Best Home Insurance Rates

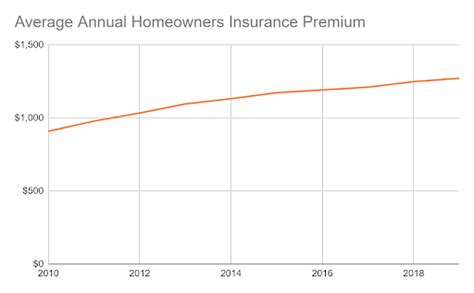

Home insurance is a vital investment for any homeowner, providing financial protection against various risks and unforeseen events. In the United States, the average cost of home insurance varies significantly depending on factors such as location, property value, coverage limits, and the insurer chosen. Securing the best home insurance rates involves understanding these variables and making informed decisions to ensure adequate coverage at a competitive price.

Understanding Home Insurance Costs

The cost of home insurance is influenced by a multitude of factors, each contributing to the overall premium. These factors include:

- Location: Geographical location plays a pivotal role in determining insurance rates. Areas prone to natural disasters, such as hurricanes, floods, or wildfires, typically have higher premiums due to the increased risk of claims.

- Property Value: The value of your home and its contents directly impacts the insurance premium. Higher-value properties often require more extensive coverage, leading to higher costs.

- Coverage Limits: The amount of coverage you choose directly affects your premium. Opting for higher coverage limits provides more financial protection but comes at a higher cost.

- Deductibles: Deductibles represent the portion of a claim that you pay out of pocket. Higher deductibles can lower your premium, but they also mean you'll pay more if you need to file a claim.

- Claim History: Insurers consider your claim history when setting rates. A history of frequent claims may result in higher premiums or even non-renewal of your policy.

- Discounts: Many insurers offer discounts for various reasons, such as bundling home and auto insurance, installing security systems, or being claim-free for a certain period.

Comparing Home Insurance Rates

To secure the best home insurance rates, it’s essential to compare quotes from multiple insurers. This process allows you to assess the coverage and costs offered by different providers, ensuring you find the most competitive rates for your needs.

Online Quote Comparison Tools

Online quote comparison tools have revolutionized the home insurance shopping experience. These platforms provide a convenient way to gather quotes from multiple insurers in one place, saving time and effort. However, it’s crucial to remember that the quotes generated are estimates and may not accurately reflect the final premium, as insurers consider additional factors during the underwriting process.

Working with an Insurance Agent

Engaging the services of an insurance agent can be beneficial, especially if you’re new to the home insurance landscape or have unique coverage needs. Insurance agents can provide personalized advice, help you understand complex policies, and negotiate better rates on your behalf. They often have established relationships with insurers, which can result in access to exclusive discounts or policies tailored to your specific situation.

Understanding Coverage Options

When comparing home insurance rates, it’s essential to understand the different coverage options available. Home insurance typically includes coverage for:

- Dwelling Coverage: Protects the structure of your home against damages caused by covered perils, such as fire, wind, or theft.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture, electronics, and clothing, in the event of a covered loss.

- Liability Coverage: Provides protection against lawsuits arising from injuries or property damage caused by you or your family members on your property.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered loss, such as hotel stays or restaurant meals.

- Medical Payments Coverage: Pays for medical expenses incurred by visitors who are injured on your property, regardless of fault.

Tips for Lowering Home Insurance Costs

While the cost of home insurance is influenced by various factors beyond your control, there are several strategies you can employ to potentially lower your premiums:

- Shop Around: As mentioned earlier, comparing quotes from multiple insurers is crucial. Even if you've been with the same insurer for years, it's worth exploring other options to ensure you're not overpaying.

- Increase Your Deductible: Opting for a higher deductible can lead to significant savings on your premium. However, ensure that you can afford the deductible in the event of a claim.

- Bundle Policies: Many insurers offer discounts when you bundle multiple policies, such as home and auto insurance, under one provider. Bundling can result in substantial savings on your overall insurance costs.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly reviewing your coverage limits and ensuring they align with your current situation can help prevent overpaying for unnecessary coverage.

- Enhance Your Home's Safety: Installing security systems, smoke detectors, and fire sprinklers can lead to discounts on your home insurance premium. These safety features not only protect your home but also reduce the risk of claims, making you a more attractive customer to insurers.

- Consider Renovations: Certain home improvements, such as updating your roof or reinforcing your home against natural disasters, can lead to lower insurance rates. Insurers often view these improvements as reducing the risk of extensive damage, which can result in lower premiums.

The Impact of Claims on Home Insurance Rates

Filing a claim with your home insurance provider can have both immediate and long-term effects on your insurance rates. Immediately after a claim, your insurer may increase your premium or choose not to renew your policy. Additionally, insurers often consider your claim history when setting rates, and frequent claims can lead to higher premiums or difficulty finding affordable coverage in the future.

It's important to note that not all claims will impact your rates. Minor claims, especially those with minimal or no payout, are less likely to result in rate increases. However, it's essential to weigh the potential impact of a claim against the financial benefit it provides. For instance, filing a claim for a small amount may not be worth it if it leads to a significant premium increase.

The Role of Insurance Companies

Insurance companies play a critical role in the home insurance landscape, providing financial protection to homeowners and helping them recover from losses. When choosing an insurer, it’s essential to consider their financial stability, customer service reputation, and claims handling process. A reputable insurer with a strong financial standing is more likely to be able to pay out claims promptly and fairly.

Financial Stability and Ratings

Understanding an insurer’s financial stability is crucial. Reputable rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, assign ratings to insurance companies based on their financial strength and ability to meet their obligations. These ratings provide valuable insights into an insurer’s stability and can help you make an informed decision when choosing a provider.

Customer Service and Claims Handling

The quality of an insurer’s customer service and claims handling process can significantly impact your experience as a policyholder. Researching customer reviews and ratings can provide insights into an insurer’s responsiveness, efficiency, and fairness when dealing with claims. A reputable insurer should have a track record of prompt and fair claims handling, ensuring you receive the financial protection you deserve when you need it most.

Conclusion

Securing the best home insurance rates involves a comprehensive understanding of the factors influencing costs, a willingness to shop around, and a strategic approach to coverage and risk management. By comparing quotes, understanding coverage options, and implementing cost-saving strategies, you can find a policy that provides the protection you need at a competitive price. Remember, home insurance is an investment in your financial security, and choosing the right coverage and insurer is a crucial step in safeguarding your home and assets.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever significant changes occur, such as renovations, additions, or changes in personal belongings. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

What are some common exclusions in home insurance policies?

+Common exclusions in home insurance policies include damage caused by earthquakes, floods, and poor maintenance. It’s crucial to understand these exclusions to avoid surprises when filing a claim.

How can I improve my chances of getting a lower premium when shopping for home insurance?

+To improve your chances of getting a lower premium, consider increasing your deductible, bundling policies with the same insurer, and maintaining a good credit score. Additionally, implementing home safety measures and making certain renovations can also lead to discounts.