At&T Claim Insurance

AT&T, one of the leading telecommunications companies in the United States, offers its customers a range of services, including wireless plans, internet, and TV. To protect their devices and ensure peace of mind, AT&T provides an insurance option known as AT&T Claim Insurance. This article aims to delve into the details of this insurance program, providing an in-depth analysis and answering key questions to help users understand its benefits and coverage.

Understanding AT&T Claim Insurance

AT&T Claim Insurance is a comprehensive device protection plan designed to safeguard customers’ smartphones, tablets, and other eligible devices against various types of damage and loss. It serves as a valuable addition to AT&T’s suite of services, offering an extra layer of security and convenience for device owners.

The insurance program covers a wide range of unforeseen events, including:

- Accidental damage, such as drops, spills, and screen cracks.

- Theft or robbery of the insured device.

- Liquid damage resulting from accidental immersion or exposure to liquids.

- Mechanical and electrical failures not covered by the manufacturer's warranty.

Benefits and Advantages

AT&T Claim Insurance provides several benefits that can be advantageous for AT&T customers:

- Affordable Premiums: The insurance plan offers competitive pricing, allowing customers to protect their devices without breaking the bank. The premium amount varies based on the device type and the level of coverage chosen.

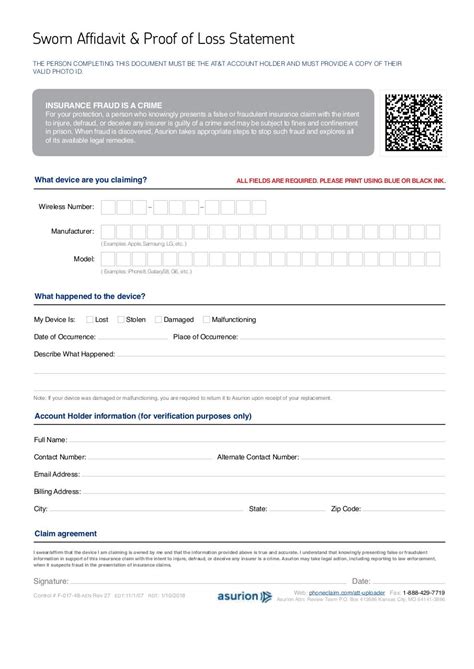

- Quick and Efficient Claims Process: AT&T has streamlined its claims process, ensuring a hassle-free experience for customers. Users can file claims online or via the AT&T mobile app, and the process is typically completed within a few business days.

- Comprehensive Coverage: The insurance covers a wide range of incidents, providing peace of mind against unexpected events. This includes protection against common accidents like drops and spills, as well as more serious issues like theft and liquid damage.

- No Deductibles for Total Losses: In the event of a total loss, where the device is stolen or completely damaged beyond repair, AT&T waives the deductible. This means customers can receive a replacement device without any additional out-of-pocket costs.

- Device Protection Registry: AT&T maintains a Device Protection Registry, which allows customers to register their eligible devices. This registry provides an additional layer of security, as it enables AT&T to track and locate lost or stolen devices, increasing the chances of recovery.

Eligibility and Coverage Details

AT&T Claim Insurance is available for a wide range of devices, including smartphones, tablets, and wearables. However, it's essential to note that the insurance coverage varies based on the device type and the plan chosen.

| Device Type | Coverage Details |

|---|---|

| Smartphones | AT&T offers two levels of coverage for smartphones: Basic and Enhanced. Basic coverage includes protection against accidental damage, theft, and liquid damage, with a deductible ranging from $49 to $149, depending on the device model. Enhanced coverage provides the same protection but with a lower deductible, ranging from $29 to $99. |

| Tablets | Tablet coverage is available for select models, offering protection against accidental damage, theft, and liquid damage. The deductible for tablets typically ranges from $49 to $99. |

| Wearables | AT&T also provides insurance for certain wearable devices, such as smartwatches and fitness trackers. Coverage includes accidental damage and theft, with deductibles ranging from $29 to $49. |

It's important to note that AT&T Claim Insurance does not cover intentional damage, normal wear and tear, or loss of data. Additionally, the insurance program is only available for devices purchased from AT&T or added to an AT&T wireless plan within 30 days of activation.

