Att Phone Claim Insurance

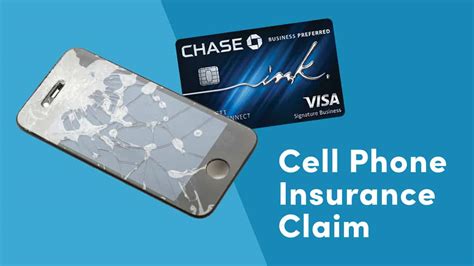

Insurance for smartphones has become increasingly popular as our devices become more sophisticated and expensive. With the constant advancements in technology, the cost of repairing or replacing a damaged phone can be a significant financial burden. This article delves into the world of ATT phone claim insurance, exploring its benefits, coverage, and how it can provide peace of mind to smartphone users. We will examine the specific features of ATT's insurance plans, compare them with other providers, and offer insights into the value they bring to consumers.

Understanding ATT Phone Claim Insurance

ATT, one of the leading telecommunications companies in the United States, offers a comprehensive insurance program for its customers’ smartphones. The insurance plan is designed to protect against a wide range of unforeseen circumstances that could damage or destroy a device, including accidental damage, theft, and even mechanical or electrical failures. By enrolling in ATT’s insurance program, smartphone users can gain access to reliable protection and potentially save themselves from costly repair or replacement expenses.

Coverage and Benefits

The ATT phone claim insurance provides coverage for a variety of situations. It typically includes protection against accidental damage, such as drops, spills, or cracks on the screen. Additionally, the insurance covers theft or loss of the device, ensuring that the customer is not left with a substantial financial loss. Mechanical and electrical failures are also covered, which is especially valuable given the complexity of modern smartphones.

One of the key benefits of ATT's insurance plan is the fast and efficient claims process. Customers can initiate a claim online or over the phone, and ATT provides a convenient option to have a replacement device shipped directly to their location. This expedites the recovery process, minimizing the time the customer is without their primary means of communication.

Furthermore, ATT offers flexible payment options for its insurance plans. Customers can choose to pay monthly or annually, with the option to cancel at any time. This flexibility allows individuals to tailor their insurance coverage to their specific needs and budget.

| Coverage Type | Description |

|---|---|

| Accidental Damage | Covers drops, spills, and screen cracks. |

| Theft and Loss | Protects against theft and accidental misplacement of the device. |

| Mechanical/Electrical Failures | Covers internal component failures and battery issues. |

Real-World Scenarios

Consider the case of a college student who relies on their smartphone for communication, academic research, and social connections. While walking to class one day, their phone slips out of their hand and shatters on the ground. Without insurance, they would be facing a costly repair bill or the need to purchase a new device. However, with ATT phone claim insurance, they can simply file a claim, and a replacement device will be sent to them, ensuring minimal disruption to their daily life.

Comparing ATT’s Insurance with Other Providers

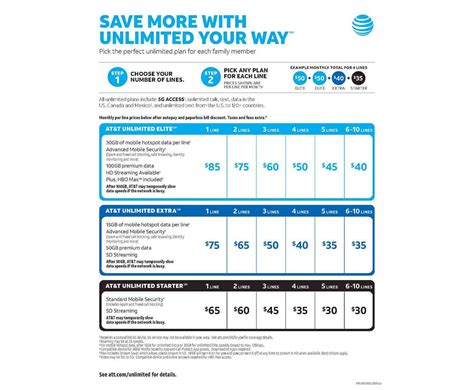

When evaluating smartphone insurance plans, it’s essential to compare the offerings from different providers to find the best fit for your needs. While ATT’s insurance program is comprehensive, it’s beneficial to understand how it stacks up against competitors.

Competitive Analysis

One of the key advantages of ATT’s insurance is its comprehensive coverage, which extends beyond accidental damage to include theft and mechanical failures. This sets it apart from some competitors who may offer more limited coverage, such as only covering accidental damage.

Additionally, ATT's insurance program is highly accessible, with straightforward enrollment and claims processes. This convenience is a significant advantage over providers who may have more complex or time-consuming procedures.

