Best Supplemental Dental Insurance

Dental health is an essential aspect of overall well-being, and while most health insurance plans cover basic dental services, many individuals seek additional protection through supplemental dental insurance plans. These plans offer extra benefits and coverage, ensuring comprehensive dental care without breaking the bank. In this article, we delve into the world of supplemental dental insurance, exploring the best options available to individuals and families seeking optimal dental coverage.

Understanding Supplemental Dental Insurance

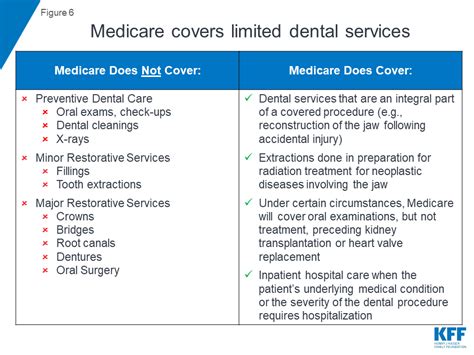

Supplemental dental insurance, also known as dental add-on or supplementary dental plans, provides an extra layer of coverage beyond what a standard dental insurance policy offers. These plans are designed to fill gaps in coverage, offering more comprehensive benefits for a wide range of dental procedures, including preventative care, restorative treatments, and even cosmetic dentistry.

One of the primary advantages of supplemental dental insurance is its flexibility. Unlike traditional dental insurance, which often has specific networks and limitations, supplemental plans can be customized to fit individual needs and preferences. This flexibility allows policyholders to choose their own dentists, ensuring they receive care from trusted professionals.

The Benefits of Supplemental Dental Insurance

Supplemental dental insurance plans offer a myriad of benefits that go beyond the basic coverage provided by standard dental policies. Here are some key advantages that make these plans a popular choice among individuals and families:

Enhanced Coverage for Comprehensive Care

Supplemental dental insurance plans typically provide more extensive coverage for a wider range of dental procedures. This includes not only routine check-ups and cleanings but also more complex treatments such as root canals, dental implants, and orthodontic work. By offering higher coverage limits and lower out-of-pocket expenses, these plans ensure that individuals can access the dental care they need without facing financial strain.

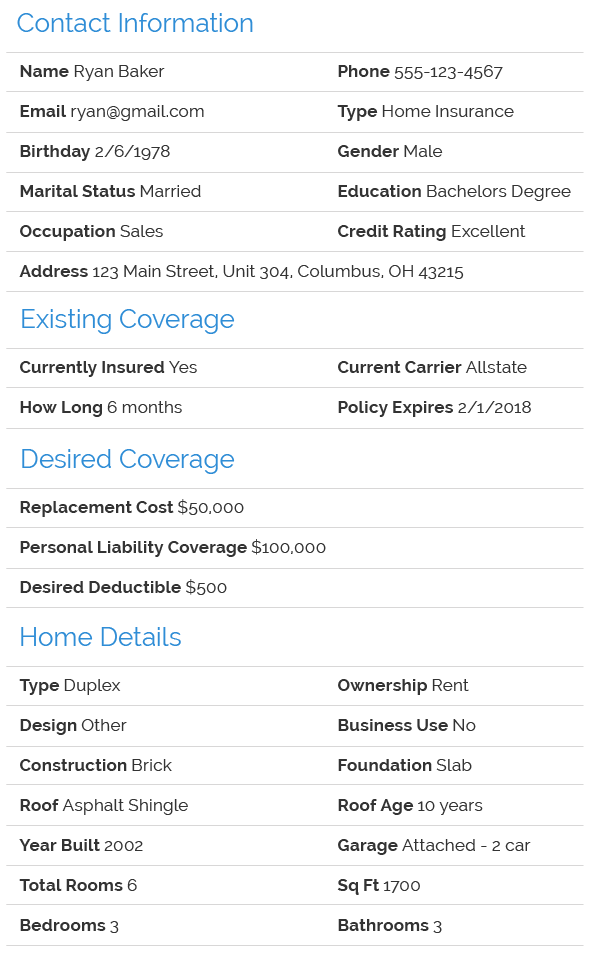

| Procedure | Standard Coverage | Supplemental Coverage |

|---|---|---|

| Routine Check-ups | Covered annually | Covered twice annually |

| Dental Cleanings | Once a year | Twice a year, with deeper cleaning options |

| Root Canals | Limited coverage | Full coverage with higher reimbursement rates |

