Best Life Insurance Whole Life

Securing the financial well-being of your loved ones is a paramount concern for many individuals, and whole life insurance emerges as a comprehensive solution to this crucial task. In the vast landscape of insurance options, whole life insurance stands out for its enduring nature and comprehensive coverage. This article delves into the intricacies of whole life insurance, exploring its benefits, key features, and how it compares to other insurance types, empowering you to make informed decisions about your financial future.

Understanding Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a policy that provides lifelong coverage, ensuring financial protection for your beneficiaries regardless of when you pass away. This type of insurance is distinct from term life insurance, which offers coverage for a specified period, typically 10, 20, or 30 years. Whole life insurance combines both a death benefit and a cash value component, making it a versatile and long-term financial tool.

Key Features of Whole Life Insurance

Whole life insurance policies offer a range of features that set them apart from other insurance types:

- Guaranteed Death Benefit: The primary function of whole life insurance is to provide a guaranteed death benefit to your beneficiaries. This benefit remains constant throughout the policy's duration, ensuring your loved ones receive a predetermined sum upon your passing.

- Cash Value Accumulation: One of the unique aspects of whole life insurance is the cash value accumulation feature. A portion of your premium payments is allocated to building cash value within the policy. This cash value grows over time, offering a savings component to your insurance plan. It can be accessed through policy loans or withdrawals, providing flexibility for various financial needs.

- Fixed Premiums: Whole life insurance policies typically come with fixed premiums, meaning you pay the same amount each month or year throughout the policy's lifetime. This predictability in premium payments allows for better financial planning and budgeting.

- Policy Loans and Withdrawals: The cash value within your whole life insurance policy can be utilized in various ways. You can take out a policy loan, using the cash value as collateral, or make withdrawals directly from the policy. These options provide liquidity and can be advantageous in times of financial need or for specific goals like funding a child's education.

- Tax Advantages: The cash value component of whole life insurance offers tax advantages. Growth within the policy is tax-deferred, and withdrawals or loans may be tax-free up to the amount of premiums paid. This makes whole life insurance an attractive option for tax-efficient savings and wealth accumulation.

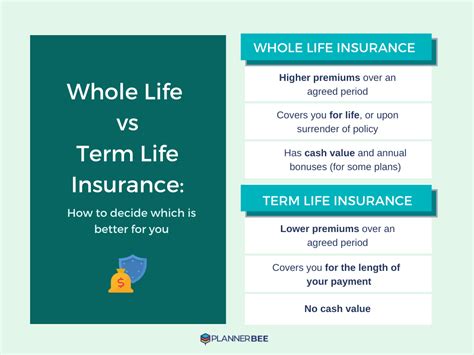

Whole Life Insurance vs. Term Life Insurance

When considering life insurance options, it's essential to understand the differences between whole life and term life insurance. Term life insurance provides coverage for a specified period, typically at a lower cost than whole life insurance. It is suitable for individuals seeking temporary coverage, such as during their working years when financial obligations are higher. On the other hand, whole life insurance offers lifelong coverage and the added benefit of cash value accumulation.

Here's a comparison table outlining the key differences between whole life and term life insurance:

| Feature | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Period | Lifetime coverage | Specified term (e.g., 10, 20, or 30 years) |

| Death Benefit | Guaranteed and fixed | Guaranteed and fixed during the term |

| Premiums | Fixed throughout the policy | Fixed during the term, but may increase upon renewal |

| Cash Value | Accumulates over time | None |

| Flexibility | Offers loans and withdrawals | No cash value or flexibility |

Benefits of Whole Life Insurance

Whole life insurance offers a multitude of benefits that make it an attractive choice for individuals seeking long-term financial protection and stability:

Long-Term Financial Security

The primary advantage of whole life insurance is its ability to provide lifelong financial security. With a guaranteed death benefit, your beneficiaries are ensured a stable financial future, regardless of when you pass away. This security is especially valuable for individuals with long-term financial obligations, such as providing for a spouse or funding a child's education.

