Best Affordable Insurance

In today's world, finding affordable insurance coverage is a top priority for many individuals and businesses. With rising costs and an ever-evolving market, navigating the insurance landscape can be challenging. This comprehensive guide aims to shed light on the best affordable insurance options, offering expert insights and practical advice to help you secure the protection you need without breaking the bank.

Understanding the Landscape: Affordable Insurance Options

The insurance market offers a wide array of options, catering to various needs and budgets. From traditional insurers to innovative startups, there are numerous players offering competitive rates. Understanding the different types of insurance and their key features is essential to making informed choices.

Health Insurance: Protecting Your Wellbeing

Health insurance is a critical component of financial security. With rising healthcare costs, affordable health insurance plans can provide peace of mind. Consider the following when searching for the best health insurance coverage:

- Network Providers: Opt for plans with a wide network of healthcare providers to ensure access to quality care.

- Deductibles and Copays: Compare plans based on their deductible amounts and copay structures to find the most cost-effective option.

- Coverage Limits: Understand the plan’s coverage limits and exclusions to ensure adequate protection for your specific needs.

Additionally, government-sponsored programs like Medicare and Medicaid offer affordable healthcare options for eligible individuals. These programs provide comprehensive coverage at a low cost, making them a popular choice for many.

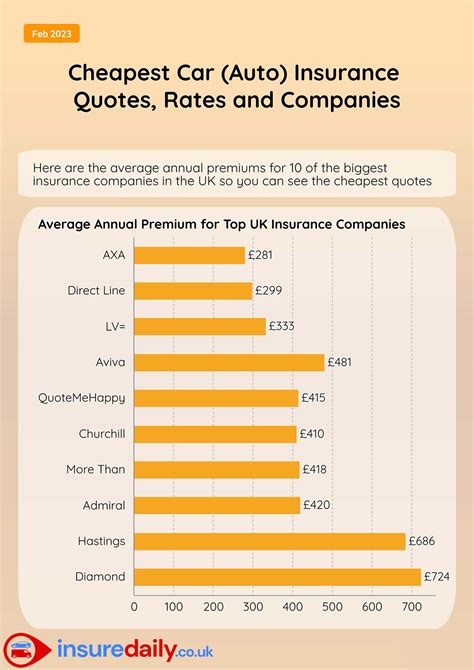

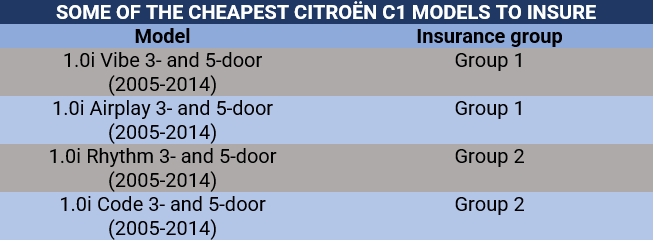

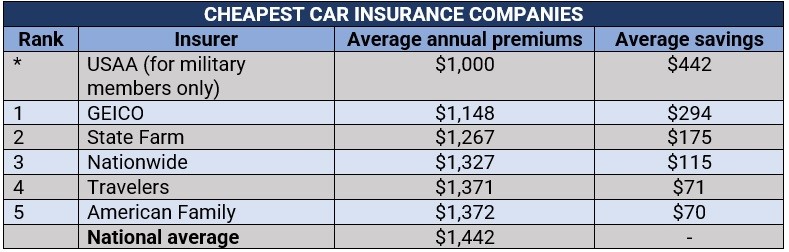

Auto Insurance: Safeguarding Your Vehicle

Auto insurance is mandatory in most regions and plays a vital role in protecting your vehicle and financial stability. When searching for affordable auto insurance, consider these factors:

- Coverage Types: Understand the different coverage options such as liability, collision, and comprehensive insurance, and choose the ones that align with your needs.

- Discounts: Explore insurance providers that offer discounts for safe driving records, multiple vehicles, or even good academic performance (for young drivers).

- Bundling: Consider bundling your auto insurance with other policies, such as home or life insurance, to potentially save on overall costs.

For those seeking the most affordable auto insurance, state-sponsored programs or high-risk insurance pools can be a viable option. These programs cater to drivers with unique circumstances, offering coverage at competitive rates.

Home Insurance: Securing Your Sanctuary

Home insurance is essential for protecting your property and belongings. When choosing an affordable home insurance policy, keep these considerations in mind:

- Coverage Amount: Ensure the policy provides adequate coverage for the replacement cost of your home and its contents.

- Perils Covered: Review the policy’s list of covered perils (such as fire, theft, or natural disasters) to ensure you have the protection you need.

- Deductibles: Assess the impact of different deductible amounts on your premium to find the right balance between affordability and coverage.

Furthermore, some insurers offer discounts for safety features like security systems or fire-resistant roofing. Taking proactive measures to protect your home can result in significant savings on your insurance premiums.

