Best Insurance Companies For Auto

Navigating the Landscape: Top Auto Insurance Providers in the Market

In the vast realm of auto insurance, selecting the right provider is crucial to ensure comprehensive coverage and peace of mind. This comprehensive guide aims to shed light on some of the best insurance companies specializing in automotive policies, offering insights into their unique offerings, coverage options, and customer experiences.

As an informed consumer, understanding the intricacies of auto insurance is essential. From liability coverage to collision and comprehensive plans, each policy type serves a specific purpose. Additionally, factors like deductibles, policy limits, and add-ons further customize coverage to meet individual needs. This guide will explore these aspects in detail, providing a comprehensive overview of the best auto insurance companies.

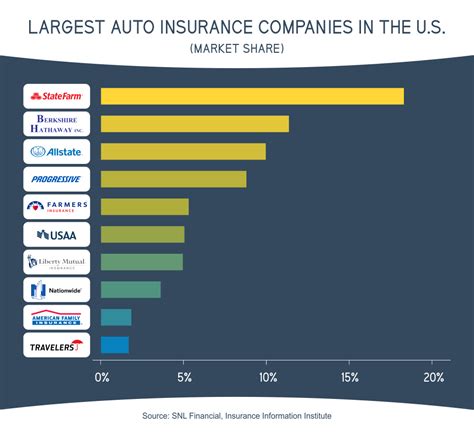

Exploring the Top Auto Insurance Providers

The auto insurance market is diverse, with numerous providers offering competitive rates and comprehensive coverage. Here's an in-depth exploration of some of the industry leaders:

State Farm: A Trusted Name in Auto Insurance

State Farm has long been a staple in the auto insurance industry, known for its extensive network of local agents and personalized service. With a strong focus on customer satisfaction, State Farm offers a range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) plans. The company's Drive Safe & Save program rewards safe driving habits with potential discounts, making it an attractive option for conscientious drivers.

State Farm's extensive agent network provides personalized guidance, ensuring customers understand their policy and coverage options. The company also offers additional benefits like rental car coverage, roadside assistance, and accident forgiveness, enhancing the overall customer experience. With a solid reputation for claims handling and customer service, State Farm remains a top choice for many drivers.

Geico: Innovation Meets Affordability

Geico has revolutionized the auto insurance industry with its innovative approach and focus on affordability. The company's online platform and mobile app offer convenient policy management, allowing customers to access their accounts and make changes anytime. Geico's extensive range of coverage options includes liability, collision, comprehensive, and personal injury protection (PIP) plans, ensuring drivers can customize their policies to fit their needs.

One of Geico's standout features is its Digital Toolkit, which includes tools like Digital ID Cards, Digital Claims Tracking, and Digital Policy Management. These digital enhancements streamline the insurance experience, making it more efficient and accessible. Additionally, Geico's extensive discounts, including multi-policy, military, and good student discounts, make it an appealing choice for a wide range of drivers.

Progressive: Leading the Way with Customizable Coverage

Progressive has established itself as a leader in the auto insurance industry, known for its innovative products and customizable coverage options. The company's Name Your Price tool allows customers to choose their desired coverage level and price, providing a unique and flexible approach to insurance shopping. Progressive's range of coverage options includes liability, collision, comprehensive, and personal injury protection (PIP) plans, ensuring drivers can tailor their policies to their specific needs.

Progressive's Snapshot program is another innovative offering, rewarding safe driving habits with potential discounts. By installing a small device in their vehicle or using the Snapshot mobile app, drivers can track their driving behavior, with safe driving potentially leading to lower insurance rates. Progressive's commitment to innovation and customer satisfaction has made it a top choice for many drivers seeking customizable and affordable coverage.

Allstate: Comprehensive Coverage and Rewards

Allstate is a well-known name in the auto insurance industry, offering a comprehensive range of coverage options and rewards for safe driving. The company's Drivewise program uses a small device or mobile app to track driving behavior, with safe driving potentially leading to discounts on insurance premiums. Allstate's coverage options include liability, collision, comprehensive, and personal injury protection (PIP) plans, ensuring drivers have the protection they need.

Allstate's comprehensive approach to insurance extends beyond auto coverage. The company offers a range of additional products, including homeowners, renters, and life insurance, providing a one-stop shop for all insurance needs. With a strong focus on customer service and a dedicated network of local agents, Allstate ensures customers receive personalized guidance and support throughout the insurance process.

USAA: Exceptional Service for Military Members and Their Families

USAA is a unique auto insurance provider, offering comprehensive coverage exclusively to military members, veterans, and their families. With a strong focus on customer service and military-specific needs, USAA has built a reputation for exceptional coverage and support. The company's range of coverage options includes liability, collision, comprehensive, and personal injury protection (PIP) plans, ensuring military members have the protection they need.

USAA's exclusive focus on the military community allows it to offer specialized benefits and discounts, such as deployment discounts and coverage for unique military situations. The company's commitment to its members is evident in its excellent customer service, with a dedicated team of experts providing personalized guidance and support. USAA's comprehensive coverage and military-centric approach make it an outstanding choice for those who have served or are currently serving in the armed forces.

