Biggest Insurance Companies In The World

The global insurance industry is a behemoth, playing a crucial role in safeguarding individuals, businesses, and economies worldwide. With a market size estimated to be in the trillions of dollars, it's an industry that touches nearly every aspect of our lives, offering protection and peace of mind. In this article, we delve into the world of insurance, exploring the biggest players, their strategies, and the impact they have on the global stage.

Dominating the Insurance Landscape: A Global Perspective

When discussing the biggest insurance companies in the world, it’s important to consider the diverse nature of the industry. From general insurance to life assurance, health coverage, and reinsurance, the sector is vast and varied. Here, we delve into the rankings, strategies, and impact of these insurance giants.

The Top 5 Insurance Companies Worldwide

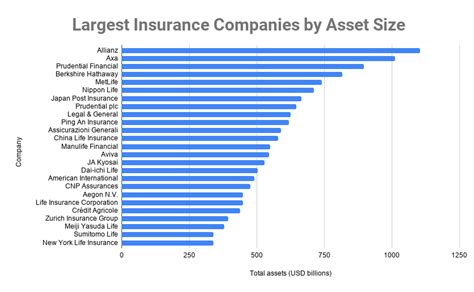

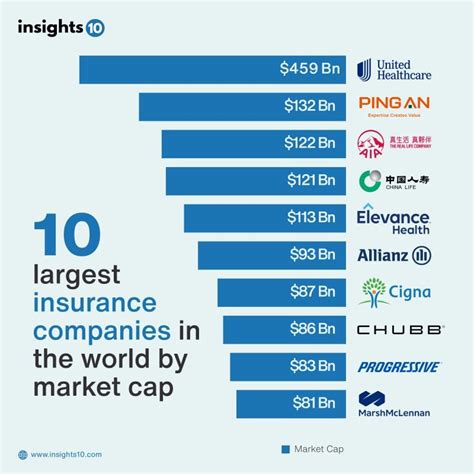

The top 5 insurance companies worldwide, based on their total assets, are a mix of global giants with a presence in multiple sectors and regional powerhouses with a strong market share in their respective countries.

- AXA Group: Headquartered in Paris, France, AXA is a global leader in insurance and asset management. With a presence in over 60 countries, AXA offers a wide range of insurance products, including life, health, and property & casualty insurance. The group's total assets exceed $1.4 trillion, making it a true powerhouse in the industry.

- Ping An Insurance: Based in Shenzhen, China, Ping An is one of the largest financial services groups in the world. It offers a diverse range of products and services, including insurance, banking, and asset management. With a focus on innovation and digital transformation, Ping An has total assets of over $1.3 trillion, making it a key player in the global insurance market.

- China Life Insurance Company: As the name suggests, this company is a leading provider of life insurance and financial services in China. With a strong focus on the domestic market, China Life has expanded its reach internationally as well. Its total assets are valued at over $800 billion, making it one of the largest insurance companies globally.

- Allianz SE: Headquartered in Munich, Germany, Allianz is a global leader in insurance and asset management. With a presence in over 70 countries, the group offers a wide range of insurance products, including property & casualty, life & health, and corporate insurance. Allianz's total assets exceed $700 billion, solidifying its position as one of the world's largest insurance companies.

- Prudential plc: Based in London, United Kingdom, Prudential is a leading international financial services group. With a focus on life insurance and asset management, the group has a strong presence in Asia, Africa, and the United States. Prudential's total assets are valued at over $700 billion, making it a key player in the global insurance market.

These top 5 insurance companies, with their vast resources and global reach, play a crucial role in shaping the industry's landscape. They offer a wide range of products and services, catering to the diverse needs of individuals and businesses around the world.

The Regional Powerhouses: A Focus on Geographic Diversity

While the top 5 insurance companies are truly global giants, there are also regional powerhouses that dominate specific markets. These companies have a strong market share and brand presence in their respective regions, contributing significantly to the global insurance industry.

| Company | Region | Total Assets |

|---|---|---|

| Berkshire Hathaway | North America | $741.8 billion |

| MetLife | North America | $556.2 billion |

| Munich Re | Europe | $394.4 billion |

| Zurich Insurance Group | Europe | $389.6 billion |

| Sun Life Financial | North America | $382.4 billion |

These regional powerhouses demonstrate the diversity and strength of the global insurance industry. While they may not have the same global reach as the top 5, their impact on their respective markets is undeniable.

The Impact and Reach of Insurance Giants

The biggest insurance companies in the world have an immense impact on both the financial and societal landscape. Their influence extends far beyond providing insurance policies, as they play a crucial role in stabilizing economies, fostering innovation, and shaping public policy.

Stabilizing Economies: A Safety Net for the Financial Sector

Insurance companies act as a critical buffer for economies, especially during times of financial crisis. Their vast resources and global reach allow them to provide stability and liquidity to the financial markets. During economic downturns, these companies can inject much-needed capital into the system, helping to prevent systemic failures and support economic recovery.

