Average Yearly Car Insurance Cost

Understanding the average yearly cost of car insurance is essential for any vehicle owner. This comprehensive guide will delve into the factors that influence these costs, providing you with the insights needed to make informed decisions about your insurance coverage.

Unraveling the Average Yearly Car Insurance Cost

Car insurance is a vital aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The cost of this coverage varies significantly based on numerous factors, making it essential to understand the average expenses and the reasons behind them.

According to recent data, the average yearly cost of car insurance in the United States is approximately $1,674. However, this figure is just an average, and the actual cost can vary widely based on individual circumstances and the specific coverage chosen.

Let's explore the key factors that influence these costs and provide a detailed breakdown of how these averages are calculated.

Factors Influencing Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. These factors can be broadly categorized into personal characteristics, vehicle-related factors, and geographical and usage-based considerations.

Personal Characteristics

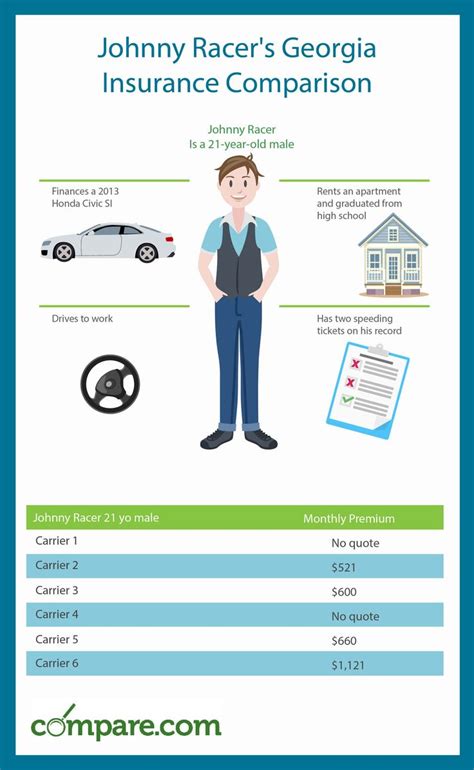

Your personal details and driving history are significant factors in determining insurance costs. Insurers consider age, gender, and driving experience when assessing risk. For instance, younger drivers, particularly males under 25, are often considered high-risk due to their propensity for more frequent and severe accidents, leading to higher insurance premiums.

Additionally, your driving record plays a pivotal role. A clean driving history with no accidents or traffic violations can result in lower premiums, while a history of accidents or moving violations can significantly increase your insurance costs.

Other personal factors, such as marital status and education level, can also impact insurance rates. Married individuals and those with advanced degrees are often considered lower-risk and may benefit from reduced premiums.

Vehicle-Related Factors

The type of vehicle you drive and its usage are significant determinants of insurance costs. Vehicle make and model, engine size, and vehicle age are all considered by insurers. Sports cars, luxury vehicles, and high-performance cars often carry higher insurance costs due to their higher repair costs and greater likelihood of theft or accidents.

The primary use of your vehicle also matters. If you primarily use your car for business purposes or have a long daily commute, your insurance premiums may be higher due to the increased mileage and exposure to potential risks.

Geographical and Usage-Based Considerations

Your location and driving habits are key factors in insurance pricing. Areas with higher population densities and more traffic tend to have higher insurance rates due to the increased likelihood of accidents. Similarly, areas with higher crime rates may see higher premiums due to the risk of vehicle theft or vandalism.

Insurers also consider mileage and usage patterns. If you drive fewer miles annually or primarily use your vehicle for leisure, you may be eligible for lower premiums through usage-based insurance programs. These programs use telematics devices or smartphone apps to track your driving behavior and offer discounts for safe driving habits.

Breaking Down the Average Yearly Cost

The average yearly car insurance cost of $1,674 is an aggregate of various coverage types and scenarios. This average is calculated based on a standard policy that includes liability coverage, comprehensive and collision coverage, and personal injury protection (PIP) or medical payments coverage, depending on the state.

Liability coverage, which is typically the minimum required by law, covers damages you cause to others' property or injuries you cause to others in an accident. The average cost for liability-only coverage is around $500 to $700 per year. However, this can vary significantly based on the state you reside in, as each state has different minimum liability requirements.

Comprehensive and collision coverage, which protect against damages to your own vehicle, typically add significant cost to the premium. The average cost for these coverages can range from $500 to $1,000 per year, depending on the value of your vehicle and your deductible choice.

Personal injury protection (PIP) or medical payments coverage, which covers medical expenses for you and your passengers in an accident, also contributes to the overall cost. The average cost for this coverage can vary widely, from $100 to $500 per year, depending on the state's requirements and the level of coverage chosen.

Other optional coverages, such as rental car reimbursement, roadside assistance, and gap insurance, can further increase the overall premium. These additional coverages are typically chosen based on individual needs and can add an extra $50 to $200 per year to the total cost.

| Coverage Type | Average Cost |

|---|---|

| Liability-Only | $500 - $700 per year |

| Comprehensive and Collision | $500 - $1,000 per year |

| PIP or Medical Payments | $100 - $500 per year |

| Optional Coverages | $50 - $200 per year |

It's important to note that these averages are just estimates and the actual cost of your car insurance can vary significantly based on your unique circumstances and the coverage options you choose.

Comparative Analysis of Car Insurance Costs

To further understand the landscape of car insurance costs, let’s delve into a comparative analysis of rates across different states and demographic groups.

