Best Priced Car Insurance

When it comes to car insurance, finding the best-priced policy that offers adequate coverage can be a challenging task. With numerous insurance providers in the market, it's essential to compare rates and understand the factors that influence premium costs. This comprehensive guide aims to provide an in-depth analysis of the best-priced car insurance options, offering valuable insights to help you make an informed decision.

Understanding the Factors Affecting Car Insurance Premiums

Several key factors play a significant role in determining the price of your car insurance policy. By familiarizing yourself with these factors, you can better navigate the insurance market and identify the most cost-effective options.

Driver Profile and History

Your personal driving record and history are among the primary considerations for insurance providers. Factors such as your age, gender, driving experience, and claims history significantly impact your premium rates. Younger drivers, especially males under the age of 25, often face higher premiums due to their perceived higher risk on the road. Additionally, a clean driving record with no accidents or traffic violations can result in more favorable insurance rates.

| Driver Profile | Premium Impact |

|---|---|

| Age: 22 | Higher premiums due to limited experience |

| Gender: Male | Generally higher rates compared to females |

| Driving Experience: 5 years | More favorable rates with increasing experience |

| Clean Driving Record | Lower premiums due to reduced risk |

Insurance providers also consider your credit score when determining your premium. A higher credit score often translates to lower insurance rates, as individuals with better credit are statistically less likely to file claims. However, this practice, known as credit-based insurance scoring, is not permitted in all states, so it's essential to check your state's regulations.

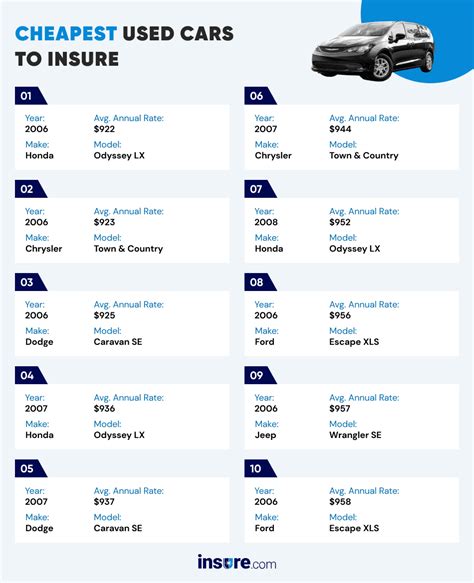

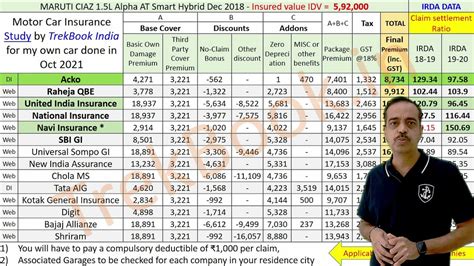

Vehicle Type and Usage

The type of vehicle you drive and its intended usage are other crucial factors in car insurance pricing. Generally, newer and more expensive vehicles carry higher insurance costs due to their replacement and repair expenses. Additionally, vehicles with powerful engines and those prone to theft or accidents may attract higher premiums. On the other hand, older, less valuable cars, or those with advanced safety features, can lead to more affordable insurance rates.

| Vehicle Characteristics | Premium Impact |

|---|---|

| Vehicle Age: 3 years | Lower premiums compared to newer models |

| Vehicle Value: $25,000 | Affordable rates due to moderate value |

| Advanced Safety Features: Lane Departure Warning | Potential for lower premiums |

The purpose and frequency of your vehicle's usage also influence insurance costs. Insurance providers consider factors such as daily commuting distances, annual mileage, and whether the vehicle is used for personal or business purposes. Generally, higher mileage and business-related usage can result in increased premiums.

Location and Coverage Requirements

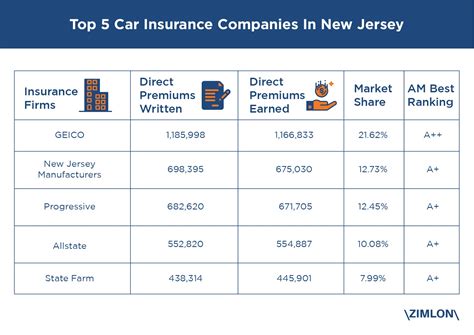

Your geographic location plays a significant role in determining car insurance premiums. Insurance rates can vary widely between states, counties, and even zip codes due to differences in accident rates, theft frequency, and local laws. Additionally, the coverage limits and types of insurance you require, such as liability, collision, and comprehensive coverage, directly impact your overall premium.