However, it's worth noting that ATT's insurance plans may have higher premiums compared to some competitors. While the coverage is extensive, individuals should carefully consider their specific needs and budget to determine if the premium is justified for the level of protection provided.

| Provider | Coverage | Premium | Enrollment Process |

|---|---|---|---|

| ATT | Accidental Damage, Theft, Mechanical Failures | Moderate to High | Simple and Online |

| Provider X | Accidental Damage Only | Low | Complex, Requires In-Store Visit |

| Provider Y | Comprehensive Coverage Similar to ATT | High | Online, but Time-Consuming |

Choosing the Right Insurance Plan

When selecting a smartphone insurance plan, consider factors such as your device’s value, your usage patterns, and the likelihood of encountering different types of damage or loss. For instance, if you frequently travel or live in an area with a high crime rate, the theft and loss coverage offered by ATT could be invaluable.

It's also crucial to understand the deductibles and limitations of each insurance plan. While ATT's insurance provides comprehensive coverage, there may be specific exclusions or maximum claim limits that you should be aware of. Reading the fine print and understanding these details will help you make an informed decision.

Performance and Customer Satisfaction

ATT’s phone claim insurance has received positive feedback from customers, with many praising the prompt and efficient claims process. The ability to initiate a claim online and receive a replacement device quickly has been a significant advantage for individuals who rely heavily on their smartphones for work and personal life.

Additionally, ATT's customer support has been praised for its responsiveness and willingness to assist customers throughout the claims process. This level of support is crucial, especially during times of stress when a device is damaged or lost.

However, it's essential to note that customer experiences can vary, and some individuals may encounter challenges or delays during the claims process. It's always beneficial to read reviews and seek recommendations from trusted sources to gain a well-rounded understanding of a company's performance.

Real Customer Testimonials

“I had a great experience with ATT’s insurance plan. My phone was stolen while I was traveling, and I was able to file a claim online and receive a replacement device within a few days. The process was seamless, and their customer support was incredibly helpful throughout.”

"ATT's insurance coverage has been a lifesaver for me. I've had multiple instances where my phone was accidentally damaged, and each time, the claims process was straightforward. I highly recommend their insurance for anyone looking for peace of mind."

Future Implications and Industry Trends

As the smartphone industry continues to evolve, the demand for reliable insurance plans is expected to grow. With devices becoming more expensive and technologically advanced, the potential financial loss from damage or theft is significant.

Looking ahead, we can anticipate that smartphone insurance providers will focus on enhancing their coverage to keep up with the changing landscape. This may involve expanding coverage to include new types of damage, such as water damage from accidental exposure to liquids, or even covering data loss and recovery.

Furthermore, innovations in technology may lead to more efficient and cost-effective repair processes, potentially impacting insurance premiums and coverage options. As smartphone manufacturers explore new materials and designs, the risk factors and potential damage scenarios may shift, influencing the insurance industry's approach.

In conclusion, ATT's phone claim insurance offers a comprehensive and accessible solution for smartphone users seeking protection against various unforeseen circumstances. By comparing different insurance plans and understanding their coverage, customers can make informed decisions to safeguard their devices and minimize financial risks. As the industry evolves, staying informed about the latest trends and advancements in smartphone insurance will be crucial for consumers and providers alike.

Can I add ATT phone claim insurance to an existing plan?

+Yes, you can add ATT’s phone claim insurance to your existing plan. Simply log into your ATT account, navigate to the insurance section, and follow the enrollment process. ATT offers flexible options to add insurance coverage to your smartphone plan.

How much does ATT’s phone insurance cost?

+The cost of ATT’s phone insurance varies based on the device model and the level of coverage chosen. On average, you can expect to pay a monthly premium ranging from 7 to 15. The specific cost will be displayed during the enrollment process, allowing you to make an informed decision.

What is the claims process like with ATT’s insurance?

+ATT’s claims process is designed to be straightforward and efficient. You can initiate a claim online or over the phone by providing details about the damage or loss. ATT will then guide you through the next steps, which may involve sending in your damaged device or receiving a replacement.