Auto Insurance In California

California, the Golden State, is renowned for its diverse landscapes, vibrant cities, and, of course, its unique automotive culture. With a population of over 39 million residents and a vast network of roads, highways, and freeways, California presents a complex landscape for auto insurance. Understanding the intricacies of auto insurance in this state is essential for both residents and visitors alike.

In this comprehensive guide, we delve into the world of auto insurance in California, exploring the regulations, coverage options, and strategies to navigate this complex yet vital aspect of automotive ownership. Whether you're a seasoned driver or a newcomer to the California roads, this guide aims to provide expert insights and practical advice to ensure you're adequately protected and compliant with state regulations.

The Landscape of Auto Insurance in California

California stands out among US states for its unique approach to auto insurance. The state's Department of Insurance has implemented a range of regulations and consumer protections that influence the insurance market and the policies available to drivers. Understanding these regulations is key to making informed decisions about your coverage.

One of the most notable aspects of auto insurance in California is the Financial Responsibility Law. This law mandates that all drivers maintain financial responsibility for any potential damages they might cause in an accident. This typically translates to carrying auto insurance, but other options, such as self-insurance or posting a cash deposit, are also available.

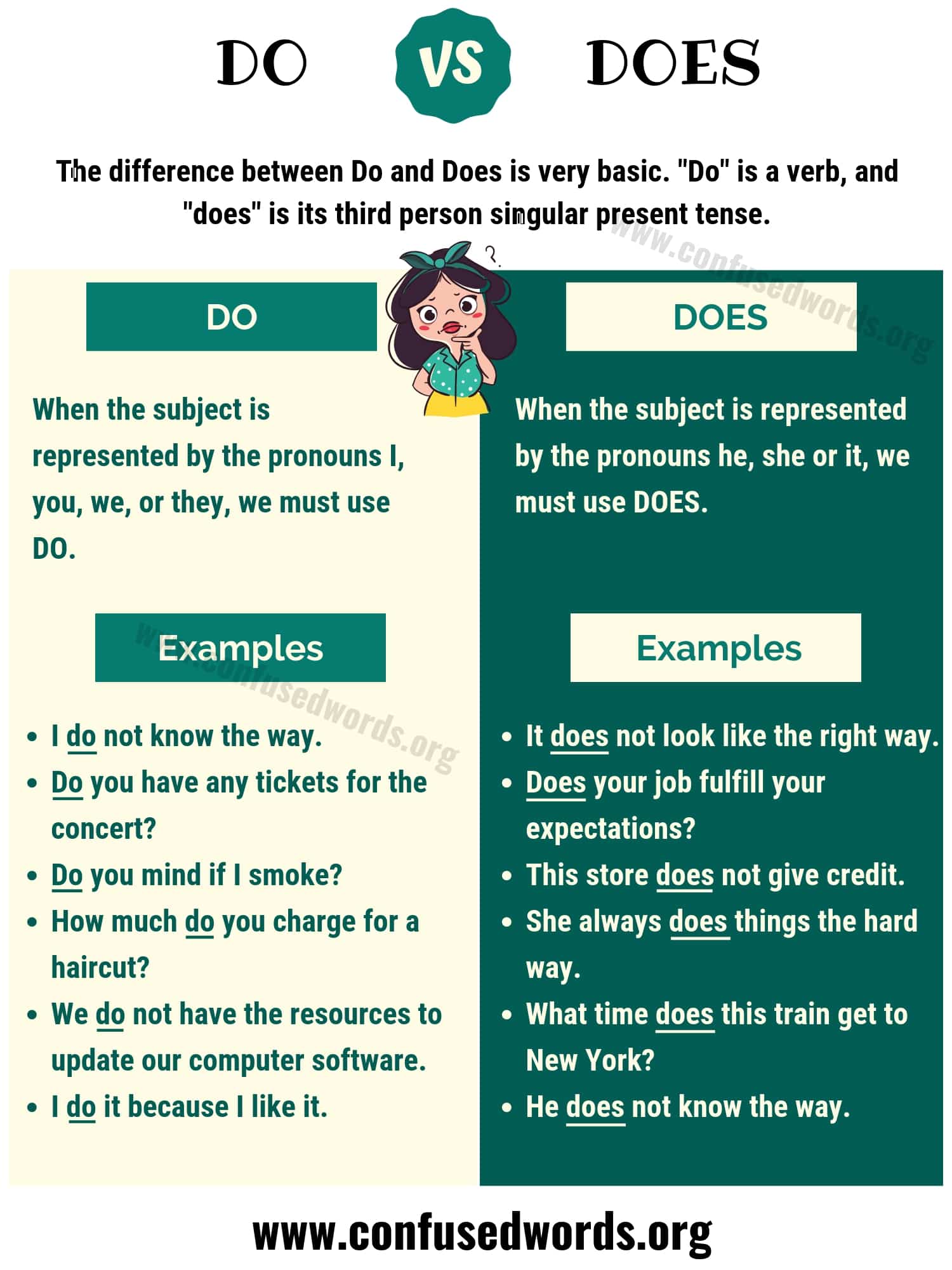

Minimum Coverage Requirements

California has set specific minimum coverage requirements for auto insurance policies. These minimums are designed to ensure that drivers can cover basic damages in the event of an accident. The state's minimum liability coverage requirements are as follows:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability per Person | $15,000 |

