Auto Liability Insurance Coverage

Auto liability insurance is an essential component of vehicle ownership, providing crucial financial protection for drivers and their vehicles. This coverage safeguards individuals from potential legal and financial consequences arising from accidents or incidents involving their automobiles. Understanding the intricacies of auto liability insurance is vital for every driver to ensure adequate protection and peace of mind while navigating the roads.

Understanding Auto Liability Insurance

Auto liability insurance, a critical aspect of vehicle ownership, offers protection against legal and financial liabilities arising from automobile-related incidents. This coverage is designed to safeguard drivers and vehicle owners from potential financial burdens and legal repercussions in the event of accidents or other mishaps. By understanding the different facets of auto liability insurance, drivers can make informed decisions to secure adequate protection for themselves and their vehicles.

The Importance of Auto Liability Coverage

Auto liability insurance is a legal requirement in most jurisdictions, ensuring that drivers can meet their financial obligations in the event of an accident. It provides a safety net, covering the costs of bodily injury, property damage, and other expenses that may arise from an accident. This coverage is particularly crucial in situations where the insured driver is at fault, as it helps mitigate the financial impact on both the driver and the affected parties.

For instance, imagine a scenario where a driver causes an accident resulting in significant injuries to another person and substantial damage to their vehicle. Without adequate auto liability insurance, the driver may face overwhelming medical bills, property damage claims, and potential legal fees. Auto liability coverage steps in to provide the necessary financial support, covering these expenses and protecting the driver from devastating financial consequences.

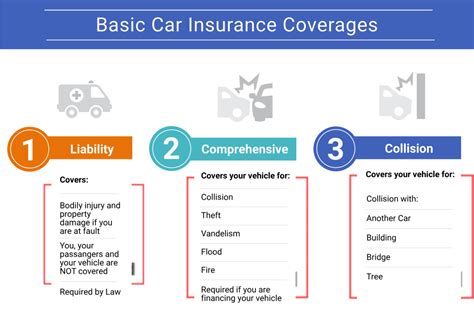

Types of Auto Liability Insurance

Auto liability insurance can be categorized into two main types: Bodily Injury Liability and Property Damage Liability. Bodily Injury Liability coverage pays for medical expenses, lost wages, and other costs incurred by individuals injured in an accident caused by the insured driver. On the other hand, Property Damage Liability coverage addresses the repair or replacement costs of damaged property, such as vehicles, structures, or other assets.

Consider a situation where a driver accidentally collides with a parked car, causing extensive damage. Without Property Damage Liability coverage, the driver would be responsible for covering the repair costs out of pocket, which could be financially burdensome. However, with this type of liability insurance, the insurance provider would step in to handle the necessary repairs, ensuring that the driver is not left with a hefty financial burden.

| Liability Type | Coverage |

|---|---|

| Bodily Injury Liability | Covers medical expenses and other costs for injured individuals. |

| Property Damage Liability | Pays for the repair or replacement of damaged property. |

Factors Influencing Auto Liability Insurance Rates

The cost of auto liability insurance is influenced by a variety of factors, each playing a crucial role in determining the premium amount. These factors include the driver’s age, gender, and driving record, as well as the make and model of the vehicle, the location where it is primarily driven, and the chosen coverage limits.

Driver-Related Factors

One of the primary considerations in auto liability insurance rates is the driver’s profile. Insurance providers assess factors such as age, gender, and driving history to evaluate the risk associated with insuring a particular individual. Younger drivers, especially those under the age of 25, often face higher premiums due to their relatively limited driving experience and higher propensity for accidents. Similarly, male drivers may be charged slightly higher premiums based on statistical trends showing higher accident rates among this demographic.

Additionally, an individual's driving record plays a significant role in determining insurance rates. Drivers with a clean record, free from accidents or moving violations, are typically offered more favorable premiums. Conversely, those with a history of accidents or traffic violations may face higher insurance costs, as they are considered a higher risk to insure.

Vehicle-Related Factors

The make and model of the vehicle being insured also influence auto liability insurance rates. Vehicles with higher repair costs or those that are more susceptible to theft may result in increased premiums. Additionally, the primary location where the vehicle is driven can impact insurance rates. Areas with higher accident rates or a higher prevalence of theft may lead to higher insurance costs.

Coverage Limits

The chosen coverage limits significantly affect the cost of auto liability insurance. Higher coverage limits, which provide more extensive protection, generally result in higher premiums. It is important for drivers to carefully consider their coverage needs and financial capabilities when selecting coverage limits to ensure they have adequate protection without incurring excessive costs.

| Factor | Impact on Rates |

|---|---|

| Driver's Age, Gender, and Driving Record | Influences risk assessment and premium amounts. |

| Vehicle Make, Model, and Location | Affects repair costs, theft risks, and accident rates. |

| Coverage Limits | Higher limits typically result in higher premiums. |

Benefits and Considerations of Auto Liability Insurance

Auto liability insurance offers a range of benefits and considerations that drivers should carefully evaluate to ensure they make informed decisions regarding their coverage. Understanding these aspects is crucial for selecting the right insurance plan that provides adequate protection without unnecessary financial burden.

Benefits of Auto Liability Insurance

Auto liability insurance provides a crucial safety net for drivers, offering protection against financial losses and legal liabilities arising from accidents. This coverage ensures that drivers can meet their obligations to injured parties and damaged property, mitigating the potential for devastating financial consequences.