For instance, during the 2008 financial crisis, many insurance companies stepped in to provide liquidity and stability to the markets. Their actions helped prevent a complete collapse of the financial system, demonstrating their crucial role in economic stability.

Fostering Innovation: Driving Technological Advances

The insurance industry is not immune to the disruptive forces of technology. In fact, many of the biggest insurance companies are at the forefront of innovation, leveraging technology to enhance their products and services. From artificial intelligence and machine learning to blockchain and the Internet of Things (IoT), these companies are driving technological advancements that benefit both their operations and their customers.

For example, many insurance companies are now using AI and machine learning to improve risk assessment and fraud detection. This not only helps them provide more accurate quotes and premiums but also enhances their overall operational efficiency.

Shaping Public Policy: A Voice in Regulatory Affairs

Given their size and global presence, the biggest insurance companies often have a significant influence on public policy and regulatory affairs. They work closely with governments and regulatory bodies to shape the insurance landscape, ensuring that regulations are fair, effective, and aligned with industry needs.

These companies also play a crucial role in advocating for insurance literacy and consumer protection. By working with governments and educational institutions, they help promote financial literacy and ensure that consumers have the knowledge and tools to make informed insurance decisions.

The Future of Insurance: Trends and Predictions

As we look ahead, the insurance industry is poised for significant transformation. Driven by technological advancements, changing consumer preferences, and a dynamic global economy, the future of insurance is exciting and full of potential.

Technological Disruption: The Rise of InsurTech

The emergence of InsurTech, or insurance technology, is one of the most significant trends shaping the future of the industry. InsurTech startups and innovative solutions are disrupting traditional insurance models, offering more efficient, customer-centric products and services. From digital-first insurance platforms to the use of advanced analytics and AI, InsurTech is revolutionizing the way insurance is sold, managed, and experienced.

One notable example is the rise of parametric insurance, which uses data-driven models and smart contracts to provide faster, more efficient payouts. This innovative approach is particularly beneficial in the wake of natural disasters, where traditional insurance processes can be slow and cumbersome.

The Growing Importance of ESG and Sustainability

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in the insurance industry. With growing awareness and concern about climate change and social responsibility, insurance companies are being held to higher standards. They are expected to not only manage risk but also contribute to sustainable development and social progress.

Many insurance companies are now incorporating ESG factors into their investment strategies and business operations. This shift towards sustainability is not only beneficial for the environment and society but also presents new opportunities for insurance products and services.

The Digital Revolution: Embracing a Customer-Centric Approach

The digital revolution is transforming the way insurance companies interact with their customers. With the rise of digital platforms and online services, insurance companies are shifting towards a more customer-centric approach. This means offering convenient, personalized products and services, and providing a seamless digital experience.

For instance, many insurance companies are now offering digital-first policies, allowing customers to purchase and manage their insurance online. This not only enhances customer convenience but also reduces operational costs for insurance providers.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are transforming the way auto insurance is priced and sold. With the use of telematics devices and advanced analytics, insurance companies can now offer policies that are tailored to individual driving behaviors and habits. This not only provides a more accurate and fair pricing model but also encourages safer driving practices.

Usage-based insurance is particularly beneficial for younger drivers and those who drive infrequently. By offering pay-as-you-drive or pay-how-you-drive policies, insurance companies can attract a wider range of customers and provide more affordable coverage.

Conclusion: Navigating the Complex World of Insurance

The insurance industry is a complex and ever-evolving landscape, with a diverse range of players and a multitude of products and services. From the biggest global giants to regional powerhouses, these companies play a crucial role in safeguarding individuals, businesses, and economies worldwide.

As we've explored, the biggest insurance companies have an immense impact on the financial and societal landscape. They act as stabilizers during economic crises, foster innovation through technological advancements, and shape public policy through their influence and advocacy. Looking ahead, the future of insurance is full of potential, with technological disruption, ESG considerations, and a digital revolution driving significant change.

For businesses and individuals alike, understanding the insurance landscape is crucial. It allows for informed decisions, strategic partnerships, and a deeper appreciation of the vital role insurance plays in our lives and the global economy.

How do insurance companies determine premiums and coverage amounts?

+

Insurance companies use a variety of factors to determine premiums and coverage amounts. These factors can include the type of insurance (e.g., life, health, property), the individual’s risk profile (e.g., health status, driving record), and the coverage options selected (e.g., deductible, policy limits). Additionally, external factors such as market trends, competition, and regulatory requirements can also influence premiums and coverage.

What are the key challenges facing the insurance industry today?

+

The insurance industry faces several key challenges, including increasing competition from new entrants and disruptive technologies, changing consumer preferences and expectations, and the need to adapt to a rapidly evolving regulatory landscape. Additionally, managing risk in an uncertain economic and geopolitical environment is a constant challenge for insurance companies.

How do insurance companies manage risk and ensure financial stability?

+

Insurance companies employ a range of risk management strategies to ensure financial stability. These strategies can include diversification of insurance products and geographic markets, rigorous underwriting practices, and the use of reinsurance to transfer risk. Additionally, many insurance companies invest in high-quality, liquid assets to provide a stable source of funding.