Co Health Insurance

Health insurance is an essential aspect of modern life, providing individuals and families with financial protection and access to quality healthcare services. In the state of Colorado, known for its diverse landscapes and active lifestyle, having comprehensive health coverage is crucial. This article delves into the world of Co Health Insurance, exploring its intricacies, benefits, and how it empowers Coloradans to take control of their healthcare.

Understanding Co Health Insurance: A Comprehensive Overview

Colorado, with its vibrant communities and varied healthcare needs, offers a range of health insurance options to cater to its residents. Co Health Insurance refers to the state-specific health plans and policies designed to meet the unique requirements of Coloradans. From Denver’s bustling urban centers to the serene mountain towns, having access to adequate healthcare is a priority.

The Co Health Insurance landscape is shaped by a combination of private insurance companies, government-funded programs, and employer-sponsored plans. This diverse ecosystem ensures that individuals, families, and businesses can find coverage that aligns with their specific needs and budgets.

Key Components of Co Health Insurance:

-

Individual and Family Plans: These plans offer comprehensive coverage for individuals and their dependents, providing access to a network of healthcare providers and services. From routine check-ups to specialized treatments, these plans ensure Coloradans can prioritize their well-being.

-

Employer-Sponsored Insurance: Many Coloradans receive health insurance coverage through their employers. These plans often come with added benefits, such as dental and vision coverage, and can be tailored to meet the needs of the workforce.

-

Government Programs: Colorado participates in federal health initiatives, including Medicaid and the Children’s Health Insurance Program (CHIP). These programs provide essential healthcare coverage to eligible low-income individuals and families, ensuring that everyone has access to necessary medical services.

-

Marketplace Plans: The Colorado Health Insurance Marketplace, established under the Affordable Care Act, offers a platform for residents to compare and purchase health insurance plans. With a range of options and subsidies available, it empowers individuals to find affordable coverage.

By understanding these key components, Coloradans can navigate the complex world of health insurance and make informed decisions about their coverage.

The Benefits of Co Health Insurance

Having comprehensive Co Health Insurance brings a multitude of advantages to Coloradans. Here are some key benefits:

Financial Protection and Peace of Mind

Health insurance acts as a financial safety net, protecting individuals and families from the potentially devastating costs of medical care. With Co Health Insurance, Coloradans can access necessary treatments, medications, and procedures without worrying about overwhelming medical bills.

Whether it's a routine check-up, an unexpected emergency, or a long-term condition, having insurance provides peace of mind, knowing that healthcare expenses are covered.

Access to Quality Healthcare Services

Co Health Insurance plans typically include a network of healthcare providers, such as doctors, specialists, and hospitals, ensuring Coloradans have access to a wide range of medical services. This network allows individuals to choose from a variety of healthcare professionals, enabling them to find the right fit for their needs.

From primary care physicians to specialists in various fields, insured individuals can receive timely and expert care, promoting better health outcomes.

Preventive Care and Wellness Programs

Many Co Health Insurance plans prioritize preventive care, offering coverage for essential services such as annual check-ups, immunizations, and screenings. These preventive measures help identify potential health issues early on, allowing for timely interventions and improved long-term health.

Additionally, some plans include wellness programs and incentives, encouraging Coloradans to adopt healthier lifestyles through fitness initiatives, smoking cessation programs, and nutritional guidance.

Coverage for Specialized Treatments

Colorado’s diverse population has varying healthcare needs, including those with chronic conditions, mental health concerns, or specialized medical requirements. Co Health Insurance plans often provide coverage for these unique needs, ensuring individuals can access the specific treatments and therapies they require.

Whether it's managing a chronic illness, seeking mental health support, or undergoing specialized procedures, having insurance coverage provides the necessary financial support and access to specialized care.

Choosing the Right Co Health Insurance Plan

With a multitude of options available, selecting the right Co Health Insurance plan can be a daunting task. Here are some key considerations to help Coloradans make informed choices:

Assessing Individual Needs

Every individual and family has unique healthcare needs. It’s important to evaluate these needs, considering factors such as age, health status, family size, and any specific medical requirements. Understanding these needs will help guide the selection process.