Comparative Analysis: Key Considerations for Choosing the Right Auto Insurance Provider

When selecting an auto insurance provider, several key factors should be considered to ensure the best fit for individual needs. Here's a comparative analysis of some critical aspects to help guide your decision-making process:

Coverage Options and Customization

Each auto insurance provider offers a range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) plans. It's essential to evaluate these options and ensure the provider offers the specific coverage needed for your vehicle and driving situation. Additionally, consider the provider's approach to customization, as some offer innovative tools like Progressive's Name Your Price or Geico's Digital Toolkit, providing a more personalized insurance experience.

Discounts and Rewards

Auto insurance providers often offer a variety of discounts and rewards to attract and retain customers. These may include multi-policy, good student, safe driver, or loyalty discounts. Some providers, like State Farm's Drive Safe & Save program or Allstate's Drivewise program, reward safe driving habits with potential premium reductions. Evaluate the discounts and rewards offered by each provider to determine which align best with your circumstances and driving habits.

Claims Handling and Customer Service

The quality of claims handling and customer service is a critical aspect of any auto insurance provider. Research and read reviews to understand the provider's reputation in these areas. Consider factors like response time, ease of communication, and the overall customer experience during the claims process. A provider with a strong track record in claims handling and customer satisfaction can provide added peace of mind.

Digital Tools and Accessibility

In today's digital age, the availability and usability of digital tools can significantly enhance the insurance experience. Evaluate the provider's online platform and mobile app for convenience and functionality. Look for features like digital ID cards, policy management tools, and claims tracking to streamline your insurance management. A provider with robust digital offerings can provide added efficiency and accessibility.

Price and Value

While price is an essential consideration, it's crucial to evaluate it in conjunction with the overall value offered by the provider. Compare quotes from multiple providers to ensure you're getting competitive rates. Additionally, consider the coverage and benefits provided by each quote. A provider that offers comprehensive coverage and valuable add-ons at a competitive price can provide excellent value for your insurance needs.

The Future of Auto Insurance: Industry Trends and Innovations

The auto insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here's a glimpse into some of the key trends and innovations shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining prominence in the auto insurance industry. Usage-based insurance (UBI) programs, like State Farm's Drive Safe & Save or Allstate's Drivewise, use telematics to reward safe driving habits with potential discounts. This innovative approach to insurance pricing is expected to become more prevalent, offering a more personalized and data-driven insurance experience.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is revolutionizing the customer experience. Providers like Geico and Progressive have embraced digital tools and platforms, offering convenient online and mobile access to policy management and claims tracking. This shift towards digital services enhances accessibility and efficiency, providing customers with greater control over their insurance journey.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are increasingly being utilized by auto insurance providers to enhance decision-making and improve customer experiences. AI-powered chatbots and virtual assistants provide instant support and guidance, while data analytics enable providers to offer more accurate and personalized coverage options. These technologies are expected to play an even more significant role in the future, driving innovation and efficiency in the industry.

Connected Cars and Autonomous Vehicles

The rise of connected cars and autonomous vehicles presents new challenges and opportunities for the auto insurance industry. As vehicles become more integrated with technology, insurance providers will need to adapt their coverage options to address these changes. The potential for reduced accidents and improved safety in autonomous vehicles may lead to new pricing models and coverage innovations.

Sustainability and Green Initiatives

With growing environmental awareness, sustainability and green initiatives are becoming increasingly important in the auto insurance industry. Some providers are offering incentives and discounts for eco-friendly vehicles and driving behaviors. As the industry evolves, we can expect to see more providers incorporating sustainability into their coverage options and corporate strategies.

FAQ: Common Questions About Auto Insurance

What factors influence auto insurance rates?

+

Auto insurance rates are influenced by a variety of factors, including the make and model of your vehicle, your driving history, and your geographic location. Additionally, your age, gender, and marital status can also impact rates. Some insurers may also consider your credit score and claims history when determining premiums.

How can I reduce my auto insurance costs?

+

There are several ways to potentially reduce your auto insurance costs. Shop around and compare quotes from multiple providers to find competitive rates. Consider increasing your deductible, as this can lower your premium. Additionally, maintain a clean driving record, as insurers often offer discounts for safe driving habits. Taking advantage of available discounts, such as multi-policy or good student discounts, can also help lower your costs.

What types of coverage are typically included in an auto insurance policy?

+

A standard auto insurance policy typically includes liability coverage, which protects you if you’re found at fault in an accident. It also includes collision coverage, which covers damages to your vehicle in an accident, and comprehensive coverage, which covers non-accident-related damages, such as theft or weather-related incidents. Personal injury protection (PIP) or medical payments coverage may also be included to cover medical expenses resulting from an accident.

How do I file an auto insurance claim?

+

To file an auto insurance claim, you’ll typically need to contact your insurance provider and provide details about the incident. Be prepared to offer information such as the date, time, and location of the accident, as well as any relevant contact information for involved parties. Your insurer will guide you through the claims process, which may involve providing additional documentation and working with an adjuster to assess the damages.

What happens if I’m at fault in an accident but don’t have enough liability coverage to cover the damages?

+

If you’re at fault in an accident and your liability coverage is insufficient to cover the damages, you may be held personally responsible for the remaining amount. This could result in significant financial liability, potentially impacting your assets and future earnings. It’s crucial to review your policy limits and consider increasing your liability coverage to ensure adequate protection.