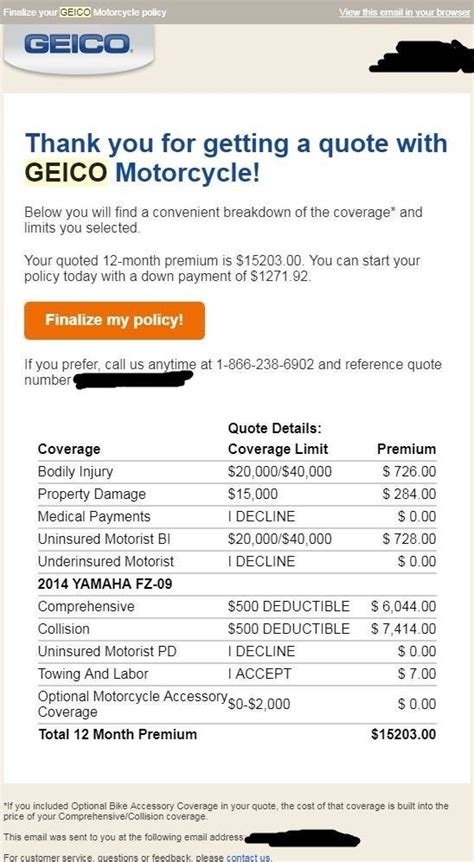

Insurance Quote For Motorcycle

Obtaining an insurance quote for your motorcycle is an essential step in ensuring you have the right coverage to protect your bike and yourself. The process can seem daunting, especially with the numerous options and variables involved. However, with the right approach and understanding, you can navigate the insurance landscape with ease and find a policy that suits your needs and budget.

Understanding Motorcycle Insurance

Motorcycle insurance provides financial protection against various risks associated with owning and riding a bike. It covers a range of scenarios, including accidents, theft, vandalism, and even damage caused by natural disasters. The coverage ensures that you, your bike, and other parties involved in an incident are protected, minimizing the financial burden.

The specific coverage and premiums vary depending on several factors, including your location, the make and model of your bike, your riding experience, and the type of coverage you opt for. Understanding these factors and how they influence your quote is crucial in making an informed decision.

Factors Affecting Your Quote

- Location: Insurance rates can vary significantly based on where you live. Areas with higher crime rates or a history of severe weather events may see increased insurance costs. Additionally, the number of registered motorcycles and accident statistics in your region can influence rates.

- Bike Details: The make, model, and year of your bike play a role in determining your quote. High-performance bikes or those with a reputation for theft may attract higher premiums. Conversely, older bikes or those with standard engines might be more affordable to insure.

- Riding Experience: Your riding history is a significant factor. Insurers consider your age, the number of years you’ve been riding, and your accident and violation record. Novice riders or those with a history of accidents may face higher premiums until they establish a safer riding record.

- Coverage Type: The type of coverage you choose affects your quote. Basic liability coverage, which protects you from claims against you, is typically the most affordable. However, comprehensive coverage, which offers protection for your bike in a wide range of scenarios, will cost more.

| Coverage Type | Description |

|---|---|

| Liability | Covers damage or injury you cause to others but not your own bike. |

| Collision | Covers damage to your bike in an accident, regardless of fault. |

| Comprehensive | Covers a wide range of incidents, including theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist | Covers you if you're involved in an accident with a driver who has no or insufficient insurance. |

Obtaining an Insurance Quote

Getting a motorcycle insurance quote is a straightforward process that can be done online or through an insurance agent. Online quotes provide a quick and convenient way to compare rates from multiple insurers, while working with an agent allows for more personalized advice and guidance.

Online Quote Process

- Visit the website of an insurance provider or use a comparison website that aggregates quotes from multiple insurers.

- Enter your personal details, including your name, date of birth, and contact information.

- Provide details about your bike, such as the make, model, year, and any modifications.

- Specify the type of coverage you’re interested in and any additional features or endorsements you require.

- Answer questions about your riding experience, including your annual mileage, accident history, and any safety courses you’ve completed.

- Review and compare the quotes you receive, considering the coverage limits, deductibles, and any additional benefits or discounts offered.

Working with an Insurance Agent

Engaging an insurance agent can provide additional benefits, especially if you’re new to motorcycle insurance or have specific coverage needs. Agents can offer personalized advice, explain policy details, and help you tailor a policy to your requirements.

- Contact a reputable insurance agency that specializes in motorcycle insurance.

- Provide them with the necessary details about yourself and your bike, including any modifications or custom features.

- Discuss your riding habits, the types of riding you do (e.g., commuting, touring, or off-road riding), and any safety measures you take.

- The agent will then provide you with quotes from various insurers, explaining the key differences and helping you understand the coverage.

- You can ask the agent to shop around for better rates or negotiate with insurers to get the most competitive quote.