Real-Life Examples and Testimonials

To better understand the impact of AT&T Claim Insurance, let’s explore some real-life scenarios and testimonials from AT&T customers who have utilized the insurance program:

Accidental Damage: The Case of a Broken Screen

Sarah, an AT&T customer, accidentally dropped her smartphone, resulting in a shattered screen. Without AT&T Claim Insurance, she would have had to pay for costly repairs or even purchase a new device. However, with her insurance coverage, she was able to file a claim online and receive a replacement device within a week, avoiding any additional expenses.

Theft Protection: Recovering a Stolen Device

John, another AT&T subscriber, had his smartphone stolen while on vacation. He immediately reported the theft to AT&T and filed a claim. Thanks to the Device Protection Registry, AT&T was able to track the device and provide John with the necessary information to report the theft to local authorities. Although he didn’t recover his original device, AT&T provided him with a replacement, ensuring he could continue using his wireless services without interruption.

Liquid Damage: Saving a Water-Damaged Phone

Emily, a college student, accidentally spilled water on her smartphone, rendering it unusable. She was worried about the repair costs, but with AT&T Claim Insurance, she filed a claim and received a replacement device within days. The insurance coverage allowed her to continue her studies without missing a beat, as she could access her notes and stay connected with her peers.

Future Implications and Recommendations

AT&T Claim Insurance has proven to be a valuable asset for many AT&T customers, providing a sense of security and financial protection. Here are some key implications and recommendations for the future:

Expanding Coverage Options

AT&T could consider expanding its insurance coverage to include a wider range of devices, such as laptops and cameras. This would provide customers with a more comprehensive solution for all their electronic devices, offering convenience and peace of mind.

Introduction of Additional Benefits

To enhance the insurance program, AT&T could introduce new benefits, such as coverage for data loss or a device upgrade program. Data loss coverage would provide customers with a backup solution, ensuring their important files and information are protected. Additionally, a device upgrade program could offer customers the opportunity to trade in their insured devices for a new model, providing an incentive for loyalty and an improved user experience.

Enhanced Customer Education

AT&T should continue to educate its customers about the benefits of AT&T Claim Insurance. By providing clear and concise information about the coverage, eligibility, and claims process, customers can make informed decisions and fully utilize the insurance program. This education can be delivered through various channels, including online resources, in-store consultations, and targeted marketing campaigns.

Conclusion

AT&T Claim Insurance is a well-designed and comprehensive device protection plan that provides AT&T customers with a valuable layer of security. By offering affordable premiums, efficient claims processing, and comprehensive coverage, AT&T has created an insurance program that caters to the needs of its diverse customer base. Real-life examples showcase the impact and benefits of this insurance, emphasizing its role in protecting devices and providing peace of mind.

As AT&T continues to evolve its insurance offerings, the future looks bright for customers seeking device protection. With potential expansions in coverage and the introduction of additional benefits, AT&T Claim Insurance is poised to become an even more attractive and indispensable service for AT&T subscribers.

Can I add AT&T Claim Insurance to my existing AT&T wireless plan?

+

Yes, you can add AT&T Claim Insurance to your existing AT&T wireless plan. Simply log in to your AT&T account online or via the mobile app, and navigate to the “Add-ons” or “Insurance” section. From there, you can select the device you wish to insure and choose the level of coverage that best suits your needs.

What is the deductible for AT&T Claim Insurance?

+

The deductible for AT&T Claim Insurance varies depending on the device type and the level of coverage chosen. For smartphones, the deductible ranges from 29 to 149. Tablets typically have deductibles ranging from 49 to 99, and wearables have deductibles of 29 to 49. It’s important to review the specific coverage details for your device to understand the applicable deductible.

How long does it take to process a claim with AT&T Claim Insurance?

+

AT&T has streamlined its claims process to ensure a quick turnaround. Typically, it takes a few business days to process a claim. Once you file a claim online or via the AT&T app, an AT&T representative will review your claim and provide an update on the status. In most cases, you can expect to receive a replacement device or a repair solution within a week.

Can I cancel my AT&T Claim Insurance at any time?

+

Yes, you have the flexibility to cancel your AT&T Claim Insurance at any time. However, it’s important to note that cancellations are not retroactive, meaning you will still be responsible for any premiums paid up until the cancellation date. To cancel your insurance, you can log in to your AT&T account and follow the instructions provided in the “Manage Add-ons” or “Manage Insurance” section.