Comparing Plan Options

Co Health Insurance plans vary in terms of coverage, network providers, and costs. It’s essential to compare different plans, considering factors such as:

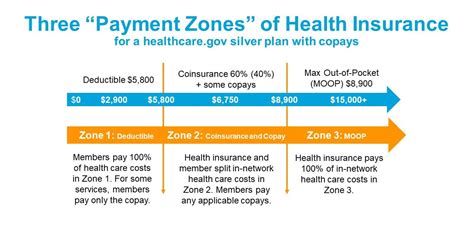

- Monthly premiums and deductibles.

- Copayments and coinsurance structures.

- Network of healthcare providers and facilities.

- Coverage limits and exclusions.

- Additional benefits like dental, vision, and prescription drug coverage.

By carefully reviewing these aspects, individuals can find a plan that aligns with their needs and budget.

Understanding Plan Types

Co Health Insurance plans come in various types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and more. Each plan type has its own network of providers and coverage rules.

HMOs, for example, typically require members to choose a primary care physician and obtain referrals for specialist visits. PPOs offer more flexibility, allowing members to visit any healthcare provider but with higher out-of-pocket costs for out-of-network care.

Understanding the differences between plan types is crucial in making an informed decision.

Exploring Subsidies and Tax Credits

For eligible individuals and families, subsidies and tax credits can significantly reduce the cost of health insurance. The Colorado Health Insurance Marketplace offers a range of financial assistance options based on income and family size.

By exploring these subsidies, Coloradans can make their health insurance more affordable and accessible.

The Future of Co Health Insurance

As the healthcare landscape continues to evolve, so too does Co Health Insurance. Here’s a glimpse into the potential future of health insurance in Colorado:

Digital Transformation

The rise of digital health technologies is revolutionizing the way healthcare is delivered and accessed. From telemedicine services to digital health records, Co Health Insurance plans are increasingly integrating these innovations to enhance convenience and efficiency.

Telemedicine, for instance, allows individuals to receive medical consultations and treatments remotely, eliminating the need for physical travel and providing access to care in remote areas.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while reducing costs. These models incentivize healthcare providers to prioritize patient outcomes and satisfaction, rather than simply providing services. Co Health Insurance plans may increasingly adopt these models, ensuring better care coordination and improved health outcomes.

Expanded Coverage for Mental Health

Recognizing the importance of mental health, there is a growing emphasis on expanding coverage for mental health services. Co Health Insurance plans may continue to enhance their mental health benefits, ensuring Coloradans have access to necessary support and treatment options.

From therapy sessions to medication management, increased coverage for mental health can significantly improve the overall well-being of Coloradans.

Innovative Wellness Initiatives

Health insurance providers are increasingly focusing on preventive care and wellness initiatives. Co Health Insurance plans may introduce innovative programs and incentives to encourage healthy lifestyles, such as fitness challenges, nutrition education, and stress management resources.

By promoting overall wellness, these initiatives can help prevent chronic conditions and improve the long-term health of Coloradans.

Conclusion

Co Health Insurance is more than just a necessity; it’s a cornerstone of a healthy and vibrant Colorado community. By providing financial protection, access to quality healthcare, and support for specialized needs, health insurance empowers Coloradans to lead fulfilling lives.

As the healthcare landscape continues to evolve, so too will the options and benefits of Co Health Insurance. With a range of plans, subsidies, and innovative initiatives, Coloradans can find the coverage they need to prioritize their health and well-being.

How do I find the best Co Health Insurance plan for my family?

+To find the best Co Health Insurance plan for your family, start by assessing your specific needs. Consider factors such as age, health status, and any specialized requirements. Compare different plan options, including premiums, deductibles, and coverage limits. Seek advice from insurance professionals and explore the Colorado Health Insurance Marketplace for additional guidance.

What are some common types of Co Health Insurance plans available in Colorado?

+Colorado offers a range of health insurance plan types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and more. Each plan type has its own network of providers and coverage rules. It’s important to understand the differences to make an informed choice.

Are there any financial assistance programs available for Co Health Insurance?

+Yes, there are financial assistance programs available for Co Health Insurance. The Colorado Health Insurance Marketplace offers subsidies and tax credits based on income and family size. These programs can significantly reduce the cost of health insurance, making it more affordable for eligible individuals and families.

How can I stay updated on the latest developments in Co Health Insurance?

+To stay updated on Co Health Insurance developments, follow reputable healthcare news sources, subscribe to industry newsletters, and keep an eye on official government websites and announcements. Additionally, connecting with insurance professionals and healthcare providers can provide valuable insights into emerging trends and changes.