Cash Value Accumulation

The cash value component of whole life insurance is a unique feature that sets it apart from other insurance types. Over time, the cash value within your policy grows, offering a savings vehicle with tax advantages. This accumulated cash value can be used for various financial goals, such as funding retirement, paying for a child's education, or supplementing income during retirement.

Fixed Premiums

Whole life insurance policies come with the benefit of fixed premiums. Unlike term life insurance, where premiums can increase upon renewal, whole life insurance premiums remain constant throughout the policy's lifetime. This predictability in premium payments allows for better financial planning and budgeting, ensuring you can maintain your coverage without unexpected cost increases.

Policy Loans and Withdrawals

The flexibility offered by whole life insurance policies is a significant advantage. You have the option to take out policy loans or make withdrawals from the cash value, providing liquidity for various financial needs. Whether it's funding a home renovation, starting a business, or covering unexpected expenses, the cash value within your policy can be a valuable resource.

Tax Advantages

Whole life insurance offers tax advantages that can enhance its overall value. The cash value within the policy grows tax-deferred, meaning you don't pay taxes on the earnings until you withdraw or use the funds. Additionally, withdrawals or loans up to the amount of premiums paid may be tax-free, making whole life insurance an efficient tool for tax-efficient savings and wealth accumulation.

Choosing the Right Whole Life Insurance Policy

When selecting a whole life insurance policy, it's essential to consider various factors to ensure you choose the right option for your needs:

Coverage Amount

Determining the appropriate coverage amount is crucial. Consider your financial obligations, such as mortgage payments, outstanding debts, and future expenses like college tuition. Ensure the death benefit of your whole life insurance policy is sufficient to cover these expenses and provide a comfortable financial cushion for your beneficiaries.

Premium Payments

Whole life insurance policies come with fixed premiums, but these can vary based on factors like your age, health, and the insurance company. Assess your financial situation and choose a premium amount that aligns with your budget. Remember, the earlier you purchase whole life insurance, the lower the initial premiums tend to be.

Cash Value Accumulation Goals

Whole life insurance offers the opportunity to build cash value over time. Consider your financial goals and determine how you plan to utilize this cash value. Whether it's funding a specific goal, such as a child's education, or using it as a long-term savings vehicle, understanding your objectives will help you choose a policy with the right features and benefits.

Rider Options

Many whole life insurance policies offer additional rider options, which are add-ons that can enhance your coverage. Common riders include accelerated death benefit riders, which provide access to the death benefit if you're diagnosed with a terminal illness, and waiver of premium riders, which waive premium payments if you become disabled.

Performance and Reliability

When choosing a whole life insurance policy, it's crucial to consider the performance and reliability of the insurance company. Look for reputable insurers with a strong financial standing and a track record of paying claims promptly. Research customer reviews and ratings to gain insights into the insurer's reputation and customer satisfaction.

Additionally, consider the insurer's financial strength ratings from reputable rating agencies like Standard & Poor's, Moody's, and A.M. Best. These ratings provide an indication of the insurer's ability to meet its financial obligations, ensuring your policy's longevity and stability.

Whole Life Insurance as an Investment

Whole life insurance can be viewed as both a financial protection tool and an investment vehicle. The cash value accumulation within the policy offers a long-term savings opportunity with tax advantages. Over time, the cash value can grow substantially, providing a valuable asset for your financial portfolio. However, it's important to note that whole life insurance should not be the sole investment strategy, as it may not offer the highest returns compared to other investment options.

Considerations for Using Whole Life Insurance as an Investment

- Long-Term Commitment: Whole life insurance is a long-term commitment, typically spanning several decades. It's important to assess your financial situation and ensure you can maintain premium payments over the policy's lifetime.

- Liquidity: While whole life insurance offers policy loans and withdrawals, it's essential to understand the implications. Policy loans accrue interest and reduce the policy's death benefit, while withdrawals reduce the policy's cash value and may have tax consequences.

- Investment Alternatives: Whole life insurance may not offer the highest investment returns compared to other options like stocks, bonds, or mutual funds. Consider diversifying your investment portfolio to maximize returns and minimize risk.

