Bop Insurance Cost

Bop Insurance, or Business Owner's Policy, is a type of commercial insurance specifically designed to meet the needs of small and medium-sized businesses. It combines multiple coverage types into a single policy, offering comprehensive protection at a competitive price. The cost of Bop Insurance can vary significantly depending on various factors, including the nature of the business, its size, location, and the specific coverage options chosen. In this article, we will delve into the factors influencing the price of Bop Insurance, explore average costs, and provide insights to help business owners make informed decisions when seeking the right coverage for their enterprises.

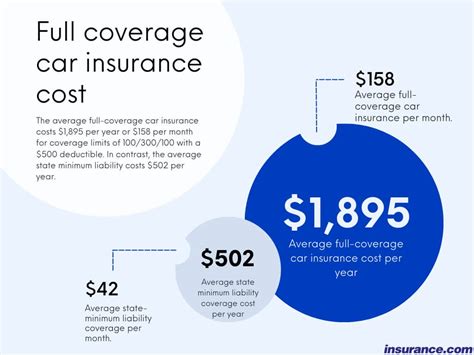

For small businesses with annual revenue below 500,000, the average cost of Bop Insurance typically ranges from 500 to 1,500 annually. However, this can vary based on factors like business type, location, and coverage needs.">What is the average cost of Bop Insurance for a small business with annual revenue below 500,000? +

Understanding the Factors that Affect Bop Insurance Cost

Several key factors contribute to the variability in Bop Insurance costs. By understanding these factors, business owners can better anticipate and manage their insurance expenses. Here’s a detailed breakdown of these influential elements:

Business Type and Size

The nature of your business plays a crucial role in determining the cost of Bop Insurance. Different industries face unique risks, and insurance providers assess these risks differently. For instance, a retail store might have different coverage needs compared to a manufacturing business due to the distinct hazards associated with each industry. Additionally, the size of your business, measured by revenue or number of employees, is a significant factor. Larger businesses typically require more extensive coverage and may face higher insurance costs.

Location and Operational Risks

The geographic location of your business is another critical factor. Insurance providers consider the region’s susceptibility to natural disasters, crime rates, and other environmental factors that could pose risks to your operations. Businesses located in areas prone to hurricanes, floods, or high crime rates may face higher insurance premiums. Moreover, the specific operations of your business, such as the use of heavy machinery or the storage of hazardous materials, can also impact insurance costs.

Coverage Options and Limits

The coverage options and limits you choose for your Bop Insurance policy have a direct influence on the cost. Different businesses may require varying levels of coverage based on their specific needs. For example, a business with valuable inventory might opt for higher limits on property coverage, while a service-based business might prioritize professional liability coverage. The more comprehensive the coverage, the higher the premium is likely to be.

Claims History and Risk Management

Insurance providers assess the claims history of a business when determining insurance costs. A business with a history of frequent or costly claims may be considered a higher risk and face higher premiums. Conversely, a business with an excellent claims record and effective risk management practices may qualify for discounts or lower rates. Demonstrating a commitment to minimizing risks through safety measures and regular maintenance can positively impact insurance costs.

Deductibles and Policy Terms

The deductibles you choose for your Bop Insurance policy can also affect the overall cost. Opting for higher deductibles typically results in lower premiums, as the business assumes more financial responsibility in the event of a claim. Additionally, the term length of the policy can influence costs. Longer policy terms may offer some cost savings, as they provide stability and continuity for the business and insurer.

Average Costs of Bop Insurance: A Comprehensive Overview

Understanding the average costs of Bop Insurance can provide valuable context for business owners seeking to budget for their insurance needs. While exact costs can vary widely based on the factors mentioned earlier, here’s a general overview of average Bop Insurance costs across different business types and sizes:

| Business Type | Average Annual Premium |

|---|---|

| Small Retail Stores | $500 - $1,500 |

| Professional Services (e.g., Law Firms, Accounting) | $800 - $2,000 |

| Restaurants and Bars | $1,000 - $3,000 |

| Manufacturing Businesses | $2,000 - $5,000 |

| Construction Companies | $3,000 - $8,000 |

It's important to note that these averages are just a general guide and may not reflect the precise costs for every business. The unique characteristics of each business and the specific coverage needs can significantly impact the final insurance cost.

Optimizing Your Bop Insurance Costs: Strategies and Considerations

While the cost of Bop Insurance can be influenced by various factors, there are strategies business owners can employ to optimize their insurance costs and ensure they are getting the best value for their investment. Here are some key considerations and strategies to keep in mind:

Conduct a Comprehensive Risk Assessment

Start by conducting a thorough risk assessment of your business. Identify the potential hazards and risks your business faces, including property damage, liability issues, and business interruption risks. Understanding these risks will help you determine the appropriate coverage levels and tailor your Bop Insurance policy accordingly.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. Different insurers may offer varying rates and coverage options, so it’s essential to explore your options to find the best fit for your business. Consider using an insurance broker or agent who can help you navigate the market and secure the most competitive rates.