Identifying the Best-Priced Car Insurance Providers

Now that we’ve explored the key factors influencing car insurance premiums, let’s delve into the best-priced car insurance providers in the market. By comparing rates and coverage options, you can make an informed decision to secure the most cost-effective insurance plan for your needs.

State Farm: Competitive Rates and Personalized Service

State Farm is a leading insurance provider known for its competitive rates and exceptional customer service. With a vast network of local agents, State Farm offers personalized guidance to help you find the right coverage at the best price. They provide a range of car insurance options, including liability, collision, and comprehensive coverage, as well as additional endorsements to customize your policy.

State Farm's rates are particularly attractive for young drivers and those with a clean driving record. They offer discounts for multiple vehicles, safe driving, and accident-free years, which can significantly reduce your premium. Additionally, State Farm provides excellent customer support, with 24/7 claims service and a dedicated agent to assist you throughout the claims process.

| State Farm Highlights | Key Features |

|---|---|

| Competitive Rates | Attractive discounts for safe drivers and multiple vehicles |

| Personalized Service | Dedicated local agents for guidance and support |

| Comprehensive Coverage | Flexible options for liability, collision, and comprehensive coverage |

| Excellent Customer Support | 24/7 claims service and assistance from a dedicated agent |

Geico: Affordable Rates and Digital Convenience

Geico is renowned for its affordable car insurance rates and convenient digital services. With a strong focus on online and mobile interactions, Geico offers a seamless experience for policyholders, allowing them to manage their insurance needs efficiently. Their online platform provides easy access to policy details, billing information, and claims tracking.

Geico's rates are particularly appealing for good drivers and those seeking comprehensive coverage at a reasonable price. They offer a range of discounts, including multi-policy, good driver, and emergency deployment discounts. Additionally, Geico's mobile app allows for quick claims reporting and provides valuable resources for policyholders, such as accident checklists and repair shop recommendations.

| Geico Highlights | Key Features |

|---|---|

| Affordable Rates | Competitive pricing for good drivers and comprehensive coverage |

| Digital Convenience | Seamless online and mobile interactions for policy management |

| Comprehensive Discounts | Multi-policy, good driver, and emergency deployment discounts |

| Mobile App Features | Quick claims reporting and valuable resources for policyholders |

Progressive: Customizable Coverage and Innovative Options

Progressive is a well-established insurance provider known for its customizable coverage options and innovative products. They offer a wide range of car insurance policies, including standard liability, collision, and comprehensive coverage, as well as unique offerings like gap insurance and rental car coverage.

Progressive's rates are competitive, and they provide various discounts to help policyholders save. These include multi-policy, snapshot (usage-based), and continuous insurance discounts. Progressive also offers a unique Name Your Price tool, allowing customers to set their desired premium and explore coverage options to meet their budget. Additionally, Progressive's Snapshot program utilizes telematics to monitor driving behavior, potentially leading to further premium savings for safe drivers.

| Progressive Highlights | Key Features |

|---|---|

| Customizable Coverage | Wide range of standard and innovative coverage options |

| Competitive Rates | Attractive pricing with various discounts |

| Name Your Price Tool | Customized coverage based on your desired premium |

| Snapshot Program | Telematics-based monitoring for potential premium savings |

Esurance: Digital-First Approach and Convenience

Esurance is a digital-first insurance provider offering a convenient and streamlined experience for policyholders. With a strong focus on online interactions, Esurance provides an efficient and user-friendly platform for managing insurance needs. Their website and mobile app allow for easy policy management, billing, and claims reporting.

Esurance's rates are competitive, and they offer a range of coverage options, including liability, collision, and comprehensive coverage. They provide various discounts, such as multi-policy, good student, and safe driver discounts. Esurance also offers a unique DriveSense program, which utilizes telematics to monitor driving behavior, potentially leading to premium savings for safe drivers.

| Esurance Highlights | Key Features |

|---|---|

| Digital-First Approach | Efficient and user-friendly online platform for policy management |

| Competitive Rates | Attractive pricing with various discounts |

| Comprehensive Coverage | Liability, collision, and comprehensive options available |

| DriveSense Program | Telematics-based monitoring for potential premium savings |

Comparing Coverage and Additional Benefits

When choosing the best-priced car insurance, it’s crucial to compare not only the premium costs but also the coverage and additional benefits offered by each provider. While affordability is essential, ensuring you have adequate coverage to protect yourself and your vehicle is equally vital.

