Auto Insurance Quote Ca

Auto insurance is a critical aspect of vehicle ownership, providing financial protection and peace of mind for drivers across Canada. In the diverse landscape of Canadian provinces, the requirements and rates for auto insurance can vary significantly. This comprehensive guide aims to delve into the specifics of auto insurance quotes in the province of Ontario, offering an in-depth analysis of the factors that influence these quotes and providing valuable insights for drivers navigating the complex world of insurance.

Understanding Auto Insurance Quotes in Ontario

In Ontario, auto insurance is a mandatory requirement for all drivers, and the quotes are influenced by a myriad of factors. These factors can be broadly categorized into personal characteristics, vehicle-related factors, and driving behavior. Let’s explore each of these categories in detail to understand how they impact insurance quotes.

Personal Characteristics

Your personal details play a significant role in determining your auto insurance quote. Insurance providers consider factors such as age, gender, marital status, and occupation. Younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, certain occupations with higher mileage or specific job risks may attract different insurance rates.

For instance, a young, single male driver in downtown Toronto might face a different quote than a middle-aged, married female driver in a suburban area. The former, due to their demographic and location, is considered a higher risk, leading to a potentially higher insurance premium.

| Personal Factor | Impact on Quote |

|---|---|

| Age | Higher rates for younger drivers |

| Gender | Differences in premiums based on statistical risk profiles |

| Marital Status | Married individuals may receive discounts |

| Occupation | High-risk occupations may result in higher premiums |

Vehicle-Related Factors

The type of vehicle you drive is another crucial aspect that affects your insurance quote. Insurance providers consider factors such as the make, model, year, and value of your vehicle. High-performance cars, luxury vehicles, and SUVs often attract higher premiums due to their repair costs and potential for higher accident risks.

Additionally, the safety features of your vehicle can influence your quote positively. Advanced safety technologies like collision avoidance systems, lane departure warnings, and automatic emergency braking can reduce your insurance premium. For instance, a 2022 Toyota Prius with advanced driver-assistance systems may attract a lower premium compared to a similar-year Honda Civic without these features.

Driving Behavior

Your driving behavior is a key determinant of your auto insurance quote. Insurance providers use driving records to assess your risk profile. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents, speeding tickets, or other violations may result in higher insurance rates.

Moreover, the number of kilometers driven annually is another critical factor. High-mileage drivers are generally considered higher risks and may face increased premiums. For example, a salesperson who drives over 50,000 km annually for work might pay more for insurance compared to a retiree who only drives locally.

Impact of Ontario’s Insurance Market

The auto insurance landscape in Ontario is unique, with a mix of private and public insurance providers. The Financial Services Regulatory Authority (FSRA) regulates the insurance industry in the province, ensuring compliance and consumer protection. This regulatory body plays a vital role in maintaining the stability and fairness of the insurance market.

The competitive nature of Ontario's insurance market often leads to varied insurance rates between providers. This means that shopping around and comparing quotes from multiple insurers can be beneficial. Factors like the insurer's claim settlement history, customer service reputation, and additional perks (such as accident forgiveness or roadside assistance) should also be considered when choosing an insurance provider.

Impact of No-Fault Insurance

Ontario operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, your own insurance policy covers your injuries and vehicle damages. This system aims to simplify the claims process and reduce litigation. However, it also means that the cost of insurance in Ontario can be higher compared to provinces with fault-based systems.

The no-fault system in Ontario has led to the development of a robust accident benefits coverage that provides extensive medical and rehabilitation benefits to policyholders. This coverage, while comprehensive, contributes to the overall cost of insurance premiums in the province.

Tips for Obtaining the Best Auto Insurance Quote

Navigating the world of auto insurance quotes in Ontario can be complex, but there are strategies to ensure you obtain the best possible quote for your circumstances.

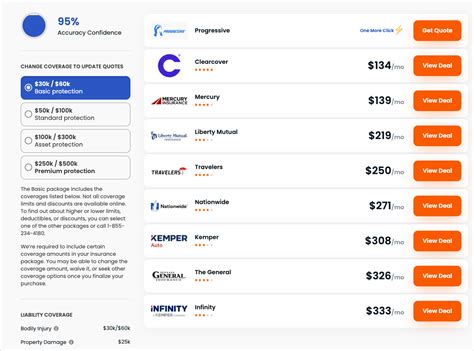

Shop Around and Compare

As mentioned earlier, the competitive nature of Ontario’s insurance market means that quotes can vary significantly between providers. Take the time to obtain quotes from multiple insurers to ensure you’re getting the most competitive rate. Online comparison tools can be a convenient way to do this.

Understand Your Coverage Needs

Different drivers have different insurance needs. Assess your specific coverage requirements based on your vehicle, driving habits, and personal circumstances. For instance, if you have an older vehicle, you may opt for liability-only coverage instead of comprehensive coverage, which would be more suitable for a newer, high-value car.

Explore Discounts and Bundling Options

Insurance providers often offer discounts for various reasons. These can include discounts for safe driving records, taking defensive driving courses, insuring multiple vehicles under one policy, or bundling your auto insurance with other policies like home insurance.

