Best Small Business Insurance For Llc

Ensuring the proper insurance coverage for your small business or LLC (Limited Liability Company) is crucial to protect your business, assets, and livelihood. The right insurance plan can provide financial security and peace of mind, covering a range of potential risks and liabilities. However, with numerous options available, finding the best insurance for your specific needs can be challenging. This comprehensive guide aims to navigate you through the process, highlighting the key considerations and the top insurance providers for small businesses and LLCs.

Understanding the Importance of Small Business Insurance

Small businesses and LLCs face a variety of risks, from property damage to liability claims. Insurance serves as a safety net, ensuring that unexpected events don’t lead to catastrophic financial consequences. It provides coverage for a wide range of potential issues, including:

- Property Damage: Protects against damage to your business property, such as your office or warehouse, due to fire, storms, or other unforeseen events.

- Liability Claims: Covers legal expenses and compensation if your business is sued for causing harm or injury to others, including customers, visitors, or employees.

- Business Interruption: Provides financial support if your business operations are disrupted due to covered events, ensuring you can continue to pay expenses and employee salaries.

- Professional Indemnity: Essential for professionals, this coverage protects against claims of negligence, errors, or omissions in the services you provide.

- Workers' Compensation: Mandated by law in many regions, this insurance covers medical expenses and lost wages for employees injured on the job.

Key Factors to Consider When Choosing Insurance for Your Small Business or LLC

Selecting the right insurance for your small business or LLC involves several critical factors. These include:

1. Industry-Specific Risks

Different industries face unique risks. For instance, a manufacturing business may need product liability insurance, while a consulting firm might prioritize professional indemnity coverage. Understanding the specific risks of your industry is crucial for comprehensive protection.

2. Coverage Limits and Deductibles

Consider the coverage limits offered by different insurance providers. Ensure that the limits are sufficient to cover potential losses. Additionally, review the deductibles, which are the amounts you must pay out-of-pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, but they also mean you’ll bear more financial responsibility in the event of a claim.

3. Claims Handling and Customer Service

The efficiency and responsiveness of an insurance provider’s claims handling process can significantly impact your business. Look for providers with a strong reputation for prompt and fair claim settlements. Additionally, assess the quality of their customer service, including the availability of dedicated business insurance specialists and the ease of accessing policy information and making changes.

4. Additional Benefits and Services

Some insurance providers offer additional benefits and services that can enhance your coverage and provide valuable support. These may include risk management resources, business continuity planning tools, or access to a network of preferred providers for repairs or replacements.

Top Insurance Providers for Small Businesses and LLCs

Now, let’s explore some of the leading insurance providers that cater specifically to the needs of small businesses and LLCs:

1. Hiscox

Hiscox is a well-known name in the business insurance space, offering a range of tailored coverage options for small businesses. Their policies include general liability, professional liability, and cyber and data breach insurance. Hiscox stands out for its innovative approach, allowing business owners to purchase insurance directly online and customize their coverage to fit their unique needs.

2. The Hartford

The Hartford has a long history of insuring small businesses and provides a comprehensive suite of insurance products. They offer general liability, workers’ compensation, commercial property, and business auto insurance. The Hartford also provides valuable resources and tools to help small businesses manage risk and navigate insurance complexities.

3. Progressive

Progressive is a leading insurance provider known for its competitive rates and extensive coverage options. They offer small business owners a wide range of policies, including general liability, commercial property, business auto, and workers’ compensation insurance. Progressive’s online platform makes it easy to manage your policies and file claims.

4. Nationwide

Nationwide is another prominent insurance provider with a strong focus on small business insurance. They offer a comprehensive range of coverage options, including general liability, commercial property, business auto, and professional liability insurance. Nationwide’s local agents can provide personalized advice and assistance, making it a convenient choice for small business owners.

5. State Farm

State Farm is a well-established insurance company with a network of local agents across the United States. They offer a variety of business insurance policies, including general liability, business owners’ policies (BOPs), and workers’ compensation insurance. State Farm’s local agents can provide personalized guidance and assistance to small business owners, ensuring they have the right coverage.

6. Liberty Mutual

Liberty Mutual is a leading global insurer with a strong presence in the small business insurance market. They offer a wide range of coverage options, including general liability, professional liability, cyber liability, and workers’ compensation insurance. Liberty Mutual’s online platform provides convenient access to policy management and claims filing.