Bundle Policies for Potential Discounts

Many insurance providers offer discounts when you bundle multiple policies together. If you have other insurance needs, such as personal auto or homeowners’ insurance, consider bundling these policies with your Bop Insurance. By consolidating your insurance needs with a single provider, you may be eligible for significant savings.

Implement Risk Mitigation Measures

Taking proactive steps to mitigate risks can not only reduce the likelihood of claims but also lower your insurance costs. Implement safety measures, maintain your equipment and premises, and consider investing in security systems to deter theft or vandalism. By demonstrating a commitment to risk management, you may qualify for lower premiums.

Review and Adjust Coverage Regularly

Your business’s needs and risks may change over time. Regularly review your Bop Insurance policy to ensure it aligns with your current needs. As your business grows or undergoes changes, you may need to adjust your coverage limits or add new endorsements to maintain adequate protection. Stay vigilant and adapt your insurance coverage as your business evolves.

The Future of Bop Insurance: Trends and Implications

The landscape of Bop Insurance is continually evolving, influenced by technological advancements, changing regulatory environments, and shifting business dynamics. Staying informed about these trends can help business owners make strategic decisions regarding their insurance coverage. Here are some key trends and their potential implications for the future of Bop Insurance:

Digital Transformation and Insurtech

The insurance industry is experiencing a digital transformation, with Insurtech companies leveraging technology to streamline processes and enhance customer experiences. This trend is likely to continue, with increased automation, data analytics, and online platforms making insurance more accessible and efficient. For business owners, this means quicker quotes, more transparent pricing, and potentially lower costs as insurers optimize their operations.

Changing Regulatory Landscape

Regulatory changes can significantly impact the insurance industry and the costs associated with Bop Insurance. For example, changes in environmental regulations or workplace safety standards may require businesses to implement new practices, which could influence insurance premiums. Staying informed about relevant regulatory developments and ensuring compliance can help businesses mitigate potential risks and avoid costly penalties.

Increased Focus on Cyber Security

With the rise of digital technologies and remote work, cyber threats have become a significant concern for businesses. Insurance providers are increasingly offering cyber liability coverage as a standalone policy or as an endorsement to Bop Insurance. As cyber attacks become more sophisticated, the demand for comprehensive cyber security coverage is likely to grow. Business owners should assess their cyber risks and ensure they have adequate protection to mitigate potential losses.

Shift Towards Risk-Based Pricing

Insurance providers are increasingly adopting risk-based pricing models, where premiums are determined based on an individual business’s unique risks and claims history. This shift towards personalized pricing can result in more accurate and fair pricing for businesses. However, it also means that businesses with a history of frequent or severe claims may face higher premiums. Focusing on risk management and maintaining a positive claims history can help businesses secure more favorable rates under these models.

Conclusion: Empowering Business Owners with Knowledge

Understanding the factors that influence the cost of Bop Insurance is crucial for business owners seeking to protect their enterprises effectively. By assessing their unique risks, shopping around for the best rates, and implementing strategic cost-saving measures, business owners can optimize their insurance costs while maintaining comprehensive coverage. Staying informed about industry trends and being proactive in risk management further empowers business owners to make informed decisions and secure the best value for their insurance investments.

What is the average cost of Bop Insurance for a small business with annual revenue below 500,000?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>For small businesses with annual revenue below 500,000, the average cost of Bop Insurance typically ranges from 500 to 1,500 annually. However, this can vary based on factors like business type, location, and coverage needs.

How can I reduce my Bop Insurance costs without compromising coverage?

+To reduce Bop Insurance costs without sacrificing coverage, consider increasing your deductibles, bundling policies, and implementing risk mitigation measures. Regularly reviewing and adjusting your coverage to match your evolving business needs can also help optimize costs.

Are there any discounts available for Bop Insurance policies?

+Yes, insurance providers often offer discounts for Bop Insurance policies. Common discounts include multi-policy discounts (when you bundle multiple policies), loyalty discounts for long-term customers, and risk mitigation discounts for businesses that implement safety measures.

How often should I review my Bop Insurance policy?

+It’s recommended to review your Bop Insurance policy annually, or whenever your business undergoes significant changes. This ensures that your coverage remains aligned with your current needs and that you’re not paying for unnecessary coverage.

Can I customize my Bop Insurance policy to meet my specific business needs?

+Absolutely! Bop Insurance policies are designed to be customizable, allowing business owners to choose the coverage types and limits that best fit their unique needs. By working with an insurance broker or agent, you can tailor a policy that provides comprehensive protection for your specific business.