By adopting a proactive approach to risk management, businesses can enhance their overall resilience and adaptability in the face of uncertainty.

Peace of Mind and Focus on Core Operations

The presence of comprehensive business insurance coverage provides business owners and stakeholders with a sense of peace of mind, knowing that their financial interests are protected. This assurance allows businesses to focus their attention and resources on their core operations, strategic initiatives, and growth opportunities without the constant distraction and worry associated with potential risks. By alleviating these concerns, business insurance fosters a more productive and innovative work environment.

Enhanced Reputation and Credibility

Robust business insurance coverage can contribute to the enhancement of a company’s reputation and credibility in the eyes of various stakeholders, including customers, partners, and investors. By demonstrating a commitment to risk management and financial responsibility, businesses can instill confidence and trust in their stakeholders, fostering stronger relationships and long-term success. The presence of adequate insurance coverage also serves as a testament to the professionalism and reliability of the enterprise.

Compliance and Regulatory Requirements

In many industries and jurisdictions, specific insurance requirements are mandated by law or regulatory bodies. By obtaining and maintaining the necessary insurance coverage, businesses can ensure compliance with these regulations and avoid potential legal and financial repercussions. Compliance with insurance requirements not only protects the business but also demonstrates a commitment to ethical and responsible business practices.

Future Implications and Trends in Business Insurance

The landscape of business insurance is dynamic and ever-evolving, influenced by a multitude of factors, including technological advancements, changing regulatory environments, and evolving risk profiles. Here, we explore some of the key trends and future implications that are shaping the world of commercial insurance:

Digital Transformation and Automation

The digital transformation of the insurance industry is gaining momentum, with technology playing an increasingly pivotal role in streamlining processes and enhancing efficiency. From automated underwriting and policy administration to digital claims management and customer service, technology is revolutionizing the way insurance is delivered and experienced. As businesses embrace digital solutions, they can expect faster and more convenient insurance processes, along with enhanced transparency and control over their coverage.

Rising Cyber Risks and Specialized Coverage

As businesses become increasingly reliant on technology and digital systems, the risks associated with cyber attacks and data breaches are on the rise. In response, insurance providers are developing specialized cyber insurance coverage options to address these emerging threats. From ransomware attacks and phishing scams to data privacy breaches, cyber insurance is evolving to provide comprehensive protection against the full spectrum of cyber risks. As businesses continue to prioritize cybersecurity, the demand for specialized cyber insurance coverage is expected to grow exponentially.

Sustainable and Ethical Business Practices

In today’s environmentally and socially conscious business landscape, there is a growing emphasis on sustainable and ethical practices. As a result, insurance providers are increasingly offering coverage options that align with these values, such as environmental liability insurance and sustainability-focused business interruption coverage. By incentivizing and supporting sustainable practices, insurance providers are playing a pivotal role in driving positive change and fostering a more responsible business environment.

The Rise of Telematics and Usage-Based Insurance

Telematics, the integration of telecommunications and informatics, is gaining traction in the insurance industry, particularly in the realm of commercial auto insurance. By leveraging telematics technology, insurers can collect real-time data on driving behavior, such as speed, acceleration, and braking patterns. This data-driven approach enables insurers to offer usage-based insurance policies, where premiums are determined based on actual driving habits rather than traditional risk factors. As telematics continues to advance, businesses can expect more personalized and accurate insurance coverage that reflects their unique driving profiles.

Collaborative Risk Management and Shared Economies

The rise of shared economies and collaborative business models is prompting a shift towards more collaborative risk management approaches. In this context, insurance providers are exploring innovative solutions, such as parametric insurance and risk-sharing arrangements, to address the unique risks associated with these emerging business models. By leveraging the power of collective risk management, businesses can access more affordable and tailored insurance coverage, fostering greater collaboration and resilience in the face of shared challenges.

Conclusion

Business insurance stands as a cornerstone of commercial success and resilience, empowering enterprises to navigate the complexities and uncertainties of the business landscape with confidence and adaptability. By providing financial protection, mitigating risks, and fostering a culture of proactive risk management, insurance coverage plays a pivotal role in the long-term viability and growth of businesses across diverse industries. As the insurance industry continues to evolve and innovate, businesses can expect access to more tailored, efficient, and sustainable insurance solutions, further enhancing their ability to thrive and succeed in an ever-changing commercial environment.

How much does business insurance cost for small businesses?

+The cost of business insurance for small businesses can vary significantly based on factors such as industry, location, coverage limits, and the specific risks faced by the business. On average, small businesses can expect to pay anywhere from a few hundred to several thousand dollars annually for basic liability and property coverage. However, the cost can increase substantially for businesses operating in high-risk industries or those with specialized coverage needs.

What is the process for filing a business insurance claim?

+Filing a business insurance claim typically involves the following steps: notifying the insurance provider of the incident, providing detailed documentation of the loss or damage, completing and submitting the necessary claim forms, and working with the insurer to assess the extent of the loss and determine the appropriate compensation. The specific process may vary depending on the type of insurance and the insurer’s policies.

Are there any tax benefits associated with business insurance premiums?

+Yes, business insurance premiums can often be deducted as a business expense for tax purposes. This means that businesses can reduce their taxable income by the amount of premiums paid, resulting in potential tax savings. However, it is important to consult with a tax professional or accountant to understand the specific tax implications and eligibility criteria for deducting insurance premiums.