| Dental Implants | Often excluded | Partial or full coverage, depending on the plan |

| Orthodontic Treatments | Minimal coverage | Significant discounts or full coverage for braces and Invisalign |

This enhanced coverage ensures that individuals can maintain optimal oral health, address any dental issues promptly, and prevent more significant health problems down the line.

Lower Out-of-Pocket Costs

One of the most appealing aspects of supplemental dental insurance is the reduced financial burden it places on policyholders. With higher coverage limits and lower copayments or deductibles, individuals can access the dental care they need without worrying about exorbitant costs. Many supplemental plans offer 100% coverage for preventative care, such as dental exams and X-rays, further minimizing out-of-pocket expenses.

Customizable Plans to Fit Individual Needs

Supplemental dental insurance plans are highly customizable, allowing individuals to tailor their coverage to their specific needs. Whether you require extensive orthodontic work, have a history of complex dental issues, or simply want peace of mind for unexpected emergencies, there’s a supplemental plan to suit your circumstances. This flexibility ensures that individuals can prioritize the dental services they value most, maximizing their benefits.

Access to a Broader Network of Dentists

Supplemental dental insurance often comes with an extensive network of participating dentists, giving policyholders the freedom to choose their preferred dental professionals. This is particularly beneficial for individuals who have established relationships with specific dentists or who require specialized care. By expanding the network beyond what traditional dental insurance offers, supplemental plans provide greater convenience and peace of mind.

Top Supplemental Dental Insurance Providers

When it comes to choosing the best supplemental dental insurance provider, several reputable companies stand out. Here are some of the top-rated options, along with a brief overview of their offerings:

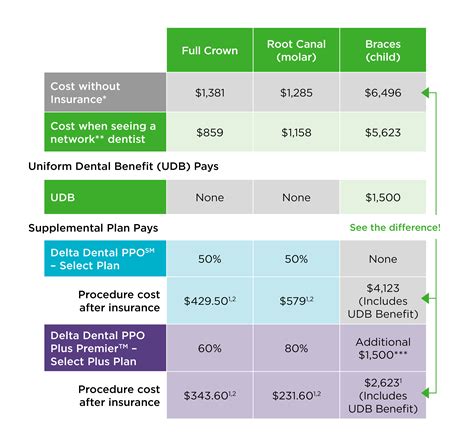

Delta Dental

Delta Dental is one of the largest and most trusted dental insurance providers in the United States. Their supplemental plans, known as Delta Dental PPO plans, offer a wide range of benefits, including coverage for orthodontic treatments, dental implants, and cosmetic procedures. With a vast network of participating dentists, Delta Dental ensures convenient access to quality care.

Cigna Dental

Cigna Dental provides a comprehensive suite of dental insurance plans, including their popular supplemental plans. These plans offer enhanced coverage for various dental procedures, with options for individuals, families, and employer groups. Cigna’s supplemental plans are known for their flexibility, allowing policyholders to choose their dentists and customize their coverage levels.

Aetna Dental

Aetna Dental offers a range of supplemental dental insurance plans, designed to complement their standard dental coverage. Their plans provide additional benefits for procedures such as root canals, crowns, and bridges. With a focus on preventive care, Aetna’s supplemental plans offer incentives for regular dental check-ups and cleanings, promoting optimal oral health.