Bundling your auto insurance with other policies can lead to significant savings. For example, by combining your auto insurance with your home insurance policy, you may qualify for a multi-policy discount, reducing the overall cost of your insurance premiums.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to reduce your auto insurance premium. Avoid traffic violations and accidents, as these can significantly increase your insurance rates. Additionally, consider taking a defensive driving course, as many insurers offer discounts for completing these courses.

Consider Telematics Insurance

Telematics insurance, also known as usage-based insurance, uses a device installed in your vehicle or an app on your smartphone to track your driving behavior. This type of insurance can be beneficial for safe drivers who want to prove their low-risk driving habits. By demonstrating safe driving practices, you may be eligible for significant discounts on your insurance premium.

The Future of Auto Insurance in Ontario

The auto insurance landscape in Ontario is continually evolving, influenced by technological advancements, regulatory changes, and consumer expectations. The rise of autonomous vehicles and electric cars is expected to bring about significant changes in the insurance industry. As these technologies become more prevalent, insurance providers will need to adapt their policies and pricing structures to accommodate these new vehicle types.

Additionally, the digitization of insurance is expected to continue, with online insurance platforms and comparison websites becoming even more sophisticated. This will provide consumers with greater transparency and control over their insurance choices. The future of auto insurance in Ontario is likely to be characterized by increased personalization, with insurance policies tailored to individual driving habits and vehicle usage patterns.

Regulatory Changes and Consumer Protection

The FSRA’s role in regulating the insurance industry will remain crucial in maintaining a fair and competitive market. As the insurance landscape evolves, the FSRA will need to adapt its policies and guidelines to ensure that consumers are protected and that the market remains stable. This may involve introducing new regulations to address emerging issues, such as those related to autonomous vehicles or data privacy.

Furthermore, the FSRA's focus on consumer education and empowerment will continue to be vital. Providing consumers with the knowledge and tools to make informed insurance decisions will help ensure that they are getting the best value for their insurance premiums. This includes educating consumers about their rights, the claims process, and the various coverage options available to them.

Impact of Technological Advancements

The integration of technology into the insurance industry is expected to bring about significant changes in how insurance is priced and delivered. Telematics, as mentioned earlier, is already revolutionizing the industry by providing insurers with real-time data on driving behavior. This data-driven approach to insurance allows for more accurate risk assessment and personalized pricing, benefiting both insurers and consumers.

Moreover, the use of artificial intelligence (AI) and machine learning is expected to grow in the insurance sector. These technologies can analyze vast amounts of data, including driving behavior, weather conditions, and traffic patterns, to predict and mitigate risks more effectively. This can lead to more efficient claims processing and potentially lower insurance premiums for consumers.

Consumer Expectations and Service Quality

As consumer expectations continue to rise, insurance providers will need to focus on delivering a high-quality customer experience. This includes providing efficient claims processing, offering personalized insurance products, and ensuring transparent communication throughout the insurance journey. Insurance providers that can meet and exceed these expectations are likely to thrive in the competitive Ontario market.

Furthermore, the increasing focus on sustainability and environmental responsibility is expected to influence the insurance industry. With the rise of electric vehicles and the push for greener transportation options, insurance providers may need to adapt their policies and offerings to cater to these changing consumer preferences.

Conclusion

Obtaining an auto insurance quote in Ontario involves considering a myriad of factors, from personal characteristics and vehicle-related factors to driving behavior and the unique aspects of Ontario’s insurance market. By understanding these factors and implementing the tips provided, drivers can navigate the complex world of insurance with confidence, ensuring they obtain the best possible quote for their circumstances.

As the insurance landscape continues to evolve, staying informed about regulatory changes, technological advancements, and consumer trends will be crucial for both insurance providers and consumers. By adapting to these changes and embracing innovation, the auto insurance industry in Ontario can continue to provide valuable protection and peace of mind to drivers across the province.

What is the average cost of auto insurance in Ontario?

+The average cost of auto insurance in Ontario varies depending on numerous factors, including the driver’s age, driving record, and the type of vehicle insured. According to recent data, the average annual premium for auto insurance in Ontario is approximately 1,500. However, this can range significantly, with some drivers paying as little as 800 per year, while others may pay over $2,500.

How can I lower my auto insurance premium in Ontario?

+There are several strategies to lower your auto insurance premium in Ontario. These include maintaining a clean driving record, shopping around for the best rates, exploring discounts (such as safe driver discounts or multi-policy discounts), and considering usage-based insurance (telematics insurance) if you’re a safe driver. Additionally, understanding your coverage needs and adjusting your policy accordingly can help reduce costs.

What factors influence auto insurance rates in Ontario?

+Auto insurance rates in Ontario are influenced by a variety of factors, including personal characteristics (age, gender, marital status, occupation), vehicle-related factors (make, model, year, safety features), and driving behavior (driving record, annual mileage). Additionally, the competitive nature of the insurance market and the specific insurance provider’s claim settlement history and customer service reputation can impact rates.

How does Ontario’s no-fault insurance system affect auto insurance quotes?

+Ontario’s no-fault insurance system, while simplifying the claims process, can lead to higher insurance premiums compared to fault-based systems. This is because under a no-fault system, your own insurance policy covers your injuries and vehicle damages regardless of who is at fault in an accident. The cost of providing extensive accident benefits coverage contributes to the overall cost of insurance premiums in Ontario.