- Fees and Expenses: Whole life insurance policies come with various fees and expenses, such as administration fees, mortality charges, and sales commissions. These expenses can impact the overall return on your investment, so it's crucial to understand and assess these costs.

Real-World Examples of Whole Life Insurance

Let’s explore some real-world examples of how whole life insurance has benefited individuals and families:

Financial Security for a Family

John, a 35-year-old married man with two young children, purchases a whole life insurance policy with a $500,000 death benefit. He chooses this policy to ensure his family’s financial security in the event of his untimely passing. With the policy’s cash value accumulation, John plans to use it to fund his children’s education and provide a stable financial foundation for his wife.

Retirement Funding

Sarah, a 45-year-old professional, purchases a whole life insurance policy with a focus on cash value accumulation. She aims to use the policy’s cash value to supplement her retirement income, ensuring a comfortable retirement without relying solely on her pension or social security benefits.

Business Succession Planning

Robert, a successful entrepreneur, purchases whole life insurance policies for himself and his business partners. The policies provide a death benefit to ensure the business’s continuity in the event of a partner’s passing. Additionally, the cash value within the policies can be used to fund business expansion or provide liquidity for the business’s future needs.

Future Implications and Trends

Whole life insurance remains a relevant and valuable financial tool, especially in an evolving economic landscape. As individuals and families face changing financial obligations and goals, whole life insurance provides a stable and flexible solution. Here are some future implications and trends to consider:

Increasing Financial Complexity

With rising costs of living, educational expenses, and healthcare, the need for comprehensive financial protection is more critical than ever. Whole life insurance offers a reliable solution to ensure financial security for individuals and families, especially as they navigate complex financial landscapes.

Longevity and Retirement Planning

As life expectancies increase, the importance of retirement planning becomes even more pronounced. Whole life insurance can play a crucial role in funding retirement, providing a steady stream of income, and ensuring financial stability throughout one’s golden years.

Flexibility and Customization

Whole life insurance policies are becoming increasingly customizable, allowing individuals to tailor their coverage and cash value accumulation goals to their specific needs. This flexibility ensures that whole life insurance remains a relevant and attractive option for a wide range of financial situations.

Digitalization and Convenience

The insurance industry is embracing digitalization, making it more convenient for individuals to research, purchase, and manage their whole life insurance policies online. This trend enhances accessibility and provides individuals with the tools to make informed decisions about their financial protection.

Conclusion

Whole life insurance stands as a comprehensive and enduring solution for individuals seeking lifelong financial protection and stability. Its unique features, including guaranteed death benefits, cash value accumulation, and fixed premiums, make it a versatile tool for various financial goals. Whether you’re securing your family’s future, funding retirement, or planning for business succession, whole life insurance offers a reliable and flexible approach.

As you navigate the world of financial planning, consider the benefits of whole life insurance and how it can contribute to your long-term financial well-being. With the right policy and a well-informed decision, you can ensure a secure future for yourself and your loved ones.

What is the difference between whole life insurance and universal life insurance?

+Whole life insurance and universal life insurance are both types of permanent life insurance, but they have some key differences. Whole life insurance has fixed premiums and a guaranteed death benefit, while universal life insurance offers more flexibility in premium payments and death benefit amounts. Universal life insurance also typically has a higher cash value accumulation potential.

How does the cash value within a whole life insurance policy grow over time?

+The cash value within a whole life insurance policy grows through a combination of factors. A portion of your premium payments is allocated to building cash value, and this value accumulates interest over time. Additionally, the policy’s dividends, if any, can also contribute to cash value growth. Over decades, the cash value can grow substantially, providing a valuable asset.

Can I use the cash value within my whole life insurance policy for any purpose?

+Yes, the cash value within your whole life insurance policy can be used for various purposes. You can take out a policy loan, using the cash value as collateral, or make withdrawals directly from the policy. However, it’s important to understand the implications of these actions, as policy loans accrue interest and reduce the policy’s death benefit, while withdrawals may have tax consequences.