Auto Owners Life Insurance

Auto Owners Life Insurance, a well-established name in the insurance industry, has a rich history and a comprehensive range of insurance products. With a focus on providing financial security and peace of mind to its policyholders, Auto Owners has been a trusted partner for individuals and families for decades. In this in-depth exploration, we delve into the world of Auto Owners Life Insurance, uncovering its unique features, offerings, and the impact it has on the lives of its customers.

A Legacy of Trust: The Story of Auto Owners Life Insurance

Auto Owners Life Insurance Company was founded in 1916 in Lansing, Michigan, by a group of visionary entrepreneurs. From its early beginnings, the company set out to revolutionize the insurance landscape by offering innovative products and exceptional customer service. Over the past century, Auto Owners has grown into a prominent player in the industry, expanding its reach across the United States and gaining a reputation for reliability and integrity.

The company's mission has always been centered around empowering individuals to protect their financial well-being and that of their loved ones. Through a comprehensive suite of insurance products, Auto Owners strives to provide a safety net for its policyholders, ensuring they can face life's uncertainties with confidence.

One of the key strengths of Auto Owners Life Insurance lies in its adaptability and responsiveness to the evolving needs of its customers. Over the years, the company has continuously updated and expanded its product offerings, keeping pace with the changing dynamics of the insurance market and the diverse requirements of its policyholders.

A Comprehensive Suite of Insurance Products

Auto Owners Life Insurance offers a wide array of insurance products tailored to meet the diverse needs of its customers. From traditional life insurance policies to specialized coverage, the company ensures that individuals can find the right solution to secure their financial future.

Term Life Insurance

Term life insurance is a cornerstone of Auto Owners’ offerings. With flexible terms ranging from 10 to 30 years, policyholders can choose coverage that aligns with their specific needs and life stage. This type of insurance provides affordable protection for a defined period, ensuring that beneficiaries receive a death benefit if the policyholder passes away during the term.

Auto Owners' term life insurance policies offer additional benefits such as convertible options, allowing policyholders to transition to permanent life insurance as their needs change. The company also provides accelerated benefit riders, enabling policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness.

| Term Length | Renewal Options | Death Benefit |

|---|---|---|

| 10, 20, or 30 years | Convertible to permanent insurance | Up to $10 million |

Permanent Life Insurance

For long-term financial protection, Auto Owners offers permanent life insurance policies, including whole life and universal life insurance. These policies provide lifelong coverage, ensuring that beneficiaries receive a guaranteed death benefit, regardless of when the policyholder passes away.

Whole life insurance from Auto Owners offers fixed premiums and a guaranteed cash value accumulation over time. This type of insurance provides a stable financial foundation and can be a valuable tool for estate planning and wealth transfer.

Universal life insurance, on the other hand, offers more flexibility in terms of premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefits based on their changing needs, making it an ideal option for those seeking customizable coverage.

| Policy Type | Premium Flexibility | Death Benefit |

|---|---|---|

| Whole Life | Fixed premiums | Guaranteed, level death benefit |

| Universal Life | Flexible premiums and death benefit | Adjustable based on policyholder's needs |

Additional Coverage Options

Auto Owners Life Insurance goes beyond traditional life insurance policies by offering a range of additional coverage options to enhance financial protection.

- Accidental Death Benefit: Provides an additional death benefit if the policyholder passes away due to an accident.

- Waiver of Premium: Allows policyholders to suspend premium payments if they become disabled, ensuring continuous coverage.

- Long-Term Care Riders: Offers coverage for long-term care expenses, providing financial support for policyholders facing extended care needs.

- Child Riders: Provides life insurance coverage for the policyholder's children, offering peace of mind for the entire family.

The Benefits of Choosing Auto Owners Life Insurance

Selecting Auto Owners Life Insurance as your trusted partner comes with a multitude of benefits. Here’s a closer look at some of the advantages policyholders can expect:

Financial Security and Peace of Mind

At its core, Auto Owners Life Insurance aims to provide financial security and peace of mind to its policyholders. By offering a comprehensive range of insurance products, the company ensures that individuals can tailor their coverage to their unique needs, protecting their loved ones and securing their financial future.

Exceptional Customer Service

Auto Owners prides itself on its commitment to exceptional customer service. The company understands that insurance can be complex, and its dedicated team of professionals is always ready to provide personalized guidance and support. Whether it’s helping policyholders choose the right coverage or assisting with claims, Auto Owners strives to make the insurance experience as seamless and stress-free as possible.

