Automobile Insurance Quotes Comparison

In the realm of personal finance and vehicle ownership, automobile insurance stands as a critical consideration. It safeguards against financial losses and legal liabilities that can arise from traffic accidents, theft, or other vehicular mishaps. With a myriad of insurance providers and policies available, the process of choosing the right coverage and securing the most competitive rates can be daunting. This comprehensive guide delves into the intricacies of automobile insurance, offering insights, tips, and real-world examples to empower you in your pursuit of the ideal coverage and the best quotes.

Understanding Automobile Insurance

Automobile insurance, also known as car insurance or auto insurance, is a contract between you and an insurance provider. It provides financial protection against physical damage, bodily injury, and other potential liabilities arising from using your vehicle. The specific terms of coverage can vary widely based on the policy and the insurance company.

The primary purpose of automobile insurance is to provide a financial safety net. It ensures that, should you be involved in an accident, you and other parties involved have the means to cover the costs of repairs, medical expenses, and legal fees. Additionally, insurance can offer protection against theft, vandalism, and other forms of non-accident-related damage.

Automobile insurance policies typically consist of several components, each covering a specific aspect of potential losses. These components can include:

- Liability Coverage: This covers bodily injury and property damage for which you are held responsible in an accident.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Provides coverage for medical expenses, loss of income, and other related costs for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who doesn't have insurance or sufficient coverage.

The specific coverage options and their limits will depend on your insurance provider and the state you reside in, as each state has its own minimum insurance requirements.

Factors Influencing Insurance Quotes

The cost of automobile insurance, often referred to as the premium, can vary significantly based on numerous factors. Understanding these factors is key to getting the best quote for your specific needs.

Personal Factors

Your personal circumstances and driving history play a significant role in determining your insurance premium. Here are some key personal factors that insurance providers consider:

- Age: Younger drivers, especially those under 25, often pay higher premiums due to their perceived higher risk on the road.

- Gender: Historically, insurance rates were influenced by gender, with males often paying more. However, with changes in regulations, this factor is becoming less significant.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or violations may result in higher rates.

- Credit Score: In many states, insurance providers are allowed to use your credit score as a factor in determining your premium. A higher credit score may lead to lower insurance rates.

- Marital Status: Married individuals often receive a discount on their insurance premiums, as they are generally perceived as lower-risk drivers.

Vehicle Factors

The type of vehicle you drive and how you use it can also impact your insurance rates. Here are some vehicle-related factors to consider:

- Make and Model: Some vehicles are more expensive to insure due to their higher repair costs or their propensity for theft.

- Vehicle Age: Older vehicles may be cheaper to insure as they typically have lower repair costs.

- Vehicle Usage: The more you drive, the higher the risk of an accident, which can lead to higher premiums. Additionally, using your vehicle for business purposes may result in higher rates.

- Safety Features: Vehicles equipped with advanced safety features like lane departure warnings or automatic braking systems may qualify for insurance discounts.

Location Factors

Your geographic location can significantly influence your insurance rates. Here’s how:

- State Laws: Each state has its own minimum insurance requirements, which can impact the cost of your policy.

- Local Crime Rates: Areas with higher crime rates, especially those with higher rates of vehicle theft, may have higher insurance premiums.

- Weather Conditions: Regions prone to severe weather events like hurricanes or tornadoes may have higher insurance rates due to the increased risk of damage.

Insurance Provider Factors

Insurance providers themselves also play a role in determining your premium. Here are some considerations:

- Company Reputation: Established insurance companies with a strong reputation for customer service and financial stability may command higher premiums.

- Discounts and Promotions: Some insurance providers offer discounts for a variety of reasons, such as multi-policy discounts (insuring multiple vehicles or combining auto and home insurance), good student discounts, or safe driver discounts.

- Coverage Options: Different providers offer different coverage options and limits. It's essential to compare these to ensure you're getting the right coverage for your needs.

Comparing Automobile Insurance Quotes

With a better understanding of the factors that influence insurance quotes, you’re now equipped to begin the process of comparing quotes from different providers. Here’s a step-by-step guide to help you navigate this process effectively.

Step 1: Determine Your Coverage Needs

Before requesting quotes, it’s crucial to understand your specific coverage needs. Consider the following:

- What type of coverage do you require (liability only, comprehensive, etc.)? Do you need additional coverage like rental car reimbursement or roadside assistance?

- What are the minimum insurance requirements in your state? Ensure you meet these legal requirements.

- Are there any discounts you may be eligible for? For example, some providers offer discounts for safe driving records, multiple vehicles insured, or membership in certain organizations.