For example, consider a scenario where a driver causes an accident resulting in significant injuries to another person and substantial damage to their vehicle. Without auto liability insurance, the driver would be solely responsible for covering these expenses, which could easily exceed their financial capabilities. However, with adequate liability coverage, the insurance provider steps in to handle these costs, providing the driver with much-needed financial relief and protection.

Considerations for Choosing Auto Liability Insurance

When selecting auto liability insurance, drivers should carefully consider their unique circumstances and needs. Factors such as the driver’s age, gender, and driving record, as well as the make and model of the vehicle and the primary driving location, should be taken into account. Additionally, drivers should evaluate their financial capabilities and choose coverage limits that provide adequate protection without straining their budget.

It is also important to consider the reputation and financial stability of the insurance provider. Opting for a reputable provider with a strong financial standing ensures that the insurance company will be able to honor its commitments and provide reliable coverage in the event of an accident. Drivers should research and compare different insurance providers to find the one that best suits their needs and offers the most favorable terms.

Potential Challenges and Limitations

While auto liability insurance provides valuable protection, it is important to be aware of certain challenges and limitations. One potential challenge is the cost of insurance, especially for younger or higher-risk drivers. Insurance providers assess various factors, such as age, driving record, and vehicle type, to determine insurance rates, and individuals with higher risk profiles may face higher premiums.

Another limitation to consider is the coverage limits. While auto liability insurance provides financial protection, it is important to note that the coverage limits may not always cover the full extent of damages in certain situations. For example, if an accident results in extremely high medical expenses or extensive property damage, the insured driver may still be responsible for covering the excess costs beyond their coverage limits.

| Benefits | Considerations |

|---|---|

| Financial protection against accidents and legal liabilities. | Choose coverage limits carefully based on financial capabilities. |

| Protection for injured parties and damaged property. | Consider reputation and financial stability of insurance provider. |

| Reliable safety net for drivers. | Research and compare insurance providers for favorable terms. |

The Future of Auto Liability Insurance

The landscape of auto liability insurance is continually evolving, driven by advancements in technology, changing regulatory environments, and shifting consumer expectations. As the automotive industry undergoes significant transformations, the future of auto liability insurance is poised to adapt and innovate to meet these new challenges and opportunities.

Technological Innovations

The integration of advanced technologies, such as autonomous driving systems and connected vehicle technologies, is set to revolutionize the automotive industry. These innovations have the potential to significantly reduce the number of accidents and traffic violations, leading to a decrease in liability insurance claims. As a result, insurance providers may need to adjust their risk assessment models and pricing structures to accommodate these technological advancements.

For instance, with the widespread adoption of autonomous driving technologies, vehicles equipped with these systems may experience fewer accidents, resulting in lower liability insurance claims. This shift could lead to a reevaluation of insurance premiums, potentially lowering costs for drivers who opt for autonomous vehicles.

Regulatory Changes

The regulatory environment surrounding auto liability insurance is subject to continuous change, influenced by factors such as political shifts, economic trends, and societal expectations. These changes can have a significant impact on the coverage and pricing of auto liability insurance policies. Insurance providers must stay abreast of these regulatory developments to ensure compliance and adapt their offerings accordingly.

For example, if new regulations mandate stricter liability standards for certain types of accidents or increase the minimum coverage requirements, insurance providers may need to adjust their policies to comply with these changes. This could result in revised pricing structures and coverage options to meet the new regulatory standards.

Consumer Expectations and Preferences

Consumer expectations and preferences are evolving rapidly, driven by increasing access to information and a heightened focus on personalized experiences. In the context of auto liability insurance, consumers are seeking more tailored coverage options, convenient digital interactions, and transparent pricing structures. Insurance providers must respond to these changing expectations by offering innovative products and services that meet the evolving needs of their customers.

One way insurance providers can meet these expectations is by offering usage-based insurance policies, where premiums are determined based on an individual's actual driving behavior and mileage. This approach provides consumers with greater control over their insurance costs and aligns coverage with their specific driving patterns.

| Technological Innovations | Regulatory Changes | Consumer Expectations |

|---|---|---|

| Autonomous driving systems and connected vehicle technologies. | Shifts in political, economic, and societal landscapes. | Demand for tailored coverage, digital interactions, and transparent pricing. |

FAQs

What is the minimum required auto liability insurance coverage in my state?

+The minimum required auto liability insurance coverage varies by state. It is essential to consult your state’s insurance regulations to understand the specific requirements. Generally, most states mandate coverage for bodily injury liability and property damage liability, with minimum coverage limits that may differ.

How can I lower my auto liability insurance premiums?

+There are several strategies to lower your auto liability insurance premiums. These include maintaining a clean driving record, comparing quotes from multiple insurance providers, considering higher deductibles, and exploring discounts for safe driving or vehicle safety features.

Does auto liability insurance cover my vehicle if I cause an accident?

+Auto liability insurance primarily covers the other parties involved in an accident caused by the insured driver. It provides financial protection for bodily injury and property damage claims made against the insured. However, it does not cover damage to the insured vehicle unless additional coverage, such as collision insurance, is included in the policy.

What happens if I am involved in an accident and my auto liability insurance coverage is insufficient?

+If you are involved in an accident and your auto liability insurance coverage is insufficient to cover the damages, you may be held personally liable for the excess costs. It is crucial to carefully assess your coverage limits and financial capabilities to ensure you have adequate protection. Consider increasing your coverage limits or exploring additional insurance options to mitigate this risk.