Auto Insurance For Car

Welcome to a comprehensive guide on the world of auto insurance, a necessity for every car owner. This article will delve into the intricacies of car insurance, offering an in-depth analysis of its importance, coverage options, and how it protects you and your vehicle. Whether you're a seasoned driver or a first-time car owner, understanding auto insurance is crucial for your financial well-being and peace of mind on the road.

The Significance of Auto Insurance

Auto insurance is a legal and financial safeguard for car owners, providing coverage for various situations that may arise while operating a vehicle. It offers protection against financial loss resulting from traffic accidents, vehicle theft, and damage to other people's property or vehicles. Furthermore, it ensures compliance with state laws, which typically mandate a minimum level of liability insurance for all registered vehicles.

In the United States, auto insurance is not a luxury but a necessity. According to the Insurance Information Institute, nearly every state requires car owners to have at least liability insurance, with varying minimum coverage amounts. For instance, most states require a minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage.

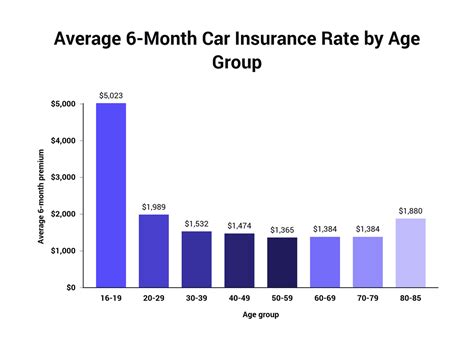

The cost of auto insurance varies significantly based on factors such as the driver's age, driving record, type of vehicle, and location. For instance, a young driver with a clean record in a rural area might pay an average of $1,500 annually for insurance, while an older driver with a history of accidents in an urban area could pay upwards of $3,000 per year.

Types of Auto Insurance Coverage

Auto insurance policies offer a range of coverage options to cater to the diverse needs of car owners. Here are some of the most common types of coverage:

Liability Coverage

Liability coverage is the most fundamental type of auto insurance. It covers the costs associated with bodily injury or property damage caused by the policyholder to others. This coverage is mandatory in most states and is typically divided into bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder. Property damage liability, on the other hand, covers the cost of repairing or replacing property, such as another person's car or fence, damaged in an accident caused by the policyholder.

Collision Coverage

Collision coverage is an optional type of insurance that pays for the repair or replacement of the policyholder's vehicle in the event of a collision, regardless of fault. This coverage is particularly beneficial for newer or more expensive vehicles, as it can cover the cost of repairs or the vehicle's actual cash value if it's totaled.

Collision coverage typically comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance company covers the rest. For instance, if a policy has a $500 deductible and the repairs cost $3,000, the policyholder would pay $500, and the insurance company would cover the remaining $2,500.

Comprehensive Coverage

Comprehensive coverage is another optional type of insurance that protects against damage to the policyholder's vehicle resulting from events other than collisions. This can include damage caused by fire, theft, vandalism, falling objects (like tree branches), or natural disasters such as hail storms or floods.

Like collision coverage, comprehensive coverage also comes with a deductible. The policyholder pays the deductible amount, and the insurance company covers the rest of the repair or replacement cost.

Medical Payments Coverage

Medical payments coverage, often referred to as "MedPay," covers the medical expenses of the policyholder and their passengers in the event of an accident, regardless of fault. This coverage can be a lifesaver, as it can help pay for emergency medical treatment, hospital stays, and even funeral expenses in the unfortunate event of a fatality.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is designed to protect policyholders when they're involved in an accident with a driver who either doesn't have insurance or doesn't have enough insurance to cover the damages. This coverage can pay for medical expenses, lost wages, and other related costs that the uninsured/underinsured driver is unable to cover.

How Auto Insurance Works

Auto insurance operates on the principle of risk sharing. When you purchase an insurance policy, you essentially enter into a contract with the insurance company. You agree to pay a certain amount, known as a premium, in exchange for the company's promise to cover specified types of losses, as outlined in your policy.

The premium you pay is determined by a variety of factors, including your age, driving record, the type of vehicle you drive, and where you live. The insurance company assesses these factors to determine the level of risk associated with insuring you. For instance, a young driver with a history of accidents will typically pay a higher premium than an older driver with a clean record, as the former is considered a higher risk.

When an insured event occurs, such as an accident or theft, you'll need to file a claim with your insurance company. This involves providing details about the incident and any relevant documentation, such as police reports or repair estimates. The insurance company will then assess the claim and, if it's covered under your policy, pay out the agreed-upon amount, minus any applicable deductibles.