Step 2: Research Insurance Providers

There are numerous insurance providers to choose from, each with its own reputation, financial stability, and coverage options. Here’s how to research them effectively:

- Check online reviews and ratings from trusted sources to get an idea of each provider's customer service and claim handling.

- Examine the financial strength ratings of the providers. Companies with higher ratings are generally more financially stable and may be better equipped to pay out claims.

- Explore the specific coverage options and limits offered by each provider. Ensure they align with your determined needs.

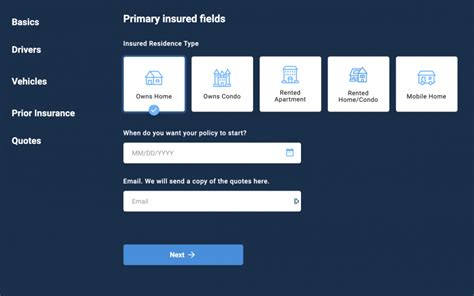

Step 3: Gather Quotes

Once you’ve narrowed down your list of potential insurance providers, it’s time to start gathering quotes. Here’s how to do it efficiently:

- Use online quote comparison tools. These can provide a quick and easy way to compare rates from multiple providers.

- Contact insurance providers directly. Many providers offer online quote forms or phone support to provide personalized quotes.

- Be sure to provide consistent information to each provider to ensure an accurate comparison.

Step 4: Analyze and Compare Quotes

With your quotes in hand, it’s time to analyze and compare them. Here are some key considerations:

- Compare the cost of the policies. While cost is an important factor, it shouldn't be the only consideration. Ensure the policy provides adequate coverage for your needs.

- Examine the coverage limits and deductibles. Higher deductibles can lower your premium, but they also mean you'll pay more out of pocket in the event of a claim.

- Look at the specific coverage options included in each policy. Ensure they align with your determined needs and preferences.

- Consider the reputation and financial stability of the insurance provider. A reputable provider with a strong financial standing can provide peace of mind.

Step 5: Make Your Decision

After analyzing and comparing your quotes, it’s time to make a decision. Choose the policy that best meets your coverage needs at a competitive price. Remember, the cheapest policy may not always be the best option if it doesn’t provide adequate coverage.

Managing Your Automobile Insurance Policy

Once you’ve selected your automobile insurance policy, it’s important to manage it effectively to ensure you’re getting the best value. Here are some tips for managing your policy:

- Review Your Policy Annually: Insurance rates can change, and your personal circumstances may evolve. Review your policy annually to ensure it still meets your needs and to look for potential cost savings.

- Keep a Clean Driving Record: A clean driving record can lead to insurance discounts. Avoid accidents and traffic violations to maintain a good record.

- Consider Bundling Policies: Many insurance providers offer discounts when you bundle multiple policies (e.g., auto and home insurance) with them.

- Explore Usage-Based Insurance: Some providers offer usage-based insurance, where your premium is based on how and when you drive. This can be a great option for low-mileage drivers.

Conclusion

Securing the best automobile insurance quote involves a comprehensive understanding of your coverage needs, the factors that influence quotes, and an effective comparison process. By following the steps outlined in this guide, you can navigate the world of automobile insurance with confidence, ensuring you get the right coverage at the right price.

Frequently Asked Questions

What is the average cost of automobile insurance in the United States?

+

The average cost of automobile insurance varies widely depending on several factors, including the insured’s age, gender, driving history, vehicle type, and geographic location. According to recent data, the national average cost of auto insurance is approximately 1,674 per year. However, this average can range from as low as 500 to over $3,000 depending on individual circumstances.

How can I lower my automobile insurance premium?

+

There are several strategies to lower your automobile insurance premium. These include maintaining a clean driving record, increasing your deductible, bundling policies with the same insurer, exploring usage-based insurance options, and shopping around for the best rates. Additionally, certain safety features in your vehicle, such as anti-theft devices or advanced driver assistance systems, may qualify you for insurance discounts.

What are the consequences of not having automobile insurance?

+

Driving without automobile insurance is illegal in most states and can result in severe consequences. If caught, you may face fines, license suspension, and even jail time. Additionally, if you’re involved in an accident without insurance, you’ll be personally responsible for all the resulting damages, which can be financially devastating.

Can I switch automobile insurance providers mid-policy term?

+

Yes, you can switch automobile insurance providers at any time, even mid-policy term. However, it’s important to ensure that your new policy is active before canceling your existing policy to avoid any lapses in coverage. When switching, compare quotes from multiple providers to find the best coverage and rates for your needs.