| Bodily Injury Liability per Accident | $30,000 |

| Property Damage Liability | $5,000 |

While these minimums provide a baseline for financial responsibility, many experts recommend carrying higher limits to ensure adequate protection. The costs of accidents can quickly exceed these minimums, leaving drivers vulnerable to significant out-of-pocket expenses.

Unique Coverages in California

California has implemented several unique coverages that are not commonly found in other states. These coverages are designed to address specific risks and concerns within the state.

- Uninsured Motorist Coverage: This coverage is mandatory in California and provides protection in the event of an accident with an uninsured or underinsured driver. It can cover medical expenses and property damage up to the limits of your policy.

- Medical Payments Coverage: Also known as MedPay, this optional coverage can help cover medical expenses for you and your passengers after an accident, regardless of fault. It provides a quick and efficient way to cover medical bills without waiting for a liability claim to be resolved.

- Personal Injury Protection (PIP): While not mandatory, PIP coverage is available in California and can provide comprehensive medical and disability coverage for you and your passengers after an accident. It can cover a wide range of expenses, including medical bills, lost wages, and funeral costs.

Understanding Auto Insurance Policies

Auto insurance policies in California can be complex, with a range of coverages, limits, and deductibles to navigate. Understanding the different components of a policy is crucial to ensure you're getting the right protection for your needs.

Types of Coverage

Auto insurance policies typically consist of several types of coverage, each designed to address specific risks. Here's a breakdown of the common coverage types found in California policies:

- Liability Coverage: This is the foundation of any auto insurance policy and is required by law in California. It covers bodily injury and property damage caused to others in an accident for which you are at fault.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault. It's particularly beneficial if you have a newer or more valuable vehicle, as it can help cover the cost of repairs or replacement.

- Comprehensive Coverage: Another optional coverage, comprehensive covers damages to your vehicle that are not caused by an accident. This can include theft, vandalism, natural disasters, and other non-collision events.

- Medical Payments Coverage (MedPay): As mentioned earlier, MedPay can help cover medical expenses for you and your passengers after an accident. It's a quick and efficient way to access medical care without waiting for liability claims to be resolved.

- Uninsured/Underinsured Motorist Coverage: This mandatory coverage in California protects you if you're involved in an accident with a driver who has little or no insurance. It can cover medical expenses, lost wages, and other damages.

- Personal Injury Protection (PIP): PIP provides comprehensive medical and disability coverage for you and your passengers after an accident. It's an optional coverage but can be valuable for ensuring a wide range of expenses are covered.

Policy Limits and Deductibles

When choosing an auto insurance policy, you'll need to decide on the limits and deductibles that best suit your needs and budget. Here's a closer look at these critical components:

- Limits: Limits refer to the maximum amount an insurance company will pay for a covered claim. For liability coverage, you'll typically see limits expressed as a combination of bodily injury and property damage limits, such as $100,000/$300,000/$50,000. The first number represents the maximum payout per person for bodily injury, the second is the maximum per accident, and the third is the property damage limit.

- Deductibles: A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your car requires $2,000 in repairs after an accident, you'll pay the first $500, and your insurance will cover the remaining $1,500. Higher deductibles can lead to lower premiums, but they also mean you'll pay more out of pocket if you need to file a claim.

Shopping for Auto Insurance in California

With a diverse insurance market, shopping for auto insurance in California can be a daunting task. However, by understanding the key factors that influence premiums and taking a strategic approach, you can find the right coverage at a competitive price.

Factors Influencing Premiums

Auto insurance premiums in California are influenced by a variety of factors. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

- Vehicle Type and Usage: The type of vehicle you drive and how you use it can impact your premiums. Sports cars and luxury vehicles tend to be more expensive to insure due to their higher repair costs and greater risk of theft. Additionally, if you use your vehicle for business purposes or have a long commute, your premiums may be higher.

- Driver Profile: Your personal driving record and history play a significant role in determining your premiums. Factors such as your age, gender, marital status, and driving experience are considered. Additionally, your claims history and any traffic violations can impact your rates. Young drivers and those with a history of accidents or violations may face higher premiums.

- Coverage and Limits: The coverages and limits you choose will directly affect your premiums. Higher coverage limits and additional coverages, such as collision and comprehensive, will typically increase your premiums. On the other hand, opting for higher deductibles can lower your premiums.