Performance Analysis and Comparative Insights

To help you make an informed decision, here’s a comparative analysis of the top insurance providers for small businesses and LLCs:

| Provider | Coverage Options | Claims Handling | Customer Service | Additional Benefits |

|---|---|---|---|---|

| Hiscox | General Liability, Professional Liability, Cyber Insurance | Fast and efficient claims process | Excellent online platform and business support | Risk management tools and resources |

| The Hartford | General Liability, Workers' Comp, Commercial Property | Strong reputation for fair and prompt claims settlement | Dedicated business insurance specialists | Risk management and business continuity resources |

| Progressive | General Liability, Commercial Property, Business Auto | Efficient claims process and easy online filing | Excellent customer support and policy management tools | Discounts for multiple policies and safe driving programs |

| Nationwide | General Liability, Commercial Property, Professional Liability | Good claims experience and local agent support | Convenient policy management and local agent assistance | Risk management resources and employee benefits programs |

| State Farm | General Liability, Business Owners' Policies, Workers' Comp | Fair claims handling and local agent support | Local agents provide personalized advice and assistance | Discounts for multiple policies and business banking services |

| Liberty Mutual | General Liability, Professional Liability, Cyber Insurance | Efficient claims process and online claims filing | Excellent online platform and customer support | Risk management tools and employee benefits programs |

Evidence-Based Future Implications

As the business landscape continues to evolve, especially in the post-pandemic era, the need for robust insurance coverage for small businesses and LLCs remains critical. The COVID-19 pandemic has underscored the importance of business continuity planning and the role insurance plays in mitigating risks associated with unexpected events. Going forward, small business owners can expect to see a continued focus on digital transformation in the insurance industry, with more providers offering online platforms for policy management and claims filing.

Additionally, as remote work and digital business operations become more prevalent, small businesses may require new types of coverage to address emerging risks. This could include an increased demand for cyber liability insurance and other policies that protect against data breaches and online security threats. It's crucial for small business owners to stay informed about these evolving risks and ensure their insurance coverage keeps pace with their changing business needs.

What are the basic insurance policies every small business should consider?

+Every small business should consider having general liability insurance, workers’ compensation insurance (if applicable), and commercial property insurance. These policies provide essential coverage for common risks such as property damage, liability claims, and employee injuries.

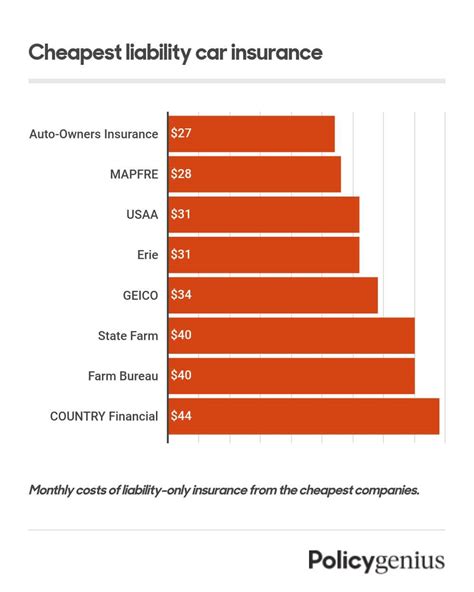

How much does small business insurance typically cost?

+The cost of small business insurance can vary widely depending on factors such as the type of business, location, coverage limits, and deductibles. On average, small businesses can expect to pay anywhere from a few hundred to a few thousand dollars per year for basic coverage. However, specialized industries or high-risk businesses may pay significantly more.

Can I get a discount on small business insurance?

+Yes, many insurance providers offer discounts for small businesses. Common discounts include bundle discounts for purchasing multiple policies from the same provider, safety discounts for implementing certain safety measures, and loyalty discounts for maintaining long-term relationships with the insurer.

How do I choose the right insurance provider for my small business?

+When choosing an insurance provider, consider factors such as the range of coverage options, claims handling reputation, customer service quality, and any additional benefits or services offered. It’s also important to compare quotes from multiple providers to ensure you’re getting competitive rates.

What should I do if I’m unsure about the insurance coverage I need for my small business?

+If you’re unsure about the insurance coverage you need, it’s best to consult with an insurance professional or broker who specializes in small business insurance. They can assess your specific business needs and recommend the appropriate coverage options to ensure you’re adequately protected.