It's important to note that while auto insurance provides financial protection, it doesn't excuse you from liability. If you're found at fault in an accident, you may still be responsible for any damages or injuries that exceed your insurance coverage. Additionally, insurance companies may increase your premiums or even cancel your policy if you make frequent claims.

The Benefits of Auto Insurance

Auto insurance offers a multitude of benefits that extend beyond the legal requirements and financial protection. Here are some key advantages of having comprehensive auto insurance coverage:

Peace of Mind

Knowing you're covered in the event of an accident, theft, or other unexpected event provides a sense of security and peace of mind. With auto insurance, you can drive with confidence, knowing that you're financially protected against a wide range of potential risks.

Financial Protection

Auto insurance safeguards your financial well-being. In the event of an accident or other covered event, your insurance policy can cover the cost of repairs, medical expenses, and even legal fees, depending on your coverage. This protection can be especially crucial if you're involved in a serious accident that results in significant property damage or personal injury.

Legal Compliance

Most states in the U.S. require car owners to have at least liability insurance. By carrying auto insurance, you ensure that you're complying with the law and avoiding potential penalties, such as fines or the suspension of your driver's license or vehicle registration.

Protection Against Uninsured/Underinsured Drivers

Uninsured and underinsured motorists can pose a significant risk on the road. If you're involved in an accident with one of these drivers, they may not have the financial means to cover the costs of the damages they've caused. Uninsured/Underinsured Motorist coverage in your auto insurance policy can step in to provide the necessary financial protection in such situations.

Choosing the Right Auto Insurance Policy

Selecting the right auto insurance policy involves careful consideration of your specific needs and circumstances. Here are some factors to keep in mind when choosing an insurance provider and policy:

Coverage Options

Review the various coverage options offered by different insurance companies. Consider your specific needs and risks. For instance, if you live in an area prone to natural disasters, comprehensive coverage might be a wise choice. If you frequently drive in high-traffic areas, uninsured/underinsured motorist coverage could be beneficial.

Premium Costs

Compare the premiums offered by different insurance companies. While it's important to find a policy that provides adequate coverage, you also want to ensure it's affordable. Look for companies that offer discounts or flexible payment options to help reduce the cost of insurance.

Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles mean higher premiums. Choose a deductible that aligns with your financial situation and risk tolerance.

Reputation and Financial Stability

Research the reputation and financial stability of potential insurance companies. You want to ensure the company is reputable, has a good track record of paying claims, and is financially stable to ensure they'll be able to pay out on your policy if needed.

Customer Service and Claims Handling

Consider the quality of customer service and claims handling provided by different insurance companies. Look for companies that offer 24/7 customer support, have a simple and efficient claims process, and offer assistance in multiple languages if needed.

Frequently Asked Questions (FAQ)

What happens if I'm involved in an accident with an uninsured driver?

+If you're involved in an accident with an uninsured driver and you have uninsured motorist coverage, your insurance company will step in to cover your losses, up to the limits of your policy. This coverage can pay for medical expenses, property damage, and other related costs that the uninsured driver is unable to cover.

How much does auto insurance typically cost?

+The cost of auto insurance varies widely based on factors such as your age, driving record, the type of vehicle you drive, and where you live. On average, the cost of a minimum liability policy can range from a few hundred dollars to over $1,000 per year. More comprehensive policies with additional coverage options can cost significantly more.

What should I do if I'm involved in an accident?

+If you're involved in an accident, it's important to remain calm and take the following steps: First, ensure the safety of yourself and others involved. Call the police to report the accident and provide them with all relevant details. Exchange information with the other driver(s), including names, contact information, and insurance details. Take photos of the accident scene and any damage to the vehicles. Finally, contact your insurance company as soon as possible to report the accident and begin the claims process.

Can I choose my own repair shop if my car is damaged in an accident?

+In most cases, you have the right to choose your own repair shop for your vehicle. However, it's important to check with your insurance company to understand their policies regarding repair shops. Some companies may have preferred repair shops or may require you to get multiple estimates before proceeding with repairs.

In conclusion, auto insurance is an essential component of responsible car ownership. It provides financial protection, legal compliance, and peace of mind for drivers and vehicle owners. By understanding the different types of coverage, how insurance works, and the benefits it offers, you can make informed decisions about your auto insurance coverage and ensure you’re adequately protected on the road.