Best Insurance Company For Renters Insurance

Renters insurance is an essential yet often overlooked aspect of financial planning for individuals who rent their living spaces. With a myriad of insurance companies offering various coverage plans, it can be daunting to choose the best option. This article aims to provide an in-depth analysis of the key players in the renters insurance market, highlighting their unique features, coverage options, and customer experiences to help you make an informed decision.

Understanding Renters Insurance

Renters insurance, also known as tenant insurance, is a type of property insurance that provides coverage for personal belongings, liability protection, and additional living expenses in the event of a covered loss. Unlike homeowners insurance, renters insurance does not cover the structure of the building; instead, it focuses on the contents and the personal liability of the policyholder. This type of insurance is particularly important for renters as it offers peace of mind and financial protection in case of unforeseen circumstances such as theft, fire, or water damage.

The Top Contenders: A Comprehensive Analysis

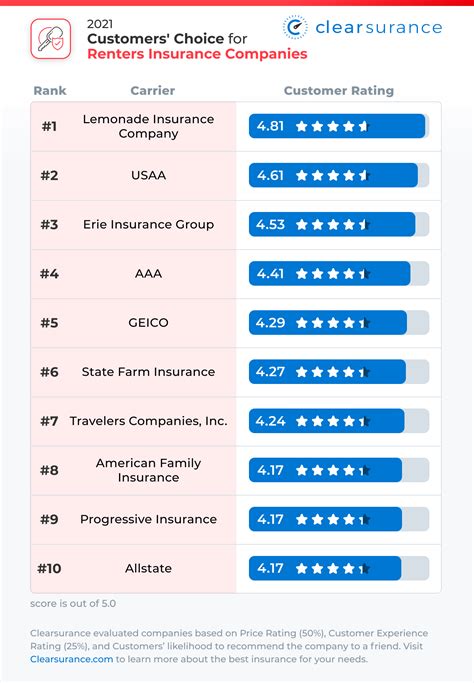

When it comes to choosing the best insurance company for renters insurance, several factors come into play. These include the breadth of coverage options, the ease of the claims process, customer service reputation, and of course, the cost of premiums. Let’s delve into some of the top-rated insurance companies in the renters insurance space and explore their unique offerings.

State Farm

State Farm is a leading insurance provider in the United States, offering a comprehensive range of insurance products, including renters insurance. Known for their competitive pricing and extensive coverage options, State Farm has consistently ranked highly in customer satisfaction surveys. Their renters insurance policies typically include coverage for personal property, liability, medical payments, and additional living expenses.

One of the standout features of State Farm's renters insurance is their Personal Articles Policy, which provides enhanced coverage for valuable items such as jewelry, fine art, and collectibles. This policy ensures that high-value items are adequately insured, offering peace of mind to renters with valuable possessions.

| Coverage Options | State Farm |

|---|---|

| Personal Property | Comprehensive coverage with optional endorsements for valuable items. |

| Liability | Protection against bodily injury and property damage claims. |

| Medical Payments | Covers medical expenses for guests injured on the rental property. |

| Additional Living Expenses | Reimbursement for temporary living costs if the rental becomes uninhabitable. |

Allstate

Allstate is another prominent insurance company that offers a wide range of insurance products, including renters insurance. Allstate’s renters insurance policies are designed to provide flexible coverage options, allowing renters to customize their policies based on their unique needs. Their Renters Advantage Package offers additional benefits such as identity theft protection and electronics coverage.

Allstate's renters insurance also includes Loss Assessment Coverage, which is particularly beneficial for renters in condominiums or cooperatives. This coverage helps protect against assessments charged to all unit owners in the event of damage to common areas.

| Coverage Options | Allstate |

|---|---|

| Personal Property | Coverage for a broad range of items with optional coverage enhancements. |

| Liability | Protects against bodily injury and property damage claims, including defense costs. |

| Medical Payments | Covers medical expenses for guests injured on the rental property. |

| Additional Living Expenses | Reimbursement for temporary housing and other necessary expenses if the rental becomes uninhabitable. |

Progressive

Progressive is a well-known insurance provider that offers a comprehensive renters insurance policy. Their Renters Plus policy provides coverage for personal property, liability, and additional living expenses, along with some unique benefits. One notable feature is their Pet Liability Coverage, which protects renters from claims arising from pet-related incidents.