The Role of Technology: Insurtech Revolution

The rise of Insurtech has revolutionized the insurance industry, offering innovative solutions for affordable coverage. These tech-driven insurers leverage advanced analytics and digital platforms to provide efficient and cost-effective insurance options.

Insurtech Startups: Disrupting the Market

Insurtech startups have emerged as game-changers in the insurance space. With a focus on digital transformation, these companies offer:

- Simplified Processes: Streamlined online applications and policy management, making insurance more accessible and convenient.

- Personalized Pricing: Advanced algorithms analyze individual risk profiles, resulting in fair and customized premiums.

- Instant Coverage: Real-time policy issuance, providing immediate protection without lengthy delays.

For instance, Lemonade, a prominent Insurtech player, offers homeowners and renters insurance with a unique pay-what-you-wish model, ensuring affordable coverage for all.

Digital Tools: Enhancing Affordability

Traditional insurers are also embracing digital tools to enhance affordability. Online quote comparisons and policy management platforms provide transparency and ease of use, allowing customers to make informed choices and save money.

Additionally, usage-based insurance programs, like Pay-as-You-Drive auto insurance, use telematics technology to monitor driving behavior, rewarding safe drivers with lower premiums.

The Impact of Personal Choices: Saving on Insurance Costs

While the insurance market and technological advancements play a significant role, personal choices also influence the affordability of insurance coverage. Making informed decisions and adopting certain strategies can lead to substantial savings.

Risk Mitigation: Lowering Premiums

Insurance providers assess risk to determine premiums. By taking steps to reduce risk, you can lower your insurance costs. Consider the following:

- Safety Measures: Installing home security systems or driving safely can lead to reduced premiums.

- Bundling Policies: Combining multiple insurance policies with the same provider often results in discounted rates.

- Health and Wellness: Maintaining a healthy lifestyle can qualify you for lower health insurance premiums in some cases.

Policy Comparison: Finding the Best Deal

Shopping around and comparing insurance policies is crucial. Use online tools and resources to compare premiums, coverage, and customer reviews. This thorough comparison ensures you find the most affordable option without compromising on quality.

Understanding Policy Terms: Avoiding Surprises

Familiarize yourself with the policy terms and conditions. Understand the coverage limits, exclusions, and any potential hidden costs. This knowledge empowers you to make informed decisions and avoid unexpected expenses down the line.

| Insurance Type | Key Considerations |

|---|---|

| Health Insurance | Network providers, deductibles, coverage limits |

| Auto Insurance | Coverage types, discounts, bundling options |

| Home Insurance | Coverage amount, perils covered, deductibles |

Future Trends: The Evolution of Affordable Insurance

The insurance industry is constantly evolving, and several trends are shaping the future of affordable coverage.

Telemedicine and Digital Health

The integration of telemedicine and digital health solutions is transforming the healthcare industry. With remote consultations and digital monitoring, healthcare becomes more accessible and cost-effective, potentially reducing the need for extensive insurance coverage.

Blockchain Technology

Blockchain’s secure and transparent nature is being explored in the insurance sector. By streamlining claims processing and reducing fraud, blockchain technology can lead to more efficient and affordable insurance processes.

Artificial Intelligence

AI-powered analytics are enhancing risk assessment and pricing models. Insurers can offer more accurate and personalized premiums, ensuring fairness and affordability for policyholders.

Sustainable Practices

The insurance industry is increasingly focusing on sustainability. By promoting eco-friendly practices and offering incentives for green initiatives, insurers are encouraging environmentally conscious choices, which can lead to reduced risk and lower premiums.

Conclusion: Navigating the Affordable Insurance Landscape

Finding the best affordable insurance involves a combination of understanding the market, embracing technological advancements, making informed personal choices, and keeping an eye on future trends. By staying informed and proactive, you can secure the protection you need while keeping costs manageable.

Remember, insurance is a vital aspect of financial planning, and investing in the right coverage can provide invaluable peace of mind. Whether you're seeking health, auto, or home insurance, there are affordable options available to suit your unique needs.

How can I find the most affordable health insurance plan for my family?

+Researching and comparing different health insurance plans is crucial. Consider factors like network providers, coverage limits, and deductibles. Government programs like Medicaid or marketplace plans can also offer affordable options. Additionally, some employers provide family coverage at a discounted rate.

What are some tips for reducing auto insurance costs?

+To save on auto insurance, maintain a clean driving record, explore discounts for safety features or good grades (for young drivers), and consider bundling your auto insurance with other policies. Shopping around and comparing quotes from different insurers can also lead to significant savings.

Are there affordable home insurance options for renters?

+Absolutely! Renters insurance is specifically designed to protect your personal belongings and liability risks. Insurtech startups often offer competitive rates for renters insurance, providing coverage at an affordable cost. Additionally, some traditional insurers provide discounts for bundling renters and auto insurance.