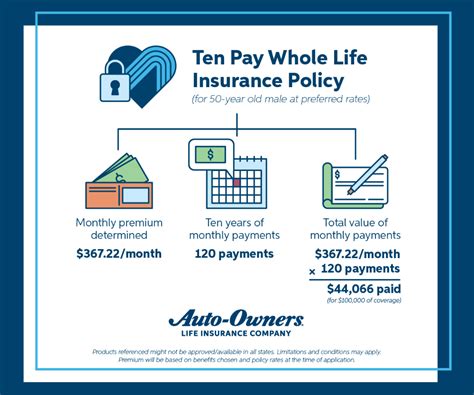

Competitive Pricing and Flexibility

Auto Owners Life Insurance is known for its competitive pricing and flexible payment options. The company offers a range of payment plans, allowing policyholders to choose the one that best suits their financial situation. Whether it’s monthly, quarterly, or annual payments, Auto Owners aims to make insurance accessible and affordable for all.

Financial Strength and Stability

With a century of experience in the insurance industry, Auto Owners has built a solid foundation of financial strength and stability. The company has consistently maintained a strong financial rating, ensuring that policyholders can trust that their investments are secure. Auto Owners’ commitment to financial stability provides peace of mind, knowing that their coverage will be there when they need it most.

Real-Life Impact: Stories of Policyholders

Auto Owners Life Insurance has had a profound impact on the lives of its policyholders. Through their stories, we can understand the true value and significance of the company’s offerings.

"Auto Owners Life Insurance has been a lifeline for my family. When my husband passed away suddenly, the life insurance policy he had with Auto Owners provided the financial support we needed to navigate the difficult times ahead. The death benefit ensured that our children's education was secure, and we were able to maintain our standard of living. I am forever grateful for the peace of mind Auto Owners has given us." - Sarah, Policyholder

"As a small business owner, I understand the importance of financial security. Auto Owners' life insurance policies have given me the confidence to focus on growing my business without worrying about the unexpected. The flexibility of their permanent life insurance plans allows me to build cash value over time, providing a solid foundation for my retirement and ensuring that my family is taken care of." - John, Policyholder and Business Owner

Future Outlook: Auto Owners’ Continuous Innovation

As the insurance industry continues to evolve, Auto Owners Life Insurance remains committed to staying at the forefront of innovation. The company recognizes the changing needs of its customers and strives to adapt its offerings accordingly.

Auto Owners is actively exploring new technologies and digital solutions to enhance the customer experience. From streamlined online policy management to innovative claims processing, the company aims to leverage technology to make insurance more accessible and convenient.

Additionally, Auto Owners is dedicated to expanding its product portfolio to meet the diverse needs of its customers. By staying abreast of industry trends and customer feedback, the company is well-positioned to introduce new coverage options and enhance existing products, ensuring that policyholders have access to the most up-to-date and comprehensive protection.

Conclusion: A Trusted Partner for Life

Auto Owners Life Insurance has earned its reputation as a trusted partner for individuals and families across the United States. With a rich history of providing financial security and peace of mind, the company continues to innovate and adapt to meet the evolving needs of its customers.

From its comprehensive suite of insurance products to its exceptional customer service, Auto Owners Life Insurance stands as a testament to the power of insurance in protecting what matters most. Whether it's term life insurance for temporary coverage or permanent life insurance for lifelong protection, Auto Owners has the expertise and dedication to guide policyholders towards a secure financial future.

What is the average cost of life insurance from Auto Owners?

+

The cost of life insurance from Auto Owners can vary based on factors such as age, health, and the type of policy. On average, term life insurance policies from Auto Owners range from 20 to 50 per month for a 500,000 death benefit. Permanent life insurance policies, such as whole life or universal life, can have higher premiums, typically ranging from 100 to $300 per month for a similar death benefit. It’s important to note that these are rough estimates, and actual costs may differ based on individual circumstances.

How long does it take to receive a death benefit from Auto Owners Life Insurance?

+

Auto Owners Life Insurance aims to process death benefit claims promptly. In most cases, once all the necessary documentation is received, the death benefit can be paid out within 10-14 business days. However, the timeframe may vary depending on the complexity of the claim and any additional requirements needed for verification.

Can I convert my Auto Owners term life insurance policy to a permanent policy?

+

Yes, Auto Owners offers the option to convert your term life insurance policy to a permanent policy, such as whole life or universal life insurance. This provides flexibility for policyholders who may wish to transition from temporary to permanent coverage. The conversion process typically needs to be initiated before the term policy expires, and the new permanent policy will have its own terms and conditions.

What additional benefits does Auto Owners Life Insurance offer besides life coverage?

+

Auto Owners Life Insurance offers a range of additional benefits to enhance financial protection. These include accidental death benefit riders, which provide an additional death benefit if the policyholder passes away due to an accident. Waiver of premium riders allow policyholders to suspend premium payments if they become disabled. Long-term care riders offer coverage for long-term care expenses, and child riders provide life insurance coverage for the policyholder’s children.

How can I get a quote for Auto Owners Life Insurance?

+

To get a quote for Auto Owners Life Insurance, you can visit their official website or contact an authorized agent. On the website, you can often find an online quote tool that allows you to provide basic information about yourself and your coverage needs. Alternatively, an agent can provide personalized guidance and assist you in choosing the right policy based on your specific circumstances.