Tips for Lowering Your Insurance Quote

While motorcycle insurance is essential, you may want to keep your premiums as low as possible. Here are some strategies to consider:

Safe Riding Practices

Insurance providers offer discounts for safe riding practices. This includes completing approved safety courses, maintaining a clean driving record, and avoiding accidents and traffic violations. The longer you maintain a safe riding history, the more you can benefit from these discounts.

Bundling Policies

If you already have other insurance policies, such as auto or home insurance, consider bundling your motorcycle insurance with the same provider. Many insurers offer multi-policy discounts, which can significantly reduce your overall premiums.

Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. However, this means you’ll pay more out of pocket if you need to make a claim. Ensure you choose a deductible amount that you’re comfortable with and can afford in case of an incident.

Security and Storage

Taking steps to secure your bike can lead to insurance discounts. This includes using approved security devices, such as alarms or GPS trackers, and storing your bike in a secure location, such as a garage or storage unit. Insurers often view these measures as a reduced risk, which can result in lower premiums.

Understanding Your Policy

Once you’ve obtained your insurance quote and decided on a policy, it’s crucial to understand the details of your coverage. Read through your policy carefully, ensuring you understand the coverage limits, deductibles, and any exclusions or limitations. If you have any questions or concerns, reach out to your insurer or insurance agent for clarification.

Common Policy Features

- Liability Coverage: This is the minimum coverage required by law in most states. It covers bodily injury and property damage you cause to others.

- Collision Coverage: Pays for repairs to your bike if you’re involved in an accident, regardless of fault. It typically has a deductible, which you must pay before the insurer covers the rest.

- Comprehensive Coverage: Covers a wide range of incidents, including theft, vandalism, fire, and natural disasters. Like collision coverage, it usually has a deductible.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Medical Payments Coverage: Covers your medical expenses and those of your passengers if you’re involved in an accident, regardless of fault.

Optional Add-ons

Depending on your needs and the value of your bike, you may want to consider adding optional coverages to your policy. These can include:

- Accessory Coverage: Covers the cost of accessories on your bike, such as a custom seat or handlebar, if they're damaged or stolen.

- Rental Reimbursement: Provides rental car coverage if your bike is in the shop for repairs covered by your policy.

- Roadside Assistance: Offers help if your bike breaks down or is involved in an accident, including towing and emergency repairs.

- Custom Parts and Equipment Coverage: Protects custom parts and equipment installed on your bike, which may not be covered under standard policies.

Renewing Your Policy

As your policy nears its renewal date, it’s a good time to review your coverage and consider whether your needs have changed. Life circumstances, such as moving to a new location or purchasing a new bike, may impact your insurance requirements. Additionally, you can shop around for better rates or negotiate with your current insurer to see if they can offer a more competitive quote.

Policy Renewal Process

- Check your policy documents to find your renewal date.

- Contact your insurer or insurance agent to discuss your renewal options. They can provide you with a new quote based on your current coverage and any changes you wish to make.

- Review the new quote, ensuring you understand any changes in coverage or premiums.

- If you’re happy with the renewal quote, you can proceed with the renewal process, typically done online or over the phone.

- If you’re not satisfied with the renewal quote or believe you can find a better deal elsewhere, shop around for alternative quotes. You can use online comparison tools or work with an insurance broker to find the best option.

FAQs

Can I get insurance for a custom-built motorcycle?

+Yes, you can insure a custom-built motorcycle. However, due to the unique nature of these bikes, the insurance process may be more complex. You’ll need to provide detailed information about the bike’s specifications and value. Some insurers specialize in insuring custom bikes, so it’s worth shopping around to find the right coverage.

What happens if I have an accident while my policy is still being processed?

+If you have an accident while your policy is being processed but not yet active, the outcome depends on the insurer’s guidelines and the specific circumstances. In some cases, the insurer may provide temporary coverage or coverage on a pro-rated basis until your policy starts. However, it’s best to check with the insurer to understand their specific policies in such situations.

Can I add a passenger to my insurance policy?

+Yes, you can typically add a passenger to your insurance policy. This is especially important if you regularly ride with a passenger. Adding a passenger ensures they are covered in case of an accident, providing protection for both you and your passenger.

Are there any discounts available for motorcycle insurance?

+Yes, many insurers offer discounts for motorcycle insurance. These can include safe riding discounts, multi-policy discounts (if you have other insurance policies with the same insurer), and loyalty discounts for long-term customers. Additionally, some insurers offer discounts for completing approved safety courses or for storing your bike in a secure location.

Can I get insurance for a vintage or classic motorcycle?

+Yes, you can insure a vintage or classic motorcycle. These bikes often require specialized coverage due to their unique value and potential for restoration. Some insurers offer specific policies for classic bikes, which can include agreed-value coverage, ensuring you receive the full agreed-upon value of your bike in case of a total loss.

Remember, when it comes to motorcycle insurance, it’s essential to shop around, compare quotes, and understand the details of your policy. By doing so, you can ensure you have the right coverage at a competitive price, allowing you to enjoy your rides with peace of mind.