Progressive's renters insurance also offers Personal Property Replacement Cost Coverage, ensuring that policyholders receive the full replacement cost for their belongings, rather than just the actual cash value. This can be particularly beneficial for renters with newer or more expensive possessions.

| Coverage Options | Progressive |

|---|---|

| Personal Property | Replacement cost coverage with optional coverage for high-value items. |

| Liability | Protection against bodily injury and property damage claims, including defense costs. |

| Medical Payments | Covers medical expenses for guests injured on the rental property. |

| Additional Living Expenses | Reimbursement for temporary living costs if the rental becomes uninhabitable. |

GEICO

GEICO, known for its catchy advertising campaigns, also offers a competitive renters insurance policy. Their Renters Insurance Policy provides coverage for personal property, liability, and additional living expenses, with the option to add coverage for valuable items and identity theft protection.

One unique aspect of GEICO's renters insurance is their Discounts and Savings program. Renters can save on their premiums by bundling their renters insurance with other GEICO policies, such as auto insurance, or by taking advantage of various membership and affiliation discounts.

| Coverage Options | GEICO |

|---|---|

| Personal Property | Coverage for a broad range of items with the option to add coverage for valuable possessions. |

| Liability | Protects against bodily injury and property damage claims, including legal defense costs. |

| Medical Payments | Covers medical expenses for guests injured on the rental property. |

| Additional Living Expenses | Reimbursement for temporary living expenses if the rental becomes uninhabitable. |

Liberty Mutual

Liberty Mutual is a prominent insurance company that offers a comprehensive renters insurance policy. Their Renters Insurance Policy provides coverage for personal property, liability, and additional living expenses, with the option to customize coverage based on individual needs.

One notable feature of Liberty Mutual's renters insurance is their Home Security Discount. Renters who install qualifying home security systems may be eligible for a discount on their premiums, providing an added incentive for renters to enhance the security of their living spaces.

| Coverage Options | Liberty Mutual |

|---|---|

| Personal Property | Coverage for a broad range of items with the option to add coverage for valuable possessions. |

| Liability | Protects against bodily injury and property damage claims, including legal defense costs. |

| Medical Payments | Covers medical expenses for guests injured on the rental property. |

| Additional Living Expenses | Reimbursement for temporary living costs if the rental becomes uninhabitable. |

Key Considerations and Tips

When shopping for renters insurance, it’s important to consider several factors to ensure you choose the best policy for your needs. Here are some key considerations and tips to keep in mind:

- Coverage Options: Evaluate the breadth of coverage options offered by different insurance companies. Ensure that the policy covers your personal belongings, provides adequate liability protection, and includes additional living expenses coverage if needed.

- Claims Process: Research the claims process and reputation of the insurance company. Look for companies with a solid track record of handling claims efficiently and fairly. Customer reviews and ratings can provide valuable insights into the claims experience.

- Customer Service: Excellent customer service can make a significant difference when it comes to resolving issues and providing assistance. Look for insurance companies with a reputation for prompt and friendly customer support.

- Pricing and Discounts: Compare premiums and look for opportunities to save. Many insurance companies offer discounts for bundling policies or for taking advantage of certain safety measures, such as installing smoke detectors or security systems.

- Policy Limits and Deductibles: Understand the policy limits and deductibles associated with the coverage. Ensure that the limits are sufficient to cover your personal belongings and that the deductibles are affordable and reasonable.

Conclusion

Choosing the best insurance company for renters insurance requires careful consideration of coverage options, customer experiences, and cost. By evaluating the offerings of top insurance providers like State Farm, Allstate, Progressive, GEICO, and Liberty Mutual, renters can make an informed decision to protect their personal belongings and financial well-being. Remember to assess your specific needs, compare coverage options, and read reviews to find the insurance company that aligns with your priorities.

What is the average cost of renters insurance?

+The average cost of renters insurance varies based on several factors, including location, coverage limits, and deductibles. On average, renters insurance policies can range from 150 to 300 per year. However, it’s important to note that premiums can vary significantly depending on individual circumstances and the insurance company.

Does renters insurance cover natural disasters?

+Renters insurance typically provides coverage for natural disasters such as fire, windstorms, and lightning. However, it’s important to review the policy carefully as some natural disasters, like floods or earthquakes, may require additional coverage or endorsements.

Can I customize my renters insurance policy?

+Yes, most insurance companies allow renters to customize their insurance policies. You can typically choose the coverage limits for personal property, liability, and additional living expenses, as well as add optional coverages for valuable items or identity theft protection.