State-by-State Comparison

Car insurance costs can vary significantly from state to state due to differences in state laws, traffic patterns, and the cost of living. For instance, states with higher populations and denser traffic, like California and New York, often have higher average insurance rates compared to less populous states like North Dakota or Wyoming.

The table below provides a state-by-state comparison of average annual car insurance costs, based on data from the Insurance Information Institute (III):

| State | Average Annual Cost |

|---|---|

| Alabama | $1,047 |

| Alaska | $1,788 |

| Arizona | $1,145 |

| Arkansas | $997 |

| California | $1,859 |

| Colorado | $1,348 |

| Connecticut | $1,258 |

| Delaware | $1,221 |

| Florida | $1,510 |

| Georgia | $1,034 |

| Hawaii | $1,552 |

| Idaho | $922 |

| Illinois | $1,261 |

| Indiana | $967 |

| Iowa | $1,088 |

| Kansas | $1,068 |

| Kentucky | $995 |

| Louisiana | $1,424 |

| Maine | $1,023 |

| Maryland | $1,587 |

| Massachusetts | $1,358 |

| Michigan | $2,357 |

| Minnesota | $1,030 |

| Mississippi | $1,201 |

| Missouri | $1,116 |

| Montana | $998 |

| Nebraska | $1,075 |

| Nevada | $1,475 |

| New Hampshire | $1,057 |

| New Jersey | $1,690 |

| New Mexico | $1,010 |

| New York | $1,599 |

| North Carolina | $995 |

| North Dakota | $779 |

| Ohio | $967 |

| Oklahoma | $1,006 |

| Oregon | $1,158 |

| Pennsylvania | $1,025 |

| Rhode Island | $1,276 |

| South Carolina | $949 |

| South Dakota | $940 |

| Tennessee | $1,028 |

| Texas | $1,295 |

| Utah | $1,123 |

| Vermont | $1,048 |

| Virginia | $1,089 |

| Washington | $1,176 |

| West Virginia | $978 |

| Wisconsin | $1,144 |

| Wyoming | $917 |

As seen in the table, the average annual cost of car insurance can vary significantly, with states like Michigan and New Jersey on the higher end and states like North Dakota and Wyoming on the lower end. This variation underscores the importance of state-specific factors in determining insurance rates.

Demographic and Vehicle-Based Comparison

Beyond state-level variations, car insurance costs can also differ significantly based on demographic factors and vehicle characteristics.

Demographically, younger drivers often face higher insurance costs due to their higher accident risk. According to data from the Insurance Information Institute (III), the average annual insurance cost for a 16-year-old driver is $6,274, while a 30-year-old driver pays an average of $1,492, and a 70-year-old driver pays an average of $1,183. This stark difference highlights the significant role age plays in insurance rates.

Similarly, the type of vehicle can significantly impact insurance costs. Sports cars, luxury vehicles, and high-performance cars often carry higher insurance costs due to their higher repair costs and greater risk of theft or accidents. For instance, the average annual insurance cost for a high-end luxury car like a Porsche 911 can be upwards of $3,000, while a more economical sedan like a Toyota Corolla might have an average annual insurance cost of $1,200.

These comparisons underscore the need for a comprehensive understanding of the various factors that influence car insurance costs. By considering state-specific laws, demographic factors, and vehicle characteristics, individuals can make more informed decisions about their insurance coverage and potentially identify areas for cost savings.

Maximizing Value in Car Insurance Coverage

Navigating the complex landscape of car insurance costs can be daunting, but there are strategies to ensure you’re getting the best value for your insurance dollar. This section will explore some key strategies to maximize the value of your car insurance coverage.

Understanding Coverage Options

Car insurance policies can be customized to fit individual needs, offering a range of coverage options. Understanding these options is crucial for making informed decisions about your coverage.

Liability coverage is the most basic and typically the minimum required by law. It covers damages you cause to others' property or injuries you cause to others in an accident. While it's the minimum requirement, it's important to note that liability coverage doesn't protect your own vehicle or your own medical expenses in an accident.

Comprehensive and collision coverage, on the other hand, protects your own vehicle. Comprehensive coverage protects against non-collision incidents like theft, vandalism, fire, or natural disasters, while collision coverage covers damages to your vehicle in an accident, regardless of who's at fault. These coverages are often required by lenders if you're leasing or financing your vehicle.

Personal injury protection (PIP) or medical payments coverage is another crucial aspect of car insurance. This coverage pays for medical expenses for you and your passengers in an accident, regardless of fault. It's particularly important in no-fault states, where medical expenses aren't covered by liability insurance.

Additionally, there are optional coverages like rental car reimbursement, roadside assistance, and gap insurance, which can provide added peace of mind and financial protection in specific situations.

Choosing the Right Coverage for Your Needs

Selecting the right coverage involves a careful balance between your financial needs and your budget. It’s important to understand your state’s minimum liability requirements and ensure you meet those standards. Beyond that, consider your vehicle’s value and your ability to cover potential repairs or replacement costs.

For instance, if you have an older vehicle that's fully paid off and wouldn't be difficult to replace, you might opt for liability-only coverage, as the cost of comprehensive and collision coverage may not be justified. However, if you have a newer vehicle or a vehicle with high sentimental value, comprehensive and collision coverage would likely be a wise investment.

Similarly, consider your personal injury protection needs. If you have comprehensive health insurance coverage, you might opt for lower PIP limits or choose to waive PIP coverage altogether. On the other hand, if you don't have robust health insurance, increasing your PIP limits could provide valuable financial protection in the event of an accident.

Remember, while it’s important to save money on insurance costs, it’s equally crucial to ensure you have adequate coverage to protect yourself