Average Cost Of Health Insurance

Understanding the cost of health insurance is essential for individuals and families as it directly impacts their financial well-being and access to healthcare services. The average cost of health insurance can vary significantly based on numerous factors, making it a complex and evolving landscape. This comprehensive analysis aims to delve into the factors influencing health insurance costs, provide real-world examples, and offer insights into optimizing insurance plans to ensure affordability and adequate coverage.

Unraveling the Factors Influencing Health Insurance Costs

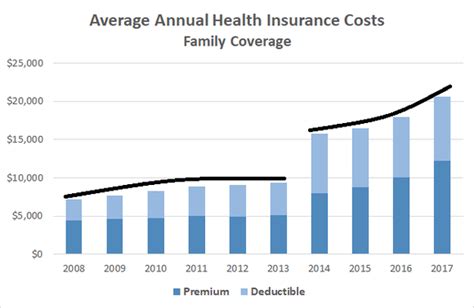

The average cost of health insurance is a multifaceted concept, shaped by a myriad of variables. These factors can be broadly categorized into personal characteristics, geographic location, plan type, and utilization of healthcare services. Personal factors include age, gender, pre-existing medical conditions, and lifestyle choices, all of which can influence insurance premiums. For instance, younger individuals generally pay lower premiums due to their lower risk of developing serious health issues, while those with pre-existing conditions may face higher costs.

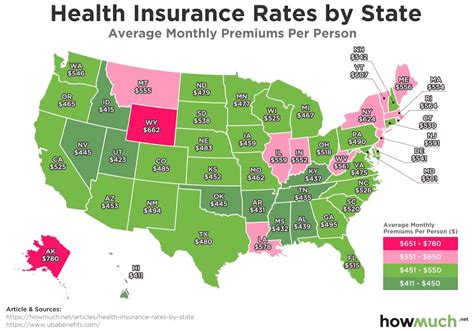

Geographic location plays a significant role as well. Healthcare costs vary across different regions, influenced by factors such as the cost of living, availability of healthcare facilities, and the overall healthcare infrastructure. Consequently, insurance premiums can differ substantially between urban and rural areas, or even between neighboring states.

The type of health insurance plan chosen is another crucial determinant of cost. Broadly, plans can be categorized into three main types: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type offers different levels of coverage and flexibility, which directly impact the premium. HMOs, for example, typically have lower premiums but more restricted provider networks, while PPOs offer more flexibility but at a higher cost.

A Case Study: The Variability of Health Insurance Costs

To illustrate the real-world application of these factors, let’s consider the case of John, a 35-year-old male living in New York City. John’s choice of insurance plan can significantly impact his annual premium. For instance, if he opts for an HMO plan with a narrow provider network and a lower premium, he might pay around 450 per month, or 5,400 annually. On the other hand, if he chooses a PPO plan with a broader network and more flexibility, his monthly premium could rise to 600, resulting in an annual cost of 7,200.

However, these costs can vary significantly depending on John's personal circumstances. If he has a pre-existing condition, such as diabetes, his premiums could increase by 20-30%, potentially adding an extra $1,080 to $1,620 to his annual costs. Additionally, if John resides in a different city or state, the cost of the same plan could differ substantially due to regional variations in healthcare costs.

Strategies for Optimizing Health Insurance Costs

Given the complexities and variations in health insurance costs, it’s crucial to employ strategies that optimize coverage while managing expenses. Here are some expert recommendations:

- Compare Plans: Don't settle for the first plan that comes your way. Compare different plans, considering factors like premium costs, deductibles, copays, and provider networks. Online platforms and insurance brokers can be valuable resources for comparing options.

- Assess Your Healthcare Needs: Evaluate your personal healthcare requirements. If you generally have minimal healthcare needs, a plan with a higher deductible and lower premium might be more cost-effective. Conversely, if you anticipate frequent medical visits, a plan with a lower deductible and higher premium could be a better fit.

- Explore Employer-Sponsored Plans: If you're employed, consider the health insurance plans offered by your employer. These plans often come with significant cost savings, as employers typically contribute to the premium costs.

- Consider Government-Sponsored Programs: For those who are eligible, government-sponsored programs like Medicare or Medicaid can provide comprehensive coverage at a reduced cost or even no cost.

- Utilize Health Savings Accounts (HSAs): If you're enrolled in a high-deductible health plan, consider opening an HSA. These accounts allow you to save money tax-free for medical expenses, providing an effective way to manage healthcare costs.

The Impact of Technology on Health Insurance Costs

Advancements in technology are playing an increasingly significant role in the health insurance landscape. Telemedicine, for instance, has become a viable alternative to traditional in-person visits, offering convenience and cost savings. Many insurance plans now cover telemedicine services, reducing the need for costly in-person appointments.

Additionally, the use of artificial intelligence (AI) and data analytics is revolutionizing the industry. Insurance companies are leveraging these technologies to more accurately predict healthcare costs and identify potential health risks, leading to more precise pricing and tailored coverage options. As a result, individuals can expect more personalized and cost-effective insurance plans in the future.

Conclusion: Navigating the Health Insurance Landscape

Understanding the average cost of health insurance is a complex but crucial task for individuals and families. By recognizing the various factors that influence insurance premiums and adopting strategies to optimize coverage and costs, individuals can make more informed decisions about their healthcare. As the healthcare industry continues to evolve, staying informed about the latest trends and advancements will be essential for navigating the health insurance landscape effectively.

What is the average cost of health insurance for an individual in the United States?

+The average cost of health insurance for an individual in the United States can vary widely based on factors such as age, location, and plan type. As of 2022, the average monthly premium for individual plans was around 452, but this can range from as low as 200 to over $1,000 depending on various factors.

How does age impact the cost of health insurance?

+Age is a significant factor in determining health insurance costs. Generally, younger individuals pay lower premiums as they are less likely to have serious health issues. However, as individuals age, their premiums tend to increase due to the higher likelihood of health complications.

Are there any government programs that can help reduce the cost of health insurance?

+Yes, there are government programs like Medicaid and the Children’s Health Insurance Program (CHIP) that provide low-cost or no-cost health coverage for eligible individuals and families. Additionally, the Affordable Care Act (ACA) offers subsidies to help reduce the cost of health insurance premiums for those who qualify.