MetLife Dental

MetLife Dental is another leading provider of supplemental dental insurance. Their plans offer comprehensive coverage for a wide array of dental services, including orthodontic treatments, dental implants, and periodontal care. MetLife’s supplemental plans are known for their affordability and the extensive network of dentists they provide access to.

Key Considerations When Choosing a Supplemental Plan

When selecting the best supplemental dental insurance plan for your needs, it’s essential to consider several key factors. These considerations will help ensure that you choose a plan that aligns with your dental health goals and financial circumstances.

Evaluate Your Dental Needs

The first step in choosing a supplemental plan is to assess your current and future dental needs. Consider any ongoing dental issues, such as gum disease or tooth sensitivity, as well as any planned procedures, like braces or implants. Understanding your specific requirements will help you select a plan that provides adequate coverage.

Review Coverage Limits and Exclusions

Carefully examine the coverage limits and exclusions of each plan you’re considering. Pay attention to the maximum annual benefits, any waiting periods for specific procedures, and any restrictions on pre-existing conditions. Ensure that the plan covers the procedures you anticipate needing, and consider the potential costs if these procedures are not fully covered.

Compare Premiums and Out-of-Pocket Costs

Premiums and out-of-pocket costs are crucial factors to consider when choosing a supplemental dental plan. Evaluate the monthly premiums, deductibles, copayments, and any additional fees associated with each plan. Strike a balance between affordable premiums and minimal out-of-pocket expenses to ensure that your supplemental insurance remains cost-effective.

Assess Network Flexibility

The flexibility of the provider’s network is an important consideration. If you have a preferred dentist or specialist, ensure that they are in-network with the supplemental plan you’re considering. Some plans offer broader networks, giving you more freedom to choose your dental care providers.

Making the Most of Your Supplemental Dental Insurance

Once you’ve selected the best supplemental dental insurance plan for your needs, it’s essential to maximize the benefits it offers. Here are some tips to make the most of your coverage:

- Schedule regular dental check-ups and cleanings to maintain optimal oral health and catch any potential issues early on.

- Take advantage of any incentives or discounts offered by your plan for preventive care.

- If you have any planned procedures, consult with your dentist and insurance provider to understand the coverage and any necessary pre-authorization processes.

- Keep detailed records of your dental visits and expenses, as these may be required for reimbursement or to track your annual benefits usage.

- Stay informed about any changes to your plan's coverage or network providers to ensure continuity of care.

Frequently Asked Questions

Can I use my supplemental dental insurance with any dentist, or are there network restrictions?

+Supplemental dental insurance plans often come with a network of participating dentists. While you may have more flexibility compared to traditional dental insurance, it’s essential to check if your preferred dentist is in-network. Some plans offer broader networks, providing greater freedom of choice.

What happens if I need a dental procedure that’s not covered by my supplemental plan?

+If a procedure is not covered by your supplemental plan, you may have to pay for it out of pocket. However, it’s worth checking with your provider to see if there are any alternative treatments or options that are covered. Additionally, some plans offer flexibility to add optional riders for specific procedures.

Are there any age restrictions for supplemental dental insurance plans?

+Most supplemental dental insurance plans do not have age restrictions, making them suitable for individuals of all ages. However, it’s always a good idea to review the plan’s eligibility criteria and any potential age-related limitations or premium adjustments.

Can I combine supplemental dental insurance with my employer’s dental plan?

+Yes, you can often combine supplemental dental insurance with your employer-provided dental plan. This allows you to enhance your coverage and benefit from the advantages of both plans. However, it’s crucial to review the terms of both policies to ensure there are no conflicts or duplicate benefits.

How do I know if a supplemental dental insurance plan is right for me?

+Supplemental dental insurance is an excellent option if you value flexibility, enhanced coverage, and access to a broader network of dentists. It’s ideal for individuals who want to prioritize their dental health and have specific dental needs or preferences. Consider your current and future dental requirements, and review the benefits and limitations of different plans to make an informed decision.