- Location: Where you live and where you park your vehicle can impact your premiums. Urban areas with higher populations and traffic congestion often have higher rates due to increased risk of accidents and theft. Additionally, the specific neighborhood and garage or driveway parking can influence rates.

- Insurance Company and Policy Features: Different insurance companies offer varying rates and policy features. Shopping around and comparing quotes from multiple insurers can help you find the best value. Additionally, consider the policy features and discounts offered by each insurer to ensure you're getting the most comprehensive coverage at the best price.

Strategies for Lower Premiums

While auto insurance is a necessary expense, there are strategies you can employ to potentially lower your premiums and save money. Here are some expert tips:

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By combining your policies, you may be able to save money and streamline your insurance management.

- Maintain a Clean Driving Record: A clean driving record is one of the best ways to keep your premiums low. Avoid traffic violations and accidents, as they can significantly increase your rates. If you have a clean record, be sure to inform your insurer, as they may offer discounts for safe driving.

- Consider Higher Deductibles: As mentioned earlier, choosing a higher deductible can lower your premiums. However, it's important to ensure you have the financial means to cover the deductible in the event of a claim. Weigh the potential savings against your ability to cover the out-of-pocket expense.

- Explore Discounts: Insurance companies offer a variety of discounts, such as safe driver discounts, good student discounts, and loyalty discounts. Be sure to inquire about all available discounts and see if you qualify. Even small discounts can add up and make a difference in your overall premiums.

- Shop Around Regularly: Auto insurance rates can vary significantly between insurers. It's important to shop around and compare quotes regularly. Even if you've been with the same insurer for years, it's worth getting quotes from other companies to ensure you're still getting the best deal.

Making an Informed Decision

With a wealth of information and strategies at your disposal, making an informed decision about your auto insurance in California becomes more manageable. Remember, the key is to understand your specific needs, evaluate your options, and choose a policy that provides the right coverage at a competitive price.

Consider consulting with an insurance professional who can guide you through the process and help tailor a policy to your unique circumstances. They can provide expert advice and ensure you're not only compliant with state regulations but also adequately protected.

In the complex world of auto insurance, knowledge is power. By staying informed and proactive, you can navigate the California insurance landscape with confidence and ensure you're making the best choices for your automotive needs.

Frequently Asked Questions

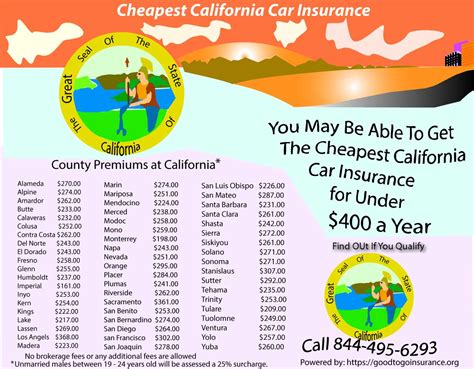

What is the average cost of auto insurance in California?

+

The average cost of auto insurance in California can vary significantly based on numerous factors, including the driver’s profile, vehicle type, coverage limits, and location. As of our latest data, the average annual premium for a minimum liability policy in California is approximately 1,200. However, for a full coverage policy with higher limits, the average premium can exceed 2,000 per year. It’s essential to get personalized quotes to understand the exact cost for your specific circumstances.

Are there any discounts available for auto insurance in California?

+

Yes, insurance companies in California offer various discounts to help lower premiums. These may include safe driver discounts for maintaining a clean driving record, good student discounts for young drivers with high grades, loyalty discounts for long-term customers, and multi-policy discounts when you bundle multiple policies, such as auto and home insurance. Additionally, some insurers offer discounts for certain safety features in vehicles, such as anti-theft devices or advanced driver-assistance systems.

Can I get auto insurance without owning a car in California?

+

Yes, it’s possible to obtain auto insurance without owning a car in California. Non-owner car insurance policies are designed for individuals who frequently borrow or rent vehicles but don’t own one themselves. These policies provide liability coverage for damages you might cause while driving someone else’s car. However, it’s essential to note that non-owner policies typically don’t cover damage to the borrowed vehicle or your own personal injuries.

What happens if I’m involved in an accident with an uninsured driver in California?

+

If you’re involved in an accident with an uninsured driver in California, your own auto insurance policy’s uninsured motorist coverage will come into play. This coverage is mandatory in the state and provides protection for you and your passengers in such situations. It can cover medical expenses, lost wages, and other damages up to the limits of your policy. It’s important to have adequate uninsured motorist coverage to protect yourself financially in case of an accident with an uninsured driver.

How often should I review and update my auto insurance policy in California?

+

It’s recommended to review your auto insurance policy at least once a year to ensure it still meets your needs and to take advantage of any potential cost savings. Life changes, such as moving to a new location, buying a new car, getting married, or adding a young driver to your policy, can impact your insurance needs and premiums. Regularly reviewing your policy allows you to make necessary adjustments and stay up-to-date with the latest coverage options and discounts available.