Liability Coverage

Liability coverage is a fundamental component of car insurance, as it protects you from financial responsibility in the event of an accident you cause. This coverage pays for damages to the other party’s vehicle, medical expenses, and legal fees. It’s essential to have adequate liability coverage to protect your assets and financial stability.

| Provider | Liability Coverage |

|---|---|

| State Farm | Offers various liability limits, with a standard option of $50,000/$100,000/$50,000 |

| Geico | Provides customizable liability limits, with a standard option of $25,000/$50,000/$25,000 |

| Progressive | Offers flexible liability coverage, with a standard option of $100,000/$300,000/$100,000 |

| Esurance | Provides customizable liability limits, with a standard option of $50,000/$100,000/$25,000 |

Collision and Comprehensive Coverage

Collision and comprehensive coverage provide protection for your vehicle in various situations. Collision coverage covers damages to your vehicle in an accident, while comprehensive coverage protects against non-collision incidents such as theft, vandalism, and natural disasters. These coverages are essential for maintaining the value and integrity of your vehicle.

| Provider | Collision and Comprehensive Coverage |

|---|---|

| State Farm | Offers customizable collision and comprehensive coverage, with optional deductibles |

| Geico | Provides collision and comprehensive coverage with flexible deductibles |

| Progressive | Offers customizable collision and comprehensive coverage, with optional deductibles |

| Esurance | Provides collision and comprehensive coverage with flexible deductibles |

Additional Benefits and Discounts

In addition to standard coverage, car insurance providers offer a range of additional benefits and discounts to enhance the value of their policies. These can include rental car coverage, gap insurance, accident forgiveness, and various discounts for safe driving, good grades, and multi-policy bundling.

| Provider | Additional Benefits and Discounts |

|---|---|

| State Farm | Rental car coverage, gap insurance, accident forgiveness, safe driver, and multiple vehicle discounts |

| Geico | Rental car coverage, accident forgiveness, emergency deployment, and good student discounts |

| Progressive | Gap insurance, accident forgiveness, multi-policy, and snapshot (usage-based) discounts |

| Esurance | DriveSense program, safe driver, and multi-policy discounts |

Tips for Finding the Best-Priced Car Insurance

Finding the best-priced car insurance involves a combination of research, comparison, and negotiation. Here are some expert tips to help you secure the most cost-effective insurance policy for your needs:

- Shop Around: Compare rates from multiple insurance providers to find the best deal. Online comparison tools and insurance broker services can simplify this process.

- Understand Your Coverage Needs: Assess your specific coverage requirements based on your vehicle, driving habits, and financial situation. This will help you tailor your policy and avoid unnecessary expenses.

- Explore Discounts: Insurance providers offer various discounts, so be sure to inquire about all available options. Common discounts include safe driver, good student, multi-policy, and loyalty rewards.

- Consider Usage-Based Insurance: Usage-based insurance programs, like Progressive's Snapshot and Esurance's DriveSense, can monitor your driving behavior and potentially reduce your premium for safe driving.

- Negotiate and Bundle: Don't hesitate to negotiate with insurance providers to get the best rate. Bundling your car insurance with other policies, such as home or renters insurance, can often result in significant savings.

Conclusion

Finding the best-priced car insurance requires a thoughtful approach, considering factors such as your driver profile, vehicle type, location, and coverage needs. By comparing rates and coverage options from reputable providers like State Farm, Geico, Progressive, and Esurance, you can make an informed decision to secure the most cost-effective insurance plan. Remember to explore additional benefits and discounts, and don’t be afraid to negotiate for the best rate.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies widely depending on factors such as location, driver profile, and coverage limits. As of 2023, the national average for full coverage car insurance is approximately 1,674 per year, while the average for minimum liability coverage is around 573 per year.

How can I lower my car insurance premiums?

+To lower your car insurance premiums, you can consider increasing your deductible, maintaining a clean driving record, exploring usage-based insurance programs, and taking advantage of available discounts. Additionally, bundling your car insurance with other policies can often result in significant savings.

Are there any states with particularly affordable car insurance rates?

+Yes, certain states have more affordable car insurance rates compared to the national average. For example, Maine, Idaho, and Vermont are known for their relatively low car insurance costs. However, it’s important to note that rates can vary significantly within a state based on local factors.